Category Archive: 5) Global Macro

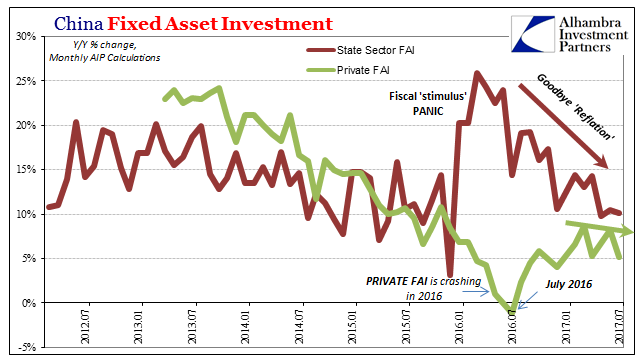

China: Losing Economic ‘Reflation’

If “reflation” was born last year in Japan, and I think it was, it was surely given its most tangible dimensions in China. The idea that the Bank of Japan was going to do something magnificent was perhaps always a longshot, but enough given the times for people to hope (sentiment) they might try (helicopter). The Chinese, however, have been relatively more pragmatic. Authorities began 2016 with an actual rather than imagined “stimulus” injection...

Read More »

Read More »

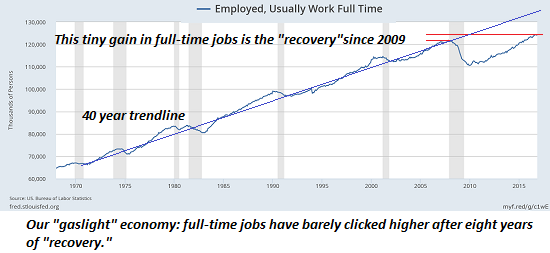

Are We Already in Recession?

How shocked would you be if it was announced that the U.S. had just entered a recession, that is, a period in which gross domestic product (GDP) declines (when adjusted for inflation) for two or more quarters? Would you really be surprised to discover that the eight-year long "recovery," the weakest on record, had finally rolled over into recession?

Read More »

Read More »

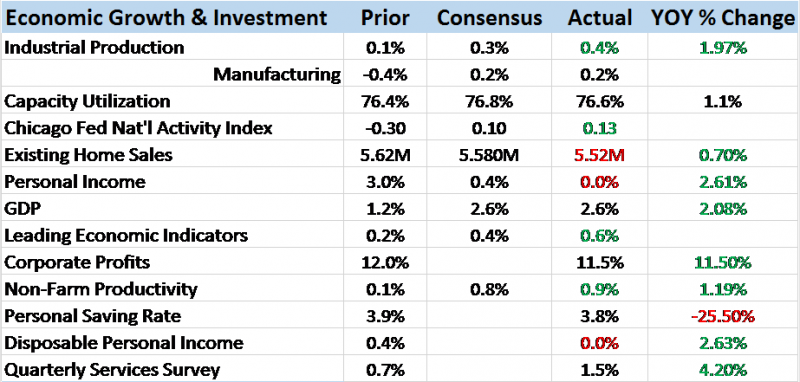

Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it.

Read More »

Read More »

ALERT ! ! ! USA’S DAY OF ECONOMIC RECKONING 2017 – Charles Hugh SMITH

Please Click Below to SUBSCRIBE for More “Special Report Radio” Subscribe & More Videos: https://goo.gl/1bvkco Thank for watching, Please Like Share And SUBSCRIBE!!! #dollarcollapse2017, #geraldcelente

Read More »

Read More »

“Under Any Analysis, It’s Insanity”: What War With North Korea Could Look Like

Now that the possibility of a war between the US and North Korea seems just one harshly worded tweet away, and the window of opportunity for a diplomatic solution, as well as for the US stopping Kim Jong-Un from obtaining a nuclear-armed ICBM closing fast, analysts have started to analyze President Trump’s military options, what a war between the US and North Korea would look like, and what the global economic consequences would be.

Read More »

Read More »

La mondialisation de l’esclavage permet la croissance des entreprises. Dossier.

Un Indien travaillant dans une fabrique de briques à l’extérieur de Calcutta, le 7 mai 2017. DIBYANGSHU SARKAR / AFP Nous avons parlé ces derniers temps d’excédents et de déficits de balances commerciales. Pourtant aucune rubrique de cette comptabilité de l' »intégration » d’un Etat dans le monde globalisé ne pénalise celui-ci en matière d’abus de travailleurs, voire d’esclavagisme. Pire, les abus sont en croissance. Il faut dire que l’affaire est...

Read More »

Read More »

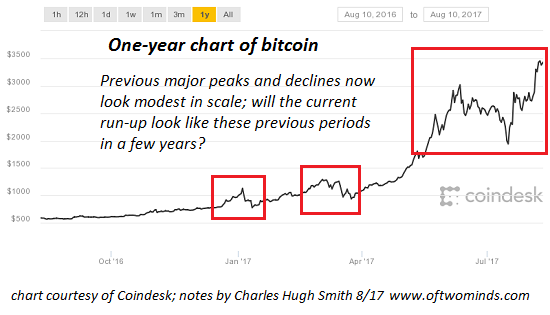

What the Mainstream Doesn’t Get about Bitcoin

The real demand for bitcoin will not be known until a global financial crisis guts confidence in central banks and politicized capital controls. I've been writing about cryptocurrencies and bitcoin for many years. For example: Could Bitcoin Become a Global Reserve Currency? (November 7, 2013) I am an interested observer, not an expert. As an observer, it seems to me that the mainstream--media, financial punditry, etc.--as a generality don't really...

Read More »

Read More »

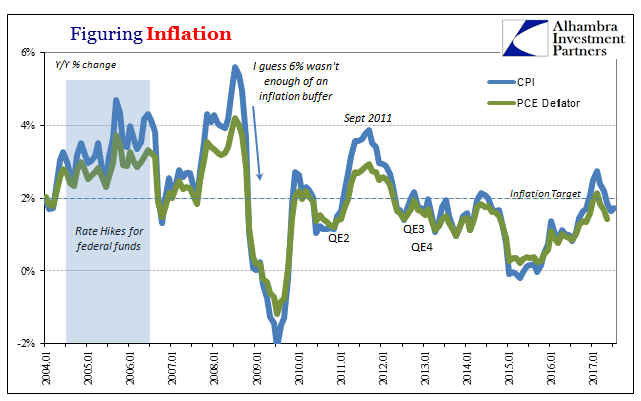

Oil Prices, CPI: Why Not Zero?

In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its notes on September 19 that year the Swedish...

Read More »

Read More »

Emerging Markets: What has Changed

Tensions on the Korean peninsula are still rising. Hong Kong boosted its 2017 growth forecast. S&P affirmed Israel’s A+ rating but moved the outlook from stable to positive. The corruption investigation against Israeli Prime Minister Netanyahu has intensified. South Africa's parliament voted down the no confidence motion against President Zuma. Argentina officials are taking steps to support the peso. Banco de Mexico has ended its tightening cycle.

Read More »

Read More »

Real GDP: The Staggering Costs

How do we measure what has been lost over the last ten years? There is no single way to calculate it, let alone a correct solution. There are so many sides to an economy that choosing one risks overstating that facet at the expense of another. It’s somewhat of an impossible task already given the staggering dimensions.

Read More »

Read More »

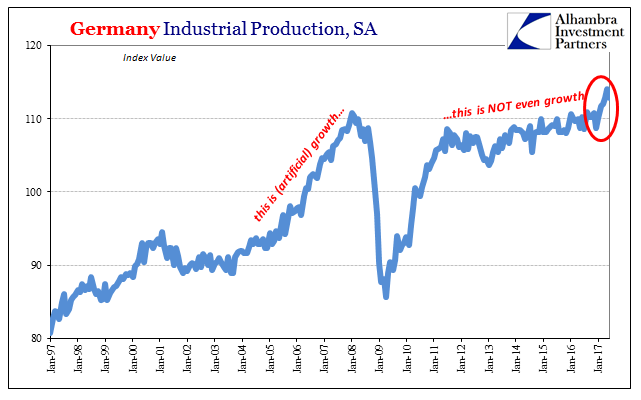

Industrial Production: Irreführende Statistiken

Germany’s Federal Statistical Office (DeStatis) reported today disappointing figures for Industrial Production. The seasonally-adjusted series fell in June 2017 month-over-month for the first time this year, last declining in December 2016. The index had been on a tear, rising nearly 5% in the first five months of this year.

Read More »

Read More »

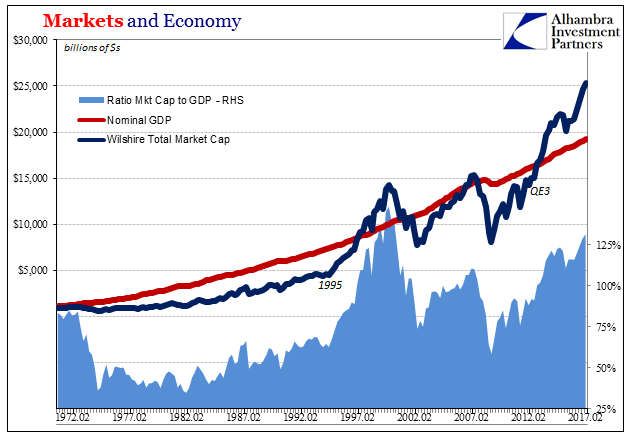

SNB Balance Sheet, Markets and Economy: As Good As It Gets?

Late 2014/early 2015 will perhaps be the closest to a real recovery from the Great “Recession” we shall see in this cycle. Q1 2015 marked the peak year over year growth rate of GDP in this recovery at 3.76%. That rate compares quite unfavorably with even the feeble post dot com crash recovery high of 4.41% in Q1 2004.

Read More »

Read More »

Vian Dakhil: Islamic State’s most-wanted woman | The Economist

Vian Dakhil, the only Yazidi member of Iraq’s parliament, is fighting to save her people from the jihadists of Islamic State. WARNING UPSETTING CONTENT Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full …

Read More »

Read More »

Oil Prices: The Center Of The Inflation Debate

The mainstream media is about to be presented with another (small) gift. In its quest to discredit populism, the condition of inflation has become paramount for largely the right reasons (accidents do happen). In the context of the macro economy of 2017, inflation isn’t really about consumer prices except as a broad gauge of hidden monetary conditions.

Read More »

Read More »

The Real Rate of Inflation | Charles Hugh Smith

Listen to the full interview at the Solari Report – solari.com “I can track the real-world inflation of the Burrito Index with great accuracy: the cost of a regular burrito from our local taco truck has gone up from $2.50 in 2001 to $5 in 2010 to $6.50 in 2016. That’s a $160% increase since … Continue reading...

Read More »

Read More »

Colombo, Sri Lanka: An Insiders Guide | The Economist

Colombo, an Insiders guide takes you to discover the hidden secrets of the city by asking the locals. Here are some top tips for experiencing Sri Lanka’s capital, Colombo. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ …

Read More »

Read More »

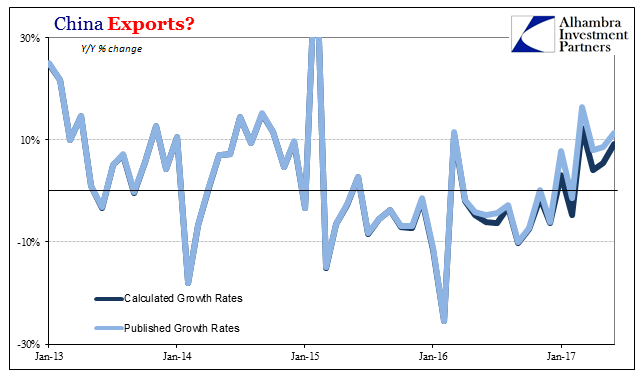

China Exports, China Imports: Textbook

China’s export growth disappointed in July, only we don’t really know by how much. According to that country’s Customs Bureau, exports last month were 7.2% above (in US$ terms) exports in July 2016. That’s down from 11.3% growth in June, which as usual had been taken in the mainstream as evidence of “strong” or “robust” global demand.

Read More »

Read More »

Is Another Oil Head-Fake Brewing?

Over the past decade I've addressed what I call Head-Fakes in the cost of oil/fossil fuel: even though we know the cost of extracting and processing oil will rise over time as the easy-to-get oil is depleted, oil occasionally plummets to such low prices that we're fooled into thinking it will remain cheap for a long time to come.

Read More »

Read More »

Will robots replace human workers? | The Economist

Demand for industrial robots is increasing, so we asked different people to guess how many jobs are held by robots, not humans. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: …

Read More »

Read More »

Emerging Markets: The Week Ahead

EM FX appears to be rolling over (see our recent piece “Is EM FX Finally Turning?”). Technical indicators are stretched as many EM currencies bump up against strong resistance levels. Strong US jobs data is bringing Fed tightening back into focus. We think ZAR could be shaping up to be the canary in a coalmine. It was -3% vs. USD last week and by far the worst in EM.

Read More »

Read More »