Category Archive: 5) Global Macro

Russia-Ukraine Crisis: Russian FM Lavrov calls Ukraine’s Donbas an ‘unconditional priority’

The “liberation” of Ukraine’s Donbas region is an “unconditional priority” for Moscow, while other Ukrainian territories should decide their future on their own, Russian Foreign Minister Sergei Lavrov said in an interview on Sunday.

Read More »

Read More »

European leaders urge Putin to hold ‘direct negotiations’ with Zelensky

Russia's military offensive in Ukraine continues. French President Emmanuel Macron and German Chancellor Olaf Scholz held a three-way telephone conversation with Vladimir Putin urging the Russian leader to hold direct and serious negotiations with his Ukrainian counterpart Volodymyr Zelensky .

Read More »

Read More »

Livelihoods in a Degrowth Economy

The sooner we start preparing for degrowth, the better off we'll be. A Chinese proverb captures this succinctly: By the time you're thirsty, it's too late to dig a well. Let's consider livelihood options in an unsustainable economy of extremes that are unraveling, an economy that is being forced to transition to Degrowth.

Read More »

Read More »

‘Unconscionably Excessive’ Denial

What would “unconscionably excessive” even look, legally speaking? More to the issue, who gets to decide what constitutes “excessive?”

Read More »

Read More »

Ukraine invasion: Russia blames West for food crisis | International Headlines | World News | WION

The collateral damage of the Ukraine war has been huge with the conflict now crossing the four-month mark. The ramifications of the war is hard to ignore, it's not just Ukraine or Russia, the effects of the war have spilled beyond the borders thus making it now a global crisis.

Read More »

Read More »

Gravitas: China and Russia draw battle lines for Quad

During the Quad summit on Tuesday, China and Russia conducted a joint military drill. The US says the military exercise was planned in advance. Japan has called the drills a provocation. Palki Sharma tells you how Russia & China are challenging the Quad.

Read More »

Read More »

Is It Being Demanded?

Shipping container rates have been dropping since early March – right around the time when we had just experienced our “collateral days” and then stood by to witness chaotic financial fireworks, inversions, the whole thing.

Read More »

Read More »

What’s a war crime? Can Russia be persecuted after Ukraine invasion? | WION Originals

A Russian soldier was recently given life sentence after he pleaded guilty during the first war crimes trial in Ukraine after the onset of Russian invasion. But what is a war crime and can Russia be persecuted after Ukraine invasion?

#Russia #Ukraine #WIONOriginals #WarCrime

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to...

Read More »

Read More »

EU President Von Der Leyen says Russia is using food supplies as war weapon | World Economic Forum

In a special address at the World Economic Forum Annual Meeting 2022, European Commission President Ursula von der Leyen denounced Russian aggression and its use of food supplies as a war weapon.

Read More »

Read More »

Hong Kong Stocks Pivot Euro$ #5

The stock market hasn’t been moneyed; well, US equities, anyway. What do I mean by “moneyed?” Common perceptions (myth) link the Federal Reserve’s so-called money printing (bank reserves) with share prices.

Read More »

Read More »

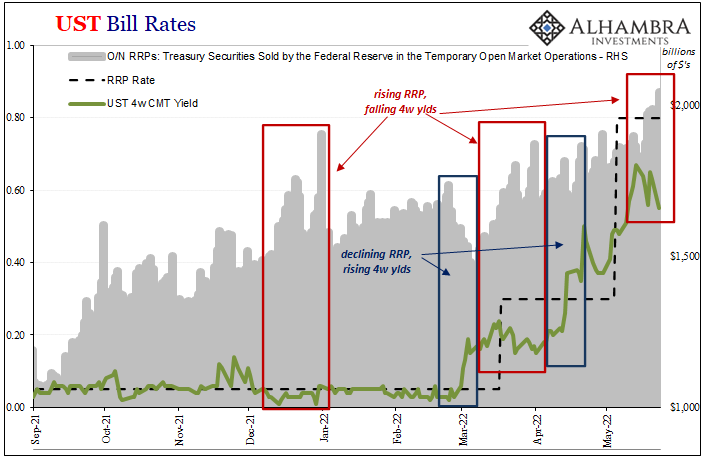

RRP (use) Hits $2T, SOFR Like T-bills Below RRP (rate), What Is (really) Going On?

You might not know it, but front-end T-bill yields are not the only market spaces which are making a mockery of the Federal Reserve’s “floor.” There are others, including the same money number the same Fed demanded the world (or whatever banks in its jurisdiction it could threaten) ditch LIBOR over.

Read More »

Read More »

China in Africa: should the West be worried? | The Economist

In the past 20 years, China has built ever closer bonds with African nations. It has spent billions transforming infrastructure across the continent, and extending its influence into politics and society. It even placed its only overseas military base there. How worried should the West be?

00:00 - China in Africa: should the West be worried?

00:50 - The start of the relationship: transforming Africa’s infrastructure

02:49 - Africa’s diplomatic...

Read More »

Read More »

Russia-Ukraine Crisis: Moscow tries to encircle Ukrainian troops in Donbas | Latest English News

Russia intensified its attacks on Ukrainian forces in eastern Ukraine, attempting to capture the Donbas region exactly three months after President Vladimir Putin ordered his troops to invade Ukraine.

Read More »

Read More »

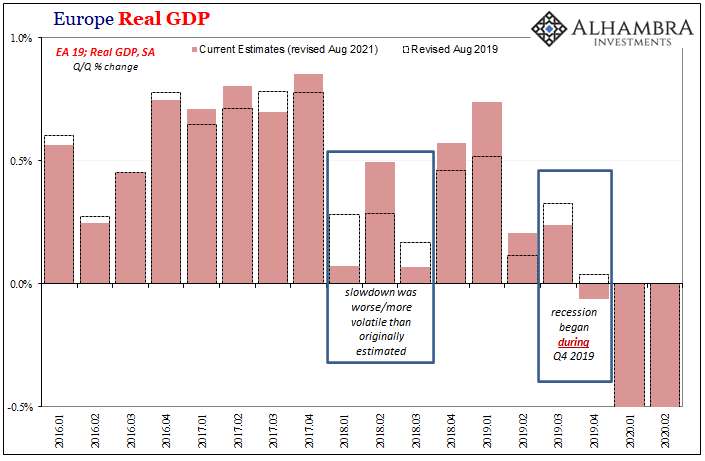

Another Month Closer To Global Recession

We always have to keep in mind that the major economic accounts perform poorly during inflections. Europe in early 2018, for example, was supposed to have been just booming only to have run right into the brick wall that was Euro$ #4.

Read More »

Read More »

Russia-Ukraine Crisis: Moscow intensifies its Donbas offensive| Luhansk & Donetsk under attack| WION

Russia intensified its attacks on Ukrainian forces in eastern Ukraine, attempting to capture the Donbas region exactly three months after President Vladimir Putin ordered his troops to invade Ukraine.

Read More »

Read More »

UST 2s & Euro$ Futures *Whites* Both Ask, Landmine At Last?

The 2-year Treasury right now is the key point, the spot on the yield curve which is influenced mostly by potential alternative rates including those offered by the Federal Reserve. Because of this, the market for the 2s is looking forward at what those alternate rates are likely to be, then pricing yields accordingly.

Read More »

Read More »

What Could Go Right?

Our economy is not resilient or antifragile, it's a fragile sand castle of debt and denial. What could go off the cliff that hasn't already gone off the cliff? Rip-roaring inflation, check.Hot war in Europe, check. Global food crisis, check. Semi-permanent supply-chain snarls, check. Geopolitical blackmail, check.

Read More »

Read More »

Pakistan inches towards political turmoil | Imran Khan to lead mega march to Islamabad | WION

The battle between Pakistan PM Shehbaz Sharif and PTI Chief Imran Khan has reignited. The last political fight ended with Imran Khan's ouster and the outcome of this one remains to be seen as Pakistan is inching towards a political turmoil again.

Read More »

Read More »

The Solution for Social Media Spam Bots Is Already Here

The right of free speech should not be confused with an obligation for privately owned enterprises to allow spamming and spoofing under the guise of free speech. The problem of bots on Twitter is in the news. This is of course a problem in all social media: fake accounts, spamming accounts, spoofing (expropriating your identity) accounts, and so on, all courtesy of anonymous account creation.

Read More »

Read More »