Category Archive: 6a) Gold and its Price

Gold’s Middle Finger To Lying Currencies

Authored by Matthew Piepenburg via GoldSwitzerland.com,Sensationalism, like central bankers and policy makers, has many faces, views and voices.This may explain why so many want to hold their ears, hug their knees and beg the heavens for a beacon of guiding light amidst a 24/7 fog of info-cycle pablum masquerading as information.

Read More »

Read More »

Things That Make Me Go Hmmm: Inflation, Crypto, Command Economies, & Gold

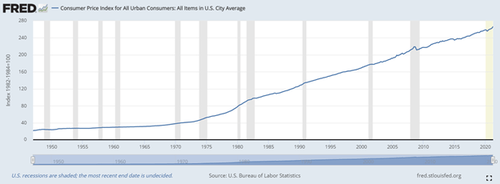

Over the years I’ve written almost ad nauseum about the crazy I see (and saw) around me as a fund manager, family office principal and individual investor.The list includes: 1) an entire book on the grotesque central bank distortions of free market price discovery.

Read More »

Read More »

Gold To $3,000/oz By End Of 2020 As The Dollar Will Fall Sharply – Ron Paul

Where Does Gold Go From Here? — Ron Paul’s “Cautious” Prediction. “Gold is an ‘insurance policy’ as the dollar will continue go down in value as it is printed” and it will end in a monetary “calamity”. “Gold is not money due to any man-made laws. Gold is money despite man-made laws, and is a product of the voluntary marketplace”.

Read More »

Read More »

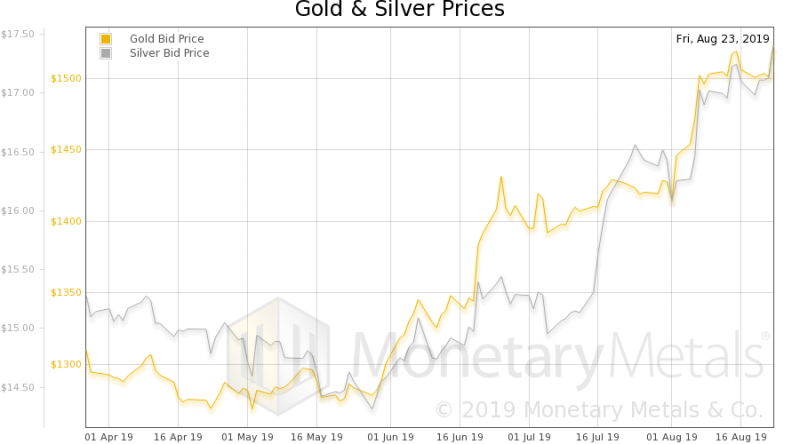

Directive 10-289, Report 25 Aug

Everyone must ask himself the question. Do you want the world to move to an honest money system, or do you just want gold to go up (we italicize discussion of apparent moves in gold, because it’s the dollar that’s moving down—not gold going up—but we sometimes frame it in mainstream terms).

Read More »

Read More »

Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran

Gold sees safe haven demand push it to highest in one month as it breaches key $1,300/oz and £1,000/oz levels. U.S. China trade wars escalates as China retaliates and imposes tariffs on $60 billion of U.S. goods. Increased risk of war in Middle East after U.S. alleges Iran bombed Saudi oil vessels destined for the U.S.

Read More »

Read More »

Gold Prices In Pounds and Euros Gain More as Economic Growth Falters in the UK and EU

Gold prices in pounds and euros as economic growth falters in UK and EU. Euro & pound gold tests multi year resistance; likely to surpass due to strong demand. Improved risk appetite sees stocks rise which may be hampering stronger gains for gold.

Read More »

Read More »

Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week

Gold futures settled above $1,300 an ounce on Friday, with prices for the yellow metal at their highest since June as the U.S. dollar pulled back and investors eyed geopolitical turmoil and global growth worries. Rising gold prices reflect “political uncertainty” in the U.S., Eurozone, Venezuela and pockets of South America, as well as China-U.S. trade talks, said George Gero, managing director in RBC.

Read More »

Read More »

Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents

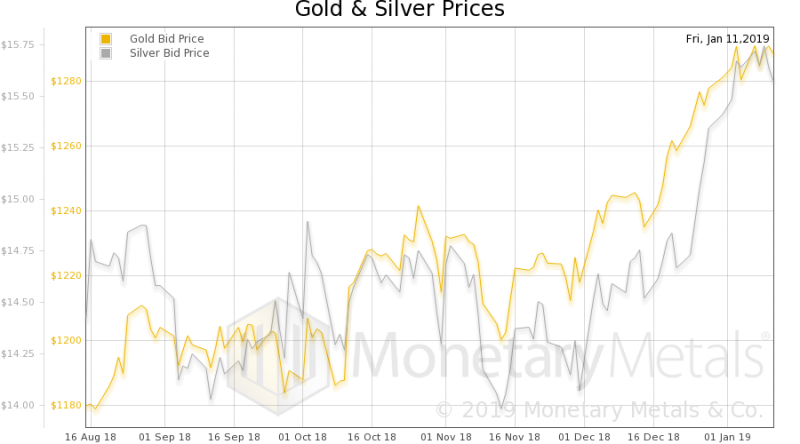

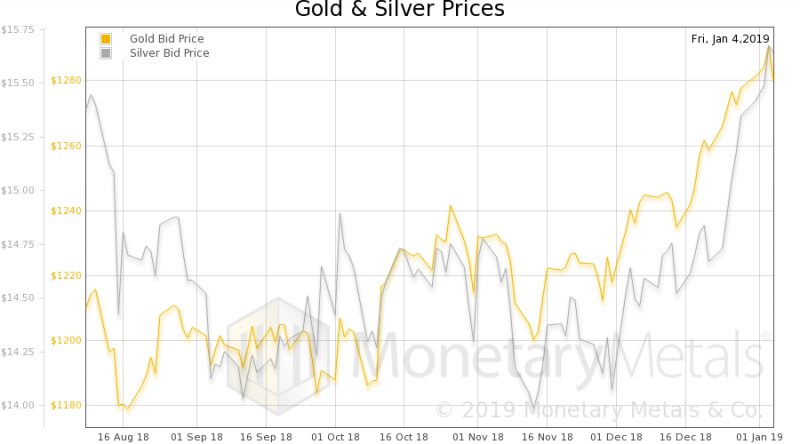

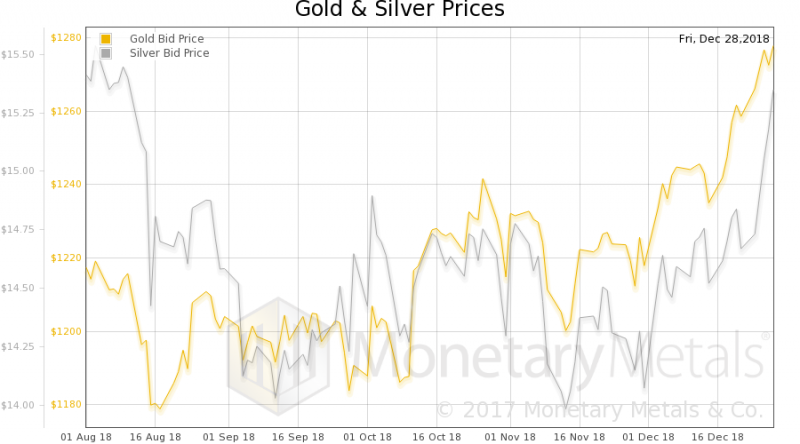

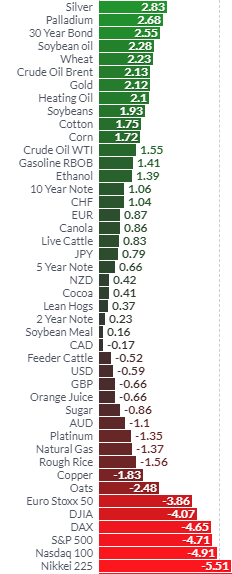

Gold acted as a safe haven last week and is again acting as a safe haven in December. It has performed well despite the rout in stocks in Ireland and globally. U.S. stocks including the S&P500 and Nasdaq were down nearly 5% last week, while gold was 2% higher and silver over 3% higher.

Read More »

Read More »

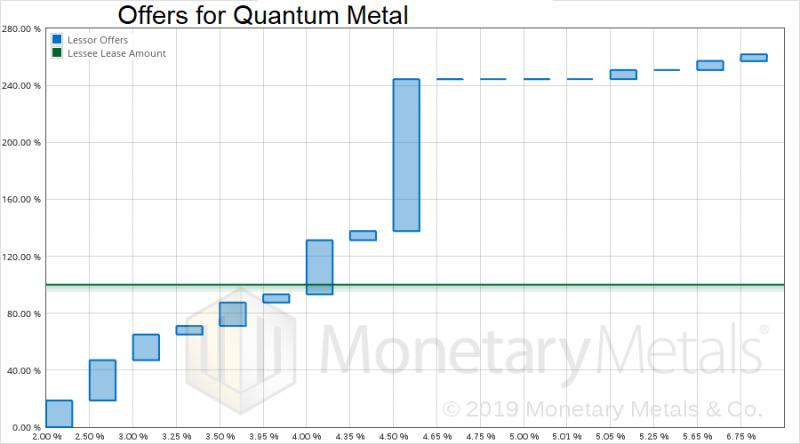

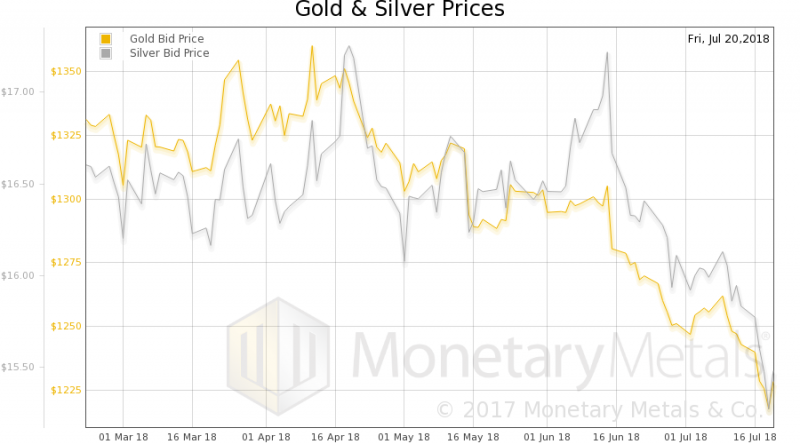

Crying Wolf, Report 22 July 2018

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »