Category Archive: 5) Global Macro

Gravitas: The big European Hypocracy over Russia

India abstained from a UNGA vote to suspend Russia from the UN Human Rights Council. The move came despite Russia's explicit warning against abstentions. Palki Sharma tells you more.

#Gravitas #India #Russia

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With our Global headquarters in New Delhi, we...

Read More »

Read More »

NATO to step up military aid to Ukraine amid the ongoing Russian invasion | World English News

Amid the ongoing Russian invasion of Ukraine, NATO has pledged to step up military aid to Ukraine. Ukraine has also demanded an energy embargo on Russia.

Read More »

Read More »

The US commits more weapons to Ukraine & ends normal trade with Russia | English News | WION

Amid the ongoing Russian invasion of Ukraine, The US has committed more weapons to Ukraine. The US has also ended normal trade with Russia.

#US #Russia #Ukraine

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With our Global headquarters in New Delhi, we bring you news on the hour, by the hour. We...

Read More »

Read More »

For Freak’s Sake, People, Even the Crash Test Dummies Are Nervous

Those trusting the Fed to be visibly weak, corrupt and incompetent forever might be in for an unwelcome surprise. When even the crash test dummies are nervous, it pays to pay attention. Being in a mild crash isn't too bad if all the protective devices inflate as intended. But in a horrific crash where nothing goes as planned, it's like speeding in a ready-to-explode Pinto and being side-swiped by a semi on Dead Man's Curve.

Read More »

Read More »

United Nations suspends Russia from human rights council | International News | WION

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With our Global headquarters in New Delhi, we bring you news on the hour, by the hour. We deliver information that is not biased. We are journalists who are neutral to the core and non-partisan when it comes to the politics of the world. People are tired of...

Read More »

Read More »

Russia-Ukraine conflict: Ukraine asks for more weapons from NATO | World News | WION

During the 2nd day meeting of NATO foreign ministers, Ukraine asked for more weapons. Ukrainian foreign minister Dmytro Kuleba said, "The more weapons we get and the sooner they arrive in Ukraine, the more human lives will be saved."

#Ukraine #NATO #Russia

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their...

Read More »

Read More »

Western duplicity on Russian imports exposed, EU says won’t ban energy imports | WION

The Western duplicity on Russian imports gets exposed as Europe did not shut off Russian gas pipelines. European Union's Foreign Affairs Chief confirmed that 27 countries in the block are paying Russia over 1 billion dollar per day on fuel imports

#EuropeanUnion #Russia #WorldNews

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower...

Read More »

Read More »

Uzbekistan and India’s IT gain from the ongoing Russia-Ukraine war | WION

Russia-Ukraine war has driven an exodus of IT specialists to former parts of Soviet Union including Uzbekistan. Reports say that India's IT sector may also see creation of around 50,000 jobs

#Russia-Ukrainewar #India #Uzbekistan

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With our Global...

Read More »

Read More »

Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two.Running red-hot to the point of near-horror, that’s “our” Federal...

Read More »

Read More »

New sanctions on Russia: UK targets Sberbank and credit bank of Moscow | Business News

Britain also ratcheted up sanctions on Russia. UK in a similar move to the United States has targeted Russia's largest bank and has decided to end all new British investment in Moscow, the latest round of sanctions were in response to the reports of civilians being killed by Russian forces in Bucha.

#UK #Sanctions #Russia

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than...

Read More »

Read More »

UK, EU impose new sanctions on Russia in response to reports of Bucha killings | Latest English News

Britain also ratcheted up sanctions on Russia. UK in a similar move to the United States has targeted Russia's largest bank and has decided to end all new British investment in Moscow, the latest round of sanctions were in response to the reports of civilians being killed by Russian forces in Bucha.

#Britain #Russia #WorldNews

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more...

Read More »

Read More »

French Elections: Marine Le Pen targeted over Russian ties, accused of being close to Putin

The presidential race in France is heating up but this is an election that's also taking place at a time when Russia has invaded into Ukraine. The war risks becoming a key issue in in the french electoral politics, here's how!

#France Macron #Elections

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world....

Read More »

Read More »

Ukraine & Russia face-off at the UNSC: Russia counters Zelensky’s address | World English News

Amid the ongoing Russian invasion of Ukraine, President Zelensky addressed the United Nations Security Council, where both Ukraine & Russia faced off.

#Ukraine #Russia #UNSC

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With our Global headquarters in New Delhi, we bring you news on the hour, by the...

Read More »

Read More »

‘How can UNSC act with Russia in it?’ Asks President Zelensky | Russian Invasion | World News

Into the second month of Russian invasion of Ukraine, President Zelensky connected via video call with UNSC and questioned the purpose of the meet.

Read More »

Read More »

Gravitas Global Headlines: Protests against rising fuel prices in Peru, NATO chief on Ukraine war

Here we bring you a quick round-up of all latest news, top headlines and international breakings from all across the globe, stay tuned with Gravitas for more!

Read More »

Read More »

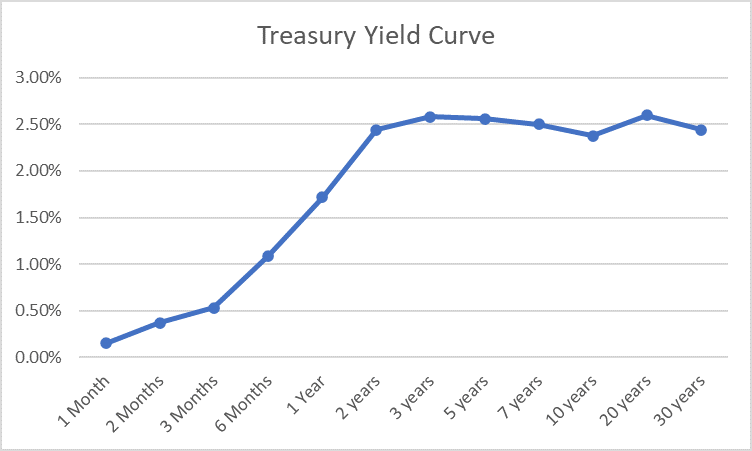

Weekly Market Pulse: What Now?

The yield curve inverted last week. Well, the part everyone watches, the 10 year/2 year Treasury yield spread, inverted, closing the week a solid 7 basis points in the negative. The difference between the 10 year and 2 year Treasury yields is not the yield curve though. The 10/2 spread is one point on the Treasury yield curve which is positively sloped from 1 month to 3 years, negatively sloped from 3 years to 10 years and positively sloped again...

Read More »

Read More »

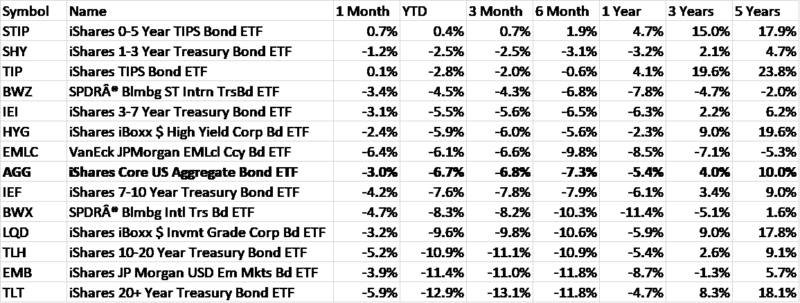

The Short, Sweet Income Case For Ugly Inversion(s), Too

A nod to just how backward and upside down the world is now. The economic data everyone is made to pay attention to, payrolls, that one is, in my view, irrelevant. As is the consumer price estimates from earlier this week, the PCE Deflator. That’s another one which receives vast amounts of interest even though it is already old news.

Read More »

Read More »

It’s All the Aliens’ Fault

As for our central banks' defaulting on their lines of credit with the Martian Central Bank--that's another

alien intervention we'll live to regret.

I hope this won't shock the more sensitive readers too greatly, but I've discovered undeniable evidence that all

our planet's problems are the result of alien intervention. Yes, aliens exist and are actively intervening

in humanity's activities, to our great detriment.

Wars, plagues, The...

Read More »

Read More »

France 2022: How to predict an election | The Economist

For as long as elections have taken place someone has tried to predict what might happen. From polls to prediction models, uncertainty is always inevitable. What’s the best way to do it?

00:00 - What’s the best way to predict elections?

00:48 - How were elections predicted in the past?

02:36 - How do modern day polls work?

04:32 - Why polls miss the mark

07:14 - How does statistical modelling work?

08:30 - Our French election model

See the data...

Read More »

Read More »

Weekly Market Pulse: The Cure For High Prices

There’s an old Wall Street maxim that the cure for high commodity prices is high commodity prices. As prices rise two things will generally limit the scope of the increase. Demand will wane as consumers just use less or find substitutes. Supply will also increase as the companies that extract these raw materials open new mines, grow more crops or drill new wells.

Read More »

Read More »