Category Archive: 6a.) GoldCore

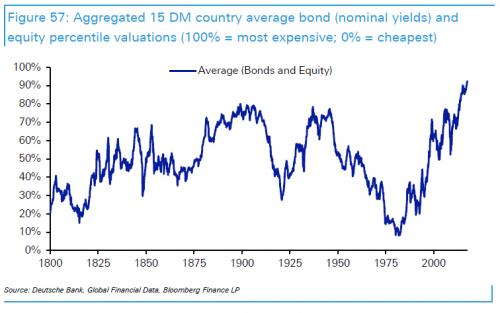

“This Is Where The Next Financial Crisis Will Come From” – Deutsche Bank

In an extensive, must-read report published on Monday by Deutsche Bank’s Jim Reid, the credit strategist unveiled an extensive analysis of the “Next Financial Crisis”, and specifically what may cause it, when it may happen, and how the world could respond assuming it still has means to counteract the next economic and financial crash.In our first take on the report yesterday, we showed one key aspect of the “crash” calculus: between bonds and...

Read More »

Read More »

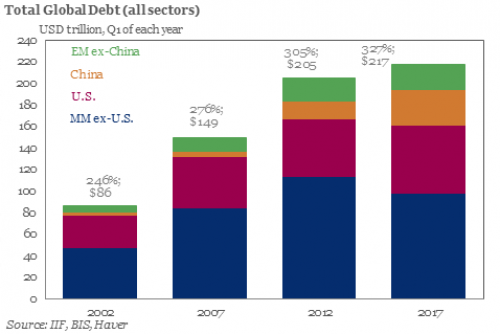

Global Debt Bubble Understated By $13 Trillion Warn BIS

Global debt bubble may be understated by $13 trillion: BIS. ‘Central banks central bank’ warns enormous liabilities have accrued in FX swaps, currency swaps & ‘forwards’. Risk of new liquidity crunch and global debt crisis. “The debt remains obscured from view…” warn BIS.

Read More »

Read More »

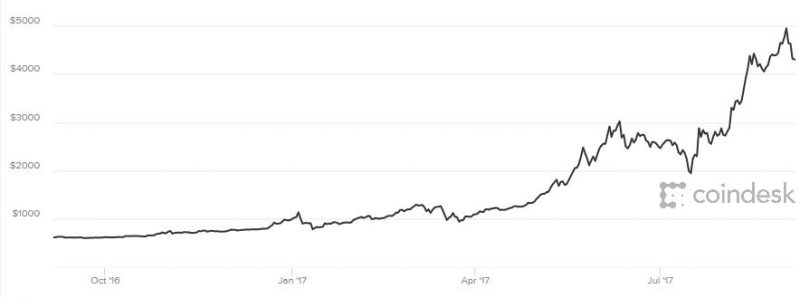

Bitcoin Price Falls 40percent In 3 Days Underling Gold’s Safe Haven Credentials

Bitcoin price action shows cryptos vulnerable to commentary and government policies. Bitcoin falls to low of $2,980, down by $1,000 in week as China flexes muscles. Volatility major issue: In 3 days btc fell 40% before bouncing 25% off lows. BIS state risks of cryptos cannot yet be fully assessed and says technology still unproven. Apple and Google developing a payment API for cryptos – may give governments full oversight. Bitcoin and cryptos...

Read More »

Read More »

Gold Up, Markets Fatigued As War Talk Boils Over

North Korea threatens to reduce the U.S. to ‘ashes and darkness’. Markets becoming used to ongoing provocations from North Korea. Russia and China continue to support watered down versions of sanctions on Kim’s regime. Both NATO and Russia running war games on one another’s borders. Putin says Russia will “give a suitable response” to NATOs threatening behaviour.

Read More »

Read More »

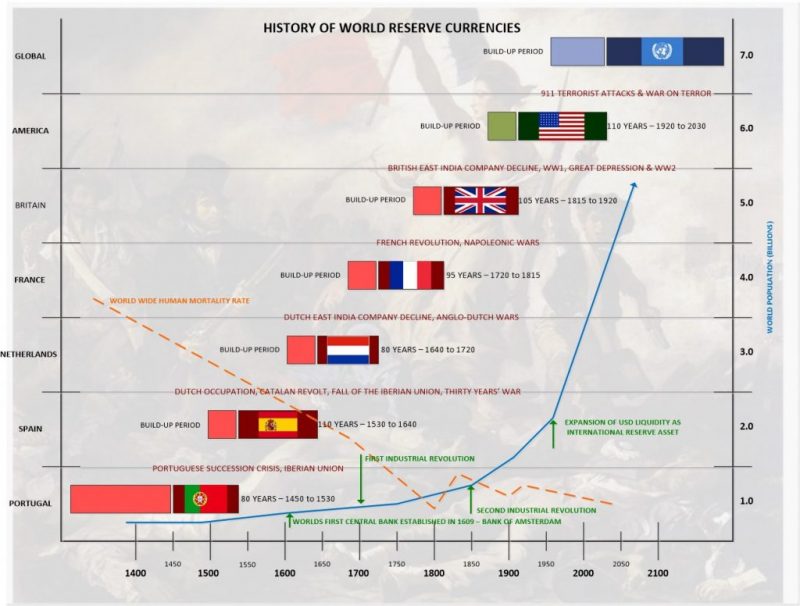

Oil Rich Venezuela Stops Accepting Dollars

President Maduro ” Venezuela will create a basket of currencies to free us from the dollar,”. Oil traders ordered to stop accepting U.S. dollar in exchange for crude oil. Order comes following calls from Russia and China to find alternatives to current reserve system. U.S. Dollar accounts for two-thirds of global trade. Venezuela has over ten-times more oil than United States. Super powers are gradually turning to gold to avoid using world’s main...

Read More »

Read More »

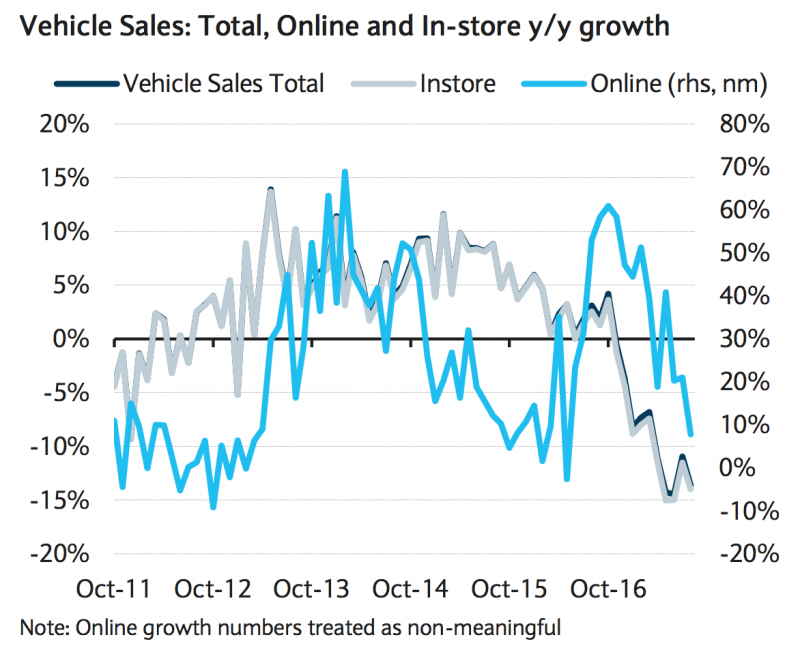

British People Suddenly Stopped Buying Cars

British people suddenly stopped buying cars. Massive debt including car loans, very low household savings. Brexit and decline in sterling and consumer confidence impacts. New cars being bought on PCP by people who could not normally afford them. UK car business has ‘exactly the same problems’ as the mortgage market 10 years ago, according to Morgan Stanley. Bank of England is investigating to make sure UK banks are not overly expose.

Read More »

Read More »

Buy Gold for Long Term as “Fiat Money Is Doomed”

Buy gold for long term as fiat money is doomed warns Frisby. Gold’s “winning streak” will continue in long term. September is traditionally a good month for gold, as we head into the Indian wedding season. “It’s just a matter of time before gold comes good again…” by Dominic Frisby, Money Week. Today folks, by popular demand, we’re talking gold.. It’s had a nice summer run. What now?

Read More »

Read More »

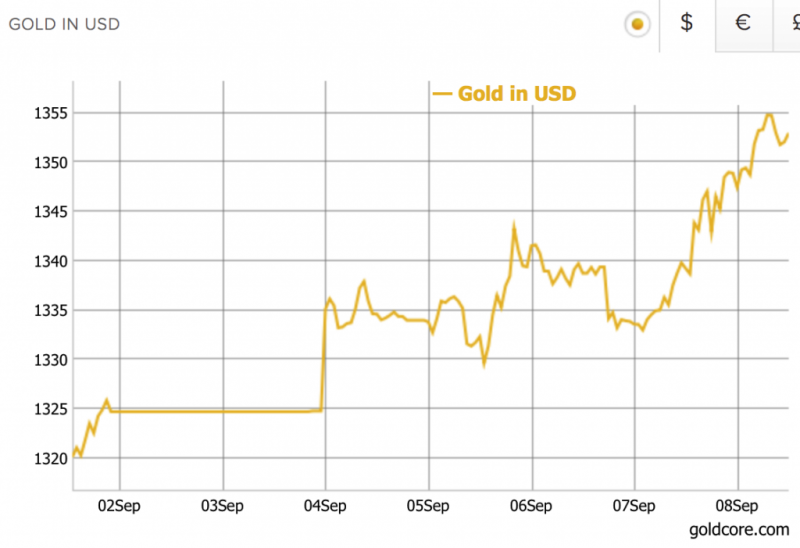

Safe Haven Gold Rises To $1338 as U.S. Warns of ‘Massive’ Military Response

Safe haven gold extends rally to 11-month high after North Korea nuke test and U.S. warns of ‘massive’ response. Asian and European stocks fall, bonds flat, gold, silver, palladium, Swiss franc rise as Korea tensions flare as North Korea tests ‘hydrogen bomb’. North Korea prepares for possible ICBM launch says S. Korea. U.S. warns of ‘massive,’ ‘overwhelming’ military response to North Korea after meeting with Trump. Trump weighing new economic...

Read More »

Read More »

“Things Have Been Going Up For Too Long” – Goldman CEO

“Things have been going up for too long…” – Goldman Sachs’ CEO. Lloyd Blankfein, Goldman CEO “unnerved by market” (see video). Bitcoin bubble is no outlier says Bank of America Merrill Lynch. Bubbles are everywhere including London property. $14 trillion of monetary stimulus has pushed investors to take more risks. We are now in a new era of bigger booms and bigger busts – BAML. “Seeing signs of bubbles in more and more parts of the capital market”...

Read More »

Read More »

Gold Has 2 percent Weekly Gain, 18 percent Higher YTD – Trump’s Debt Ceiling Deal Hurts Dollar

Gold hits $1,355/oz as USD at 32-month low -concerns about Trump, US economy. Silver and platinum 2.3% and 1.2% higher in week; palladium 3% lower. Euro Stoxx flat for week – S&P 500, Nikkei down 0.65% and 2.2%. Geo-political concerns including North Korea, falling USD push gold 2.1% in week. Gold prices reach $1,355 this morning following Mexico earthquake. Safe haven demand sees gold over one year high, highest since August 2016.

Read More »

Read More »

Physical Gold In Vault Is “True Hedge of Last Resort” – Goldman Sachs

Physical gold is “the true currency of the last resort” – Goldman Sachs. “Gold is a good hedge against geopolitical risks when the event leads to a debasement of the dollar” . Trump and Washington risk bigger driver of gold than risks such as North Korea. Recent events such as N. Korea only explain fraction of 2017 gold price rally. Do not buy gold futures or ETFs rather “physical gold in a vault” [is] the “true hedge”.

Read More »

Read More »

Bitcoin Falls 20 percent as Mobius and Chinese Regulators Warn

Bitcoin falls 20% as Mobius and Chinese regulators warn. “Cryptocurrencies are beginning to get out of control” – warns respected investor Mark Mobius. Mobius believes governments will begin to clamp down on cryptocurrencies sparking rush to gold. Yesterday China’s PBOC ruled Initial Coin Offerings (ICOs) are illegal and all related activity to halt. China is home to majority of bitcoin miners.

Read More »

Read More »

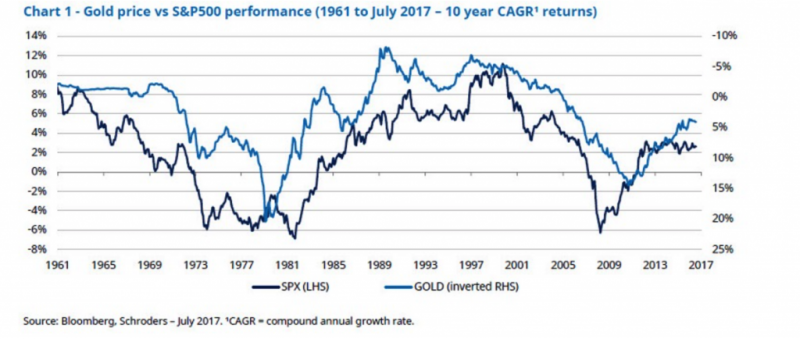

4 Reasons Why “Gold Has Entered A New Bull Market” – Schroders

4 reasons why “gold has entered a new bull market” – Schroders. Market complacency is key to gold bull market say Schroders. Investors are currently pricing in the most benign risk environment in history as seen in the VIX. History shows gold has the potential to perform very well in periods of stock market weakness (see chart). You should buy insurance when insurers don’t believe that the “risk event” will happen. Very high Chinese gold demand,...

Read More »

Read More »

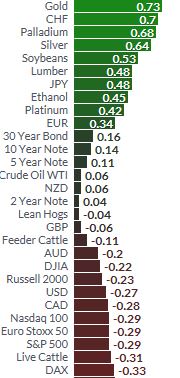

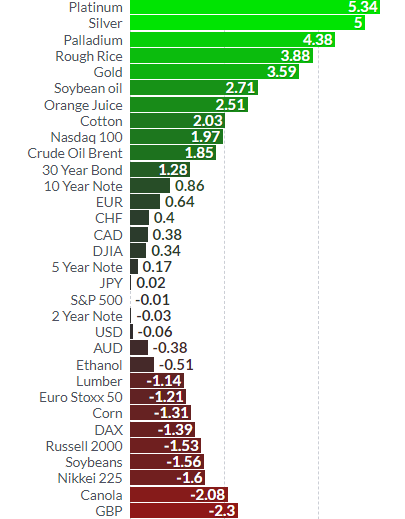

Precious Metals Outperform Markets In August – Gold +4 percents, Silver +5 percents

All four precious metals outperform markets in August. Gold posts best month since January, up nearly 4%. Gold reaches highest price since US election, climbs due to uncertainty and safe haven demand. S&P 500 marginally higher; Euro Stoxx, Nikkei lower for month. Platinum is best performing metal climbing over 5%. Palladium climbs over 4% thanks to seven year supply squeeze.

Read More »

Read More »

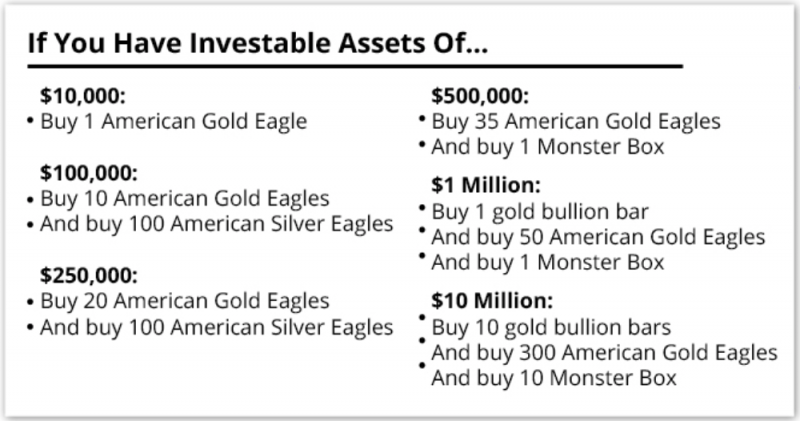

Gold Reset To $10,000/oz Coming “By January 1, 2018” – Rickards

Trump could be planning a radical “reboot” of the U.S. dollar. Currency reboot will see leading nations devalue their currencies against gold. New gold price would be nearly 8 times higher at $10,000/o. Price based on mass exit of foreign governments and investors from the US Dollar. US total debt now over $80 Trillion – $20T national debt and $60T consumer debt. Monetary reboot or currency devaluation seen frequently – even modern history. Buy...

Read More »

Read More »

Gold Surges 2.6 percent After Jackson Hole and N. Korean Missile

Gold surges as N. Korea fires ballistic missile over Japan. Safe haven buying sees gold break out to 10-month high after Jackson Hole and rising North Korea risk of attack on Guam. South Korea’s air force dropped eight MK 84 bombs near Seoul; simulating the destruction of North Korea’s leadership.

Read More »

Read More »

Diversify Into Gold On U.S. “Political Instability” Advise Blackrock

Gold set to shine as Washington stumbles. “Bet on gold’s diversifying properties rather than political stability”. World’s largest asset manager believes Trump and political drama in the U.S. means gold likely to rise. Real rates flattening out and rising political instability – Blackrock’s Koesterich. “For now my bias would be to stick with gold” – Blackrock. U.S. debt ceiling issue to be fractious as bankrupt U.S. hits $20 trillion debt....

Read More »

Read More »

The Truth About Bundesbank Repatriation of Gold From U.S.

Bundesbank has completed a transfer of gold worth €24B from France and U.S. Germany has completed domestic gold storage plan 3 years ahead of schedule. In the €7.7 million plan, 54,000 gold bars were shipped and audited.

Read More »

Read More »

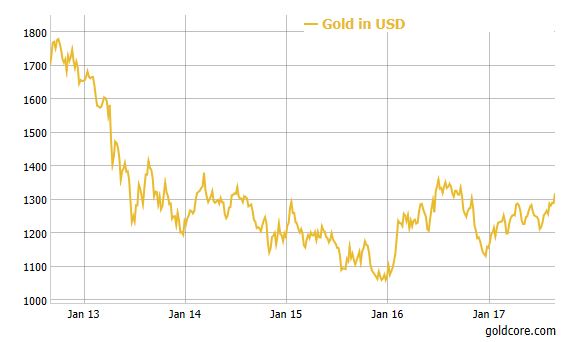

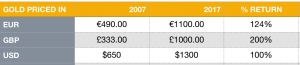

Global Financial Crisis 10 Years On: Gold Price Rises 124 percent From €490 to €1,100

Gold up over 100% in major currencies since financial crisis. Gold up 100% in USD, 124% in EUR and surged 200% in GBP. Gold has outperformed equity, bonds and most assets. Gold remains an important safe-haven in long term.

Read More »

Read More »

U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There

US Treasury Secretary Steve Mnuchin visits Fort Knox Gold

Later tweeted ‘Glad gold is safe!’

Only the third Treasury Secretary to visit the fortified vault, last visit was 1948

Read More »

Read More »