Category Archive: 6a) Gold and its Price

Investing in Gold in 2016: Global Paradigm Shifts in Politics and Markets

Crumbling Stability. In the past few months, we have witnessed a series of defining events in modern political history, with Britain’s vote to exit the EU, (several) terror attacks in France and Germany, as well as the recent attempted military coup in Europe’s backyard, Turkey. Uncertainty over Europe’s political stability and the future of the EU keeps growing.

Read More »

Read More »

The Fundamentals behind Gold Price Seasonality

Many know that gold is very volatile in the course of year. Gold prices tend to be low in January and rise between July and November. But what are the fundamental reasons behind this seasonality?

Read More »

Read More »

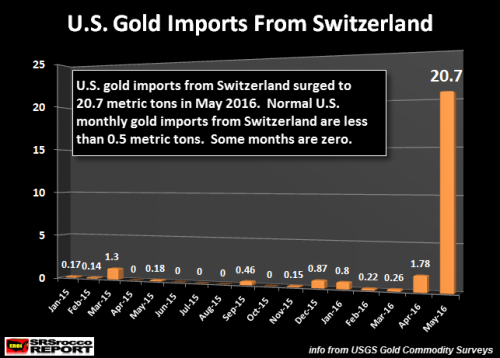

Record Swiss Gold Flow Into The United States

Record Swiss Gold Flow Into The United States. There was a huge trend change in U.S. gold investment in May. Something quite extraordinary took place which hasn’t happened for several decades. While Switzerland has been a major source of U.S. gold exports for many years, the tables turned in May as the Swiss exported a record amount of gold to the United States.

Read More »

Read More »

The Curious Case of Vanishing Lady Liberty; Only Gold and Silver Remember Her

The very first word anyone ever saw on a circulating United States coin was the word “LIBERTY.” From half-cents to silver dollars, each featured the likeness of an unnamed woman. The images varied, thanks to different engravers, but together they became recognized as Lady Liberty. Many, maybe most, of young America's citizens were illiterate. "Liberty" may have been the first word they ever learned to read.

Read More »

Read More »

Greenspan, Gold, and the Banality of Evil

Under certain circumstances, seemingly decent human beings are capable of horrific things. So it is with Former Federal Reserve Chairman Alan Greenspan, who parlayed his sound money bona fides into the top post at America’s private banking cartel and current issuer of our un-backed currency. In betrayal of his own stated free-market principles, Greenspan spent his tenure at the Fed pumping up financial markets with easy money and enabling runaway...

Read More »

Read More »

Fearing Confiscation, Japanese Savers Rush To Buy Gold And Store It In Switzerland

Japan has pushed further away from being the nation that embraces "Krugman Era" economics and deeper into the new "Bernanke Era" economics of helicopter money. As a result Japan's citizens have been on a blitz to save what little purchasing power they still possess, before hyperinflation finally arrives.

Read More »

Read More »

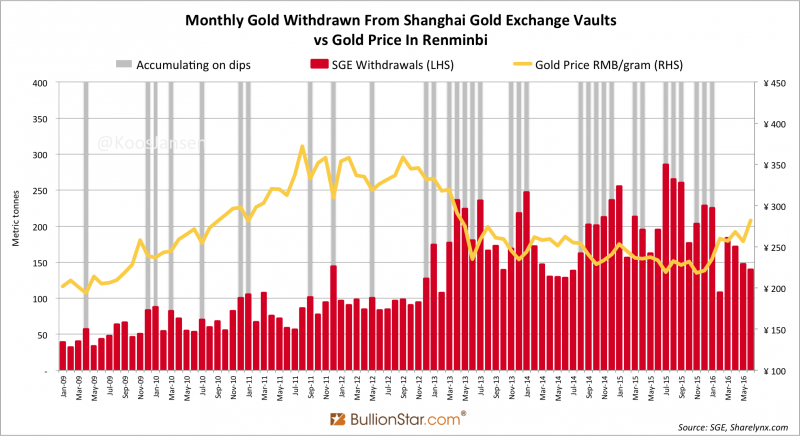

Chinese Gold Demand 973 tonnes in H1 2016, Nomura SGE Withdrawals Chart False

Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 % compared to last year.

Read More »

Read More »

Gold Silver Update for Purists

It’s that dreaded day after Independence Day. The weather is gorgeous and I don’t really feel like trading either. The thought of just phoning it in had occurred to me, but as the new month just rolled over I thought I may as well take another peek at our monthly charts.

Read More »

Read More »