Category Archive: 5) Global Macro

Why it’s harder to earn more than your parents | The Economist

In the 21st century it's got harder to earn more than your parents and to climb the social ladder. What's gone wrong, and what can be done to change this? Film supported by @Mishcon de Reya LLP

00:00 - Why it's harder to get rich if you're born poor

03:29 - Social divisions are increasing within society

04:11 - Changing patterns of social mobility over time

05:41 - Education as a determinant of social mobility

09:16 - Class barriers to further...

Read More »

Read More »

When Risk and Opportunity Become Personal

The opportunity to lower our exposure to risk is always present in some fashion, but embracing this opportunity becomes critical when precarity and change-points rise like restless seas.

Read More »

Read More »

Jeff Snider: Inflation Vs Deflation. Part 2

As the reflation trades cools down and the economic data begins to roll over, Jeff Snider, head of global research at Alhambra Investments, anticipates an ugly, near-term outcome for growth.

Read More »

Read More »

How to manage a megacity | The Economist

By 2050, 6 billion people could be living in cities. How should the challenges caused by rapid urbanization be handled in the world ahead? Film supported by @Mission Winnow

00:00 - What are megacities?

01:01 - The problem with megacities

03:07 - How is Ahmedabad tackling rapid urbanisation?

04:45 - How can cities manage traffic?

07:04 - The problem with waste

08:00 - How is Recycle Central revolutionizing trash?

10:58 - What are the most urgent...

Read More »

Read More »

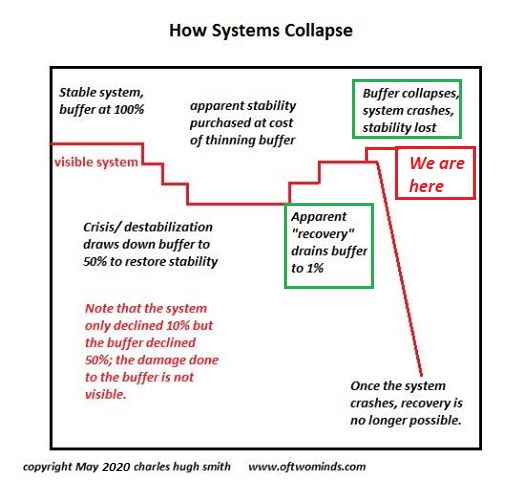

When Everything Is Artifice and PR, Collapse Beckons

The notion that consequence can be as easily managed as PR is the ultimate artifice and the ultimate delusion. The consequences of the drip-drip-drip of moral decay is difficult to discern in day-to-day life. It's easy to dismiss the ubiquity of artifice, PR, spin, corruption, racketeering, fraud, collusion and narrative manipulation (a.k.a. propaganda) as nothing more than human nature, but this dismissal of moral decay is nothing more than...

Read More »

Read More »

Jeff Snider: Inflation Vs Deflation.

As the reflation trades cools down and the economic data begins to roll over, Jeff Snider, head of global research at Alhambra Investments, anticipates an ugly, near-term outcome for growth.

Read More »

Read More »

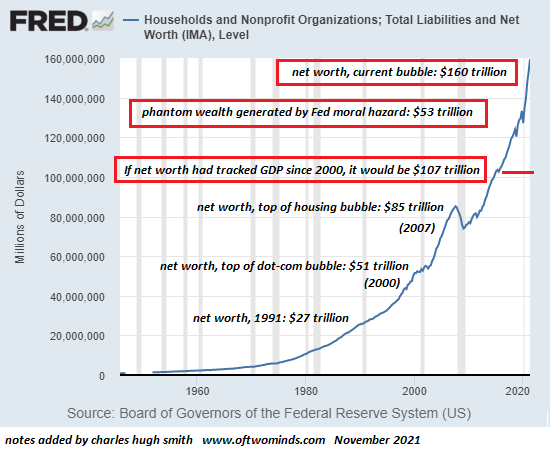

The Fed’s Moral Hazard Monster Is About to Lay Waste to “Wealth”

If the Fed set out to destroy the financial system, they're very close to finishing the job. If you set out to destroy markets and the financial system, your most important weapon is moral hazard, the disconnection of risk and consequence. You disconnect risk from consequence by rewarding those making the riskiest bets and bailing out gamblers whose bets went bad.

Read More »

Read More »

Is it time to go back to the office? | The Economist

Has the working-from-home revolution been good for productivity? Or is it time for office workers to go back to the office?

00:00 - How have our panellists’ working lives changed?

01:54 - Do employees and employers have different opinions?

03:40 - The impact of race on remote working

04:14 - Do you need to be in the office to be productive?

05:05 - Should teams choose their days in the office?

05:48 - The presenteeism bonus

Like our video...

Read More »

Read More »

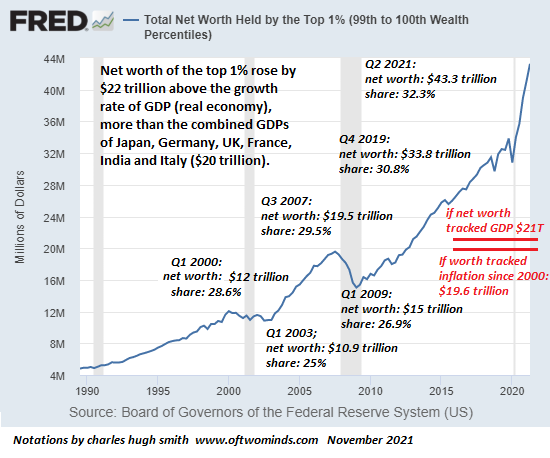

Top 1% Gains More Wealth Than the Combined GDPs of Japan, Germany, UK, France, India and Italy, Bottom 50%–You Get Nothing

Given that political power in America is a pay-to-play auction in which the highest bidder wins, how this incomprehensibly lopsided ownership of wealth plays out is an open question.

Read More »

Read More »

Why QE Is NOT Money Printing | Jeff Snider & Emil Kalinowski

In this episode of On The Margin Mike is joined by Jeff Snider of Alhambra Investments & Emil Kalinowski, Mining & Metals Researcher. Jeff & Emil are hosts of Eurodollar University, a podcast dedicated to analyzing the 2007 malfunction of the monetary system - and how its continuing disorder - affects finance, politics and society.

Read More »

Read More »

How economic policy can help the world recover | The Economist

Economic recovery from covid-19 is deeply uneven around the world. Our experts answer your questions about the problems facing the world economy and the actions governments could take.

00:00 - The problems with the global economy

00:34 - Will there be hyperinflation?

02:26 - What’s behind labour shortages?

04:12 - Disrupted supply and demand

05:20 - Economic policies to tackle climate change

06:00 - Uneven global recovery from the pandemic

07:05 -...

Read More »

Read More »

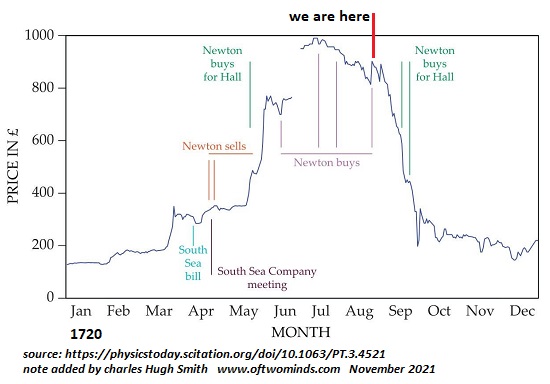

Paging Isaac Newton: Time to Buy the Top of This Bubble

Despite Newton's tremendous intelligence and experience, he fell victim to the bubble along with the vast herd of credulous greedy punters. One of the most famous examples of smart people being sucked into a bubble and losing a packet as a result is Isaac Newton's forays in and out of the 1720 South Seas Bubble that is estimated to have sucked in between 80% and 90% of the entire pool of investors in England.

Read More »

Read More »

Look Out Below: Why a Rug-Pull Flash Crash Makes Perfect Sense

It makes perfect financial sense to crash the market and no sense to reward the retail options marks by pushing it higher. An extraordinary opportunity to scoop up mega-millions in profits has arisen, and grabbing all this free money makes perfect financial sense. Now the question is: will those who have the means to grab the dough have the guts to do so?

Read More »

Read More »

The Contrarian Trade of the Decade: The Dollar Refuses to Die

Which is more valuable: Wall Street's debt/asset bubbles or the global empire? You can't have both, so choose wisely. The consensus makes sense: the U.S. dollar is doomed because the Federal Reserve and the Treasury will conjure trillions of new dollars out of thin air to prop up the status quo entitlements, monopolies, cartels and debt/asset bubbles, and since little of this issuance actually increases productivity, all it will accomplish is the...

Read More »

Read More »

How to cool a warming world | The Economist

The warmer it gets, the more people use air conditioning—but the more people use air conditioning, the warmer it gets. Is there any way out of this trap?

00:00: What’s the cooling conundrum?

01:05: The pros and cons of AC

03:28: How to reinvent air conditioning

05:02: Can buildings be redesigned to keep cool?

07:30: Scalable, affordable cooling solutions

10:24: Policy interventions for cooling

Like our video content? Take our survey to tell us...

Read More »

Read More »

Russia: how Putin is silencing his opponents | The Economist

In Russia, repression is on the rise as Vladimir Putin seeks to crush any form of dissent. From eliminating the opposition—including his main rival, Alexei Navalny—to controlling the courts and purging Russia of free speech, Putin is deploying a wider range of tactics than ever to tighten his grip on power.

00:00 - What is happening in Russia?

01:00 - Why is Putin afraid of Alexei Navanly?

02:33 - The role Russia’s economy plays in Putin’s power...

Read More »

Read More »

Eight Reasons Scarcities Will Increase Rather Than Evaporate

Who knew it would be so easy? All we have to do is collect urine and we'll be flying our electric air taxi tomorrow! While the private-jet crowd is busy selling a future of 1 billion electric vehicles, 1 billion windmills, 1 billion solar arrays, hundreds of thousands of electric aircraft, thousands of new nuclear power plants and trillions more in "wealth" accumulating in their bloated ledgers, reality is intruding on their technocratic...

Read More »

Read More »

One Solution to Soaring Food Prices: Start Your 2022 Garden Now

There is a great deal of joy and satisfaction in gardening; benefits include saving money, eating healthier, sharing the bounty with others and reducing the derealization / derangement of modern life.

Read More »

Read More »

Whistleblowers Torpedo Facebook and Pfizer: Who’s Next?

If America's total dependence on corporate profits and stock market/housing bubbles is

just fine because the bubbles just keep inflating, there's nothing left but rot.

Read More »

Read More »