Category Archive: 5) Global Macro

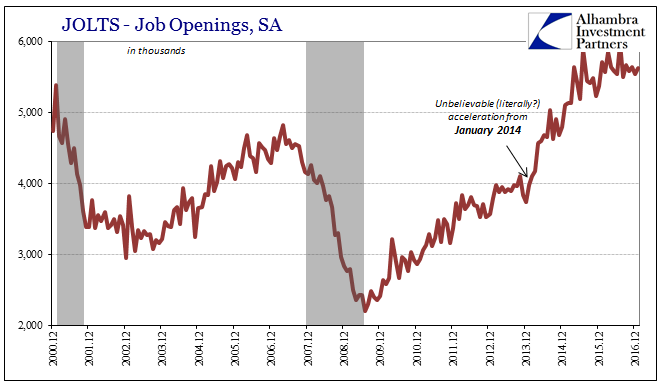

Was There Ever A ‘Skills Mismatch’? Notable Differences In Job Openings Suggest No

Perhaps the most encouraging data produced by the BLS has been within its JOLTS figures, those of Job Openings. It is one data series that policymakers watch closely and one which they purportedly value more than most. While the unemployment and participation rates can be caught up in structural labor issues (heroin and retirees), Job Openings are related to the demand for labor rather than the complications on the labor supply side.

Read More »

Read More »

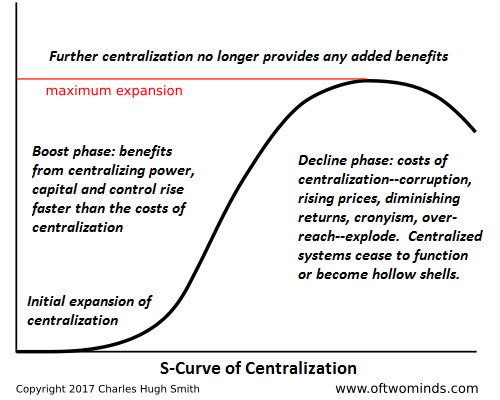

Solutions Abound–on the Local Level

Rather than bemoan the inevitable failure of centralized "fixes," let's turn our attention and efforts to the real solutions: decentralized, networked, localized.Those looking for centralized solutions to healthcare, jobs and other "macro-problems" will suffer inevitable disappointment. The era in which further centralization provided the "solution" has passed: additional centralization (Medicare for All, No Child Left Behind, federal job training,...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX had a stellar week, ending on a strong note in the aftermath of what the market perceived as a dovish Fed hike Wednesday. Every EM currency except ARS was up on the week vs. USD, with the best performers ZAR, TRY, COP, and MXN. There are some risks ahead for EM this week, with many Fed speakers lined up and perhaps willing to push back against the market’s dovish take on the FOMC.

Read More »

Read More »

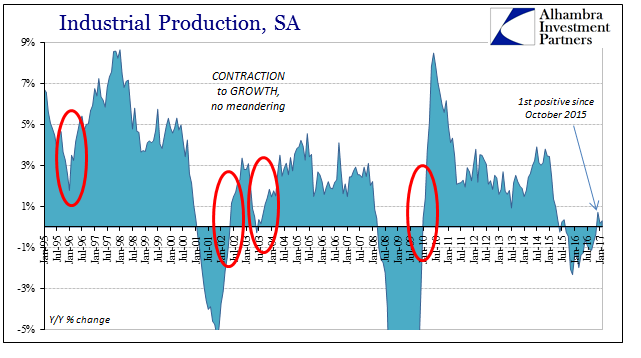

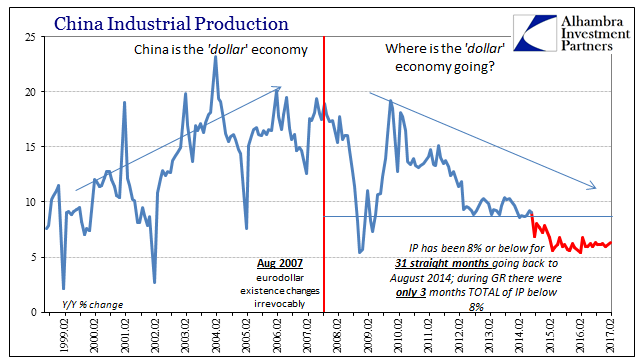

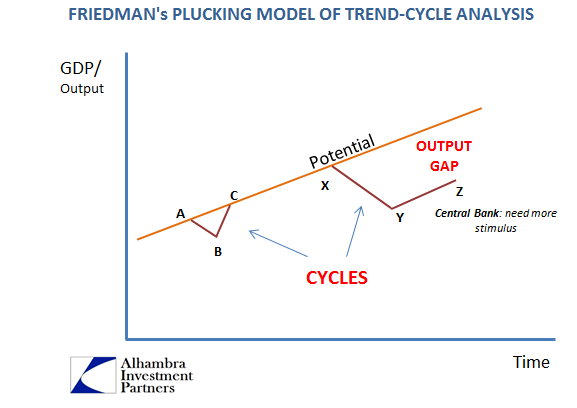

Industrial Symmetry

There has always been something like Newton’s third law observed in the business cycles of the US and other developed economies. In what is, or was, essentially symmetry, there had been until 2008 considerable correlation between the size, scope, and speed of any recovery and its antecedent downturn, or even slowdown. The relationship was so striking that it moved Milton Friedman to finally publish in 1993 his plucking model theory he had first...

Read More »

Read More »

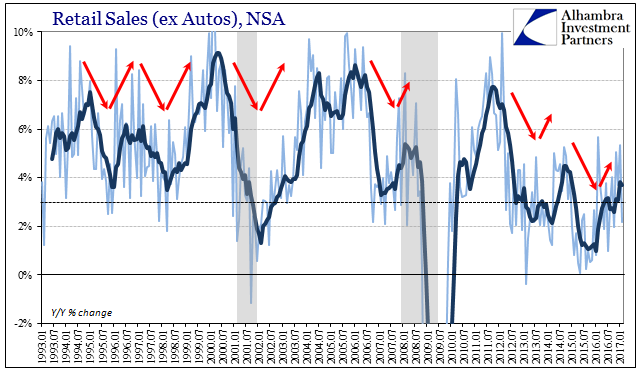

Retail Sales: Extra Day Likely, no Meaningful Difference

Retail sales comparisons were for February 2017 skewed by the extra day in February 2016. With the leap year February 29th a part of the base effect, the estimated growth rates (NSA) for this February are to some degree better than they appear. Seasonally-adjusted retail sales were in the latest estimates essentially flat when compared to the prior month (January). That leaves too much guesswork to draw any hard conclusions.

Read More »

Read More »

Emerging Markets: What has Changed

The PBOC increased the rates it charges for OMO and MLF by 10 bp. Indian Prime Minister Modi’s BJP won elections in the state of Uttar Pradesh. Czech central bank broached the possibility of a koruna cap exit later than mid-2017. Kuwait became the first OPEC member to call for extended output cuts.

Read More »

Read More »

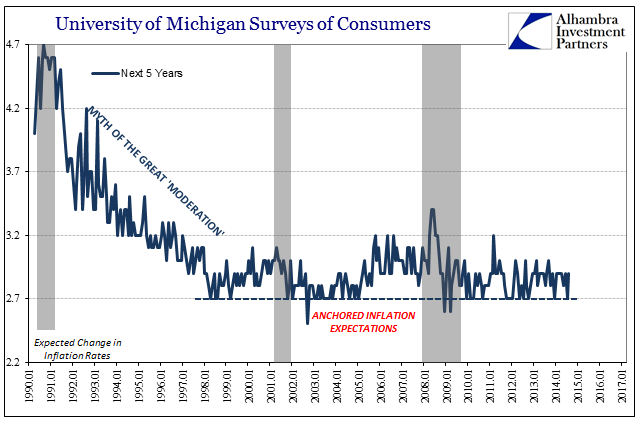

Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate.

Read More »

Read More »

What’s the most common method of contraception? | The Economist

Almost a century ago Dr Marie Stopes opened the first birth control clinic. We go out on the streets to ask which are the most common methods of contraception worldwide today. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from …

Read More »

Read More »

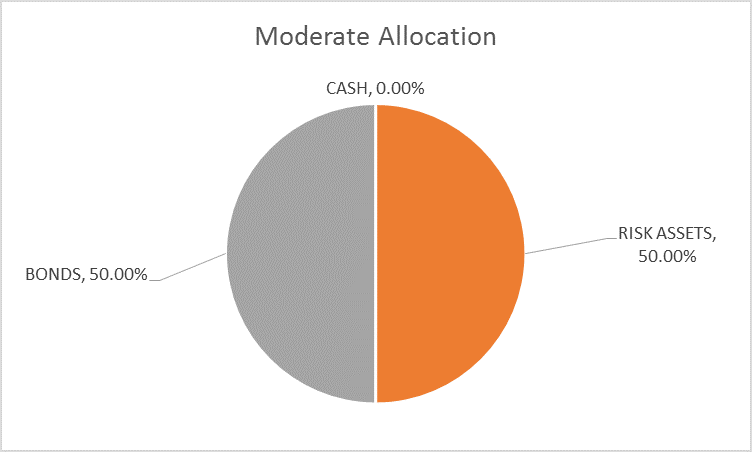

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle.

Read More »

Read More »

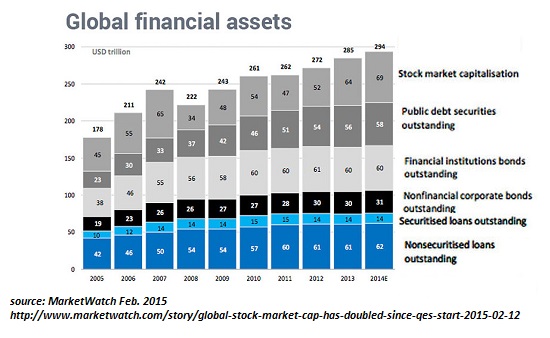

Now That Everyone’s Been Pushed into Risky Assets…

If we had to summarize what's happened in eight years of "recovery," we could start with this: everyone's been pushed into risky assets while being told risk has been transformed from something to avoid (by buying risk-off assets) to something you chase to score essentially guaranteed gains (by buying risk-on assets).

Read More »

Read More »

The fragmentation of Dutch politics

Old divisions between right and left are breaking down, scattering voters in all directions. This will make governing the Netherlands particularly difficult. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full …

Read More »

Read More »

China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%.

Read More »

Read More »

Mugged By Reality; Many Still Yet To Be

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them.

Read More »

Read More »

Kal draws… how do you solve a problem like North Korea?

Will US Secretary of State Rex Tillerson be able to find a solution to one of Asia’s most pressing issues? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: …

Read More »

Read More »

Charles Hugh Smith On Inequalities And The Distortions Caused By Central Bank Policies

FRA is joined by Charles Hugh Smith in discussing income inequality as a result of central bank policies Charles Hugh Smith is a contributing editor to PeakProsperity.com and the proprietor of the popular blog OfTwoMinds.com. He is the author of numerous books, including Why Everything Is Falling Apart: An Unconventional Guide To Investing In Troubled …

Read More »

Read More »

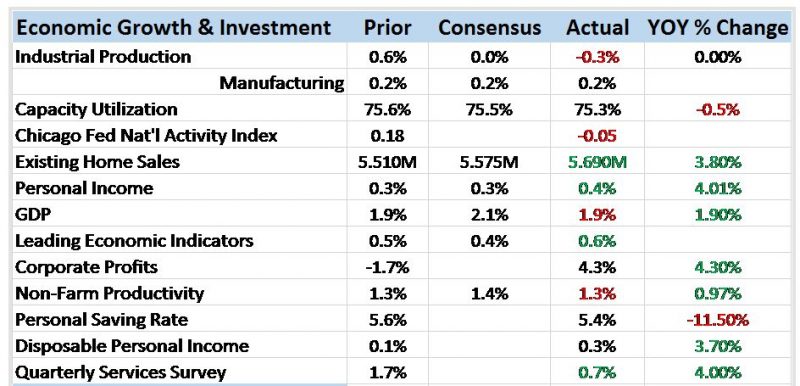

Bi-Weekly Economic Review

The Federal Reserve is widely expected to raise interest rates again at their meeting next week. They obviously view the recent cyclical upturn as being durable and the inflation data as pointing to the need for higher rates. Our market based indicators agree somewhat but nominal and real interest rates are still below their mid-December peaks so I don’t think a lot has changed.

Read More »

Read More »

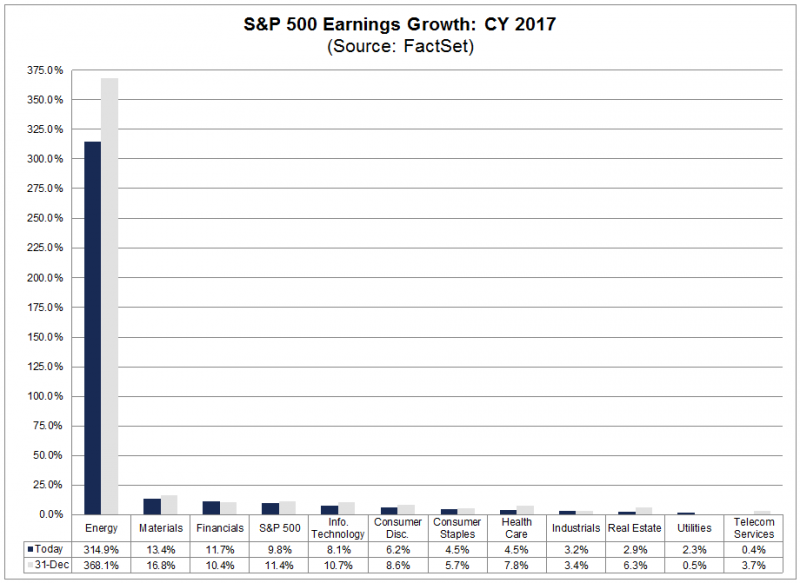

Earnings Update – A Poor Sort of Memory

“I don’t understand you,’ said Alice. ‘It’s dreadfully confusing!’

‘That’s the effect of living backwards,’ the Queen said kindly: ‘it always makes one a little giddy at first–‘

‘Living backwards!’ Alice repeated in great astonishment. ‘I never heard of such a thing!’

‘–but there’s one great advantage in it, that one’s memory works both ways.’

‘I’m sure mine only works one way,’ Alice remarked. ‘I can’t remember things before they happen.’...

Read More »

Read More »

Gene editing and the future of doping in sport | The Economist

What if you could hack your DNA to run faster, jump higher or become stronger? Gene doping is an advanced medical technology that could help athletes recover from injuries, but could also be used by drug cheats to beat the competition. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a firm note despite the strong US jobs data, with the dollar succumbing to some “buy the rumor, sell the fact” price action. We think the dollar should recover as the week begins, as it seems risky to be short/underweight dollars going into the FOMC meeting. With the Fed poised to hike 3 or perhaps 4 times this year, we don't think EM FX can continue to rally the way it has so far this year.

Read More »

Read More »

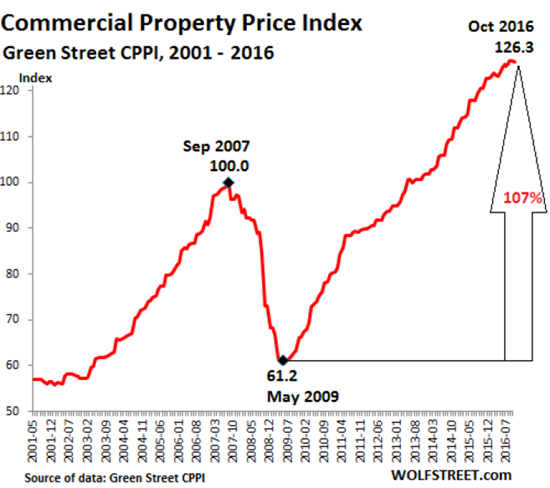

The Next Domino to Fall: Commercial Real Estate

Just as generals prepare to fight the last war, central banks prepare to battle the last financial crisis--which in the present context means a big-bank liquidity meltdown like the one that nearly toppled thr global financial system in 2008-09.

Read More »

Read More »