Category Archive: 6a) Gold and its Price

Weltwoche nimmt Blogbeitrag zu Gold von unbequemefragen.ch auf

Da habe ich nicht schlecht gestaunt, als sich Markus Schär von der Weltwoche vorgestern Abend bei mir über Twitter gemeldet und verkündet hat, dass er bei seinem Artikel über die Goldverkäufe der SNB sehr prominent meinen Blogbeitag zitiert. Nochmals...

Read More »

Read More »

Bewiesen: Die SNB verkaufte Gold, welches bei der Fed gelagert war

Endlich kommt der Beweis für meine Vermutung! Die SNB hat heute – parallel zur Propaganda des Bundesrats – ein Dokument “Goldinitiative – häufig gestellte Fragen” (PDF) ins Netz gestellt und dabei sogar interessante Fakten preisgegeben. Konkret geht ...

Read More »

Read More »

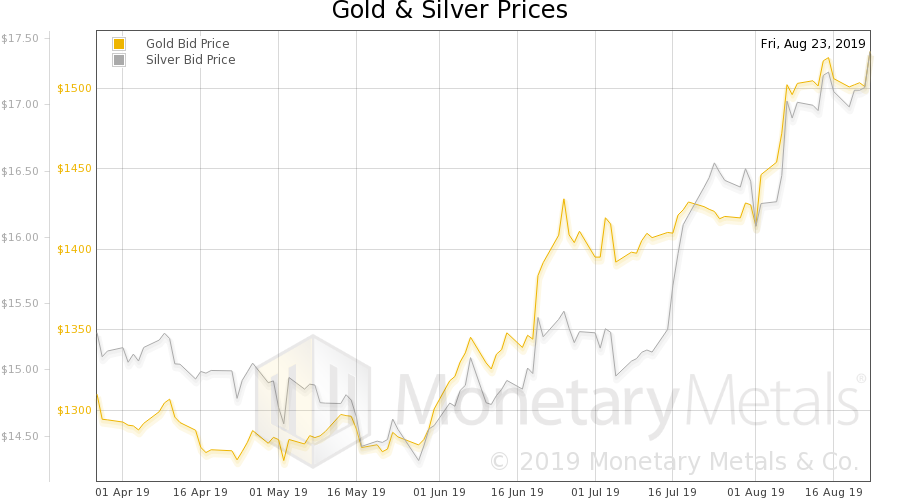

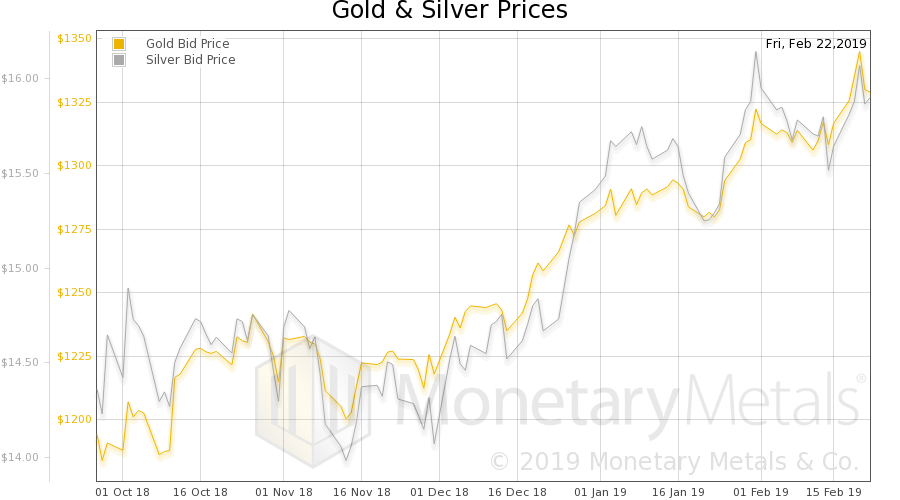

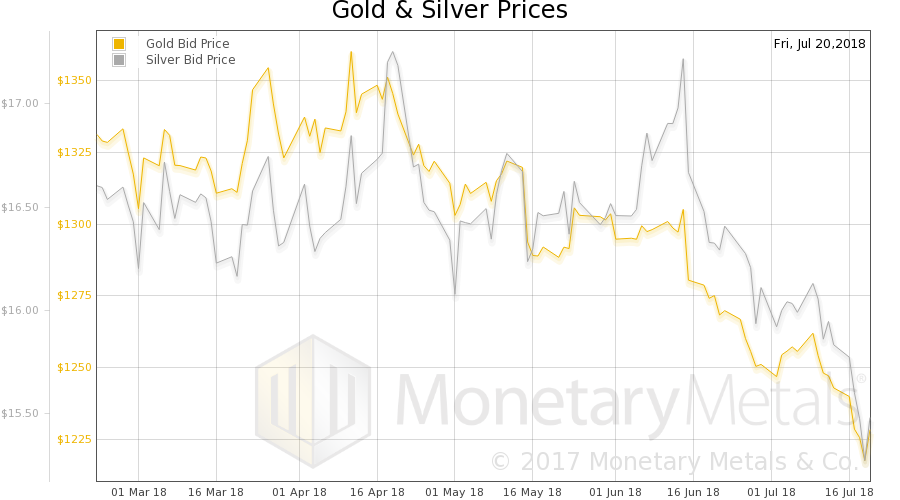

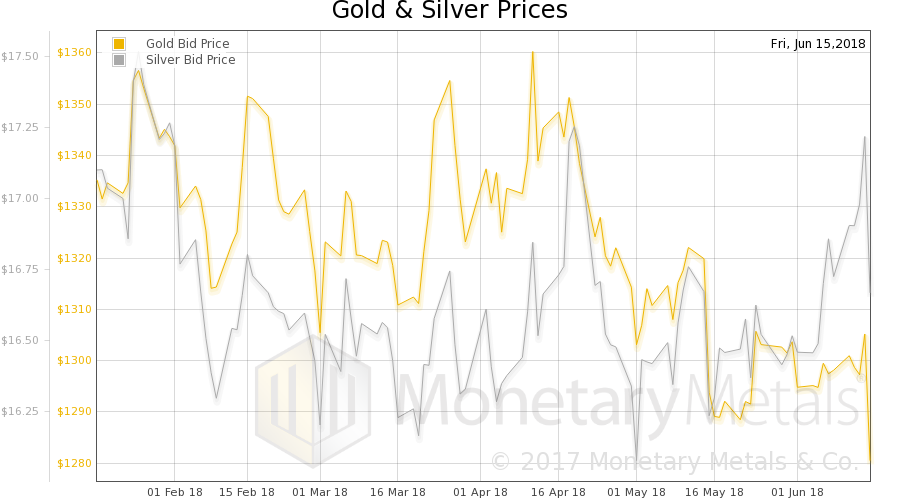

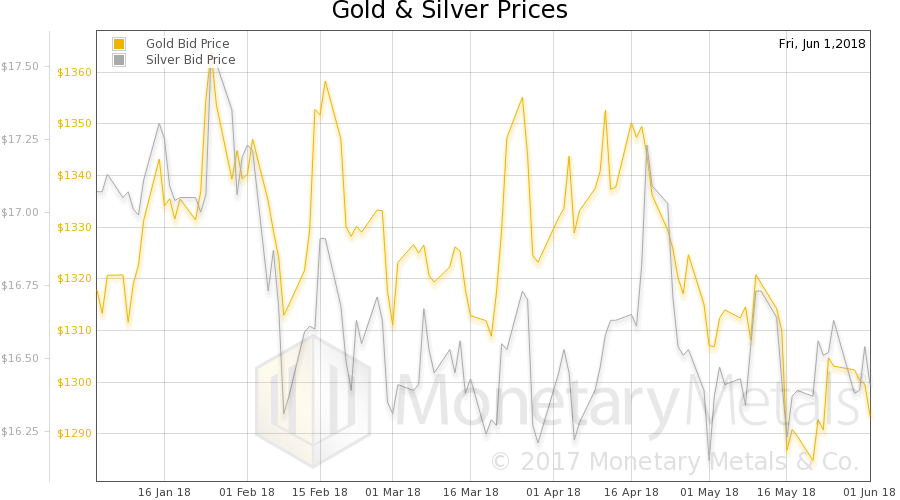

3a) Gold and its price: Monetary Metals

Monetary Metals specialist Keith Weiner gives a weekly update on price movements of gold and silver and the causes. Moreover, George Dorgan gives the fundamental basis for pricing gold and silver.

Read More »

Read More »

How to Buy Gold Bullion Today and When To Sell Gold

Receive Our Award Winning Free Research Here: http://info.goldcore.com/goldcore_email_subscription_preferences – Gold Bullion Seminar – The Outlook For Gold Today – When To Sell Your Gold Coins and Bars – Questions & Answers.

Read More »

Read More »

Geopolitischer Fehler 2. Art – extended version

Wohin man schaut: In allen – auch militärischen – Zeitschriften werden seit Monaten Beiträge publiziert, welche im aktuellen Ukraine-Konflikt, dem russischen Präsidenten Putin den schwarzen Peter zuschieben. Da wird vom Propagandakrieg gesprochen, vo...

Read More »

Read More »

How Long Will the Dollar Be the Major World Reserve Currency? A Look at Wealth

We examine how long the U.S. Dollar will remain the unique world reserve currency. The most important criterion for being a reserve currency is wealth. While China has recently overtaken the U.S. as for inflation-adjusted GDP, in the next step, it will overtake the U.S. as for wealth.

Read More »

Read More »

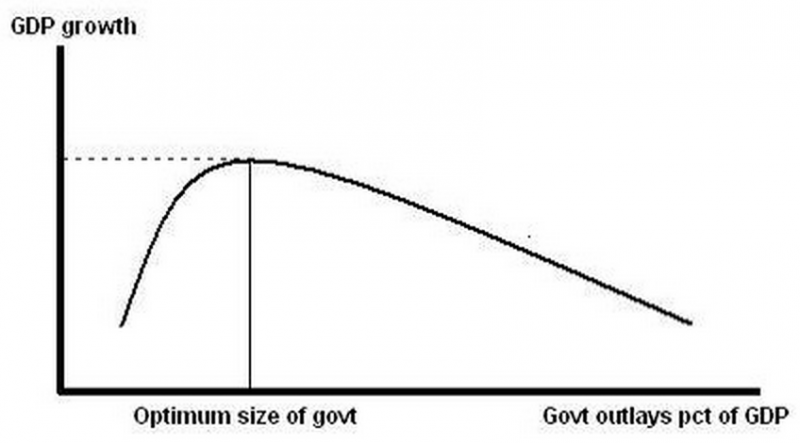

Die Rahn-Kurve und die Sicherheit

Im monatlichen Marktkommentar von Marc Faber steht dieses Mal auf Seit 5ff das Konzept der Rahn-Kurve – ein faszinierendes Konzept. Es geht darum, das Optimum bezüglich Staatsausgaben anzustreben. Bei 0% wie auch 100% Staatsaktivität am BIP ergibt si...

Read More »

Read More »

SNB verlängert Goldabkommen, aber wozu?

Die SNB schreibt heute in einer Medienmitteilung: Um ihre Absichten in Bezug auf ihre Bestände an Gold darzulegen, geben die Beteiligten am Goldabkommen folgende Erklärung ab: Gold bleibt ein wichtiges Element der globalen Währungsreserven.

Read More »

Read More »

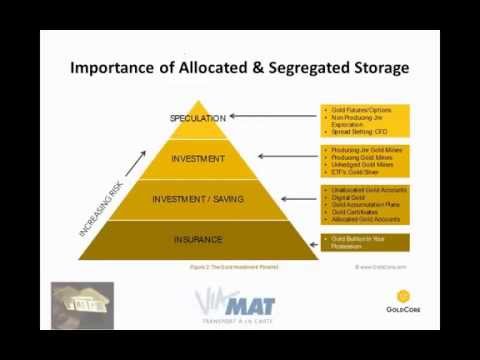

Gold Bullion Stored In Singapore Is Safest – Marc Faber

Find out why Singapore is now one of the safest places in the world to store gold in our latest gold guide – Essential Guide To Storing Gold In Singapore Please click here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore

Read More »

Read More »

AM Bron Suchecki Interview – Gold as Forex, and Bond Portfolio Balancing Implications

I invited Bron Suchecki from the Perth Mint (www.perthmint.com.au) for a conversational interview at the end of 2013. Here is the interview video, RNP #92 dated 13 December 2013. I tried to make this into a different type of conversation from what is often found in the blogosphere, by virtue of concentrating on the implications …

Read More »

Read More »

Celente On Ukraine, War, ATMs, Runs on Banks and Gold and Silver

Gerald Celente joins GoldCore for a webinar to discuss the various strategies available for protecting one’s wealth in 2014 and beyond. Also, check out our short guide to Bank Bails ‘PROTECTING YOUR SAVINGS IN THE COMING BAIL-IN ERA’ at http://info.goldcore.com/what-savers-and-depositors-need-to-do-to-protect-their-savings-and-deposits-from-bank-bail-ins Gerald Celente needs little introduction: Founder of The Trends Research...

Read More »

Read More »

Gold Is A Safe Haven

Full report now available here: http://info.goldcore.com/gold-is-a-safe-haven-asset There is a significant and growing consensus among academics, independent researchers and asset allocation experts that gold is a hedging instrument and a safe haven asset. Thus, many financial professionals, including GoldCore, now believe that gold should form part of investment and savings portfolios for reasons of diversification and …

Read More »

Read More »

2013 Posts on Swiss&Gold

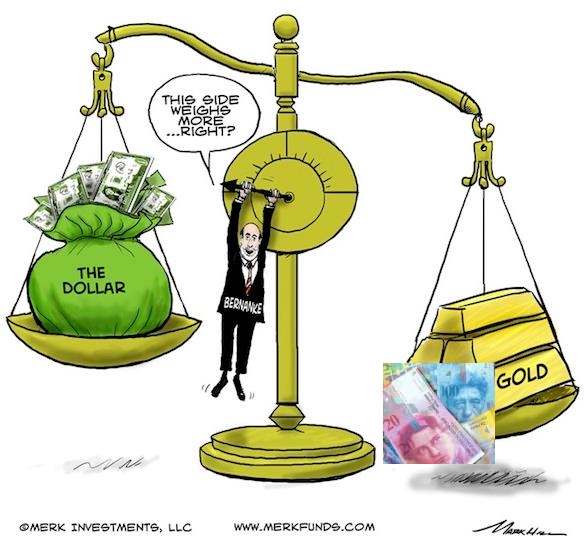

The Fed Will Remain Gold’s Strongest Supporter For Years

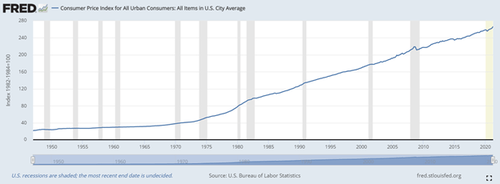

In the early 1980s the Fed stopped the wage-price spiral and destroyed the gold price. Today main-stream economists have discovered that rising company profits compared to stagnating wages could an issue for the U.S. economy. For us this implies that the ultimate Fed goal will be to increase wages and inflation. Consequently the Fed has become the biggest supporter of gold and silver prices.

Read More »

Read More »

Has Gold’s ‘Bubble’ Burst Or Is This Another Golden Opportunity?

Topics covered in the webinar: * Review Of Asset Performance H1, 2013 * Outlook For Gold And Silver This Year and Coming Years * Paper and Digital Gold * Learning From 1970s Bull Market & 1975/76 Price Collapse * Safest Way To Own Gold And Silver * Knowing When To Reduce Allocations Or Sell * … Continue...

Read More »

Read More »

Protect Your Savings Alternatives to Cash on Deposit – Top Tips from Jill Kerby

In this 40 minute session, Jill Kerby, one of Ireland’s leading authorities on personal finance will advise on how to protect your savings. Inflation is eroding the value of all cash on deposit. Also, with the recent banking crisis in Cyprus and the threat of deposit confiscation now on the table among EU finance leaders, …

Read More »

Read More »

Which Of The Six Major Fundamental Factors For Gold And Silver Are Still Positive? Which Are Not? (April 2013)

Having identified the 6 fundamental price factors previously we speak about the gold-silver ratio. We explain which fundamental factors speak for an increase of gold and silver prices and which don't.

Read More »

Read More »

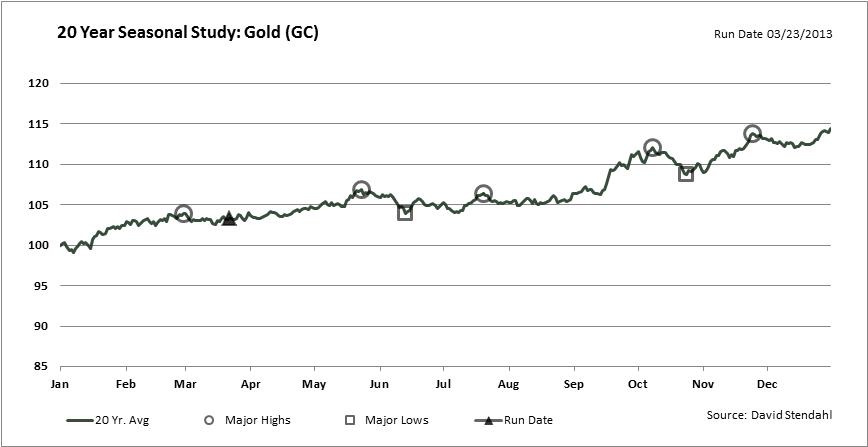

Seasonal Factors on Gold, the 19 February Short Trade

Gold came under pressure in early February when stock market strength but also U.S. gas prices rose. US purchases, however, help to improve foreign economies and therefore also the gold price.

Read More »

Read More »

All You Need To Know About Silver In 60 Minutes with David Morgan and Mark O’Byrne March 13th 2013

Poor man’s gold, silver, continues to get no love with little or no coverage despite fundamentals that are arguably better than those for other assets, securities and even gold. Thus, GoldCore conducted a webinar yesterday (March 13th, 2013) with one of the leading silver experts in the world, Mr David Morgan. The webinar was very …

Read More »

Read More »

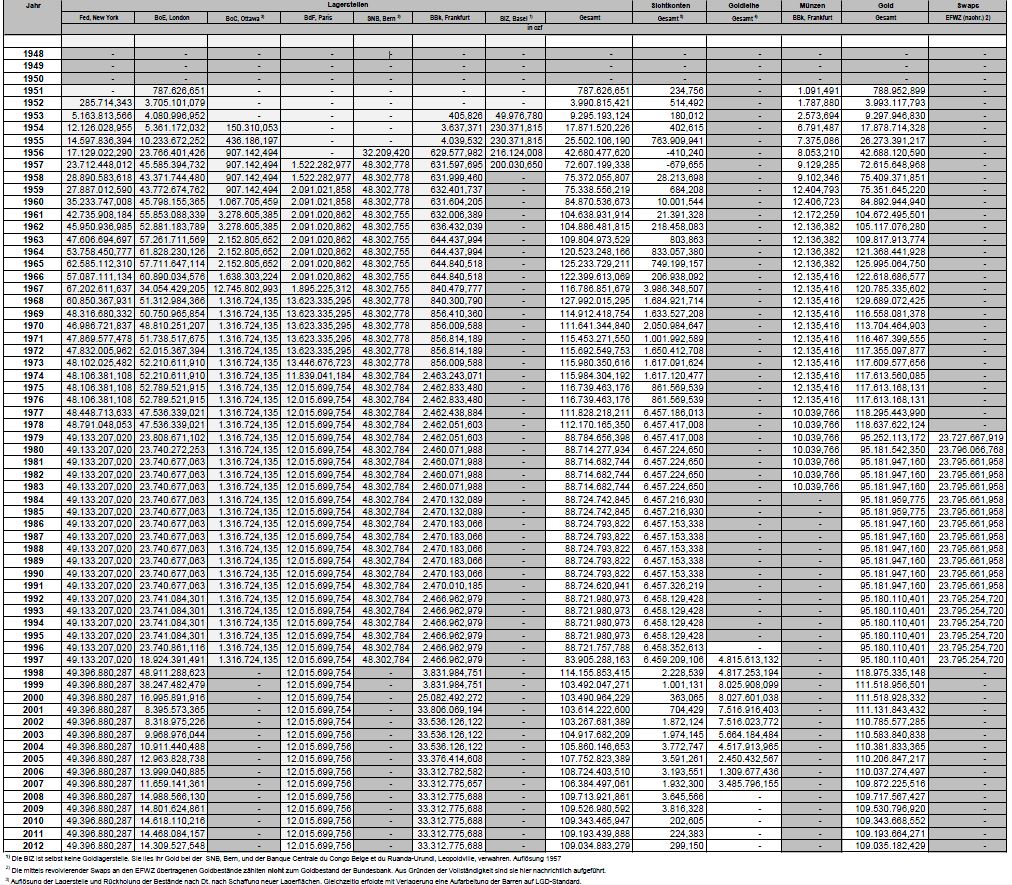

The List German Gold Transactions 1951-2012

The German Bundesbank decided to opt for full transparency of their gold reserves and their whereabouts since the second world war. Our details:

Read More »

Read More »