Category Archive: 5) Global Macro

The Crash Of A Lifetime Everything Has Fallen Jeff Snider | Treasury Bills

The Crash Of A Lifetime Everything Has Fallen Jeff Snider | Treasury Bills

#jeffsnider#treasurybills#economy#useconomy#

DISCLAIMER :

I am not a financial advisor. The ideas presented in this video are for entertainment purposes only. You (and only you) are responsible for the financial decisions that you make.

Read More »

Read More »

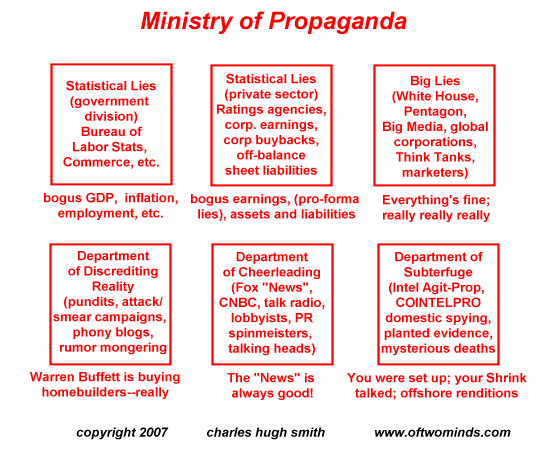

Make Sure You Download the Latest Ministry of Propaganda Updates

While it's fun to sort all the propaganda into various boxes, we would do well to look for what all the marketers / MoP players seek to mystify. It's time once again to check for Ministry of Propaganda updates, which like Windows and iOS is constantly being updated to counter new threats and enhance the user experience (heh).

Read More »

Read More »

Russian economy to contract by less than 3 percent in 2022 | WION Business News

Russia's first deputy PM Andrey Belousov has said that Russia's economy will shrink by less than three percent in 2022, that's a much shallower contraction than initially expected while inflation will be below earlier projections.

Read More »

Read More »

Why is Inflation in USA Higher than across World? [Ep. 281, Eurodollar University]

The San Francisco Fed reveals why US consumer prices accelerated more than other nations (i.e. stimulus checks). Also, the SF Fed explains why and when prices accelerated during 2020-22 (i.e. demand collapse and surge; supply shocks). At no point was it the Fed 'money printer go brr'.

Read More »

Read More »

The Roundtable Insight – Charles Hugh Smith on the Insanity of Central Banks in Addressing Inflation

Support us on Patreon - https://www.patreon.com/roundtableinsight

http://financialrepressionauthority.com/2022/08/26/the-roundtable-insight-charles-hugh-smith-on-the-insanity-of-central-banks-in-addressing-inflation/

Read More »

Read More »

Weekly Market Pulse: The Dog That Didn’t Bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?”

Sherlock Holmes: “To the curious incident of the dog in the night-time.”

Gregory: “The dog did nothing in the night-time.”

Sherlock Holmes: “That was the curious incident.”

From Silver Blaze by Arthur Conan Doyle, 1892

Read More »

Read More »

Everything Is About To Crash Jeff Snider | Treasury Bills

Everything Is About To Crash Jeff Snider, Treasury Bills.

#jeffsnider#treasurybills#economy#useconomy#

Read More »

Read More »

Boris Johnson visits Kyiv as Ukraine marks Independence Day | Latest International News

Boris Johnson has made a surprise visit to Kyiv to mark Ukraine's independence day. This is Johnson's third visit to Ukraine since Russia invaded six months ago.

Read More »

Read More »

China’s Currency (had been) Suspiciously Stable [Ep. 279, Eurodollar University]

China's economic results for July were "gruesome", the rest of the year not been much better. That's troubling enough but when the yuan doesn't move a scintilla for weeks it suggests the People's Bank of China is fighting hard to prevent a depreciation -- maybe even a devaluation?

Read More »

Read More »

The Saudi prince: how dangerous is MBS?

Muhammad bin Salman, or MBS—the millennial crown prince of Saudi Arabia—appears increasingly invincible. With the war in Ukraine disrupting energy supplies, Western leaders are eager to get their hands on his oil. But should they worry about the young prince’s power?

00:00 - How dangerous is MBS

01:06 - How MBS has reformed Saudi Arabia

02:59 - Who is MBS?

03:36 - MBS’ rise to power

06:21 - Khalid Al-Jabri on MBS’ brutal regime

08:14 - The murder...

Read More »

Read More »

What’s Worse Than Inflation? Depression + Inflation

If "markets" controlled by the rich are allowed to distribute essentials, the result will be civil disorder and the overthrow of regimes. What's worse than inflation? Depression + Inflation. And that's where we're heading. As I explained yesterday in The Fed Can't Stop Supply-Side Inflation, central banks are trying to reduce inflation by crushing demand.

Read More »

Read More »

Ukraine Nuclear Chief warns over Russian activity at nuclear site | Latest World News | WION

Zaporizhzhia Nuclear Power Plant which is at the center of the Ukraine conflict continues to worry over a possible nuclear disaster. Reports now suggest that a detailed plan has been drawn up by Russia to disconnect Europe's largest nuclear plant from Ukraine's grid, citing concerns ahead of Ukraine's atomic energy.

Read More »

Read More »

Jeffrey Snider about US Dollar

Jeffrey Snider about US Dollar: How the global monetary system actually works. What really make the FED. What is QE and QT.

Read More »

Read More »

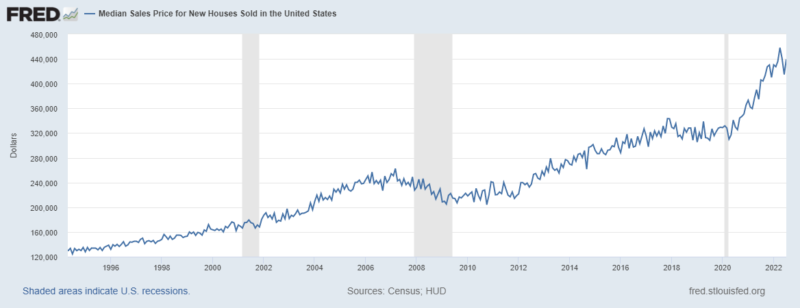

Rate Hikes Are Working

New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%.

Read More »

Read More »

Gravitas LIVE | Six months of Ukraine war | What next in battleground Ukraine? | Putin’s big bet

Watch Gravitas LIVE with Palki Sharma Upadhyay:

- 6 months of Ukraine war: Takeaways & the road ahead

- Battleground Taiwan: China building more warships

- Pak army to provide FIFA World Cup security

- China’s big move in Iraq

- Europe can’t get over a train breakdown

#Gravitas #PalkiSharma #WION

Read More »

Read More »

War in Ukraine nears 6 months, braces itself for Russian intensified attacks | Latest News | WION

Ukraine is bracing itself for increased Russian attacks ahead of its Independence Day on August 24th which falls exactly six months after Russian President Vladimir Putin announced what he called a 'special operation' in the neighboring nation. WION in an exclusive interview with Dr. Lada L Roslycky, international security analyst from Kyiv.

Read More »

Read More »

WION Fineprint: How drones are shaping the Ukraine war

Drones have become the top focus in Ukraine as thousands are being used by both sides to hit targets behind the enemy lines. Molly Gambhir tells you how drones are shaping this war.

Read More »

Read More »

The Fed Can’t Stop Supply-Side Inflation

The Fed and other central banks have zero control of supply-driven inflation, period. America's financial punditry is bewitched by four fatal fantasies: 1. Inflation is demand-driven. If the Federal Reserve (or other central banks) reduce demand with monetary tools like raising interest rates, inflation will cool. 2. Substitution of high-cost goods with lower-cost goods reduces inflation, and substitution is infinite: there's always cheaper...

Read More »

Read More »

Gravitas: Russia thwarts terror plot against India, detains I-S operative

Russia has thwarted a terror plot against India. The FSB has apprehended an Islamic state operative who planned to carry out a 'suicide attack' in India over the blasphemy row.

Read More »

Read More »