Category Archive: 5) Global Macro

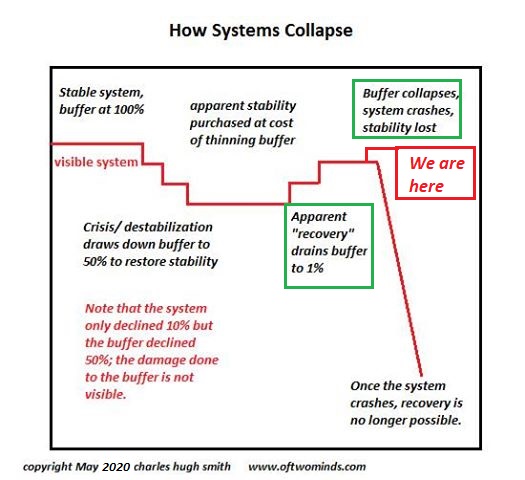

Our Financial System Is Optimized for Sociopaths and Exploitation

Let's call this financial system what it really is: the MetaPerverse, a conjured world of self-serving cons. We live in a peculiar juncture of history in which truth has been banished as a threat to the maximization of private gain, i.e. the hyper-pursuit of self-interest. Evidence that supports a causal chain has been replaced by cherry-picked data that supports a self-serving narrative: both the evidence and narrative are manufactured to serve...

Read More »

Read More »

War in Ukraine: what’s happening in Kyiv? | The Economist

Vladimir Putin has ordered Russian troops to invade Ukraine. What’s happening now and how will the war unfold? The Economist’s correspondent, Richard Ensor, reports from the Ukrainian capital, Kyiv.

Read our coverage of the Ukraine crisis here: https://econ.st/3pcnVPl

Sign up to our daily newsletter to keep up to date with the latest developments: https://econ.st/3sezh7h

Will war in Ukraine lead to a wider cyber-conflict?...

Read More »

Read More »

The Red Warning

Now it’s the Russian’s fault. Belligerence surrounding Donbas and Ukraine, raw materials and energy supplies to Europe threatened by Putin’s coiled bear. Why wouldn’t markets grow worried?There’s always a reason why we shouldn’t take these things seriously, or quickly dismiss them out of hand as the temporary product of whichever political fear-of-the-day.

Read More »

Read More »

Our Leaders Made a Pact with the Devil, and Now the Devil Wants His Due

The unprecedented credit-fueled bubbles in stocks, bonds and

real estate are popping, and America's corrupt leaders can only stammer and spew excuses and empty promises.

Unbeknownst to most people, America's leadership made a pact with the Devil: rather than face the constraints

and injustices of our economic-financial system directly, a reckoning that would require difficult choices and

some sacrifice by the ruling financial-political elites,...

Read More »

Read More »

Green building: can mushrooms help? | The Economist

The construction industry is responsible for 11% of the world’s man-made CO2 emissions—due to its reliance on concrete and steel. What alternative materials could be used in the future?

Film supported by @Infosys

00:00 - What are some sustainable alternatives?

00:31 - Why is construction bad for the environment?

01:08 - The problem with concrete

02:00 - Promising alternatives to concrete

03:07 - Can mushrooms help construct buildings?

04:09 - The...

Read More »

Read More »

Russia and Ukraine: how will the West react? | The Economist

A Russian invasion of Ukraine could be imminent. What is at stake and how will the West respond? Shashank Joshi, The Economist's defence editor, answers your questions.

00:00 - What’s happening in Ukraine?

01:10 - Is Putin bluffing?

02:08 - Is Ukraine prepared for conflict?

03:00 - What’s at stake for both Ukraine and Russia?

04:00 - How would an invasion impact the world?

05:09 - Does this situation threaten peace elsewhere?

06:25 - How should...

Read More »

Read More »

How AI can make health care better | The Economist

AI has the power to transform health care. From more efficient diagnoses to safer treatments, it could remedy some of the ills suffered by patients. Film supported by @Maersk

00:00 - Can AI help heal the world?

00:45 - How can AI spot blindness?

04:01 - Protecting patients’ privacy

05:10 - How to share medical data safely

06:11 - Medical AI is rapidly expanding

08:02 - What do the sceptics say?

08.36 - Using AI for new medical devices

11:08 -...

Read More »

Read More »

How to make computers less biased | The Economist

You might think technology is the great leveller. But as AI and other data-driven innovations race farther and faster ahead, the automation of racial bias is causing growing concern.

00:00 - Can technology be racist?

00:50 - Bias in facial-recognition tech

03:50 - Why do data discriminate?

05:50 - What can be done?

07:00 - How can regulations help?

Sign up to The Economist’s daily newsletter to keep up with our latest stories:...

Read More »

Read More »

Disputed Borders: Russia v Ukraine | The Economist

Vladimir Putin has already annexed Crimea and plunged Donbas into war. Now, he has amassed 100,000 troops at the Ukrainian border. Why can’t Russia leave Ukraine alone?

00:00 - The world’s eyes are on Ukraine

00:55 - Russia and Ukraine’s shared history

02:08 - Caught between Russia and the West

04:04 - Ukraine’s post-independence struggles

06:30 - Putin’s domestic issues

07:47 - Will Putin invade Ukraine?

Find The Economist’s coverage on...

Read More »

Read More »

How Empires Die

When the state / empire loses the ability to recognize and solve core problems of security and fairness, it will be replaced by another arrangement that is more adaptable and adept at solving problems. From a systems perspective, nation-states and empires arise when they are superior solutions to security compared to whatever arrangement they replace: feudalism, warlords, tribal confederations, etc.

Read More »

Read More »

NFTs: are they worth the hype? | The Economist

In the past year a new trend in the crypto world has boomed: NFTs, or non-fungible tokens. They started as a way for digital artists to have ownership over their work but have transformed into a dizzying new multi-billion-dollar marketplace. Are they worth the hype?

00:00 - Are NFTs worth the hype?

01:38 - How to sell an NFT

03:24 - Where did NFTs come from?

04:51 - Why are NFTs so popular?

05:45 - NFTs in the artworld

07:04 - The risks in buying...

Read More »

Read More »

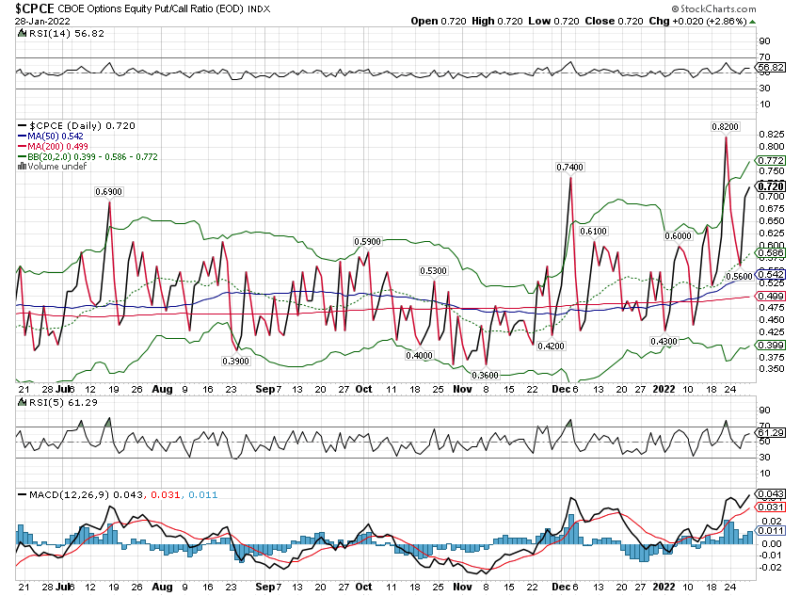

Weekly Market Pulse: Are We There Yet?

I’ll just get this out of the way right at the beginning. The question in the title of this post refers to the end of the ongoing stock market correction and the answer is likely no. There are no sure things in this business so it isn’t an unequivocal no, but based on history, the odds favor more weakness.

Read More »

Read More »

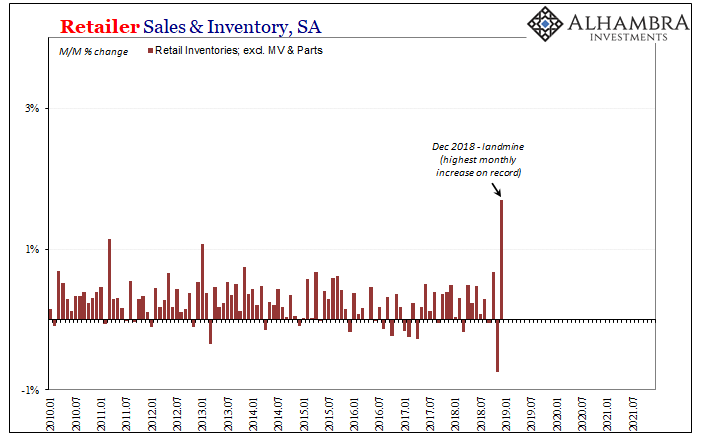

FOMC Goes With Unemployment Rate While This Huge Number Happens To Far More Relevant Economic Data

The first time I can consciously remember using the term landmine was probably here in February 2019. I had described the same process play out several times before, I had just never applied that term. There was all sorts of market chaos in the final two months of 2018, including a full-on stock market correction, believe it or not, leaving the inflation and recovery narrative in near complete tatters.

Read More »

Read More »

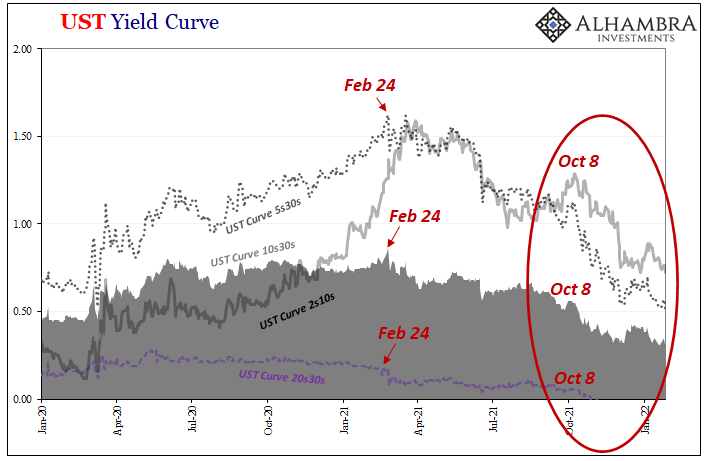

After Today’s FOMC, Yield Curve Is Already As Flat As It Was In Mar ’18 **Without A Single Rate Hike Yet**

It’s not hard to reason why there continues to be this conflict of interest (rates). On the one hand, impacting the short end of the yield curve, the unemployment rate has taken a tight grip on the FOMC’s limited imagination. The rate hikes are coming and the markets like all mainstream commentary agree that as it stands there’s nothing on the horizon to stop Jay Powell’s hawkishness.

Read More »

Read More »

Keeping warm, without warming the planet | The Economist

Humans are cranking up their thermostats at the expense of the planet. With the majority of global heating still powered by dirty fuels, are there greener solutions that won't cost the earth? Read more: https://econ.st/3g3GNeq

Film supported by @Infosys

00:00 - Heating the planet with domestic heating

01:06 - South Africa’s energy supply

02:59 - What is a heat pump and how does it work?

05:58 - The first step to decarbonising heating is...

Read More »

Read More »

Rückläufige US-Erdölvorräte lassen Ölpreise steigen

Die Vereinigten Staaten weisen sinkende Ölreserven auf. Dies führt zu einem Druck auf die Preise. Trotz eines Anstiegs der Rohölvorräte im jüngsten EIA-Bericht sind die kommerziellen Erdölvorräte in den USA in den meisten Wochen der letzten anderthalb Jahre zurückgegangen und liegen unter dem saisonalen Durchschnitt der letzten fünf Jahre und sogar unter dem Fünfjahresdurchschnitt vor der Pandemie.

Read More »

Read More »

Inflation Winners and Losers

The clear winners in inflation are those who require little from global supply chains, the frugal, and those who own their own labor, skills and enterprises. As the case for systemic inflation builds, the question arises: who wins and who loses in an up-cycle of inflation? The general view is that inflation is bad for almost everyone, but this ignores the big winners in an inflationary cycle.

Read More »

Read More »

The Hawks Circle Here, The Doves Win There

We’ve been here before, near exactly here. On this side of the Pacific Ocean, in the US particularly the situation was said to be just grand. The economy was responding nicely to QE’s 3 and 4 (yes, there were four of them by that point), Federal Reserve Chairman Ben Bernanke had said in the middle of 2013 it was becoming more than enough, creating for him and the FOMC coveted breathing space so as to begin tapering both of those ongoing programs.A...

Read More »

Read More »

Will you be eating insects soon? | The Economist

By 2050 there could be 10 billion human mouths to feed. Eating insects could help solve the global food-supply problem. Read more here: https://econ.st/3fTILxA

Film supported by @Maersk

00:00 - 00:47 How to feed our growing population

00:47 - 03:23 The potential of insects

03:23 - 05:31 Eating cricket powder in Madagascar

05:31- 06:30 Madagascar's climate change famine

06:30 - 08:00 Cricket farming in Africa

08:00 - 11:30 Expanding insect...

Read More »

Read More »

The Cult of Speculation Is a Cult of Doom

Surely the Fed gods will affirm the cult's most revered articles of faith. But false gods eventually fail, even the Fed. Every once in awhile the zeitgeist sets up an either / or: either the zeitgeist is crazy or I'm crazy. (OK, let's agree I'm crazy; see, it's not that hard to find something to agree on, is it?)

Read More »

Read More »