Category Archive: 5) Global Macro

Scottish independence: could Britain break up? | The Economist

The union between the nations of the United Kingdom is looking increasingly fragile, thanks to Brexit. If Scotland were to break away from Britain it would face an uncertain future—as would the rest of the union.

Sign up to our newsletter to keep up to date: https://econ.st/3a6aZmv

See all of our Britain coverage: https://econ.st/3e1cN15

How the pandemic has strengthened calls for Scottish independence: https://econ.st/3tqDZwL

Scottish...

Read More »

Read More »

What’s Taboo? Everything Except Greed

OK, now I get it. Take a couple tabs of Euphorestra and Hopium, and stick to talking about making money in the market. Greed won't offend anyone. So I started to tell my buddy about my new screenplay idea: "There's a global pandemic, and when they rush a bunch of vaccines to market, then...."

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 15 avril 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

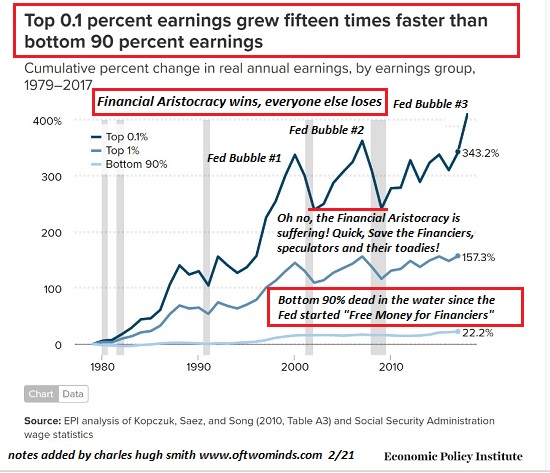

The Middle Class Has Finally Been Suckered into the Casino

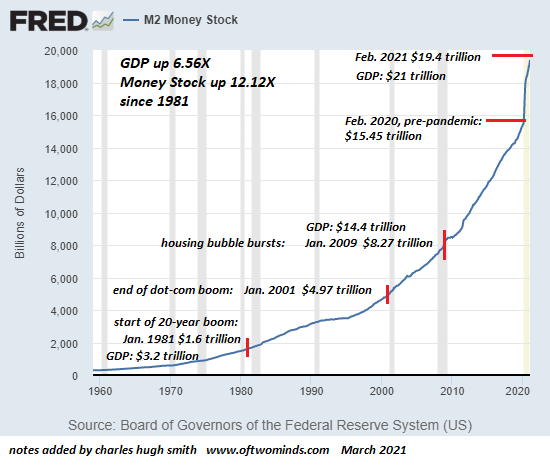

The Fed's casino isn't just rigged; it's criminally unstable. The decay of America's middle class has been well documented and many commentators have explored the causal factors. The bottom line is that this decay isn't random; the income of the middle class isn't going to suddenly increase at 15 times the growth rate of the income of the top 0.1%. (see chart below) The income of the top 0.1% grew 15 times faster than the incomes of the bottom 90%...

Read More »

Read More »

The “Helicopter Parent” Fed and the Fatal Crash of Risk

All the risks generated by gambling with trillions of borrowed and leveraged dollars didn't actually vanish; they were transferred by the Fed to the entire system. The Federal Reserve is the nation's Helicopter Parent, saving everyone from the

consequences of their actions.

Read More »

Read More »

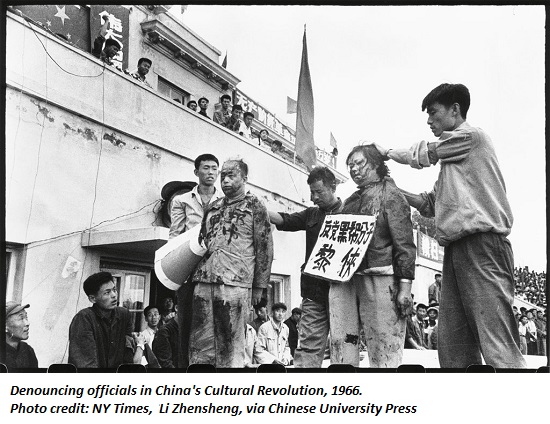

Is a Cultural Revolution Brewing in America?

The lesson of China's Cultural Revolution in my view is that once the lid blows off, everything that was linear (predictable) goes non-linear (unpredictable). There is a whiff of unease in the air as beneath the cheery veneer of free money for

almost everyone, inequality and polarization are rapidly consuming what's left of common ground in America.

Read More »

Read More »

Weekly Market Pulse: Nothing To See Here. No, Really. Nothing.

The answer to the question, “What should I do to my portfolio today (this week, this month)? is almost always nothing. Humans, and especially portfolio managers, have a hard time believing that doing nothing is the right response….to anything…or nothing. We are programmed to believe that success comes from doing things, not not doing things.

Read More »

Read More »

The Trial of the Chicago 7: fact v drama | The Economist

“The Trial of the Chicago 7” has been nominated for six Oscars. Aaron Sorkin, the film’s screenwriter and director, speaks to The Economist about the tension between historical accuracy and compelling drama.

00:00 - The Trial of the Chicago 7

00:51 - Why is the story still so relevant?

01:34 - How to adapt real events into drama

02:40 - Why the film deviates from historical fact

04:41 - Historical accuracy v artistic truth

05:41 - Altering events...

Read More »

Read More »

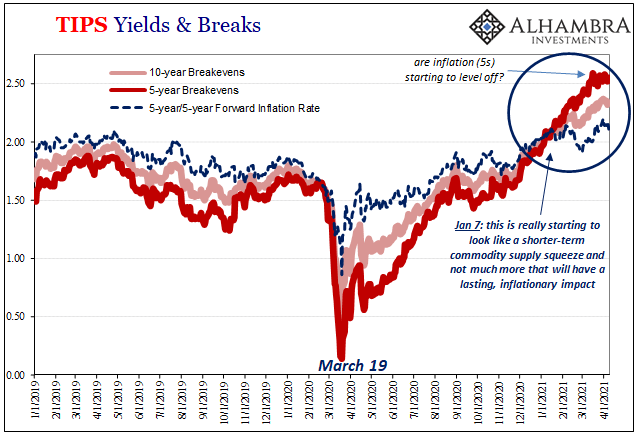

Rechecking On Bill And His Newfound Followers

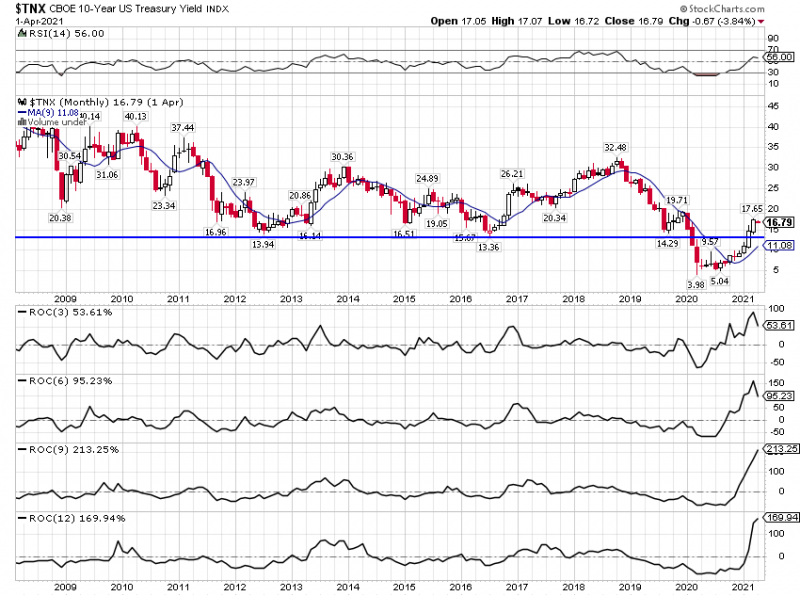

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard).

Read More »

Read More »

Real Dollar ‘Privilege’ On Display (again)

Twenty-fifteen was an important yet completely misunderstood year. The Fed was going to have to become hawkish, according to its models, yet oil prices crashed and the dollar continued to rise. Both of those things were described as “transitory” by Janet Yellen, and that they were helpful or positive (rising dollar means cleanest dirty shirt!), but domestically American policymakers’ clear lack of conviction and courage about that rate hike regime...

Read More »

Read More »

How AI is transforming the creative industries | The Economist

Artificial intelligence is helping humans make new kinds of art. It is more likely to emerge as a collaborator than a competitor for those working in creative industries. Film supported by Mishcon de Reya

Sign up to The Economist’s daily newsletter: https://econ.st/3dm9rp9

Find our most recent science and technology coverage: https://econ.st/2QTAukd

Listen to Babbage, The Economist’s science and technology podcast: https://econ.st/3ftaPJf...

Read More »

Read More »

Jeff Snider On Salomon Brothers, Repo Market, Velocity, Shadow Money, Banks, FED (RCS Ep 117)

Topics- Salomon Brothers, the eurodollar market, treasuries, collateral, derivative market: Jeff tells the story of what happened in the early 90s with the Treasury, Warren Buffett, FED, Primary Dealer Banks, Repo market. Velocity: money supply, shadow money, measuring the monetary system. Repo market as a real monetary market: missing data in the FED’s measurements. FED funds rate, banking system, monetary details.

Read More »

Read More »

Don’t Be the Victim of These 20 IRA Mistakes

Hey! It’s just an IRA. What is there to know? You put money in and it’s a tax deduction, you get to take it out after 59 ½ without paying a penalty, and at 72 the IRS makes you take some out. What else could there be?

In reality, there’s a lot more.

Read More »

Read More »

Weekly Market Pulse: Buy The Rumor, Sell The News

There’s an old saying on Wall Street that one should “buy the rumor, sell the news”, a pithy way to express the efficient market theorem. By the time an event arrives, whatever it may be, the market will have fully digested the news and incorporated it into current prices. And then the market will move on to anticipating the next event, large or small. What prompts this review of Wall Street folk wisdom is the most recent employment report.

Read More »

Read More »

What’s Changed and What Hasn’t in a Tumultuous Year

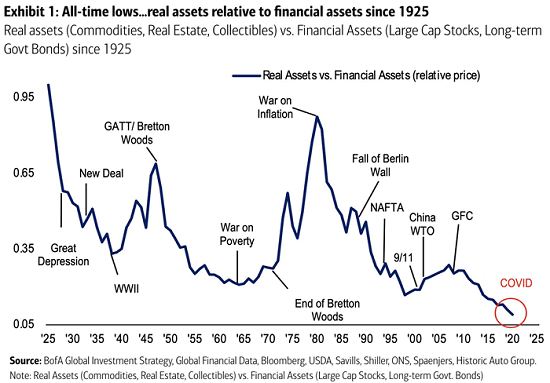

Inequality is America's Monster Id, and we're continuing to fuel its future rampage daily. What's changed and what hasn't in the past year? What hasn't changed is easy: 1. Wealth / income inequality is still increasing. (see chart #1 below)

2. Wages / labor's share of the economy is still plummeting as financial speculation's share has soared. (see chart #2 below)

Read More »

Read More »

Our “Wealth”: Cloud Castles in the Sky

Buyers know there will always be a greater fool willing to pay more for an over-valued asset because the Fed has promised us it will always be the greater fool. I realize nobody wants to hear that most of their "wealth" is nothing more than wispy Cloud Castles in the Sky that will dissipate in the faintest zephyr, but there it is: that which was conjured out of thin air will return to thin air.

Read More »

Read More »

The UFO/Fed Connection

Perhaps the aliens' keen interest in Earth's central bank magic and its potential for destruction results from a wager. You've probably noticed the recent uptick in UFO sightings and video recordings from aircraft of the extraordinary flight paths of these unidentified objects.

Read More »

Read More »

The remote-working revolution: how to get it right | The Economist

It’s likely working from home is here to stay—for some workers, at least. But this “new normal” will have long-term implications for the relationship between employers and employees—from tax, to employment law, to physical and mental health.

Read more of our coverage on business : https://econ.st/3weF8t0

Listen to our podcast “Homework: the future of the office”: https://econ.st/3ddJo3u

How pandemic is affecting working mums:...

Read More »

Read More »

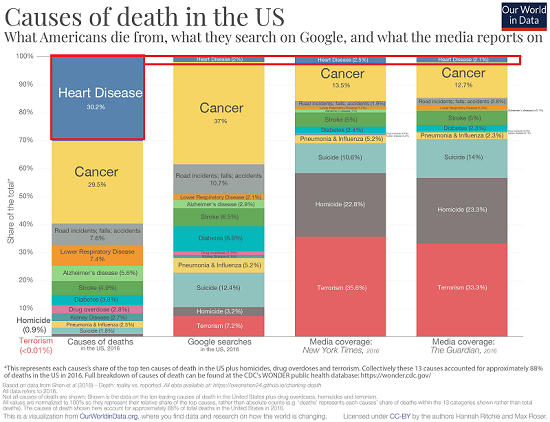

Health, Wealth and What Kills Most of Us

If health is wealth, and it most certainly is the highest form of wealth, then we would be well-served to take charge of our health-wealth in terms of what behaviors we can sustainably modify.

Read More »

Read More »

Can vaccine passports kickstart the economy? | The Economist

Vaccine passports are likely to become a feature of everyday life as lockdowns are lifted across the world. But as “green passes” kick-start economies, what are the potential drawbacks?

Read more of our coverage on coronavirus : https://econ.st/397Mkxq

Listen to "The Jab", our new vaccine-related podcast series: https://econ.st/3w2ZiGC

Listen to our daily podcast "The Intelligence": https://econ.st/3f7O1ic

How well will...

Read More »

Read More »