Category Archive: 5) Global Macro

Can We "Export Inflation?" Yes We Can, Yes We Are

A strong currency exports inflation to those nations which do not issue the currency. Though it's difficult to be confident of anything in the current flux, I am pretty confident of three things: 1) price is set on the margins 2) currencies are the foundation of every economy 3) the financial forecasts issued to calm the public do not reflect operative geopolitical goals.

Read More »

Read More »

WION Fineprint: Oil & gas price surge amid Ukraine war | Latest English News

As global economies show worrying signs of rising food prices, soaring gas prices and high inflation rates, oil super majors witness record-breaking profits. How? Well, the Russian invasion of Ukraine is driving these stunning profits for the oil giants.

Read More »

Read More »

WION Dispatch: ‘SCO has agreed to trade in local currencies,’ says Russian FM

The formal meet of the foreign ministers of the SCO grouping is currently underway in Uzbekistan's capital Tashkent. Russian foreign minister said, SCO has agreed to trade in local currencies.

Read More »

Read More »

How Much of "Inflation" Is the Price Being Jacked Up Under the Excuse of "Inflation"?

The problem for global corporations feasting on "Inflation" profiteering is that the vast majority of consumers can't afford another lavish vacation, overpriced vehicle or specious subscription.

Read More »

Read More »

When You Can’t Go On by Charles Hugh Smith, Chapter by Chapter

Hear it Here -

adbl.co/3OFQ1MB

When I burned out, what I wanted but could not find was a practical guide by someone who had experienced burnout themselves. None of the material I found spoke to what I was experiencing or to my sense that our economy is now optimized to burn people out.

I decided to write the guide I wanted but could not find. This is my experience of burnout, reckoning and renewal.

This book is my account of what helped me....

Read More »

Read More »

The Roundtable Insight – Charles Hugh Smith on the USD, Emerging Markets and Investment Implications

Http://financialrepressionauthority.com/2022/07/28/the-roundtable-insight-charles-hugh-smith-on-the-usd-emerging-markets-and-the-investment-implications/

Support us on Patreon - https://www.patreon.com/roundtableinsight

Read More »

Read More »

What Can The Beatles Teach Us about Management?

Own your work. Don't give it away or let others profit at your expense. Leverage it when opportunities arise. What can The Beatles teach us about management?Young readers may wonder why The Beatles still matter 52 years after the band broke up. It's a fair question.

Read More »

Read More »

Russia-Ukraine war: Deadly attack on a prison in Donetsk, dozens dead

It has been several months since the Russian invasion of Ukraine has been raging on. Armies of both countries are fighting since the invasion began. Now, a Deadly attack on a prison in Donetsk claim dozens of lives.

Read More »

Read More »

Fed Official: Inverted curve means Fed is awesome [Ep. 269, Eurodollar University]

James Bullard, St. Louis Fed chief, says the yield curve is twisted by the inflation surge, and may not be a recession message. Indeed, markets are twisting it because they have confidence the central bank will get control of consumer prices.

Read More »

Read More »

Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong.

Read More »

Read More »

When You Can’t Go On: Burnout, Reckoning and Renewal By: Charles Hugh Smith

Hear it Here - adbl.co/3OFQ1MB

When I burned out, what I wanted but could not find was a practical guide by someone who had experienced burnout themselves. None of the material I found spoke to what I was experiencing or to my sense that our economy is now optimized to burn people out.

I decided to write the guide I wanted but could not find. This is my experience of burnout, reckoning and renewal.

This book is my account of what helped me. The...

Read More »

Read More »

Blinken holds conversation with Lavrov; First talk since the Ukraine war began

US Secretary of State Antony Blinken held talks with Russian Foreign Minister Lavrov. They talked for the first time since the Ukraine war began.

Read More »

Read More »

Nord Stream 1 supply to be cut | Zelensky slams Russia’s gas cut move; ‘Must act soon’ says EU

Russian energy giant Gazprom has said that it will again drastically cut gas supplies to EU countries through its main pipeline the north stream one due to maintenance work. To this the EU has now said that it must stack soon to reduce its usage of Russian gas.

Read More »

Read More »

How are offices changing? | The Economist

The pandemic and hybrid working have changed the very idea of the office. This is not only changing the design and purpose of offices, but the look of cities too.

Chapters

00:00 - The office: a shifting concept

00:57 - What do future offices look like?

02:30 - The office as a social destination

03:20 - The rising demand for flexible work

04:06 - How should hybrid employees be managed?

06:01 - Will hybrid work worsen gender inequality?

06:36 -...

Read More »

Read More »

Nord Stream 1 supply to EU to be cut further, says Russia’s Gazprom | Latest English News | WION

The Russian state-controlled energy company Gazprom has announced a drastic cut to gas deliveries through Nord Stream 1 pipeline to Europe from Wednesday.

Read More »

Read More »

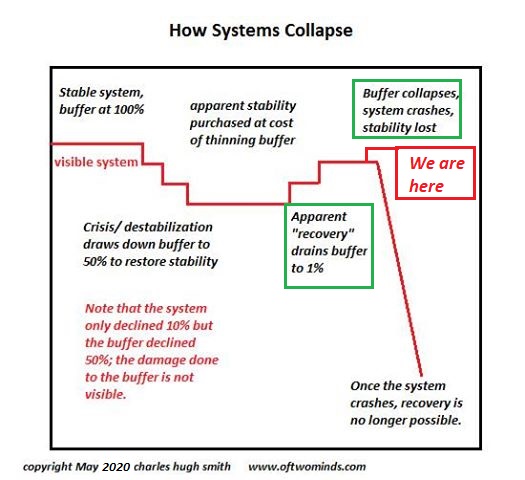

There Won’t Be Any Winners Because The Status Quo Is Corrupt Everywhere

Systemic corruption on this vast scale optimizes failure and collapse. Debating which nations will "win" as the global economy unravels is a popular but pointless parlor game.Since the status quo in every nation is deeply, profoundly, systemically corrupt, there won't be any "winners," there will only be losers.

Read More »

Read More »

What’s Truly Important? The Global Revaluation Is Accelerating

How much gold will you trade for a few eggs? It depends on how hungry you are. Two ideas will help us understand the rest of this tumultuous decade: core-periphery and the revaluation of what's truly important: systemic adaptability, transparency, accountability, risk, capital and resources.

Read More »

Read More »

Ukraine works to resume grain exports, should begin again within days | World News | WION

Amid skepticism that the recent Russian strike on Ukraine's port city of Odessa might jeopardize the un-brokered grain deal. Kyiv and the United Nations have now offered a fresh ray of hope saying that the export of grains could start within days.

Read More »

Read More »

In 1982 the Fed missed an opportunity; it still haunts us [Ep. 267, Eurodollar University]

On May 20, 1982 the Fed held an emergency conference call for which transcripts are missing (on purpose? by accident?) to solve the "Drysdale Problem". They 'solved' it by focusing on the trees and ignoring the forest.

Read More »

Read More »

White House: Russia using annexation playbook in Ukraine

The Russia-Ukraine conflict is going to enter its sixth month. In the latest the White House has now said that Russia is forming plans to annex more parts of Ukraine repeating a similar playbook it used in 2014 annexation of Crimea.

Read More »

Read More »