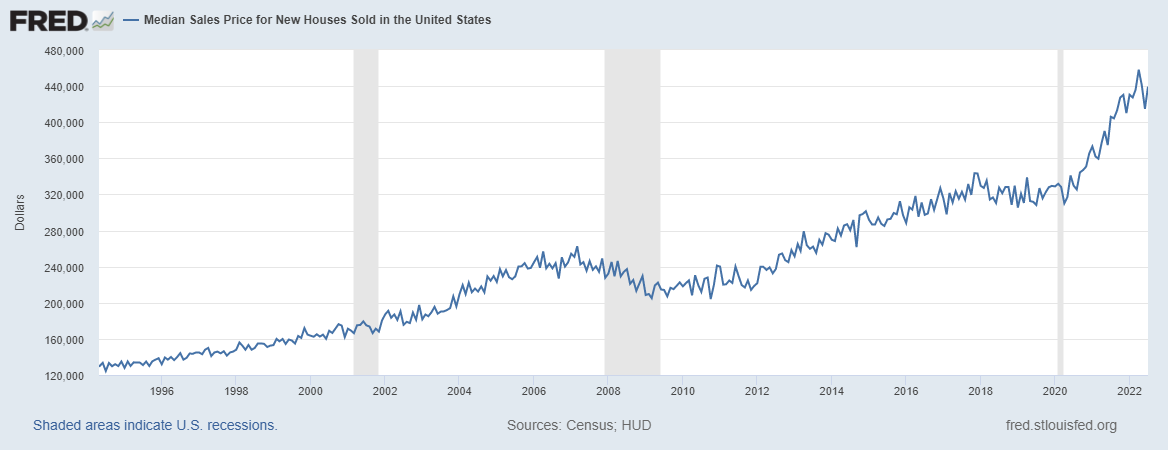

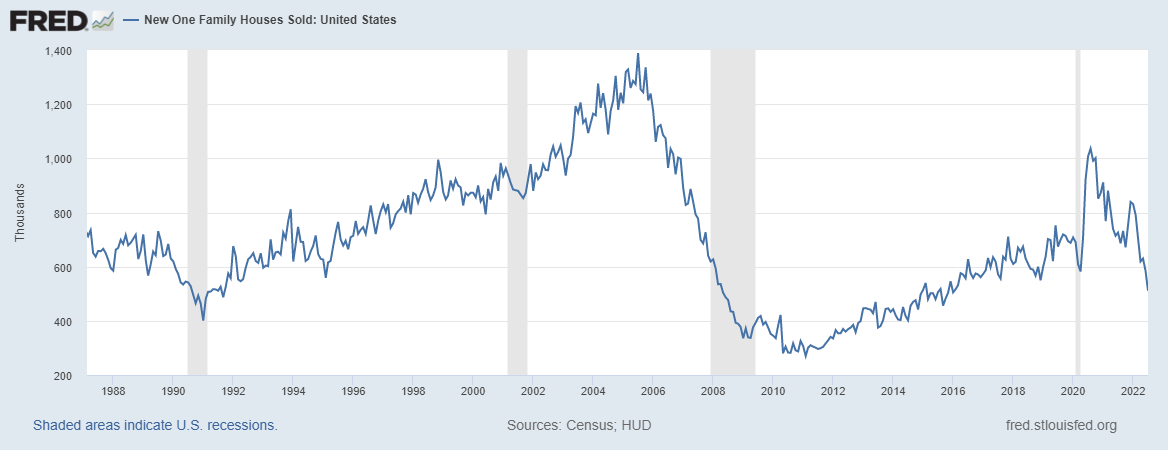

| New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%. Obviously, the fall this year is related to rising mortgage rates but that can’t be the reason sales have been falling for nearly two years. For that, I think you have to look at prices which rose 34% from the beginning of 2021 to the peak in April of this year. | |

| For housing though “price” isn’t just about the price of the house but also the financing and we all know mortgage rates have risen in recent months. A $250,000 mortgage at 6% has a monthly payment that is 42% above what it was at 3% ($1499 vs $1054). That’ll put a crimp in sales. As it was meant to and as is necessary. | |

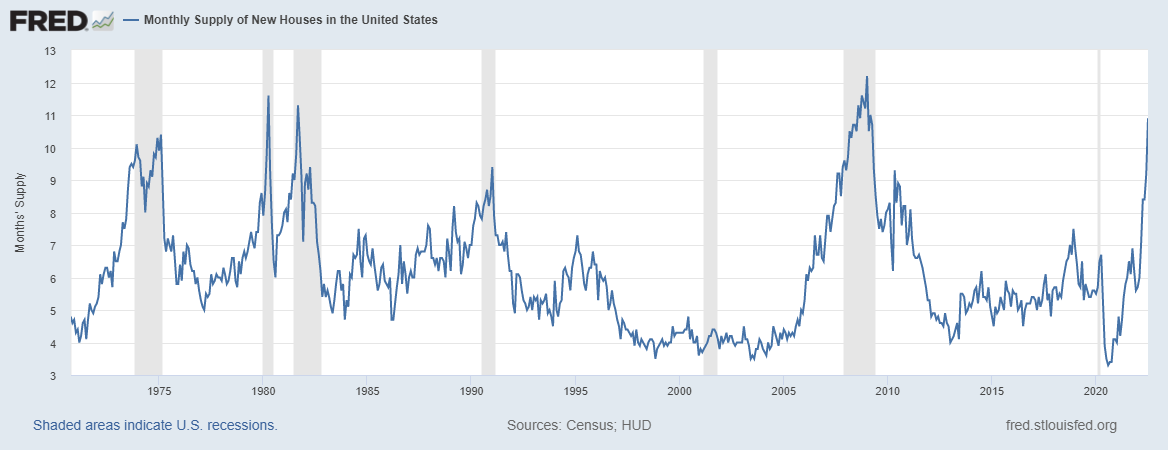

| The Fed’s goal is to reduce inflation and part of that has to be knock down house price appreciation that has been running at a more than 15% year over year rate since the spring of 2021. The only way to do that is from the demand side; homebuilders can’t build fast enough (there is a labor shortage in the trades and there are still supply chain issues) to affect price from the supply side. | |

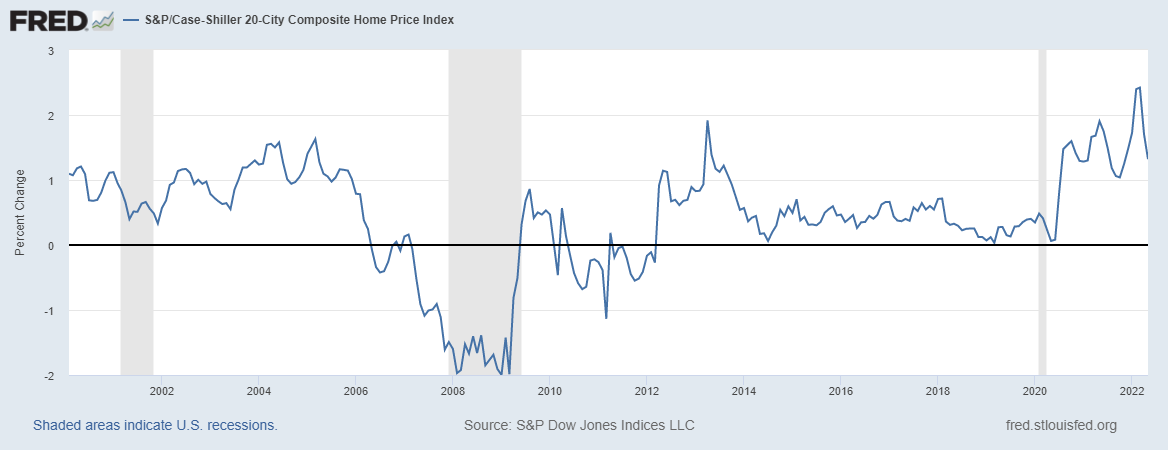

| And the common sense way to knock down housing demand is to raise the carrying cost and that’s what the Fed’s rate hikes have done.

And prices do appear to have peaked if you look at the Case Shiller data. Month to month change in house prices, 20 city composite index: Knocking down home price appreciation by itself is not a quick fix for inflation but it will impact inflation in at least two other ways I can think of. First is that lower home sales will also affect the demand for durable goods which has been inflated relative to trend by COVID and the response to it. Second – and this is probably a weaker effect – is that there will be some wealth effect. It will be weaker because we haven’t seen prices actually fall just stop rising. Asking prices for existing homes are already falling and you’ll see builders start to offer discounts on new homes soon, if it hasn’t already happened. |

The big question is whether the Fed can knock down demand for housing and also avoid recession or keep it mild. The odds look pretty long frankly but I think it is possible that the damage is limited. Residential investment was 4.7% of GDP last quarter and its long term average is 4.6% so it isn’t a big part of GDP. It is very volatile though and has an outsized impact on the business cycle. And residential investment is going to fall this quarter; the only question is how much. Can we avoid recession? I have my doubts about that but it doesn’t have to be a housing crash and bear market like 2008.

A mild recession is still a recession though so the real question is whether whatever is coming has already been discounted by markets (or was discounted at the lows). Stocks seem to be saying yes after a big rally off the lows and market sentiment is still quite negative. Large speculators are still holding very large short positions in the futures market. Interest rates and the dollar are also still rising; not what we’d expect on the verge of recession. So, is the bottom in? That may depend on how far the Fed goes with its rate hikes. Maybe we’ll find out more when Powell speaks Friday at the Fed’s annual conclave at Jackson Hole. Stay tuned.

Full story here Are you the author? Previous post See more for Next post

Tags: Alhambra Research,economy,Featured,federal-reserve,House Prices,Housing Starts,inflation,Jerome Powell,Markets,New Home Sales,newsletter,Real Estate