Category Archive: 5) Global Macro

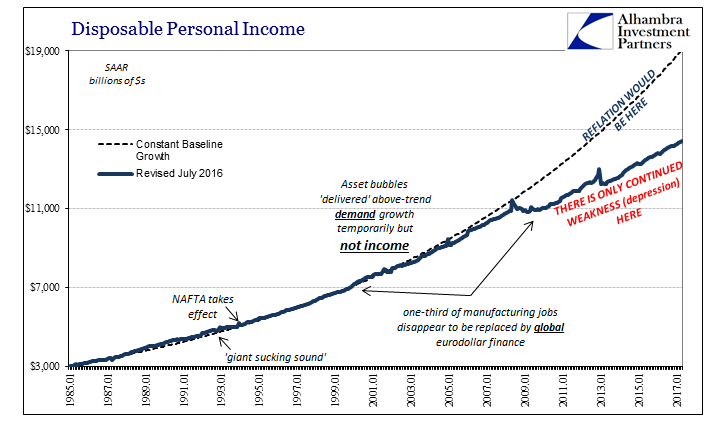

Fading Further and Further Back Toward 2016

Earlier this month, the BEA estimated that Disposable Personal Income in the US was $14.4 trillion (SAAR) for April 2017. If the unemployment rate were truly 4.3% as the BLS says, there is no way DPI would be anywhere near to that low level. It would instead total closer to the pre-crisis baseline which in April would have been $19.0 trillion. Even if we factor retiring Baby Boomers in a realistic manner, say $18 trillion instead, what does the...

Read More »

Read More »

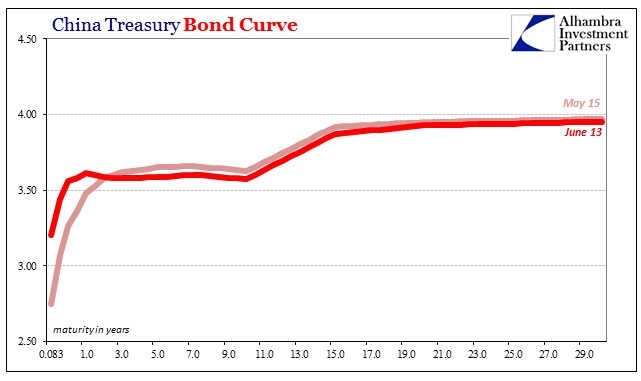

Now China’s Curve

Suddenly central banks are mesmerized by yield curves. One of the jokes around this place is that economists just don’t get the bond market. If it was only a joke. Alan Greenspan’s “conundrum” more than a decade ago wasn’t the end of the matter but merely the beginning. After spending almost the entire time in between then and now on monetary “stimulus” of the traditional variety, only now are authorities paying close attention.

Read More »

Read More »

RMR: Exclusive Interview with Charles Hugh Smith (06/27/2017)

Charles Hugh Smith author of the blog “Of Two Minds” joins “V” for a great discussion regarding the cryptocurrency market, a stock market crash scenario, what the markets are telling us and “The Over-Criminalization of American Life.” You can learn about Charles’s work at: http://charleshughsmith.blogspot.com/ We are political scientists, editorial engineers, and radio show developers …

Read More »

Read More »

A secret information war with North Korea | The Economist

A group of North Korean exiles are waging a secret war with North Korea—smuggling in information and content to the imprisoned population via USBs. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Kang Chol-hwan is a North Korean defector from North Korea. He is founder and president of the North Korea Strategy Centre. …

Read More »

Read More »

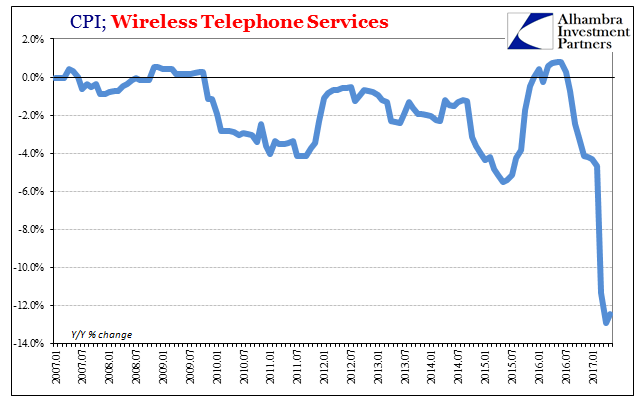

More Pieces of Impossible

On his company’s earnings conference call back on Valentine’s Day, T-Mobile CEO John Legere was unusually feisty. Never known for shyness, Legere had reason behind his bluster. T-Mobile had practically built itself up on price, being left the bottom tier of the wireless space practically to itself. That all changed, however, as both Verizon and Sprint were set to escalate the wireless price war.

Read More »

Read More »

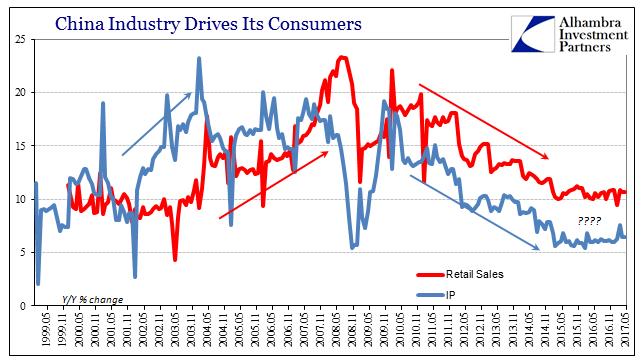

Chinese Basis For Anti-Reflation?

Yesterday was something of a data deluge. In the US, we had the predictable CPI dropping again, lackluster US Retail Sales, and then the FOMC’s embarrassing performance. Across the Pacific, the Chinese also reported Retail Sales as well as Industrial Production and growth of investments in Fixed Assets (FAI). When deciding which topics to cover yesterday, it was easy to leave off the Chinese portion simply because much of it didn’t change.

Read More »

Read More »

How I survived torture | The Economist

The United Nations Convention against Torture is 30 years old. Kolbassia Haoussou, a torture survivor, shares his story. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Over 160 states have signed the UN Convention against Torture sinces its adoption in 1984. Half of these countries still practice torture. In 2004, a failed coup …

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended last week on a firm note, though most were still down for the week as a whole. Commodity prices stabilized, but the balance remains fragile, in our view. We remain cautious, especially with regards to the high beta currencies such as BRL, MXN, TRY, and ZAR.

Read More »

Read More »

Charles Hugh Smith On Central Bank Buying Of Equities

Click here for the full summary with slides: http://financialrepressionauthority.com/2017/06/25/the-roundtable-insight-charles-hugh-smith-on-central-bank-buying-of-equities/

Read More »

Read More »

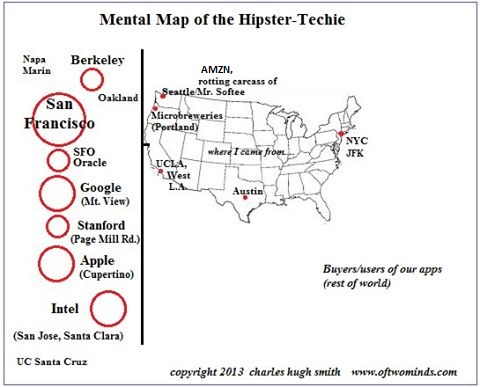

Can We See a Bubble If We’re Inside the Bubble?

If you visit San Francisco, you will find it difficult to walk more than a few blocks in central S.F. without encountering a major construction project. It seems that every decrepit low-rise building in the city has been razed and is being replaced with a gleaming new residential tower.

Read More »

Read More »

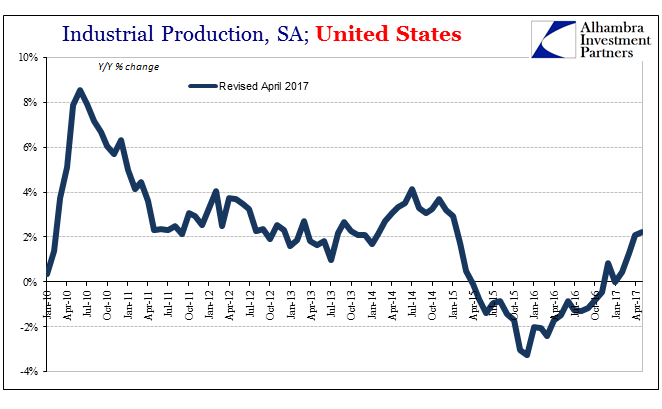

Defying Labels

Last month US Industrial Production rose rather quickly. Gaining more than 1.1% month-over-month, it might have appeared that the US economy once dragged into downturn by manufacturing and industry was finally about to experience its belated upturn. But frustration is how it has always gone, not just in this latest phase but for all phases since around 2011. Each good month is followed immediately by a disappointing one. What should be...

Read More »

Read More »

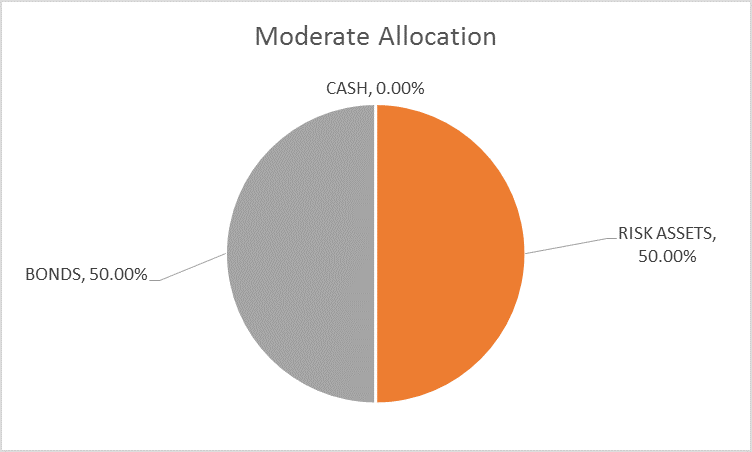

Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month.

Read More »

Read More »

Emerging Markets: What’s Changed

MSCI announced it will include 222 China Large Cap A-shares in its Emerging Markets Index. Czech central bank is pushing out rate hike expectations. Hungary central bank eased again using unconventional measures. MSCI announced that it has launched a consultation on reclassification of Saudi Arabia from Standalone to Emerging Market status.

Read More »

Read More »

Repeat 2015; An Embarrassing Day For The Fed

Today started out very badly for the FOMC. At 8:30am the Commerce Department reported “unexpectedly” weak retail sales while at the very same time the BLS published CPI statistics that were thoroughly predictable. Markets, at least credit and money markets, have gained a clearer idea what the Fed is actually doing and why. It’s not at all what the media suggests.

Read More »

Read More »

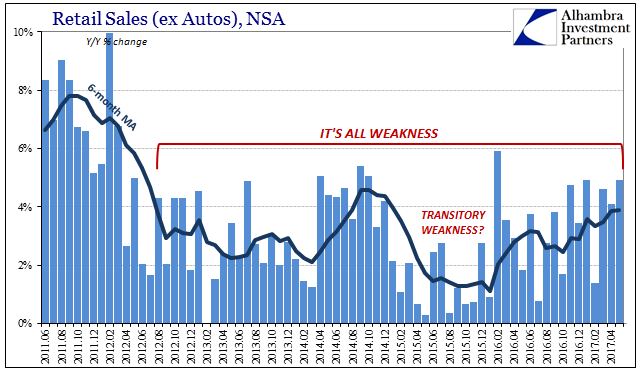

Retail Sales Weren’t All That Bad, Meaning They Were The Worst

Taken in comparison to the last few years, today’s retail sales report wasn’t that bad. Total sales for May 2017, including autos, grew by 5.17% year-over-year (NSA). That was the highest growth rate since last February. The 6-month average is now just shy of 4%, the best since early 2015. It is clear the US economy has shrugged off the effects of last year’s downturn.

Read More »

Read More »

An expert’s guide to negotiating Brexit | The Economist

Britain has begun talks on leaving the European Union. The architect of Canada’s recent trade deal with the EU discusses the complexities of Brexit. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 It is crucial for Britain to negotiate a trade deal with the EU before it leaves the bloc in March 2019. …

Read More »

Read More »

Repeat 2014: Praying Again To The God of ‘Global Growth’

One of the more troubling aspects of mainstream commentary in 2014 was its blandness. Statements were made with a purpose but also purposefully avoiding specifics. It was common to hear or read “the economy is improving” without being shown why or how in convincing fashion. After suffering a second bout of weakness in 2012 and 2013, unexpected of course, everyone simply believed those words because why not.

Read More »

Read More »

The Economics Behind Music Festivals | The Economist

Music festivals attract 32 million revellers annually around the world. That adds up to an industry worth nearly $10bn a year. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 From the mud of Glastonbury to the blockbusting headliners of Coachella, music festivals have become big business. Annually there are around 800 music festivals …

Read More »

Read More »

The ‘Dollar’ Devil Shows Itself Again In China

Some economic and financial conditions leave a yield curve as a more complex affair.Then there are others that are incredibly simple.The UST yield curve is the former, while right now the Chinese Treasury curve is the latter.

Read More »

Read More »

The conflict in South Sudan | The Economist

1.6 million South Sudanese have fled the country since December 2013, many to the world’s largest refugee camp, in Uganda. What’s behind the exodus? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Why are there so many refugees from South Sudan? South Sudan has been in a civil war for three and a …

Read More »

Read More »