Category Archive: 5) Global Macro

Not the 1970s or the 1920s: We’re in Uncharted Territory

All of these similarities and differences are setting up a sea-change revaluation of capital, resources and labor that will be on the same scale as the extraordinary transitions of the 1920s and 1970s.

Read More »

Read More »

China Then Europe Then…

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious.

Read More »

Read More »

Russia lost 23,000 soldiers in senseless war: Zelensky | World Latest News | WION

Ukrainian President Volodymyr Zelensky while addressing the nation said that Russia has lost more than 23,000 soldiers in the conflict, that he described as a 'senseless war'. He also added that efforts are being made to bring life back to normal.

Read More »

Read More »

Pentagon Spokesperson John Kirby gets emotional while talking about Putin’s ‘depravity’ | WION

The Russia-Ukraine war has entered its third month. The US has called out Russian war crimes. Pentagon Spokesperson John Kirby talked about Putin's state of mind and got emotional while narrating the situation in Ukraine

Read More »

Read More »

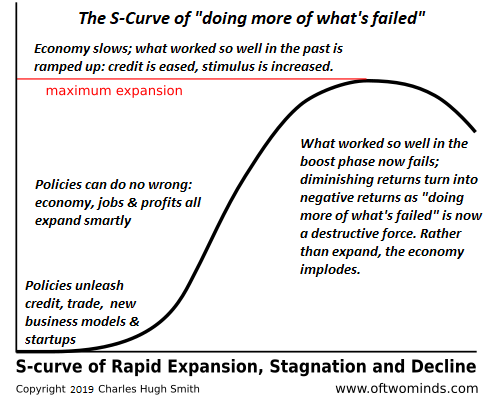

The Contrarian Curse

What if all the new consensus memes are as wrong as the ones they replaced? I have the Contrarian Curse, and I have it bad. The Contrarian Curse is: as soon as the herd adopts your previously contrarian view, you start questioning the new consensus, just as you questioned the previous consensus.

Read More »

Read More »

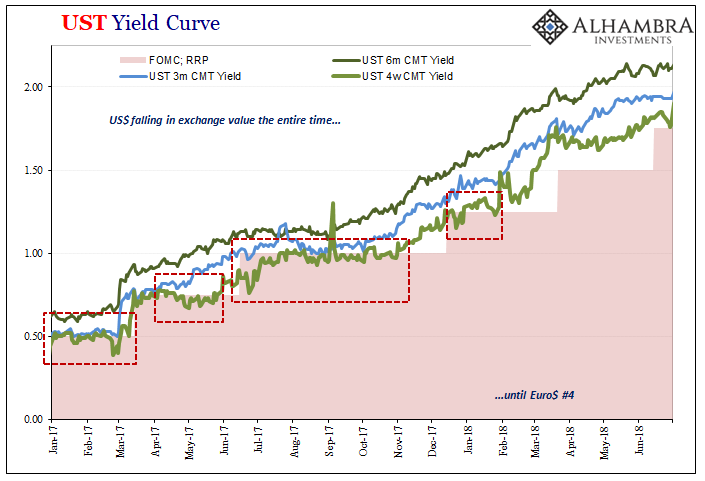

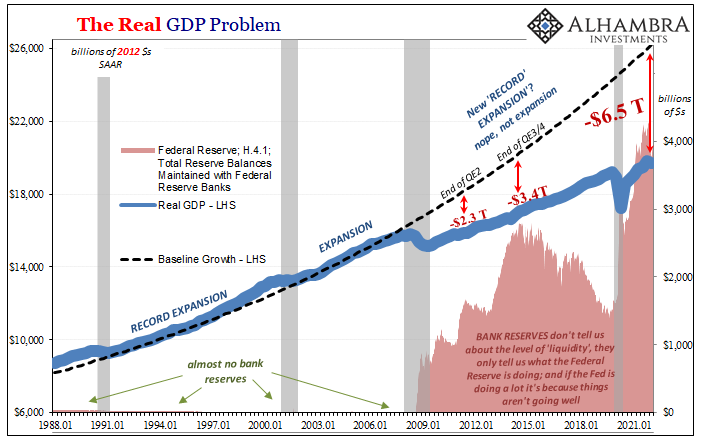

Collateral Shortage…From *A* Fed Perspective

It’s never just one thing or another. Take, for example, collateral scarcity. By itself, it’s already a problem but it may not be enough to bring the whole system to reverse. A good illustration would be 2017. Throughout that whole year, T-bill rates (4-week, in particular) kept indicating this very shortfall, especially the repeated instances when equivalent bill yields would go below the RRP “floor” and often stay there for prolonged periods....

Read More »

Read More »

Abortion and the Supreme Court: what’s at stake? | The Economist

A leaked draft opinion suggests the Supreme Court is poised to overturn the right to abortion in America. If this ruling goes ahead, women's rights are in danger.

00:00 - Abortion rights are under threat

00:45 - Why the leak was unprecedented

01:35 - Women’s rights and lives are in danger

02:22 - Will this be the first constitutional right to be erased?

02:50 - Could other constitutional rights be struck down?

04:16 - Are Americans losing trust...

Read More »

Read More »

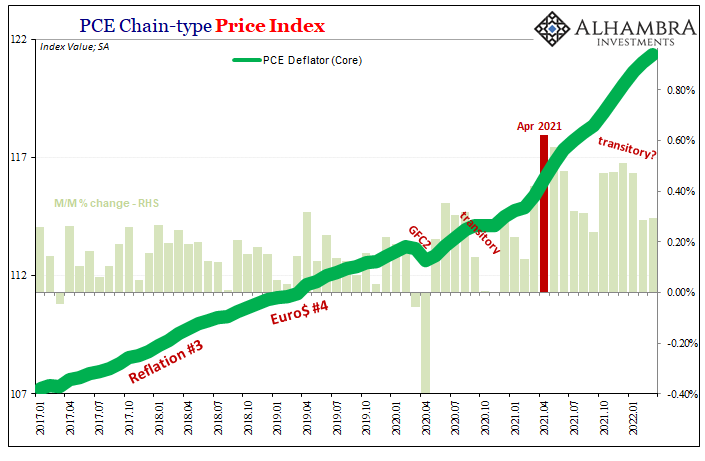

Some ‘Core’ ‘Inflation’ Difference(s)

The FOMC meets next week, with everyone everywhere expecting a 50 bps rate hike to be announced on Wednesday. Yesterday’s “unexpected” and “shocking” negative GDP is unlikely to deter anyone on the committee.

Read More »

Read More »

Russia-Ukraine war: Sweden alleges Russian plane violated airspace | International News | WION

Sweden has claimed that a Russian plane briefly violated its airspace on Friday. In a statement, Swedish Defence minister, Peter Hultqvist said, "It is totally unacceptable to violate Swedish airspace. This action is unprofessional."

Read More »

Read More »

Russia-Ukraine Conflict Live News Updates: Shelling continues in Ukraine’s Kharkiv

It has been several weeks since the Russian invasion of Ukraine started, and scores of civilians have lost their lives in the conflict. Armies of both countries have been involved in intense fights since Russian troops entered Ukraine. Now, Russia has intensified attacks on Ukraine.

Read More »

Read More »

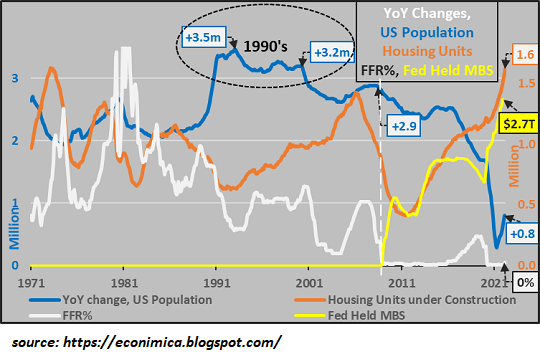

Is Housing a Bubble That’s About to Crash?

We are all prone to believing the recent past is a reliable guide to the future. But in times of dynamic reversals, the past is an anchor thwarting our progress, not a forecast. Are we heading into another real estate bubble / crash?

Read More »

Read More »

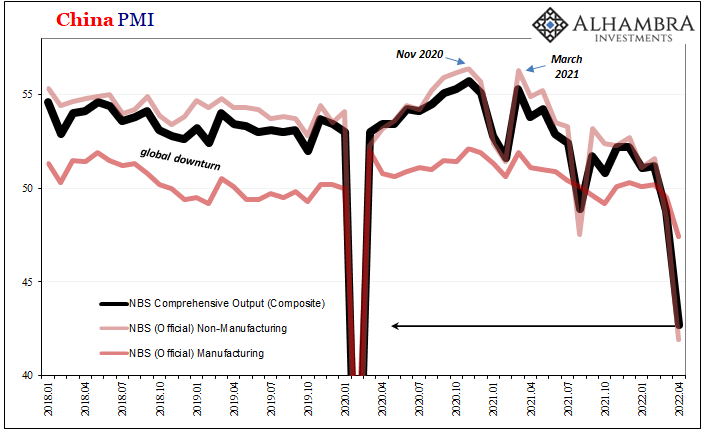

Synchronized Manufacturing, Hopefully Not Mao

This is one of those cases when Inigo Montoya, the lovable if fictional rapscallion from the movie The Princess Bride, would pop into the scene to devastatingly deliver his now famous rebuke. Last week, China’s one-man Dear Leader said that the country was going to start up its own version of Build Back Better.

Read More »

Read More »

‘Most of 1.5 million tonnes of grain stolen by Russia’, says Ukraine

Russian forces have stolen grain from the areas of Ukraine they occupy, Ukraine's deputy agriculture minister said recently. However, Kremlin denied the grain theft claims.

Read More »

Read More »

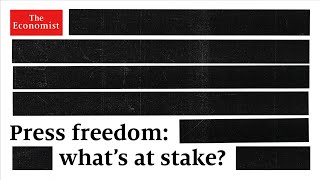

Press freedom: why you should be worried | The Economist

Global press freedom is facing its greatest challenge in decades—not just in authoritarian countries, but in democracies too. Governments are using more subtle tactics to muzzle the media. What’s going on and why is it so worrying?

00:00 – Introduction: global press freedom is in decline

01:08 – How journalists are being harassed and silenced in India

04:00 – The decline of press freedom in democracies

06:53 – Press freedom in Malta: the murder...

Read More »

Read More »

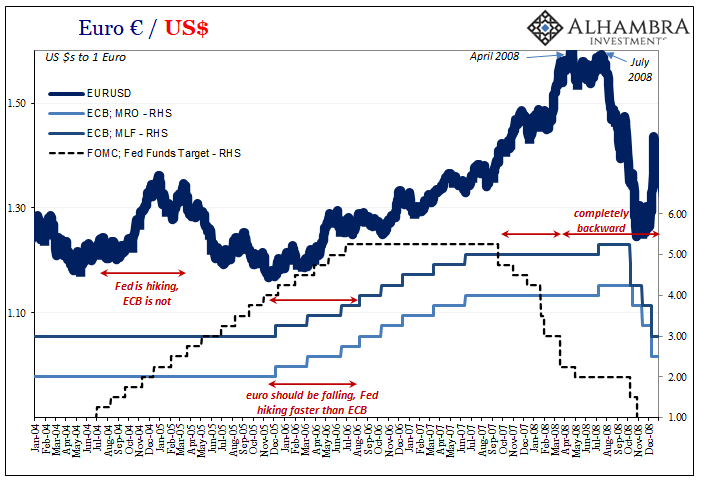

What Really ‘Raises’ The Rising ‘Dollar’

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials.

Read More »

Read More »

Weekly Market Pulse: Welcome Back To The Old Normal

Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around.

Read More »

Read More »

WION-VOA Co-Production: Russia-Ukraine war ongoings & How is Washington navigating Covid?

U.S. President Joe Biden called for the U.S. Congress to pass $33 billion in additional security and humanitarian assistance to Ukraine. For more analysis, we're joined by VOA's Correspondent, Jessica Stone.

Read More »

Read More »

From special operation to war: Will Putin declare war against Ukraine?

Russian invasion of Ukraine has entered third month now. From special operation to war, will Putin declare war against Ukraine? Watch UK's Defence Secretary's take on Ukraine conflict.

Read More »

Read More »

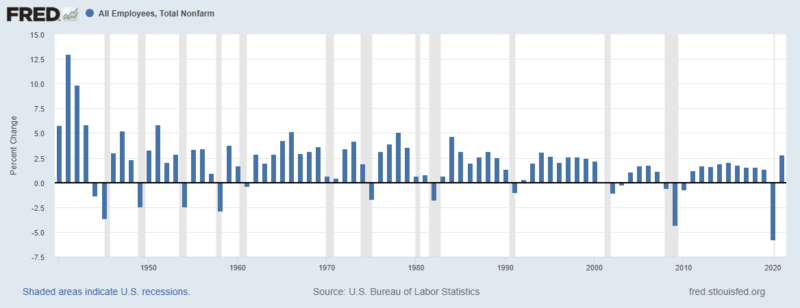

Is It Recession?

According to today’s advance estimate for first quarter 2022 US real GDP, the third highest (inflation-adjusted) inventory build on record subtracted nearly a point off the quarter-over-quarter annual rate. Yes, you read that right; deducted from growth, as in lowered it. This might seem counterintuitive since by GDP accounting inventory adds to output.

Read More »

Read More »

Doom Porn and Empty Optimism

If we can't discern the difference between doom-porn and investing in self-reliance, then solutions will continue to be out of reach. I'm often accused of calling 783 of the last two bubble pops (or was it 789? Forgive the imprecision). Like many others who have publicly explored the notion that the status quo isn't actually sustainable despite its remarkable tenaciousness, I am pilloried as a doom-and-gloomer (among other things, ahem).

Read More »

Read More »