Category Archive: 5) Global Macro

How to restore trust in politics | The Economist

In America, Britain and other Western countries, voters have lost trust in politics. Is the answer to reboot an ancient idea? Read more here: https://econ.st/3ov9kvo

Sign up to our weekly newsletter: https://econ.st/37NpM3E

Can citizens assemblies save democracy?: https://econ.st/37zAtXf

Can ordinary people solve the political deadlock?: https://econ.st/3qsTTps

How can we bring polarised societies together? https://econ.st/3qp5k1v

How...

Read More »

Read More »

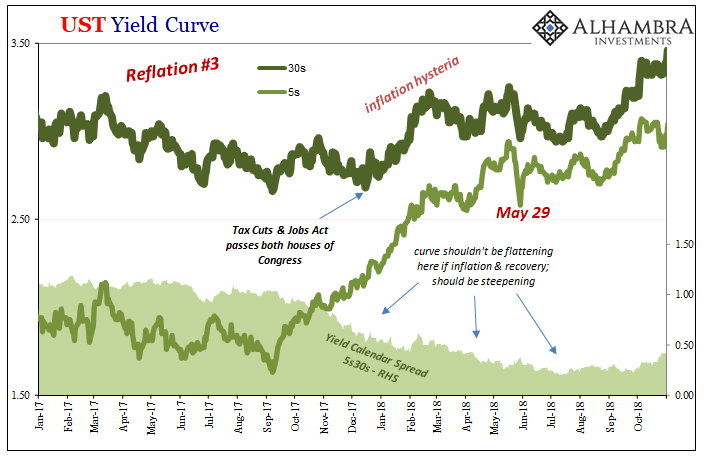

Inflation Hysteria #2 (Nominal UST)

What had given Inflation Hysteria #1 its real punch had been the benchmark 10-year Treasury note. Throughout 2017, despite the unemployment rate in the US, globally synchronized growth being declared around the world (and being declared as some momentously significant development), and whatever other tiny factors acceding to the narrative, longer-term Treasury rates just weren’t buying it.

Read More »

Read More »

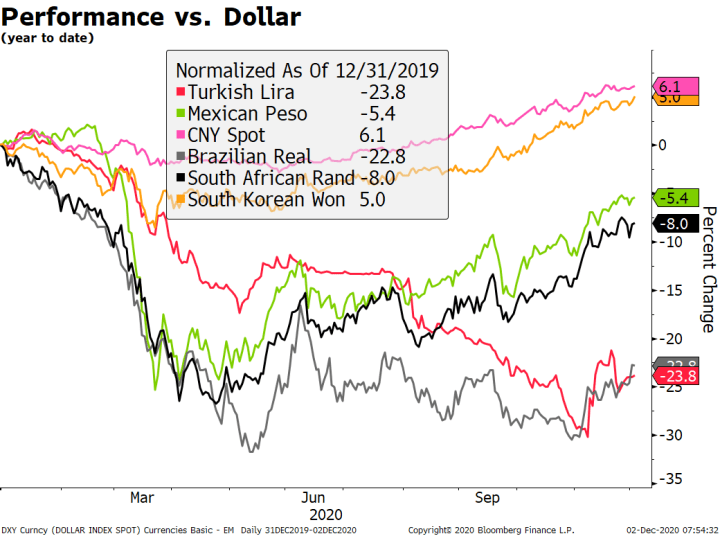

Jittery Markets Keep the Dollar Afloat (For Now)

US fiscal negotiations are taking longer than expected; US Treasury auctions $56 bln of 3-year notes; we believe the Fed is watching the yield curve closely; Brazil reports November IPCA inflation; Chile kept rates on hold at 0.50% and tweaked its asset purchase program.

Read More »

Read More »

People Are Now Aware Of What Will Happen

Recently, people are more aware of what can happen. This awareness raises in economic conditions and political realities make people think. Every new choice is a new beginning for people.

Read More »

Read More »

Submit Questions for Jeffrey Snider on Liberty and Finance!

Submit Questions for Jeffrey Snider, Chief Investment Strategist for Alhambra Investments on Liberty and Finance!

Read More »

Read More »

Polar Opposite Sides of Consumer Credit End Up in the Same Place: Jobs

If anything is going to be charged off, it might be student loans. All the rage nowadays, the government, approximately half of it, is busily working out how it “should” be done and by just how much. A matter of economic stimulus, loan cancellation proponents are correct that students have burdened themselves with unprofitable college “education” investments.

Read More »

Read More »

Take Advantage of These COVID Estate Planning Opportunities by the End of 2020

May you live in interesting times. Although that sounds like an ancient blessing, it’s believed to be a Chinese curse casting instability and uncertainty on the person who hears it. Blessing or curse, it’s a great description of the year we’ve just come through, and in spite of all the turmoil, there are some things you can do before the end of 2020 to take advantage of all the madness.

Read More »

Read More »

A Hackers Teleology by Charles Hugh Smith

"What every human wants is fairness, a chance to belong that offers everyone opportunities to get ahead by our own merit and a say when decisions are made.

Even before the global upheavals, our system was failing—it wasn’t fair at all. Now that it’s unraveling, it’s time for a new arrangement that’s actually sustainable on our resource-depleted planet that doesn’t favor wealthy insiders.

Hear it Here – https://bit.ly/hackersteleology

Those...

Read More »

Read More »

Some Thoughts on a Potential US Government Shutdown

The US Congress has returned from recess with a lot on its plate. Priority must be given to passing an omnibus spending bill that prevents a government shutdown after December 11. The next round of fiscal stimulus has taken on greater urgency and may be attached to the wider spending bill.

Read More »

Read More »

Don’t Really Need ‘Em, Few More Nails Anyway

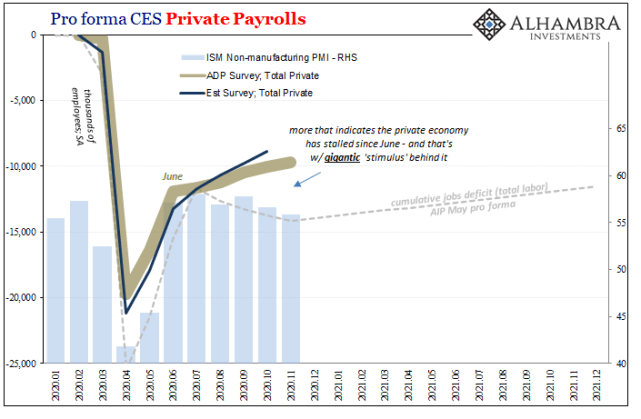

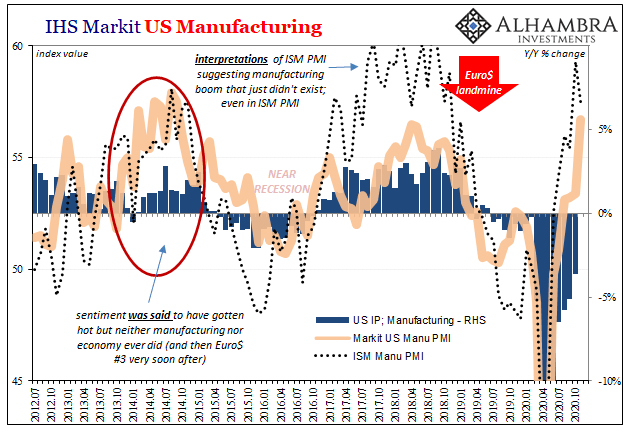

The ISM’s Non-manufacturing PMI continued to decelerate from its high registered all the way back in July 2020. In that month, the headline index reached 58.1, the best since early 2019, and for many signaling that everything was coming up “V.”

Read More »

Read More »

Dollar Stabilizes but Weakness to Resume

There are new efforts to pass another round of stimulus sooner rather than later; we warn against getting too optimistic; US bond yields rose in anticipation of stimulus; Fed Chair Powell and Treasury Secretary Mnuchin gave somewhat conflicting outlooks for the US.

Read More »

Read More »

Charles Hugh Smith on Parallels of the Great Fire of Rome 64 AD to Today

Charles Hugh Smith on Parallels of the Great Fire of Rome 64 AD to Today

http://financialrepressionauthority.com/2020/12/03/the-roundtable-insight-charles-hugh-smith-on-parallels-of-the-great-fire-of-rome-64-ad-to-today/

Receive trading ideas weekly from Yra: https://cedarportfolio.com/yra-signup-form

Read More »

Read More »

Life after Trump: what’s the future of the Republican Party? | The Economist

Donald Trump has finally accepted that a presidential transition from his administration to Joe Biden’s should begin. We answer your questions on what the Republican Party could look like in a post-Trump world.

Chapters:

00:00 Trump’s impact on the Republican Party

00:35 Party support for Trump

02:16 Trumpism after Trump

05:37 The era of “alternative facts”

06:56 The GOP in a more diverse America

08:40 The outlook for 2024

Find The Economist’s...

Read More »

Read More »

There Have Actually Been Some Jobs Saved, Only In Place of Recovery

The ISM reported a small decline in its manufacturing PMI today. The index had moved up to 59.3 for the month of October 2020 in what had been its highest since September 2018. For November, the setback was nearly two points, bringing the headline down to an estimate of 57.5.

Read More »

Read More »

Dollar Plumbs New Depths With No Relief In Sight

Stimulus talks continue but the goalposts have indeed been moved; the good news is that a package before year-end is looking more likely; optimism regarding stimulus continues to buoy US yields. ISM services PMI is expected at 55.8 vs. 56.6 in October; weekly jobless claims data will be reported; Fed Beige Book report was suitably downbeat.

Read More »

Read More »

Tesla Isn’t A Car Company

We have the luxury, the honor, of speaking to a lot of individual investors here at Alhambra. Whether they are clients or future clients (optimism is my default condition), the most common view of stocks is that they are overvalued and a fall – a large fall – is inevitable. And there is no stock that embodies that view more than Elon Musk’s Tesla Incorporated. It was once known as Tesla Motors but Musk changed the name in early 2017. There may...

Read More »

Read More »

2021 is Already Optimized for Failure

One sure way to identify a system "optimized for failure" is if all the insiders are absolutely confident the system is "optimized for my success". I often discuss optimization here because it offers an insightful window into how systems become fragile and break down.

Read More »

Read More »

Drivers for the Week Ahead

Dollar weakness has resumed. This will be a very important data week for the US and the highlight will be November jobs data Friday; we will also get some important manufacturing readings for November; the Fed releases its Beige Book report for the December FOMC meeting Wednesday; Canada also has a busy week.

Read More »

Read More »

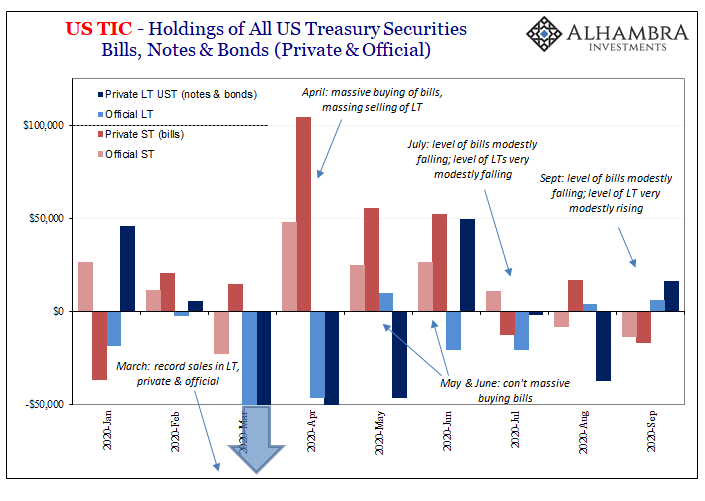

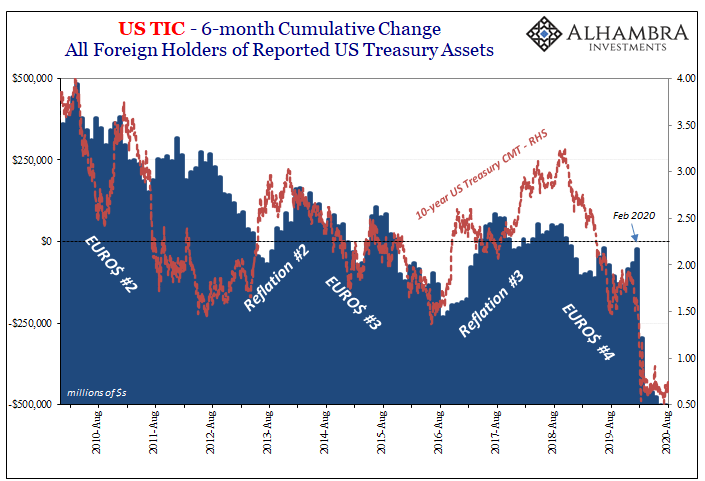

Just Who Is, And Who Is Not, Selling T-Bills

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral.

Read More »

Read More »

Treasury Auctions Are Anything But Sorry Because They’ve Never Been Sorry About Solly

Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on...

Read More »

Read More »