Category Archive: 5.) The United States

The Hidden-in-Plain-Sight Mechanism of the Super-Wealthy: Money-Laundering 2.0

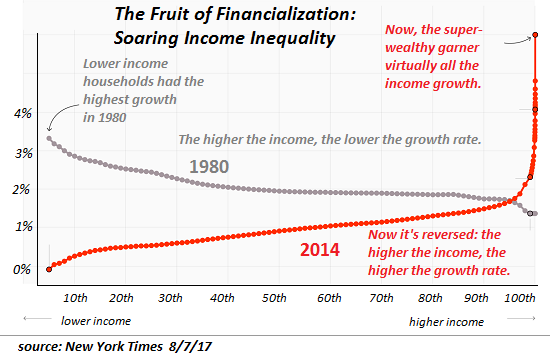

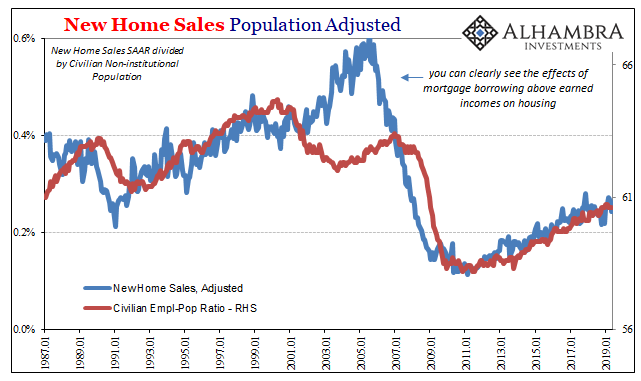

Financial and political power are two sides of one coin. We all know the rich are getting richer, and the super-rich are getting super-richer. This reality is illustrated in the chart of income gains, the vast majority of which have flowed to the top .01%--not the top 1%, or the top .1% -- to the very tippy top of the wealth-power pyramid.

Read More »

Read More »

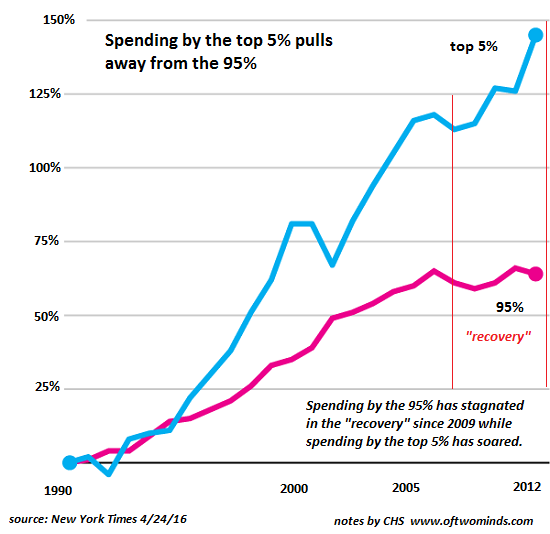

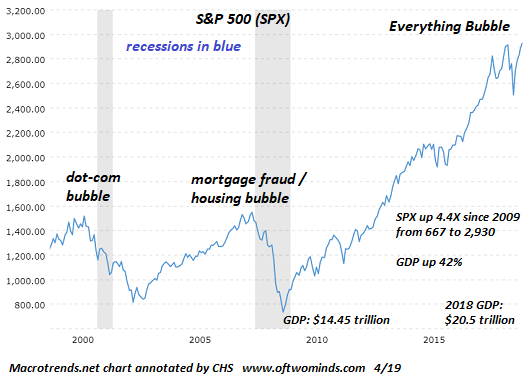

“Wealth Effect” = Widening Wealth Inequality

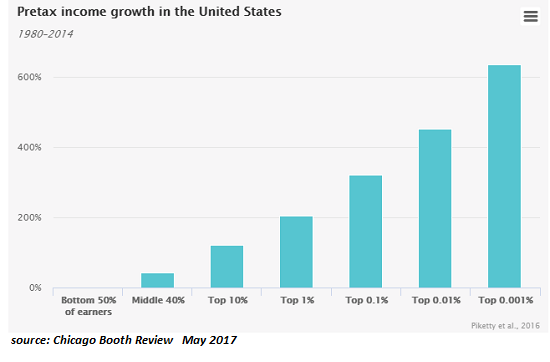

Note that widening wealth and income inequality is a non-partisan trend. One of the core goals of the Federal Reserve's monetary policies of the past 9 years is to generate the "wealth effect": by pushing the valuations of stocks and bonds higher, American households will feel wealthier, and hence be more willing to borrow and spend, even if they didn't actually reap any gains by selling stocks and bonds that gained value.

Read More »

Read More »

Christmas 2017: Why I’m Hopeful

A more human world lies just beyond the edge of the Status Quo. Readers often ask me to post something hopeful, and I understand why: doom-and-gloom gets tiresome. Human beings need hope just as they need oxygen, and the destruction of the Status Quo via over-reach and internal contradictions doesn't leave much to be happy about.

Read More »

Read More »

Santa’s Stock Market Rally: Tears of Joy, Or Just Tears?

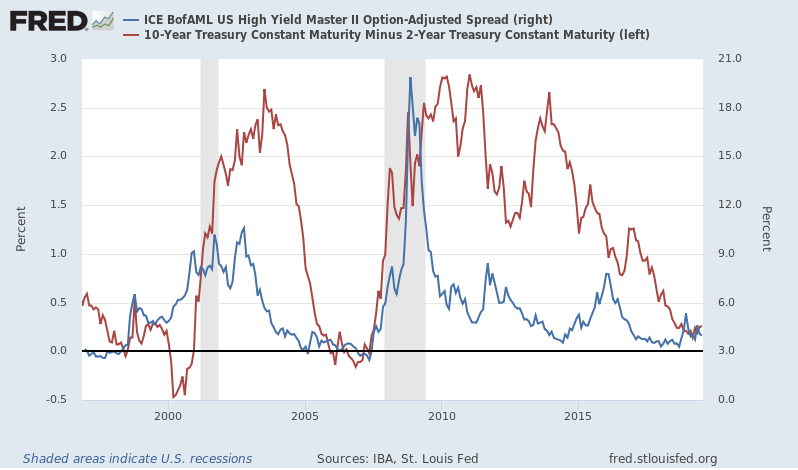

Judging by this year's version of Santa Claus's reliable year-end stock market rally, risk has vanished, not just in stocks but in bonds, junk bonds, housing, commercial real estate, collectible art--just about the entire spectrum of tradable assets (with precious metals and agricultural commodities among the few receiving coals rather than rallies).

Read More »

Read More »

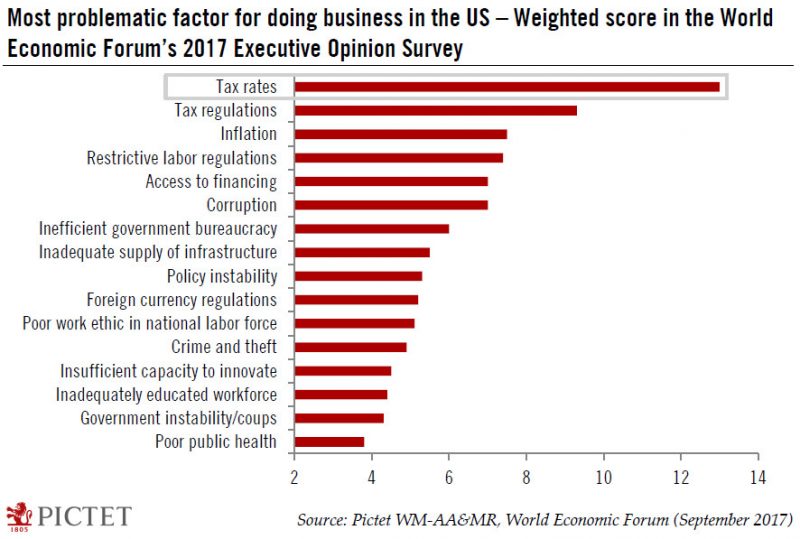

US to overtake Switzerland in WEF competitiveness survey?

The US is about to enact significant corporate tax cuts, and could therefore edge closer to the number 1 spot in the World Economic Forum’s ranking – currently held by Switzerland. The US is about to enact significant corporate tax cuts, that will see the federal statutory corporate tax rate drop to 21%, from 35%, starting in January (see our latest note ‘US tax cuts update – 19 December 2017’).

Read More »

Read More »

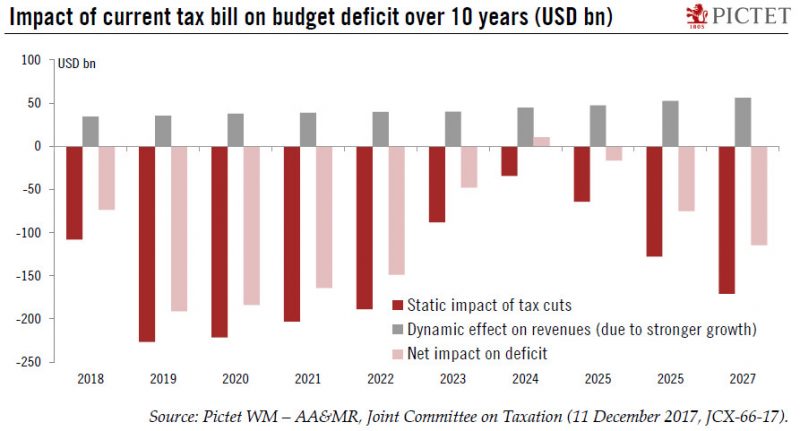

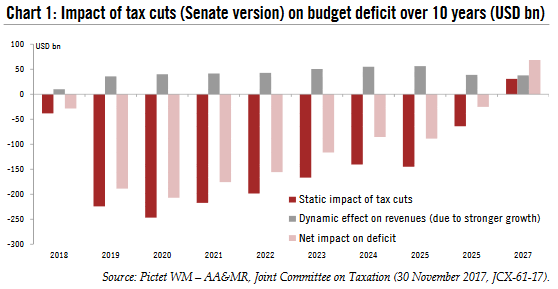

US tax bill looks set to pass

The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week, after clearing the conference committee hurdle (a compromise between the House and Senate versions). A few hesitating Republican Senators have eventually said they will vote in favour of the bill, which is key as the Republican majority in the Senate is slim at 52-48. It will shrink to 51-49 in January after...

Read More »

Read More »

Federal Council adopts measures to tackle high prices in Switzerland

On 20 December the Federal Council decided to unilaterally remove tariffs on imported industrial goods. Tariffs will also be reduced on selected agricultural goods not produced in Switzerland. Furthermore, the government wants to apply the Cassis de Dijon principle more widely by reducing the number of exceptions to it. These measures should lead to considerable savings of around CHF 900 million for businesses and consumers. Previously, on 8...

Read More »

Read More »

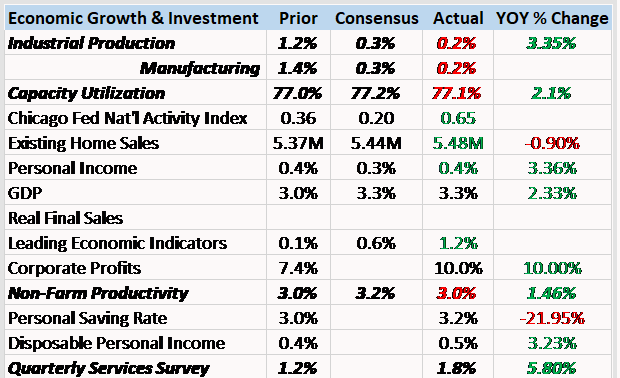

The Economy Likes Its IP Less Lumpy

Industrial Production rose 3.4% year-over-year in November 2017, the highest growth rate in exactly three years. The increase was boosted by the aftermath of Harvey and Irma, leaving more doubt than optimism for where US industry is in 2017. For one thing, of that 3.4% growth rate, more than two-thirds was attributable to just two months.

Read More »

Read More »

Chinese Are Not Tightening, Though They Would Be Thrilled If You Thought That

The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the 28-day).

Read More »

Read More »

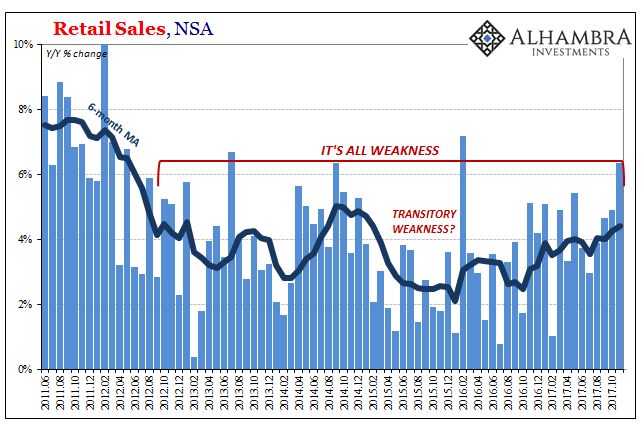

Retail Sales Bounce (Way) Too Much

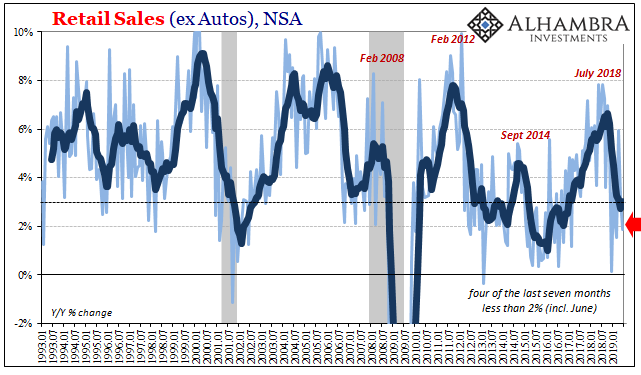

Retail sales had a good month of November, or at least what counts as decent over the last five and a half years. Total retail sales (unadjusted) rose 6.35% last month, up from 4.9% (revised higher) in October. It was the highest rate of growth since the 29-day month of February 2016. For retailers, what matters is that it comes at the start of the Christmas shopping season.

Read More »

Read More »

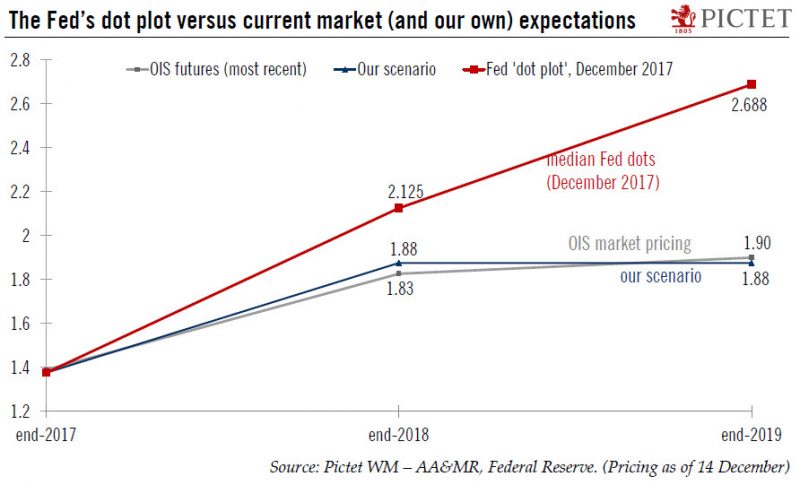

Fed’s enthusiasm on tax cut plans remains limited

The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’.

Read More »

Read More »

Bi-Weekly Economic Review: Animal Spirits Haunt The Market

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits?

Read More »

Read More »

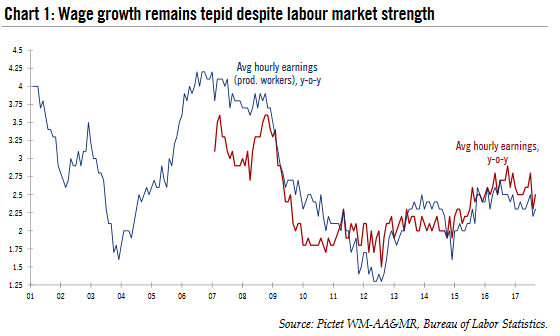

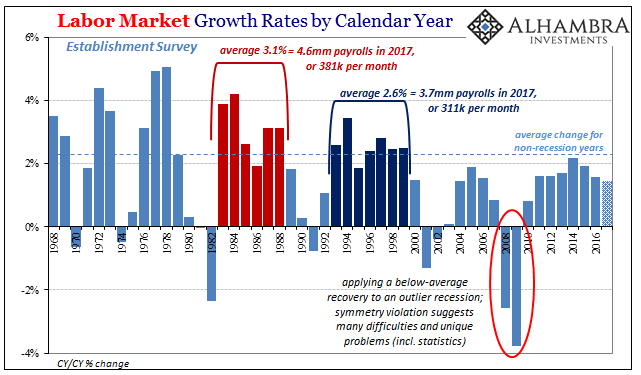

Slow wage growth to keep Fed on prudent normalisation track

The November employment report showed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest -rate hikes (although it is still very likely to hike 25bps on 13 December).

Read More »

Read More »

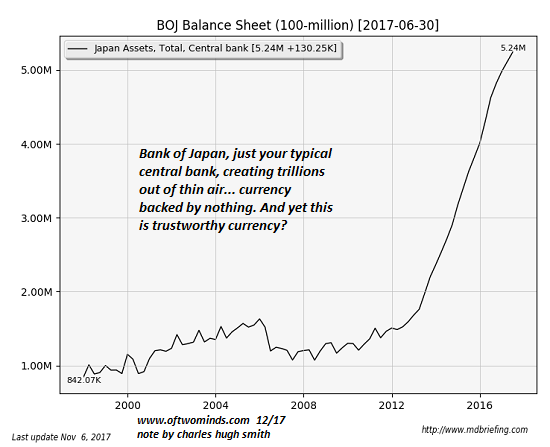

Could Central Banks Dump Gold in Favor of Bitcoin?

All of which brings us to the "crazy" idea of backing fiat currencies with cryptocurrencies, an idea I first floated back in 2013, long before the current crypto-craze emerged. Exhibit One: here's your typical central bank, creating trillions of units of currency every year, backed by nothing but trust in the authority of the government, created at the whim of a handful of people in a room and distributed to their cronies, or at the behest of their...

Read More »

Read More »

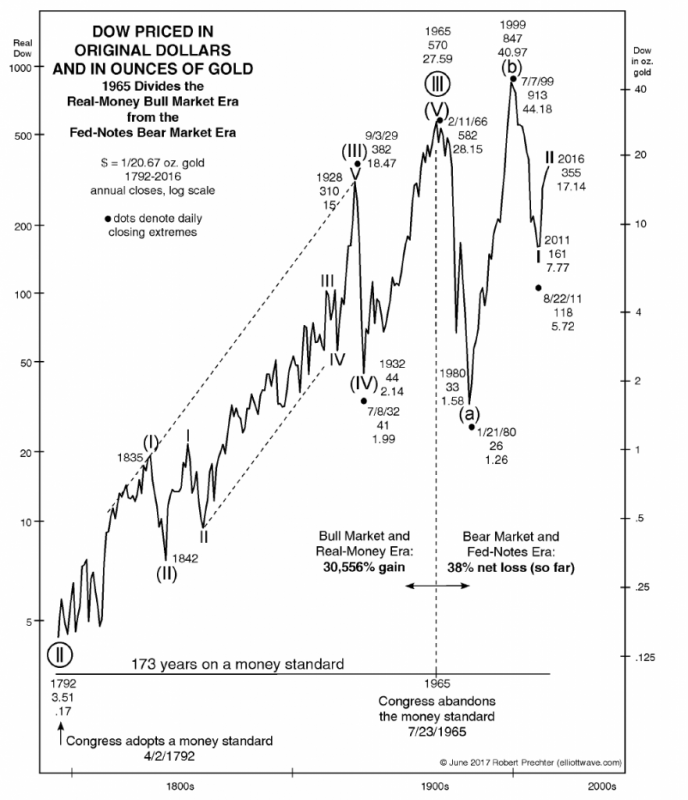

The Rug Yank Phase of Fed Policy

The political differences of today’s two leading parties are not over ultimate questions of principle. Rather, they are over opposing answers to the question of how a goal can be achieved with the least sacrifice. For lawmakers, the goal is to promise the populace something for nothing, while pretending to make good on it.

Read More »

Read More »

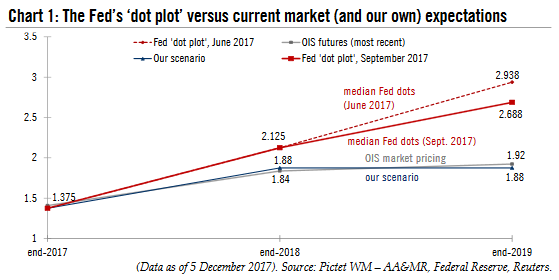

Fed rate unlikely to move much above 2 percent next year

The Federal Reserve is probably looking back at 2017 with satisfaction. After on the rate rise expected on 13 December, it will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by markets. In fact, broader financial conditions have eased this year despite the Fed’s monetary tightening....

Read More »

Read More »

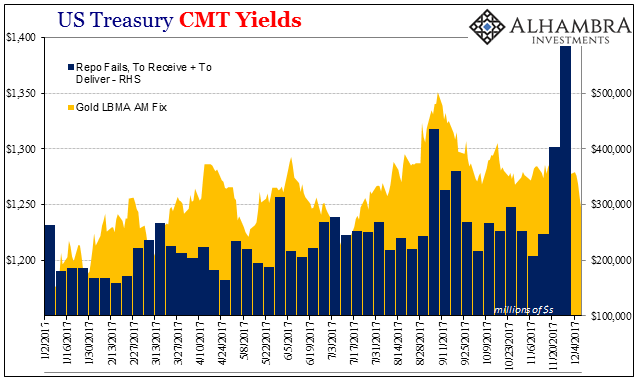

Chart of the Week: Collateral

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week.

Read More »

Read More »

The Stock Market and the FOMC

As the final FOMC announcement of the year approaches, we want to briefly return to the topic of how the meeting tends to affect the stock market from a statistical perspective. As long time readers may recall, the typical performance of the stock market in the trading days immediately ahead of FOMC announcements was quite remarkable in recent decades. We are referring to the Seaonax event study of the average (or seasonal) performance across a...

Read More »

Read More »

A crucial step towards US tax cuts

With the approval of the Senate tax bill in the early hours of Saturday 2 December, a key step has been taken toward tax cuts. The next chapter in the process is to reconcile this version with the House of Representatives’ tax bill, most likely in a ‘conference committee ’ from which a final version will emerge.

Read More »

Read More »

Defining The Economy Through Payrolls

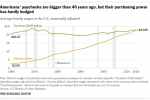

The year 2000 was a transition year in a lot of ways. Though Y2K amounted to mild mass hysteria, people did have to get used to writing the date with 20 in front of the year rather than 19. It was a new millennium (depending on your view of Year 0) that seemed to have started off under the best possible terms. Not only were stocks on fire at the outset, the economy was, too.

Read More »

Read More »