Category Archive: 5.) The United States

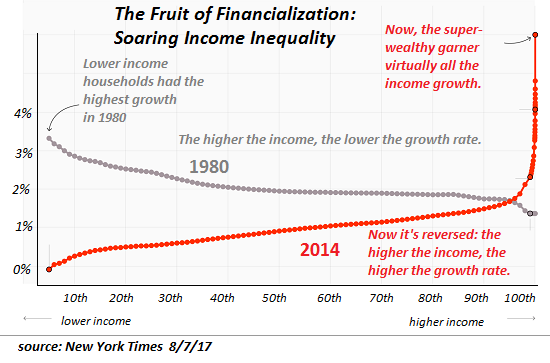

Our “Prosperity” Is Now Dependent on Predatory Globalization

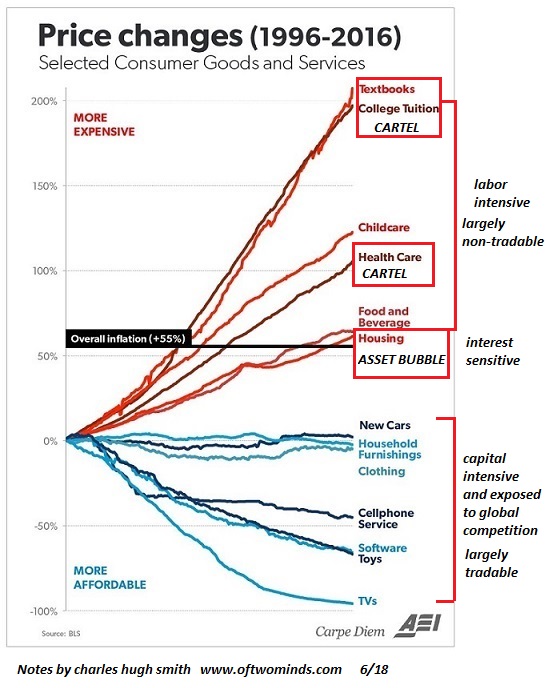

Nowadays, trade and "prosperity" are dependent on currencies that are created out of thin air via borrowing or printing. So here's the story explaining why "free" trade and globalization create so much wonderful prosperity for all of us: I find a nation with cheap labor and no environmental laws anxious to give me cheap land and tax credits, so I move my factory from my high-cost, highly regulated nation to the low-cost nation, and keep all the...

Read More »

Read More »

The Fantasy of “Balanced Returns” Funding Retirement

The fantasy that a "balanced portfolio" yielding "balanced returns" will fund a stable retirement for decades to come is widely accepted as a sure thing: inflation will stay near-zero essentially forever, assets such as stocks and bonds will continue yielding hefty income and capital gains, and all the individual or fund needs to do is maintain a "balanced portfolio" of various asset classes that yield "balanced returns," i.e. some safe "value"...

Read More »

Read More »

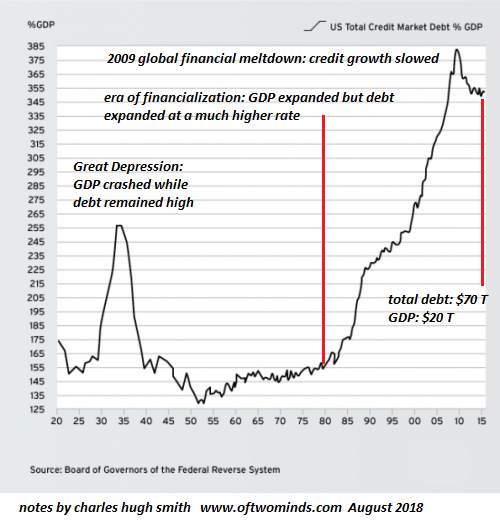

We’ll Pay All Those Future Obligations by Impoverishing Everyone (How to Destroy Our Currency In One Easy Lesson)

The only way to pay all these future obligations is by creating new money. I've been focusing on inflation, which is more properly understood as the loss of purchasing power of a currency, which when taken to extremes destroys the currency and the wealth/income of everyone forced to use that currency.

Read More »

Read More »

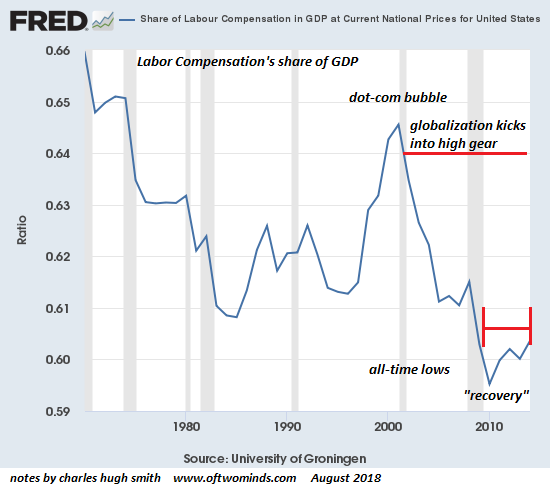

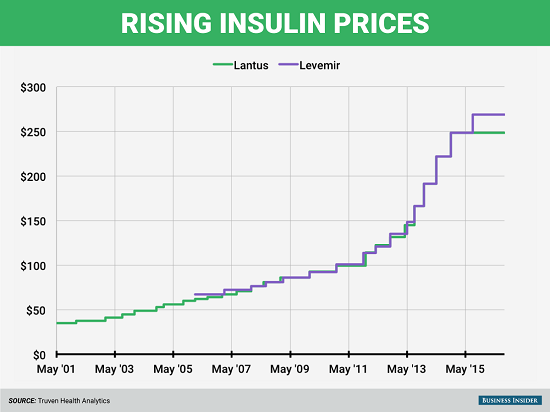

The 21st Century Misery Index: Labor’s Share of the Economy and Real-World Inflation

In the late 1970s and early 1980s, an era of stagflation, the Misery Index was the unemployment rate plus inflation, both of which were running hot. Now those numbers are at 50-year lows: both the unemployment rate and inflation are about as low as they can go, reaching levels not seen since the mid-1960s.

Read More »

Read More »

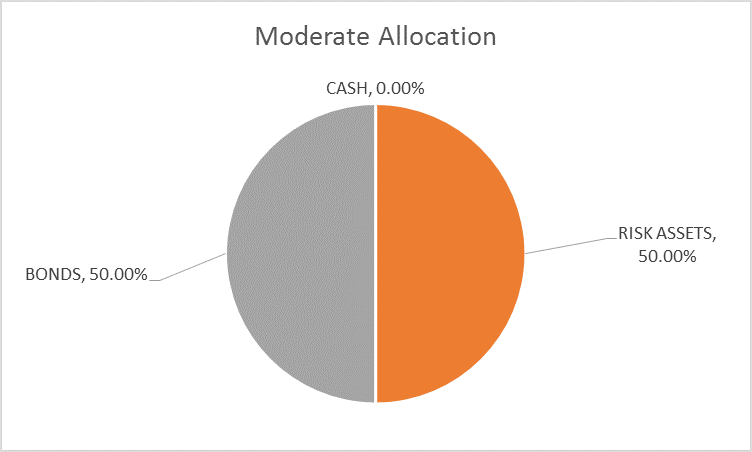

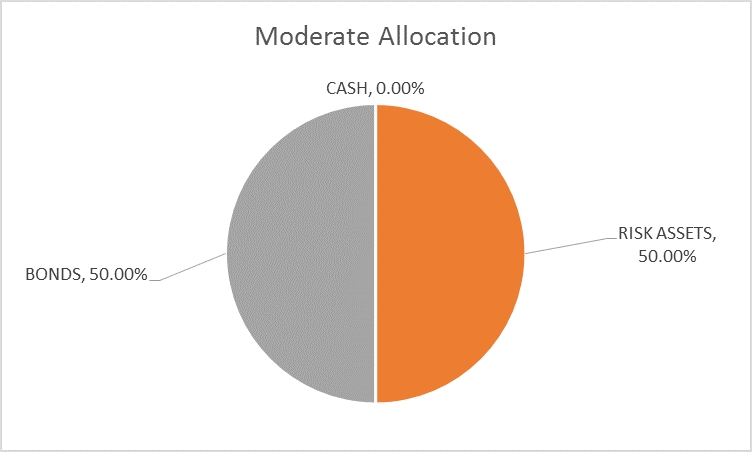

Global Asset Allocation Update

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY.

Read More »

Read More »

Russia Sells 80 percent Of Its US Treasuries

Russia Sells 80% Of Its US Treasuries. Description: In just over 2 months Russia has sold-off over 85% of its holdings of U.S. Treasuries, should the U.S. be concerned? – Russia has liquidated 85% of its US Treasury holdings in just two months. – Russia dumps over $90 billion of Treasuries in April and May as holdings collapse from near $100 billion to just $9 billion.

Read More »

Read More »

Here’s What We’ve Lost in the Past Decade

The confidence and hubris of those directing the rest of us to race off the cliff while they watch from a safe distance is off the charts. The past decade of "recovery" and "growth" has actually been a decade of catastrophic losses for our society and nation. Here's a short list of what we've lost: 1. Functioning markets. Free markets discover price and assess risk.

Read More »

Read More »

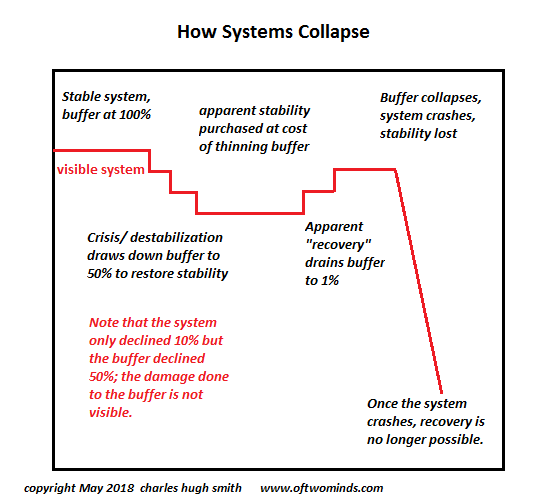

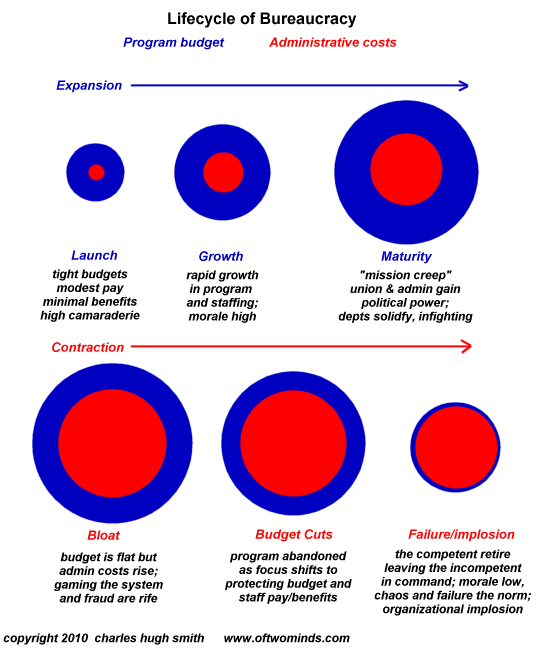

Here’s How Systems (and Nations) Fail

These embedded processes strip away autonomy, equating compliance with effectiveness even as the processes become increasingly counter-productive and wasteful. Would any sane person choose America's broken healthcare system over a cheaper, more effective alternative?

Read More »

Read More »

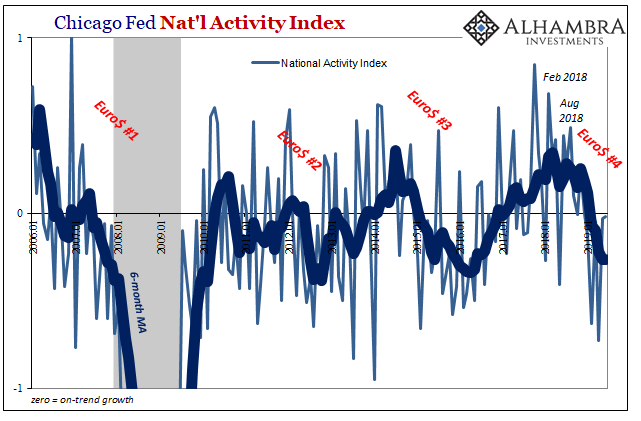

When Long-Brewing Instability Finally Reaches Crisis

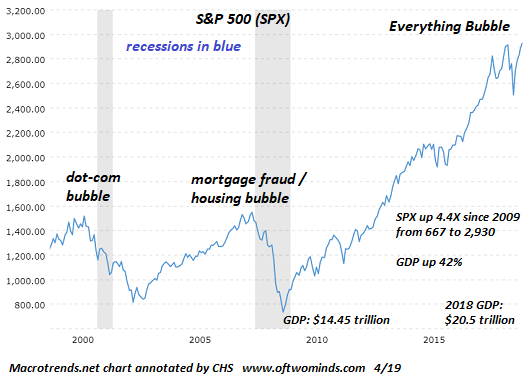

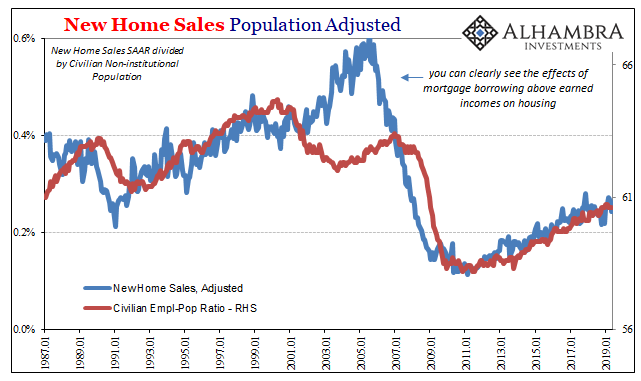

The doom-and-gloomers among us who have been predicting the unraveling of an inherently unstable financial system appear to have been disproved by the reflation of yet another credit-asset bubble. But inherently unstable / imbalanced systems can stumble onward for years or even decades, making fools of all who warn of an eventual reset.

Read More »

Read More »

Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month.

Read More »

Read More »

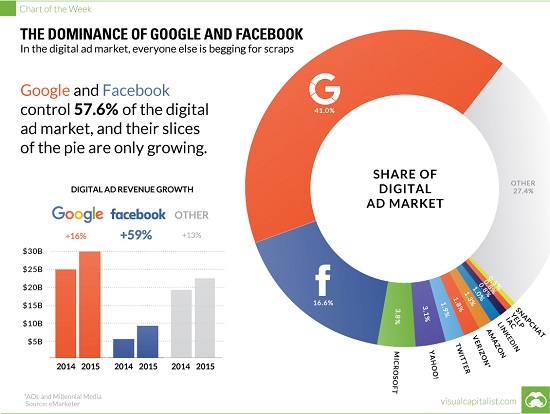

The Imperial Naivete of the American Public

The nation's premier corporate profit engines / social media giants are the ideal platforms for undermining the U.S. via the sowing of disintegration. Whether it's stated or not, one source of the inchoate outrage triggered by Russian-sourced purchases of adverts on Facebook in 2016 (i.e. "meddling in our election") is the sense that the U.S. is sacrosanct due to our innate moral goodness and our Imperial Project.

Read More »

Read More »

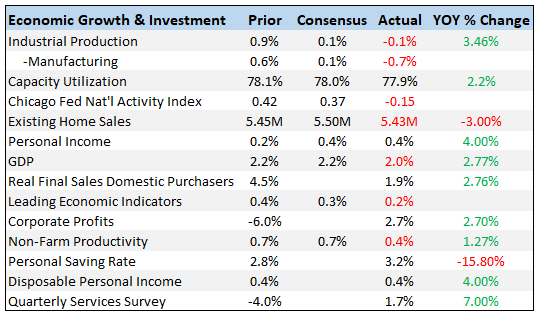

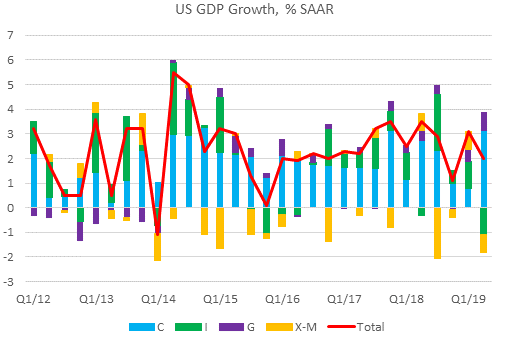

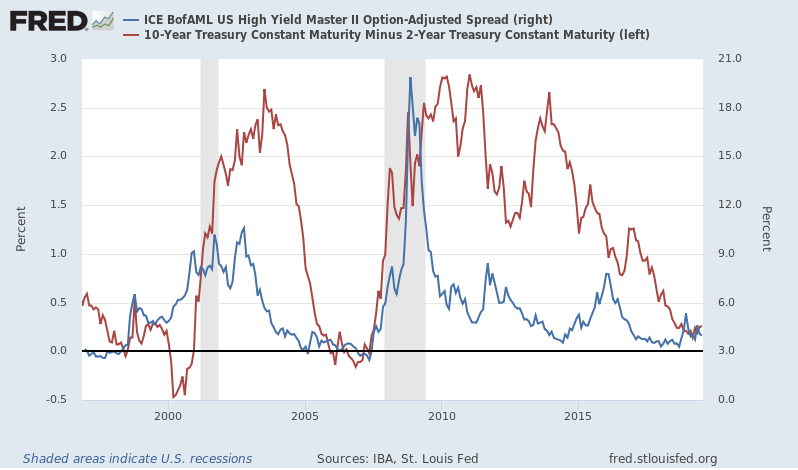

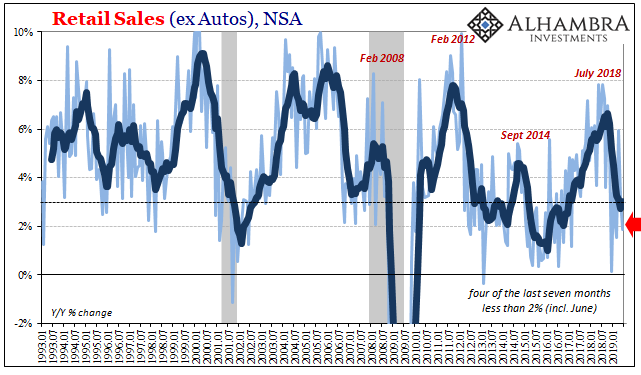

Bi-Weekly Economic Review

This will be a fairly quick update as I just posted a Mid-Year Review yesterday that covers a lot of the same ground. There were, as you’ll see below, some fairly positive reports since the last update but the markets are not responding to the better data. Markets seem to be more focused on the trade wars and the potential fallout. I would also note that at least some of the recent strength in the data is related to the tariffs.

Read More »

Read More »

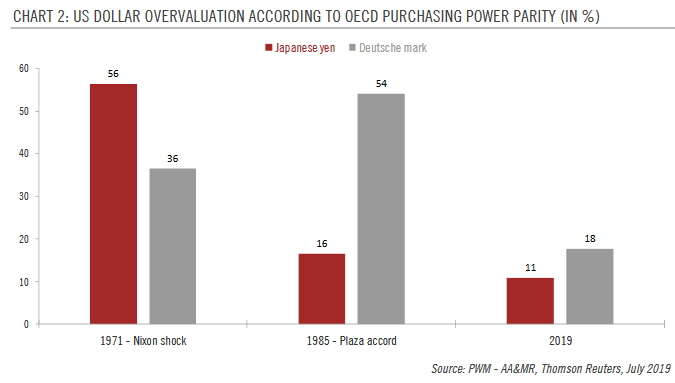

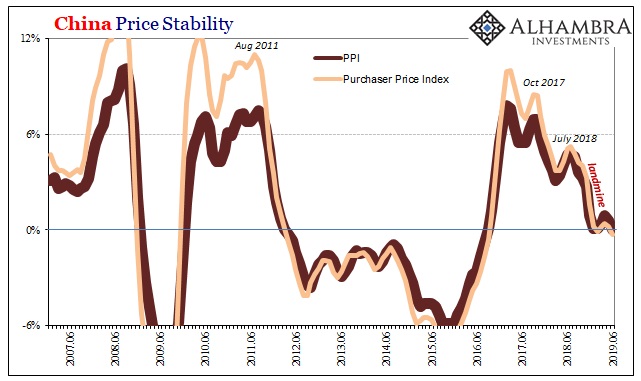

Mid-Year Global Markets Update

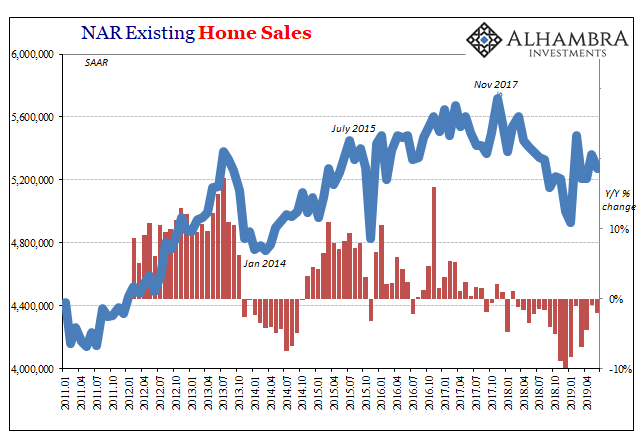

Volatility returned to markets with a vengeance in the first half of this year. 2018 started off as an extension of last year when volatility was almost wholly absent. Stocks roared out of the starting gate, up almost every day until January 26th. And then – whoosh. What took nearly a month to gain took just 6 trading days to give back and then some.

Read More »

Read More »

Our Institutions Are Failing

Our institutional failure reminds me of the phantom legions of Rome's final days. The mainstream media and its well-paid army of "authorities" / pundits would have us believe the decline in our collective trust in our institutions is the result of fake news, i.e. false narratives and data presented as factual.

Read More »

Read More »

Buybacks Get All The Macro Hate, But What About Dividends?

When it comes to the stock market and the corporate cash flow condition, our attention is usually drawn to stock repurchases. With good reason. These controversial uses of scarce internal funds are traditionally argued along the lines of management teams identifying and correcting undervalued shares. History shows, conclusively, that hasn’t really been true.

Read More »

Read More »

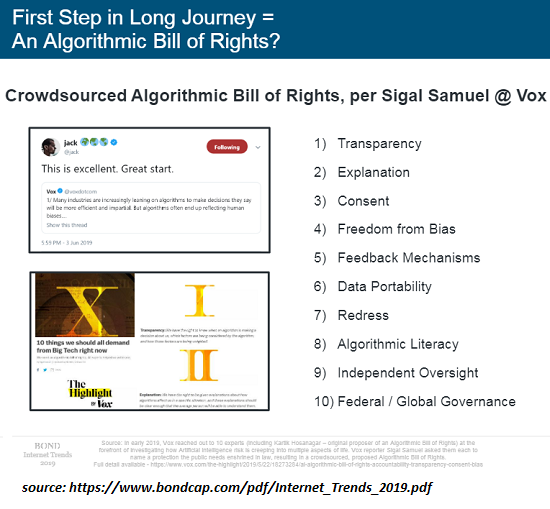

Will AI “Change the World” Or Simply Boost Profits?

The real battle isn't between a cartoonish vision or a dystopian nightmare--it's between decentralized ownership and control of these technologies and centralized ownership and control. The hype about artificial intelligence (AI) and its cousins Big Data and Machine Learning is ubiquitous, and largely unexamined. AI is going to change the world by freeing humankind from most of its labors, etc. etc. etc.

Read More »

Read More »

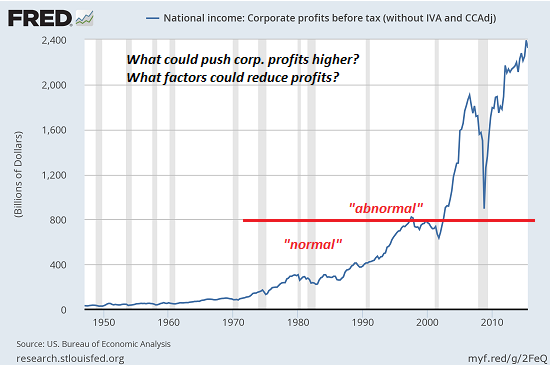

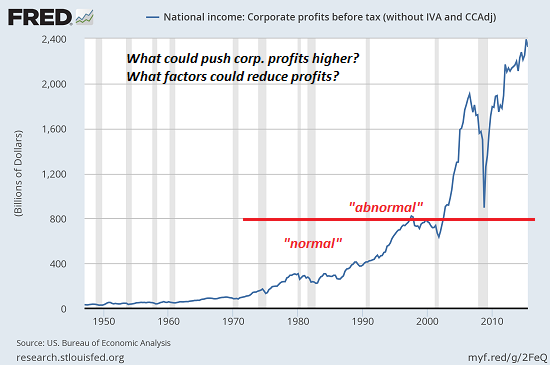

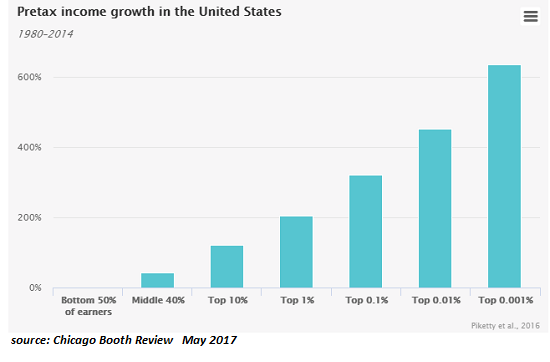

We Are All Hostages of Corporate Profits

We're in the endgame of financialization and globalization, and it won't be pretty for all the hostages of corporate profits. Though you won't read about it in the mainstream corporate media, the nation is now hostage to outsized corporate profits. The economy and society at large are now totally dependent on soaring corporate profits and the speculative bubbles they fuel, and this renders us all hostages: Make a move to limit corporate profits or...

Read More »

Read More »

The USA Is Now a 3rd World Nation

I know it hurts, but the reality is painfully obvious: the USA is now a 3rd World nation. Dividing the Earth's nations into 1st, 2nd and 3rd world has fallen out of favor;apparently it offended sensibilities. It has been replaced by the politically correct developed and developing nations, a terminology which suggests all developing nations are on the pathway to developed-nation status.

Read More »

Read More »