Category Archive: 5) Global Macro

Virus Z: A Thought Experiment

Let's run a thought experiment on a hypothetical virus we'll call Virus Z, a run-of-the-mill respiratory variety not much different from other viruses which are 1) very small; 2) mutate rapidly and 3) infect human cells and modify the cellular machinery to produce more viral particles.

Read More »

Read More »

Mass extinction: what can stop it? | The Economist

The world’s animals and wildlife are becoming extinct at a greater rate than at any time in human history. Could technology help to save threatened species?

Read our latest technology quarterly on protecting biodiversity: https://econ.st/3dqdkKN

Listen to our Babbage podcast episode on the biodiversity crisis: https://econ.st/3dqfPww

Sign up to The Economist’s daily newsletter to keep up to date with our latest stories:...

Read More »

Read More »

Anyone Remember That Whole SLR Cliff?

Does anyone remember the SLR “cliff?” Of course you don’t, because in the end it didn’t seem to make any difference. For a few weeks, it was kind of ubiquitous if only in the sense that it was another one of those deep plumbing issues no one seems able to understand (forcing all the “experts” to run to Investopedia in order write something up about it).

Read More »

Read More »

The Systemic Risk No One Sees

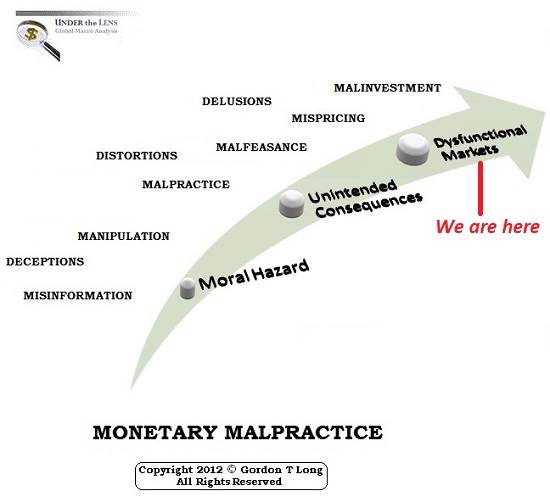

My recent posts have focused on the systemic financial risks created by Federal Reserve policies that have elevated moral hazard (risks can be taken without consequence) and speculation to levels so extreme that they threaten the stability of the entire financial system.

Read More »

Read More »

When Expedient “Saves” Become Permanent, Ruin Is Assured

The belief that the Federal Reserve possesses god-like powers and wisdom would be comical if it wasn't so deeply tragic, for the Fed doesn't even have a plan, much less wisdom. All the Fed has is an incoherent jumble of expedient, panic-driven "saves" it cobbled together in the 2008-2009 Global Financial Meltdown that it had made inevitable.

Read More »

Read More »

A Clear Balance of Global Inflation Factors

Back at the end of May, Germany’s statistical accounting agency (deStatis) added another one to the inflationary inferno raging across the mainstream media. According to its flash calculations, German consumer prices last month had increased by the fastest rate in 13 years.

Read More »

Read More »

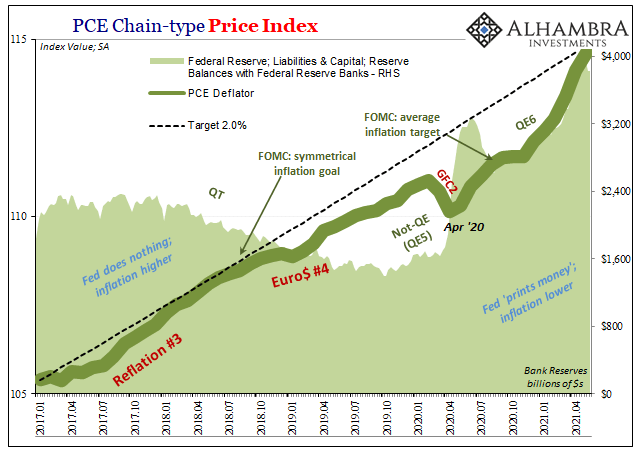

Inflation Isn’t Just The Outlier, The Inflation In It Is, Too

Following the same recent pattern as the BLS and its CPI, the Bureau of Economic Analysis’s (BEA) PCE Deflator ran up hotter in May 2021 than its already high increase during April. The latter’s headline consumer basket rose 3.91% year-over-year, its fastest pace since August 2008.

Read More »

Read More »

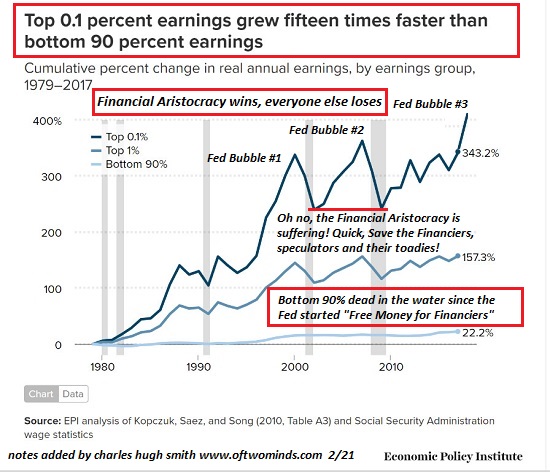

America’s Social Order is Unraveling

What kind of nation boasts a record-high stock market and an unraveling social order? Answer: a failed nation, a nation that has substituted artifice for realism for far too long, a nation that now depends on illusory phantoms of capital, prosperity and democracy to prop up a crumbling facade of "wealth" that the populace now understands is largely in the hands of a few families and corporations, most of which pay little to support the citizenry...

Read More »

Read More »

China’s economy: what’s its weak spot? | The Economist

The number of working-age people in China is shrinking. Could this threaten the country’s rise as an economic superpower? Read more here: https://econ.st/3dgzqz0

Find all of our coverage about China here: https://econ.st/3qpd7wz

Read our special report about Chinese youth: https://econ.st/2TXmwzd

Is China’s population shrinking? https://econ.st/3vTXxu2

Listen to an episode of “The Intelligence” podcast about China’s census:...

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 24 juin 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

It Always Ends The Same Way: Crisis, Crash, Collapse

One of the most under-appreciated investment insights is courtesy of Mike Tyson: "Everybody has a plan until they get punched in the mouth." At this moment in history, the plan of most market participants is to place their full faith and trust in the status quo's ability to keep asset prices lofting ever higher, essentially forever.

Read More »

Read More »

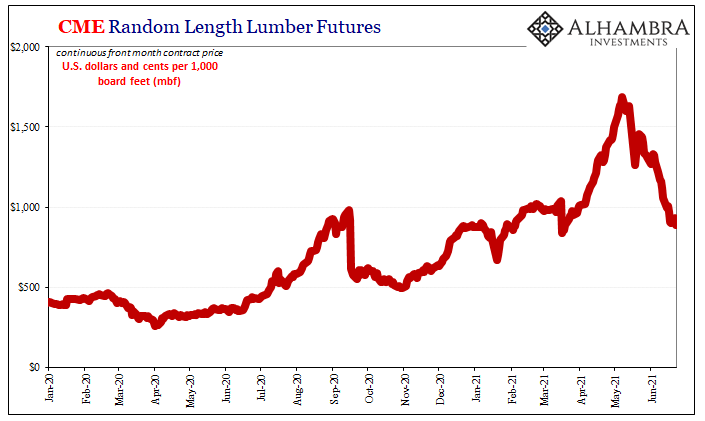

Sure Looks Like Supply Factors

If it walks like a duck and quacks like a duck, then it must be inflationary overheating. Or not? As more time passes and the situation further evolves, the more these recent price deviations conform to the supply shock scenario rather than a truly robust economy showing no signs of slowing down.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Weekly Market Pulse on June 21, where we look at significant things from last week's events with Joe Calhoun.

Read More »

Read More »

Front-Running the Crash

We have a fine-sounding word for running with the herd: momentum. When the herd is running, those who buy what the herd is buying and sell what the herd is selling are trading momentum, which sounds so much more professional and high-brow than the noisy, dusty image of large mammals (and their trading machines) mindlessly running with the herd.

Read More »

Read More »

Did covid-19 leak from a Chinese lab? | The Economist

For most of 2020 the theory that covid-19 leaked from a Chinese lab was dismissed as unlikely. In the past few months it has gained currency. Our experts explain why. Read more here: https://econ.st/3gzOVnV

00:00 - Where did covid-19 come from?

00:44 - What evidence is there?

02:06 - Why was the lab-leak theory dismissed?

03:23 - Could the lab leak have been deliberate?

04:07 - Could covid-19 be man made?

05:51 - How are the origins being...

Read More »

Read More »

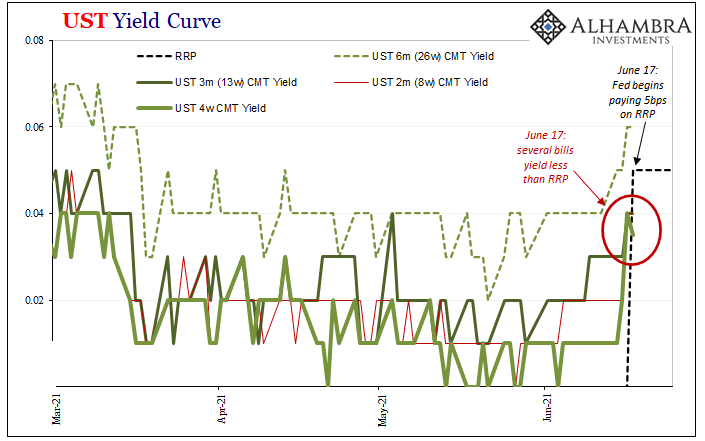

The FOMC Accidentally Exposes Itself (Reverse Repo-style)

Initially, the dots got all the attention. Though these things are beyond hopeless, the media needs them to write up its account of a more fruitful monetary policy outcome because markets continue to discount that entirely.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 17 juin 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

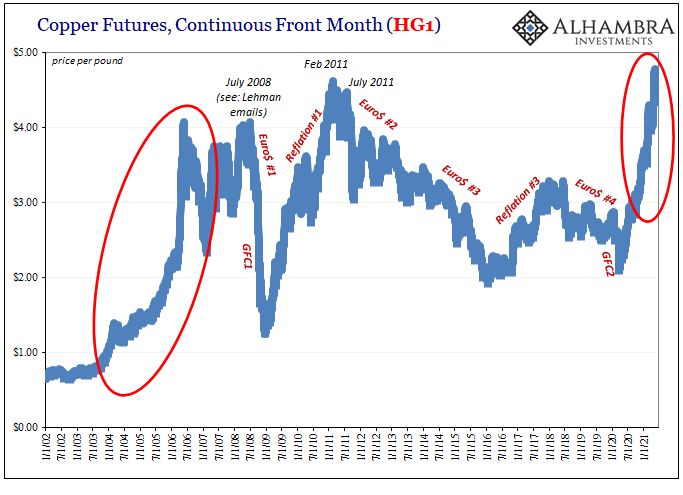

Copper Corroding PPI

Yesterday, lumber. Today, copper. The “doctor” has been in reverse for better than two months now, with trading in the current session pounding the commodity to a new multi-month low. Down almost $0.19 for the day, an unusual and eye-opening loss, this brings the cumulative decline to 9.2% since the peak way back on May 11.

Read More »

Read More »

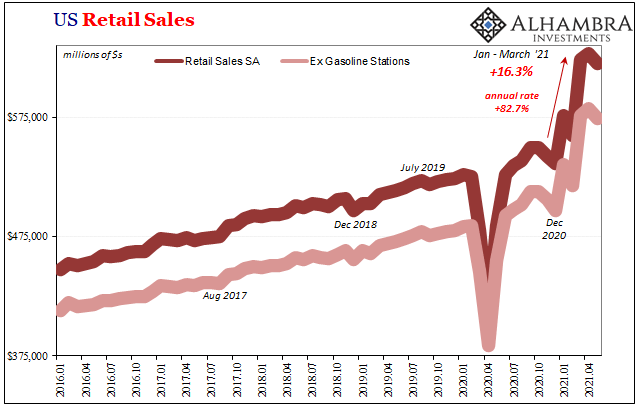

Another Round of Transitory: US Retail Sales & (revised) IP

Same stuff, different month. We can basically reprint both what was described yesterday about supply curves not keeping up with exaggerated demand as well as the past two months of commentary on Retail Sales plus Industrial Production each for the US. Quite on the nose, US demand for goods, anyway, is eroding if still artificially very high.

Read More »

Read More »

Kiss The Old Normal Goodbye and Embrace The New Normal -Charles Hugh Smith

The “old” Normal was fun, but how fun was it really. The commute was a killer and took its toll on the family. We were all working harder and making less. Time was at a premium and so was spending time with your family. The focus on consumption was all enveloping. We now defend on many other countries for vital resources. Off-shoring had many destructive impacts upon our economy and your health. Unhealthy food is highly profitable. Now we can start...

Read More »

Read More »