Category Archive: 5) Global Macro

Incels: how online extremism is changing

“Incels” are an online community of mostly young men, some of whom promote violent hatred of women. In the online world, violent extremism is evolving in ever more fluid ways — with fatal consequences in the real world.

Film supported by @Mishcon de Reya LLP

See more from our Now & Next series: https://films.economist.com/nowandnext

00:00 - How the internet is changing violent extremism

01:10 - The radicalisation superhighway

02:50 - The...

Read More »

Read More »

The End of the "Growth" Road

Everyone caught by surprise that the infinite road actually has an end will face a bewildering transition. The End of the "Growth" Road is upon us, though the consensus continues to hold fast to the endearing fantasy of infinite expansion of consumption.

Read More »

Read More »

Rishi Sunak makes his first speech as Britain’s PM, promises to lead UK out of economic turmoil

Rishi Sunak has become Britain's third Prime Minister this year. During his speech at 10 Downing Street, the new Prime Minister pledged to lead the country out of the profound economic crisis that the country finds itself in.

Read More »

Read More »

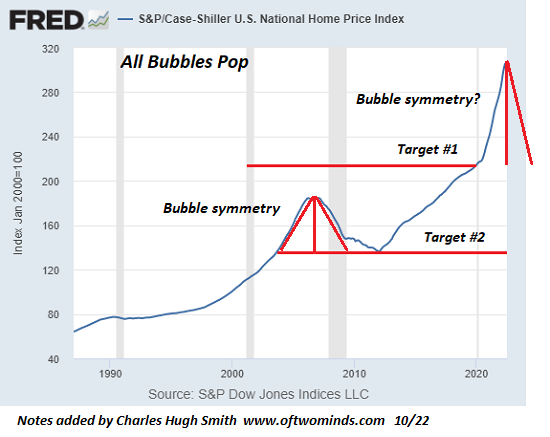

Now That Housing Is Rolling Over, Is That Fixer-Upper a Deal?

So-called "cosmetic work" can cost tens of thousands of dollars.Now that housing is finally rolling over due to rising mortgage rates and bubble valuations, many of those who have been priced out of the market are hoping to take advantage of lower prices.

Read More »

Read More »

Russia pushes dirty bomb claims, submits formal letter to UN | Latest World News | WION

After a series of accusations, Russia has submitted a formal letter to the United Nations, the latter discussed the claims in a closed-door meeting. The start of this week saw a blame game that roped the United Nations and the West, Moscow has accused Kyiv of planning to deploy a dirty bomb on its own land in return Ukraine has counter accused the Kremlin of planning a false flag operation.

Read More »

Read More »

Home prices are now falling, piling on the Fed pivot from near and dear to the FOMC (models).

As if there aren't enough suspects which could end the Fed's rate hikes regime (more importantly represent serious threats to the economy and markets), now we have confirmed falling home prices to add to the already-toxic environment.

Read More »

Read More »

Gravitas | Ukraine war: Russia raises dirty bomb threat at UN

Russia has sent a letter to the UN - repeating its claim that Ukraine is preparing to use a dirty bomb on its territory. Do Moscow's allegations have any merit? Priyanka Sharma tells you more.

Read More »

Read More »

WION Fineprint | Russian court rejects Brittney Griner’s appeal

A Russian court rejected U.S. basketball star Brittney Griner's appeal for a reduced sentence. The American was sent to prison for carrying Cannabis Oil. Neha Khanna tells you more.

Read More »

Read More »

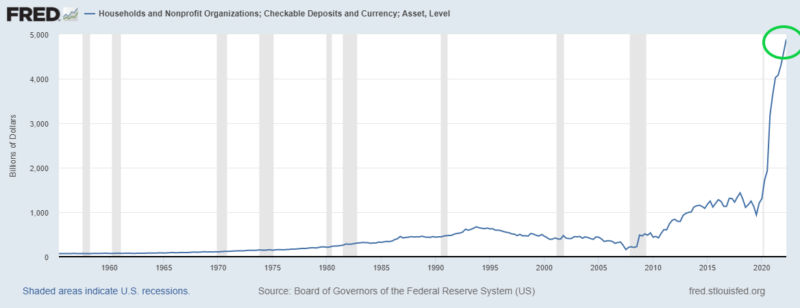

Powell’s Epiphany: There is No Free Lunch p2 Neutralizing the Money is Inflationary

Pandemic Wealth Effect. The top 1% of the US made about $14T or $4.2M per person. The next 19% made about $20T or $318,000 per person. The next 30% made about $5T or $50,000 per person. The bottom 50% made about $1T or $6,000 per person. The resulting inflation is at a 40yr high and Powell wants the money back.

Read More »

Read More »

Russia-Ukraine blame game: ‘Dirty bomb’ claims reach United Nations’ door | World News | WION

Moscow has accused Kyiv of planning to deploy a 'dirty bomb' on its own land. Ukraine and the West however have denied these claims, Zelensky has counter accused the Kremlin of planning a false flag operation.

Read More »

Read More »

SPECIAL REPORT: Follow The Money Series – Dawn Of A New Era

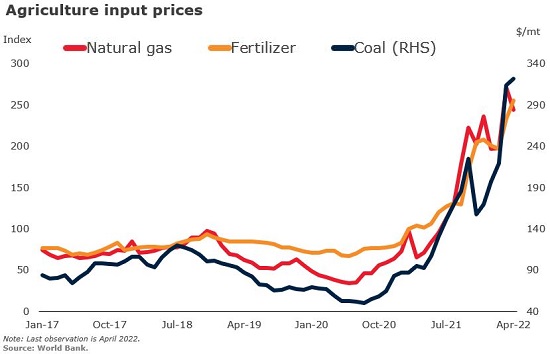

With inflation recently hitting a high not seen since 1981, it is now apparent that the factors that drove the disinflation trend of the last four decades are coming to an end. Globalization and demographics, the two big factors that combined to hold down prices and wages for so long, are reversing, and so too is the downtrend in prices, wages, and interest rates.

Read More »

Read More »

Xi Jinping’s vulgar display of power – and its target – was intended specifically for you and me.

Hu Jintao wasn't just Xi Jinping's predecessor. Hu was a technocrat who represented a different method for pursuing the Chinese socialist agenda, one that shared more in common with the rest of the world.

Read More »

Read More »

Rishi Sunak: what challenges await Britain’s new PM?

Britain has a new prime minister—again. Rishi Sunak inherits a mountain of problems. The Economist’s Britain editor assesses the challenges Mr Sunak faces.

00:00 - Britain’s new Prime Minister

00:30 - The markets react

01:07 - Public services under pressure

02:34 - Rishi’s balancing act

03:06- Political instability: the ongoing risk

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

For our most recent Britain coverage:...

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 24 octobre 2022, SMART BOURSE reçoit Thomas Costerg (Économiste senior US, Pictet WM)

Read More »

Read More »

Info not fearmongering. Swaps not Swiss. Dealers not Fed. The data and evidence are conclusive.

A negative swap spread sounds like total nonsense - at first. But in a ledger money, fictive currency system what matters is the capacities of those who collectively keep track of the distributed ledger. This is where that nonsense isn't just useful, it is extremely valuable. Swaps are the ledger and they are saying there is a very real and worsening problem on it. Global (euro)Dollar Shortage.

Read More »

Read More »

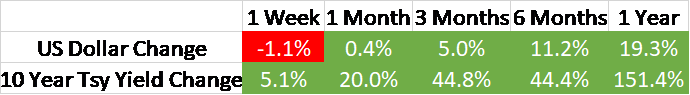

Weekly Market Pulse: Did Powell Just Blink?

Did Jerome Powell blink last Friday? It was just before the market open Friday and interest rates were jumping higher, as they had all week. The 10-year Treasury yield was up to 4.33%, another 11 basis points higher than the previous close and 32 basis points higher than the previous week’s close.

Read More »

Read More »

Russia: Ukraine is preparing ‘dirty bomb’ attacks | Top World News | Latest English News | WION

Tensions between Russia and Ukraine continue as the war enters its ninth month. Russian defense minister rang his US and other European counterparts, he alleged that Ukraine is preparing a provocation with 'dirty bombs'.

Read More »

Read More »

Domestic housing bust accelerates, yet it is foreign Treasury buyers who are inverting the curve.

What do foreign UST buyers know that maybe American bond sellers don't? The latter seem to care all about he Fed. The former are facing more obvious problems beginning with a massive global dollar shortage.

Read More »

Read More »

A Lesson in Markets and Bureaucracies: The Very Instructive History of Rat Farms

In effect, authorities created two rat farms, both unintended: the sewers, and the private-sector rat-farms.The history of Rat Farms offers a valuable lesson in how markets and bureaucracies work. The story of how the colonial authorities in Hanoi came to establish two kinds of rat farms is highly instructive. The first rat farm was unintentional.

Read More »

Read More »

Russia: Call was needed to clear up misunderstandings | Latest World News | WION

In a rare high level contact between Russia and the United States, the defence secretaries of both countries held a telephonic conversation. During the phone call, the situation of Ukraine was discussed.

Read More »

Read More »