Category Archive: 6a.) GoldCore

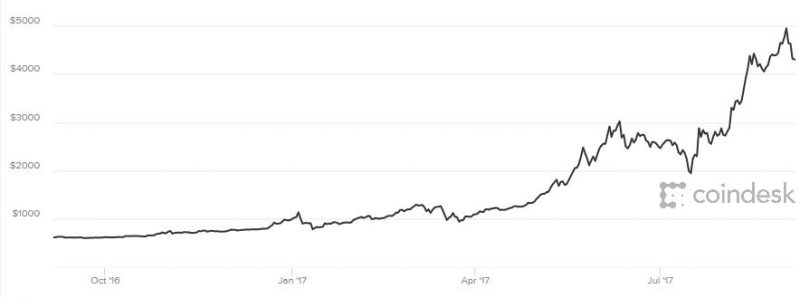

Bitcoin Falls 20 percent as Mobius and Chinese Regulators Warn

Bitcoin falls 20% as Mobius and Chinese regulators warn. “Cryptocurrencies are beginning to get out of control” – warns respected investor Mark Mobius. Mobius believes governments will begin to clamp down on cryptocurrencies sparking rush to gold. Yesterday China’s PBOC ruled Initial Coin Offerings (ICOs) are illegal and all related activity to halt. China is home to majority of bitcoin miners.

Read More »

Read More »

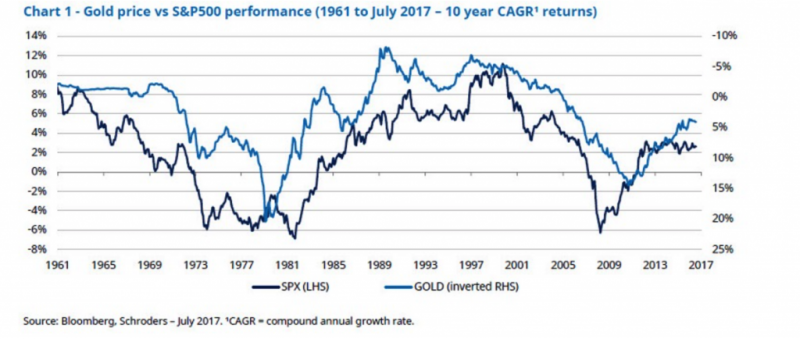

4 Reasons Why “Gold Has Entered A New Bull Market” – Schroders

4 reasons why “gold has entered a new bull market” – Schroders. Market complacency is key to gold bull market say Schroders. Investors are currently pricing in the most benign risk environment in history as seen in the VIX. History shows gold has the potential to perform very well in periods of stock market weakness (see chart). You should buy insurance when insurers don’t believe that the “risk event” will happen. Very high Chinese gold demand,...

Read More »

Read More »

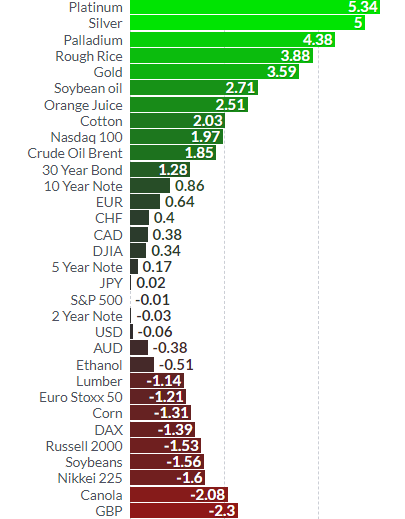

Precious Metals Outperform Markets In August – Gold +4 percents, Silver +5 percents

All four precious metals outperform markets in August. Gold posts best month since January, up nearly 4%. Gold reaches highest price since US election, climbs due to uncertainty and safe haven demand. S&P 500 marginally higher; Euro Stoxx, Nikkei lower for month. Platinum is best performing metal climbing over 5%. Palladium climbs over 4% thanks to seven year supply squeeze.

Read More »

Read More »

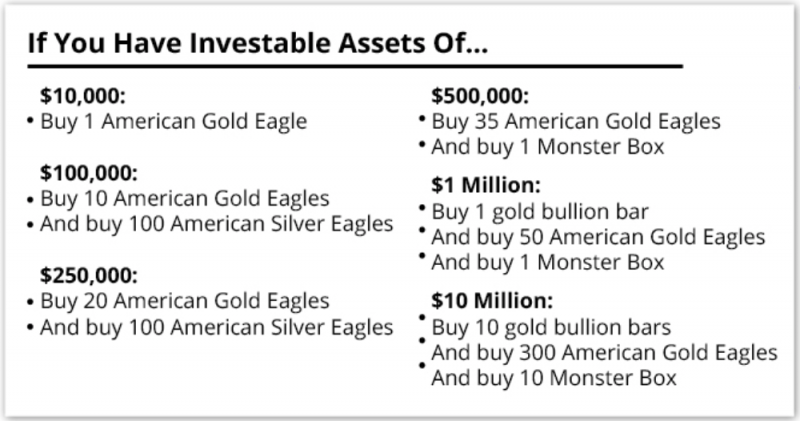

Gold Reset To $10,000/oz Coming “By January 1, 2018” – Rickards

Trump could be planning a radical “reboot” of the U.S. dollar. Currency reboot will see leading nations devalue their currencies against gold. New gold price would be nearly 8 times higher at $10,000/o. Price based on mass exit of foreign governments and investors from the US Dollar. US total debt now over $80 Trillion – $20T national debt and $60T consumer debt. Monetary reboot or currency devaluation seen frequently – even modern history. Buy...

Read More »

Read More »

Gold Surges 2.6 percent After Jackson Hole and N. Korean Missile

Gold surges as N. Korea fires ballistic missile over Japan. Safe haven buying sees gold break out to 10-month high after Jackson Hole and rising North Korea risk of attack on Guam. South Korea’s air force dropped eight MK 84 bombs near Seoul; simulating the destruction of North Korea’s leadership.

Read More »

Read More »

Diversify Into Gold On U.S. “Political Instability” Advise Blackrock

Gold set to shine as Washington stumbles. “Bet on gold’s diversifying properties rather than political stability”. World’s largest asset manager believes Trump and political drama in the U.S. means gold likely to rise. Real rates flattening out and rising political instability – Blackrock’s Koesterich. “For now my bias would be to stick with gold” – Blackrock. U.S. debt ceiling issue to be fractious as bankrupt U.S. hits $20 trillion debt....

Read More »

Read More »

The Truth About Bundesbank Repatriation of Gold From U.S.

Bundesbank has completed a transfer of gold worth €24B from France and U.S. Germany has completed domestic gold storage plan 3 years ahead of schedule. In the €7.7 million plan, 54,000 gold bars were shipped and audited.

Read More »

Read More »

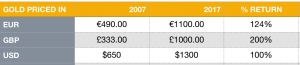

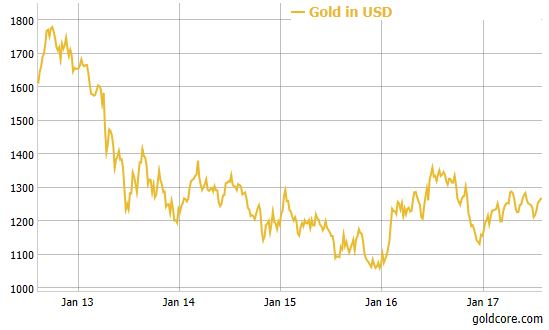

Global Financial Crisis 10 Years On: Gold Price Rises 124 percent From €490 to €1,100

Gold up over 100% in major currencies since financial crisis. Gold up 100% in USD, 124% in EUR and surged 200% in GBP. Gold has outperformed equity, bonds and most assets. Gold remains an important safe-haven in long term.

Read More »

Read More »

U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There

US Treasury Secretary Steve Mnuchin visits Fort Knox Gold

Later tweeted ‘Glad gold is safe!’

Only the third Treasury Secretary to visit the fortified vault, last visit was 1948

Read More »

Read More »

Buffett Sees Market Crash Coming? His Cash Speaks Louder Than Words

The Sage of Omaha’s adage is “it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” But for Warren Buffett the current environment doesn’t appear to be offering up any wonderful companies at fair valuations. The situation is so bad that the cash stockpile of Berkshire Hathaway has more than doubled in the last four years, from under $40 billion to $100bn.

Read More »

Read More »

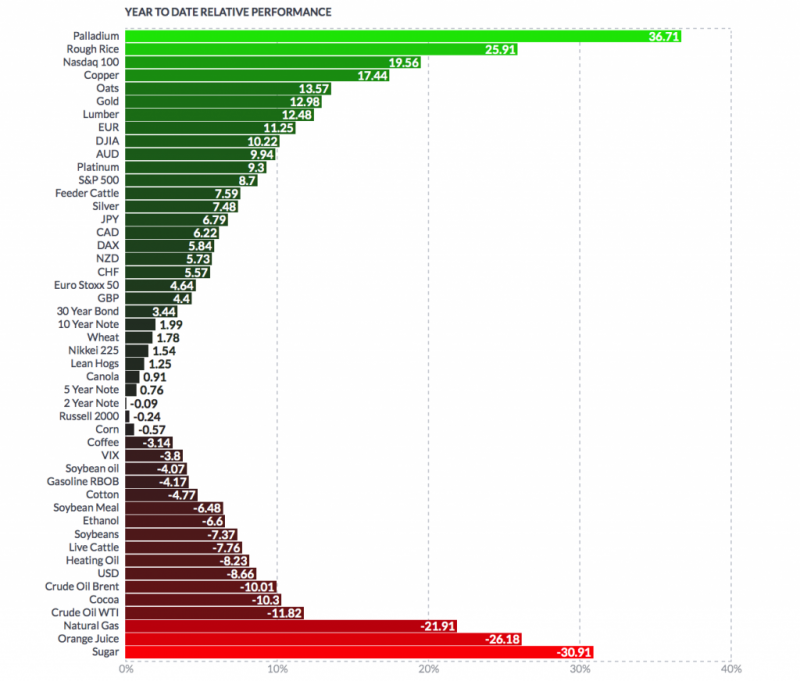

Gold, Silver Consolidate On Last Weeks Gains, Palladium Surges 36% YTD To 16 Year High

Gold and silver rise as stocks fall sharply after Barcelona attack. Gold, silver 0.6% higher in week after last weeks 2%, 5% rise. Palladium +36% ytd, breaks out & reaches 16 year high (chart). Gold to silver ratio falls to mid 75s after silver gains last week

Read More »

Read More »

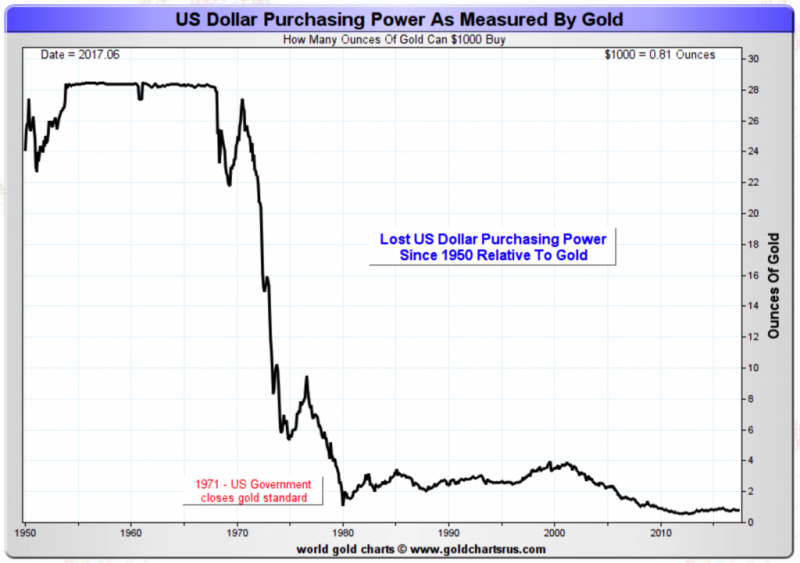

Gold Hedges USD Devaluation, Rise in Oil, Food and Cost of Living Since 1971 – Must See Charts

Gold hedges massive ongoing devaluation of U.S. Dollar. 46th anniversary of ‘Tricky Dicky’ ending Gold Standard (see video). Savings destroyed by currency creation and now negative interest rates. Long-term inflation figures show gold a hedge against rising cost of fuel, food and cost of living. $20 food and beverages basket of 1971 cost $120.17 in 2017.

Read More »

Read More »

Silver Mining Production Plummets 27 percent At Top Four Silver Miners

Silver Mining Production Plummets 27% At Top Four Silver Miners by SRSRocco Report

In an interesting change of events, production at four of the top primary silver miners plummeted during the second quarter of 2017. This goes well beyond normal fluctuations in mining companies production figures during different quarterly reporting periods.

Read More »

Read More »

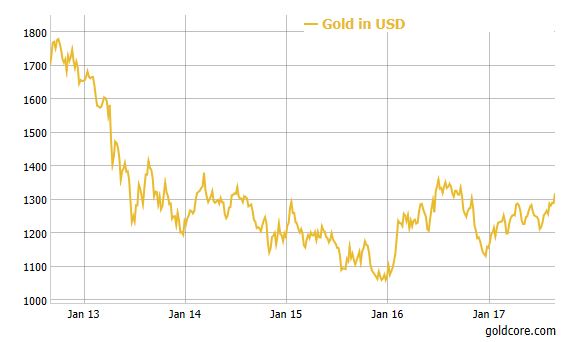

Gold Consolidates On 2.5percent Gain In July After Dollar Has 5th Monthly Decline

Gold consolidates on 2.5% gain in July as the dollar has fifth monthly decline. Trump administration and vicious “civil war” politics casting shadow over America and impacting dollar. All eyes on non farm payrolls today for further signs of weakness in U.S. economy. Gold recovers from 1.7% decline in June as dollar falls. Gold outperforms stocks and benchmark S&P 500 YTD.

Read More »

Read More »

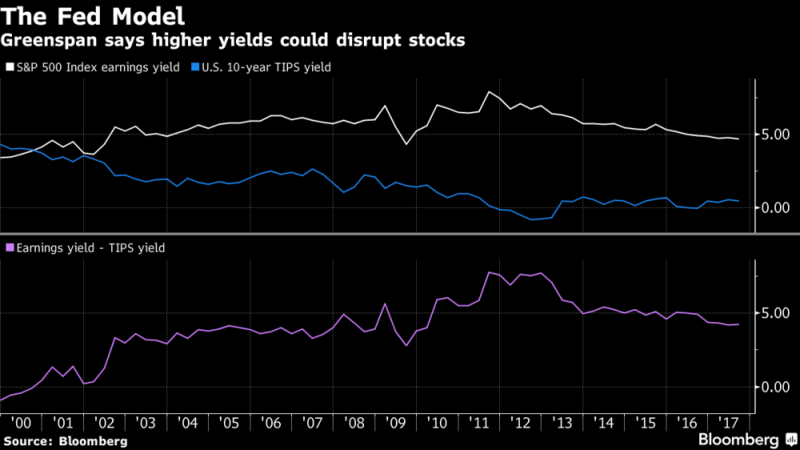

Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

‘We are experiencing a bubble, not in stock prices but in bond prices. This is not discounted in the marketplace.’ There are a lot of warnings on Bloomberg, CNBC and other financial media these days about a bubble in the stock market, particularly in FANG stocks and the tech sector.

Read More »

Read More »

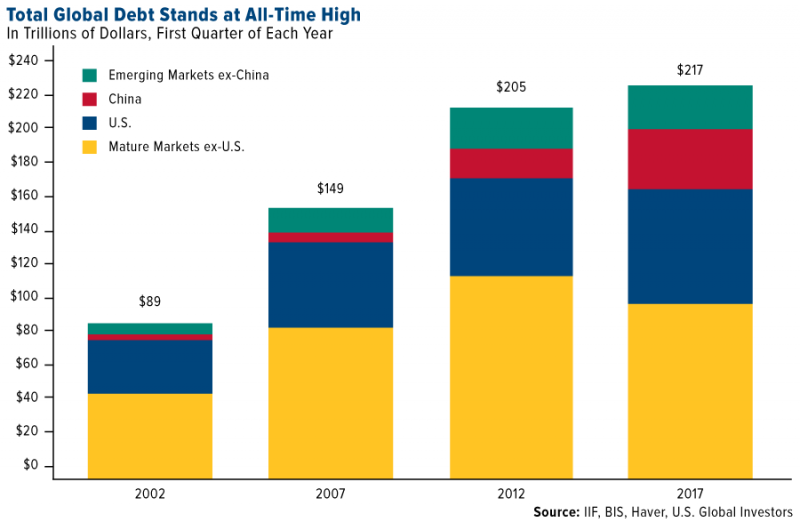

Gold A Good Store Of Value – Protect From $217 Trillion Global Debt Bubble

‘Mother of all debt bubbles’ keeps gold in focus. Global debt alert: At all time high of astronomical $217 T. India imports “phenomenal” 525 tons in first half of 2017. Record investment demand – ETPs record $245B in H1, 17. Investors, savers should diversify into “safe haven” gold. Gold good ‘store of value’ in coming economic contraction.

Read More »

Read More »

Why Surging UK Household Debt Will Cause The Next Crisis

Easy credit offered by UK banks is endangering “everyone else in the economy”. UK banks are “dicing with the spiral of complacency” again. Bank of England official believes household debt is good in moderation. Household debt now equals 135% of household income. Now costs half of average income to raise a child. Real incomes not keeping up with real inflation. 41% of those in debt are in full-time work. £1.537 trillion owed by the end of May...

Read More »

Read More »

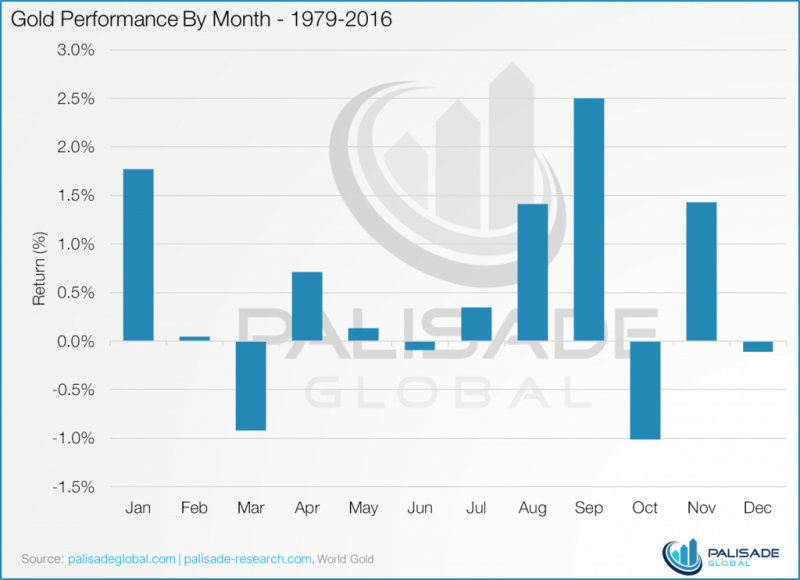

Gold Seasonal Sweet Spot – August and September – Coming

Gold seasonal sweet spot – August and September – is coming. Gold’s performance by month from 1979 to 2016 – must see table. August sees average return of 1.4% and September of 2.5%. September is best month to own gold, followed by January, November & August.

Read More »

Read More »

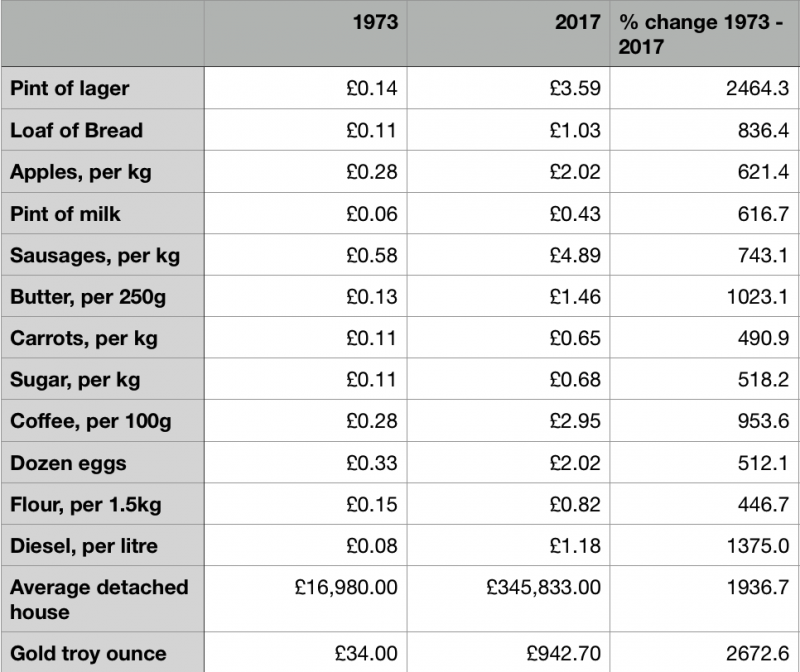

Gold Hedge Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

Gold hedge against currency devaluation – cost of fuel, food, housing. True inflation figures reflect impact on household spending. Household items climbed by average 964%. Pint of beer sees biggest increase in basket of goods – rise of 2464%. Bread rises 836%, butter by 1023% and fuel (diesel) up by 1375%. Gold rises 2672% and hold’s its value over 40 years.

Read More »

Read More »

Bank Of England Warns “Bigger Systemic Risk” Now Than 2008

Bank of England warn that “bigger systemic risk” now than in 2008. BOE, Prudential Regulation Authority (PRA) concerns re financial system. Banks accused of “balance sheet trickery” -undermining spirit of post-08 rules. EU & UK corporate bond markets may be bigger source of instability than ’08. Credit card debt and car loan surge could cause another financial crisis. PRA warn banks returning to similar practices to those that sparked 08 crisis....

Read More »

Read More »