Category Archive: 5) Global Macro

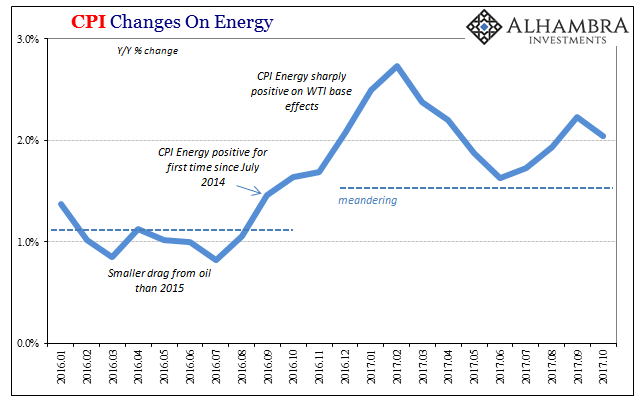

Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found.

Read More »

Read More »

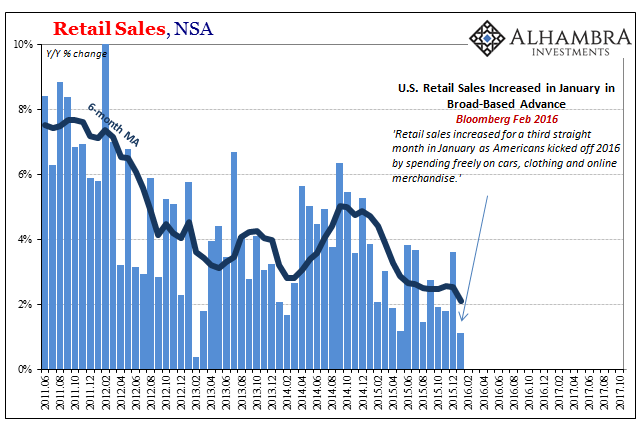

Retail Sales (US) Are Exhibit #1

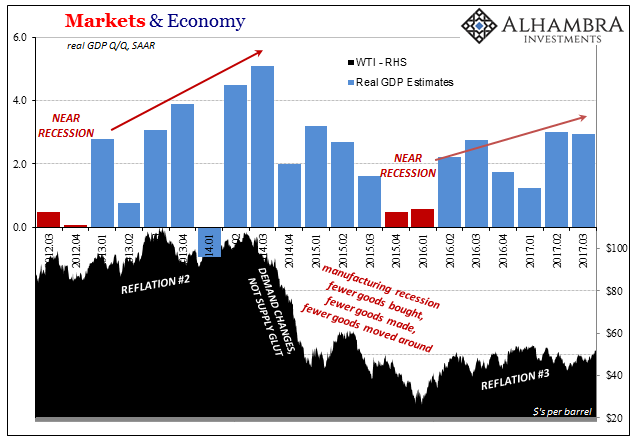

In January 2016, everything came to a head. The oil price crash (2nd time), currency chaos, global turmoil, and even a second stock market liquidation were all being absorbed by the global economy. The disruptions were far worse overseas, thus the global part of global turmoil, but the US economy, too, was showing clear signs of distress.

Read More »

Read More »

Emerging Markets: What has Changed

Moody's raised India's sovereign debt rating for the first time since 2004 by a notch to Baa2. Nigerian officials are on a global roadshow to support plans to issue its longest-dated Eurobonds ever. The head of South Africa’s budget office resigned.

Read More »

Read More »

What Central Banks Have Done Is What They’re Actually Good At

As a natural progression from the analysis of one historical bond “bubble” to the latest, it’s statements like the one below that ironically help it continue. One primary manifestation of low Treasury rates is the deepening mistrust constantly fomented in markets by the media equivalent of the boy who cries recovery.

Read More »

Read More »

Zimbabwe is free of Robert Mugabe, should the world celebrate? | The Economist

Zimbabwe may be free of Robert Mugabe, who has been deposed in an apparent military coup, but the celebrations occurring in the country’s capital will be short-lived. Emmerson Mnangagwa, the man who may end up in charge, is every bit as nasty as his ex-boss, and the economic turmoil that the country is in will …

Read More »

Read More »

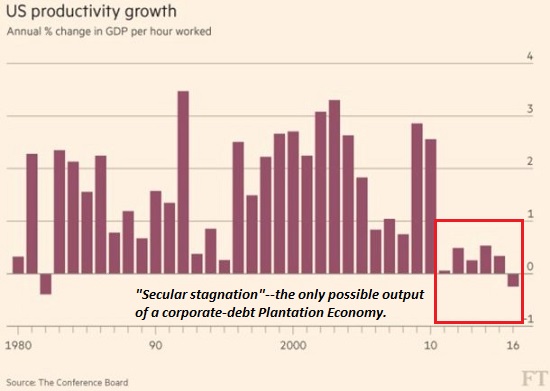

Is This Why Productivity Has Tanked and Wealth Inequality Has Soared?

Needless but highly profitable forced-upgrades are the bread and butter of the tech industry. One of the enduring mysteries in conventional economics (along with why wages for the bottom 95% have stagnated) is the recent decline in productivity gains (see chart).

Read More »

Read More »

Globally Synchronized Downside Risks

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have pushed oil investors to buy...

Read More »

Read More »

Abortion at sea | The Economist

Making abortions illegal does not stop them from happening, but it does stop them happening safely. Meet the charity taking women out to international waters where they can have safe abortions without fear of prosecution. Screen reader support enabled. Click here to subscribe to The Economist on YouTube: http://econ.st/2A5ZevU This woman is about to be …

Read More »

Read More »

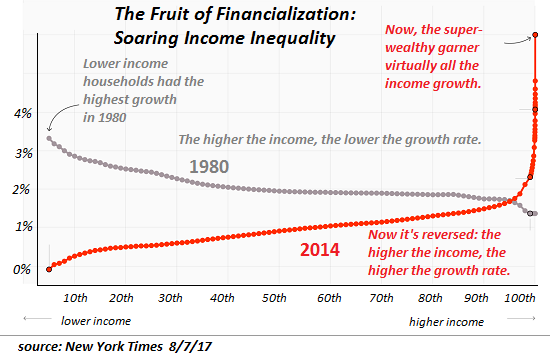

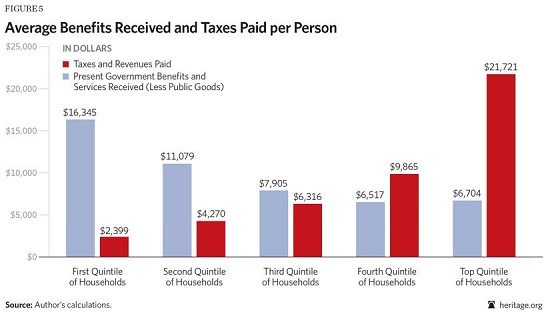

Forget the Bogus Republican “Reform”: Here’s What Real Tax Reform Would Look Like

The point is to end the current system in which billionaires get all the privileges and financial benefits of owning assets in the U.S. but don't pay taxes that are proportional to the benefits they extract. As has been widely noted, the Republicans' proposed "tax reform" is not only just more BAU (business as usual, i.e. cut taxes for the wealthy), it's also not real reform. At best, it's just another iteration of D.C. policy tweaks packaged for...

Read More »

Read More »

Brexit could end the age of “Cool Britannia” | The Economist

Brexit is not only a concern for Britain’s economic future, it’s also threatening the country’s “street cred”: 2018 could mark the end of “Cool Britannia”. Click here to subscribe to The Economist on YouTube: http://econ.st/2zF0LIE Could 2018 be the year Britain loses its cool? By autumn, the complex Brexit negotiations should be drawing to a …

Read More »

Read More »

The Fetid Swamp of Tax Reform

The likelihood that either party will ever drain the fetid swamp of corruption that is our tax code is zero, because it's far too profitable for politicos to operate their auction for tax favors. To understand the U.S. tax code and the endless charade of tax reform, we have to start with four distasteful realities: 1. Ours is not a representational democracy, it's a political auction in which wealth casts the votes that count.

Read More »

Read More »

CHARLES HUGH SMITH – Collapse of the American Market 2018

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL / GLOBAL ECONOMIC COLLAPSE / AGENDA 21 / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHEREUM / LITECOIN / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

Returning ISIS fighters: How should governments deal with them? | The Economist

ISIS fighters are returning home to Europe. In Britain, half of the 850 citizens known to have joined ISIS have already come back. As France marks the two-year anniversary of the deadliest terrorist attack on its soil, governments have to decide what to do with returning foreign fighters. Click here to subscribe to The Economist …

Read More »

Read More »

Where are Europe’s Fault Lines?

Beneath the surface of modern maps, numerous old fault lines still exist. A political earthquake or two might reveal the fractures for all to see. Correspondent Mark G. and I have long discussed the potential relevancy of old boundaries, alliances and structures in Europe's future alignments.Examples include the Holy Roman Empire and the Hanseatic League, among others.

Read More »

Read More »

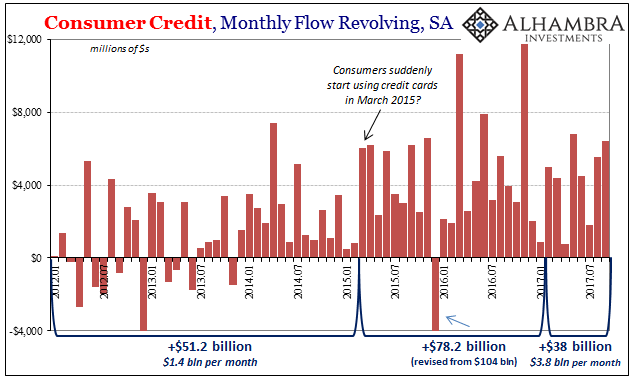

Consumer Credit Both Accelerating and Decelerating Toward The Same Thing

Federal Reserve revisions to the Consumer Credit series have created some discontinuities in the data. Changes were applied cumulatively to December 2015 alone, rather than revising downward the whole data series prior to that month. The Fed therefore estimates $3.531 trillion in outstanding consumer credit (seasonally-adjusted) in November 2015, and then just $3.417 trillion the following month.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX closed the week on a soft note. For the week as a whole, best performers were MYR, PLN, and COP, while the worst were BRL, ZAR, and INR. US inflation and retail sales data will likely set the tone for EM. Also, the US fiscal debate is set to continue this week, so expect lots of choppy trading across many markets.

Read More »

Read More »