Category Archive: 5) Global Macro

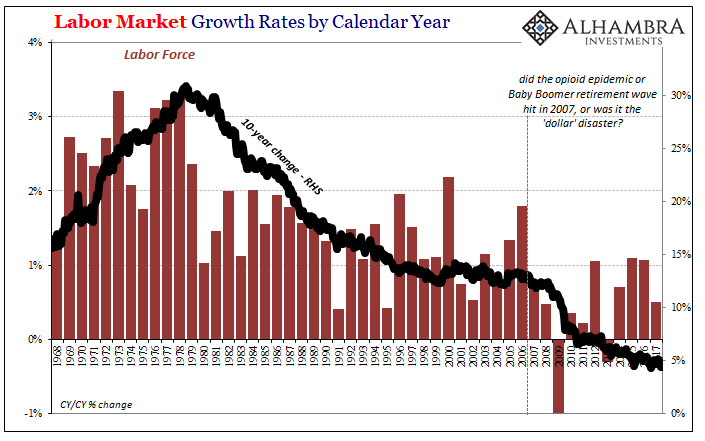

The Reluctant Labor Force Is Reluctant For A Reason (and it’s not booming growth)

In 2017, the BLS estimates that just 861k Americans were added to the official labor force, the denominator, of course, for the unemployment rate. That’s out of an increase of 1.4 million in the Civilian Non-Institutional Population, the overall prospective pool of workers. Both of those rises were about half the rate experienced in 2016.

Read More »

Read More »

How to bring down a dictator | The Economist

North Korea’s dictator Kim Jong Un celebrates his birthday today. How can he–and leaders like him–be brought down by non-violent action? Click here to subscribe to The Economist on YouTube: http://econ.st/2CTZrn6 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://econ.st/2CTRKx8 Check out The Economist’s full video catalogue: http://econ.st/20IehQk …

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX was mostly firmer last week, but ended on a mixed note Friday. Best performers on the week for COP, MXN, and BRL while the worst were ARS, PHP, and CNY. We continue to warn investors against blindly buying into this broad-based EM rally, as we believe divergences will once again assert themselves in the coming weeks.

Read More »

Read More »

The Great Risk of So Many Dinosaurs

The Treasury Borrowing Advisory Committee (TBAC) was established a long time ago in the maelstrom of World War II budgetary as well as wartime conflagration. That made sense. To fight all over the world, the government required creative help in figuring out how to sell an amount of bonds it hadn’t needed (in proportional terms) since the Civil War. A twenty-person committee made up of money dealer bank professionals and leaders was one of the few...

Read More »

Read More »

Emerging Markets: What Changed

Tensions on the Korean peninsula appear to be easing. Relations between Pakistan and the US have worsened. The Philippine central bank is tilting more hawkish. The ANC may consider removing Zuma from the presidency at the January 10 meeting of its National Executive Committee. Turkish banker Atilla was convicted of helping Iran evade US financial sanctions.

Read More »

Read More »

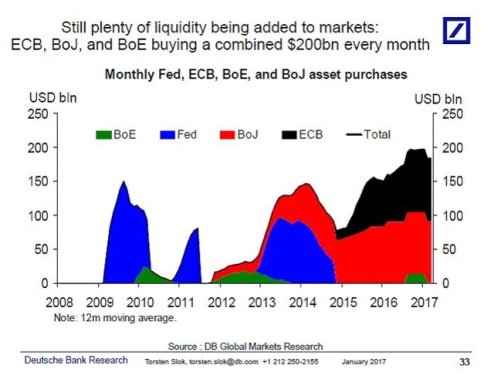

Why the Financial System Will Break: You Can’t “Normalize” Markets that Depend on Extreme Monetary Stimulus

Central banks are now trapped. In a nutshell, central banks are promising to "normalize" their monetary policy extremes in 2018. Nice, but there's a problem: you can't "normalize" markets that are now entirely dependent on extremes of monetary stimulus. Attempts to "normalize" will break the markets and the financial system. Let's start with the core dynamic of the global economy and nosebleed-valuation markets: credit.

Read More »

Read More »

Central Banks Have Manipulated The Markets Which Will Ultimately Crash Charles Hugh Smith

Thanks for ing. Today’s Guest: Charles Hugh Smith Websites: Of Two Minds Books: Get a Job, Build a Real Career. Why. Thanks for ing. Central Banks Have Manipulated The Markets Which Will Ultimately Crash Charles Hugh Smith ———————————- $ Help Finance News reach 1000 subscribers: Thanks for ing. Today’s Guest: Charles Hugh Smith Websites: Of …

Read More »

Read More »

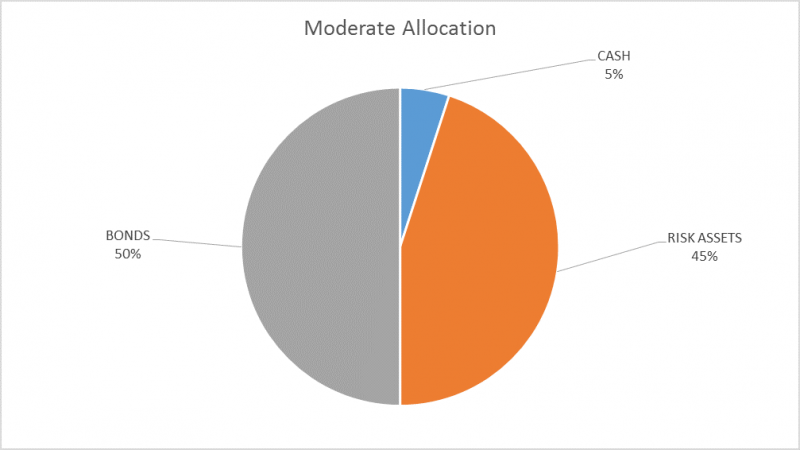

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market persists so I will continue to hold a modest amount of cash. There are some minor changes within the portfolios but the overall allocation is unchanged.

Read More »

Read More »

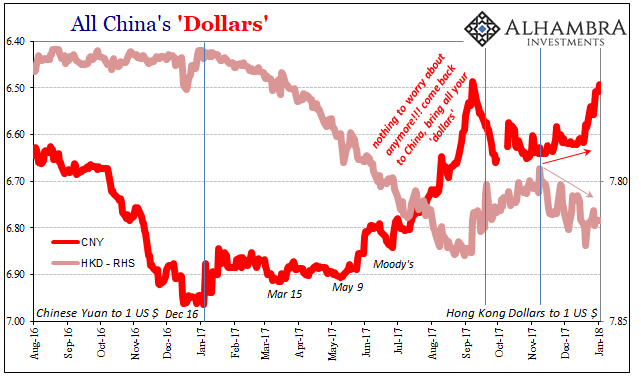

Industrial production: The Chinese Appear To Be Rushed

While the Western world was off for Christmas and New Year’s, the Chinese appeared to have taken advantage of what was a pretty clear buildup of “dollars” in Hong Kong. Going back to early November, HKD had resumed its downward trend indicative of (strained) funding moving again in that direction (if it was more normal funding, HKD wouldn’t move let alone as much as it has). China’s currency, however, was curiously restrained during that...

Read More »

Read More »

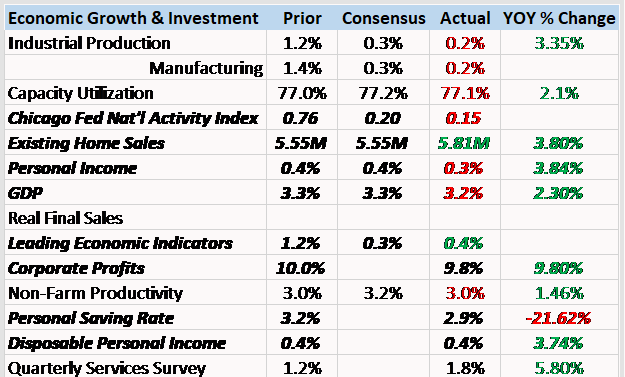

Bi-Weekly Economic Review: Housing Market Accelerates

The economy ended 2017 with current growth just slightly above trend. In general the reports of the last two weeks of the year were pretty good with housing a standout performer going into the new year. We are still trying to get past the impact – positive and negative – from the hurricanes a few months ago though so it is probably prudent to wait for more evidence before making any definitive pronouncements about the economy.

Read More »

Read More »

California’s recreational cannabis legalisation | The Economist

Cannabis can now be sold legally for recreational use in California. The change in law in the most populous American state has the potential to make marijuana go mainstream. Click here to subscribe to The Economist on YouTube: http://econ.st/2lI31px Could California make cannabis go mainstream? California is not the first American state to legalise cannabis …

Read More »

Read More »

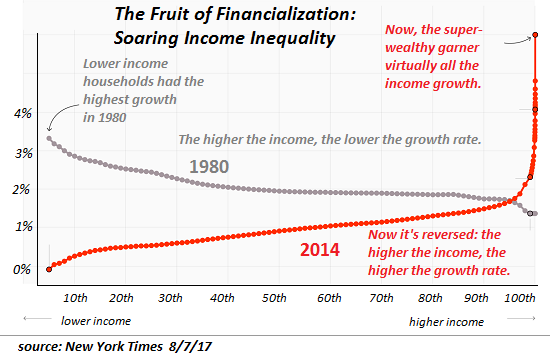

The Hidden-in-Plain-Sight Mechanism of the Super-Wealthy: Money-Laundering 2.0

Financial and political power are two sides of one coin. We all know the rich are getting richer, and the super-rich are getting super-richer. This reality is illustrated in the chart of income gains, the vast majority of which have flowed to the top .01%--not the top 1%, or the top .1% -- to the very tippy top of the wealth-power pyramid.

Read More »

Read More »

Should three-parent families be legally recognised? | The Economist

What does a modern family look like? The Economist’s Matt Steinglass travels to the Netherlands where multiple-parent families–with up to four parents–could be recognised by law. Click here to subscribe to The Economist on YouTube: http://econ.st/2B3k8sA What does a modern family look like? The Netherlands could become the first country in the world to allow …

Read More »

Read More »

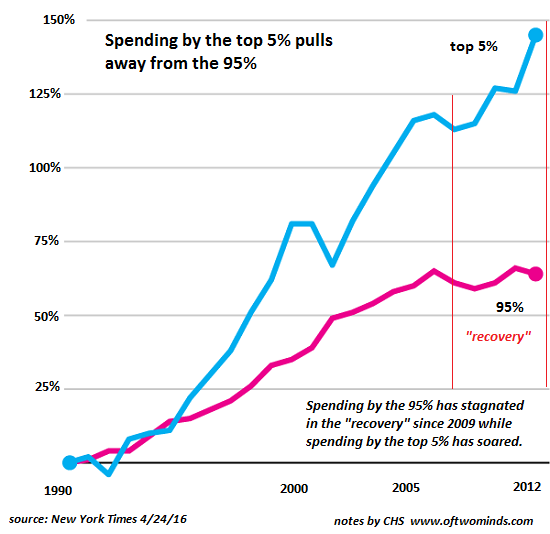

“Wealth Effect” = Widening Wealth Inequality

Note that widening wealth and income inequality is a non-partisan trend. One of the core goals of the Federal Reserve's monetary policies of the past 9 years is to generate the "wealth effect": by pushing the valuations of stocks and bonds higher, American households will feel wealthier, and hence be more willing to borrow and spend, even if they didn't actually reap any gains by selling stocks and bonds that gained value.

Read More »

Read More »

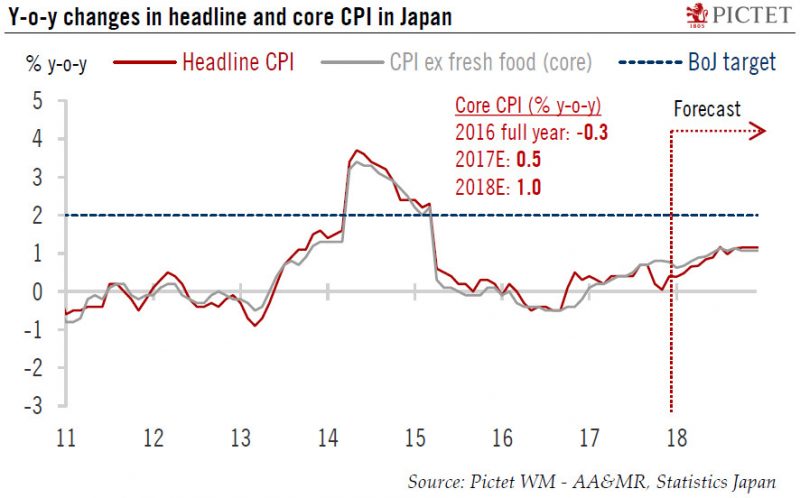

The BoJ is sticking to monetary easing

The BoJ remains the last major central bank still firmly committed to large-scale monetary easing.After its Monetary Policy Meeting of December 21, the Bank of Japan (BoJ) announced its intention to keep its current monetary easing programme intact. The BOJ will continue with its “Quantitative and Qualitative Monetary Easing with Yield Curve Control ”, aiming to achieve and overshoot the core inflation target of 2%.

Read More »

Read More »

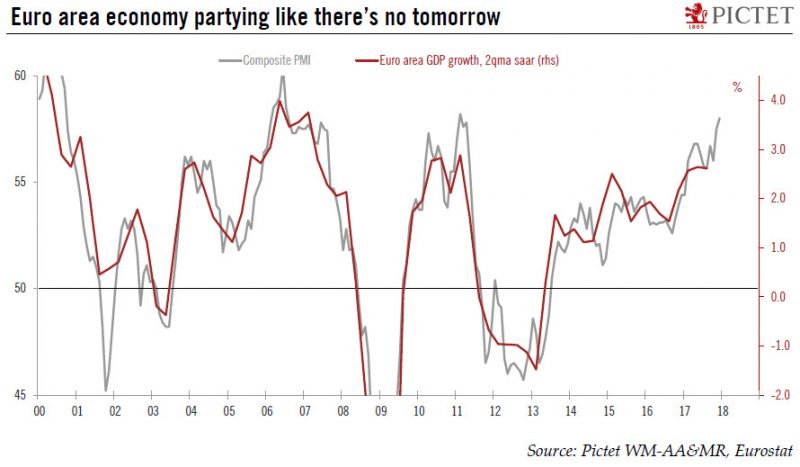

Global macro: 10 surprises for 2018

Having laid down our expectations for the World economy in 2018, in this note we describe a number of potential surprises to the outlook. The usual suspects, or ‘known unknowns’, include a larger-than-expected fiscal boost from US tax cuts, (geo-)political risks, economic policy mistakes, inflation surprises, a financial bubble burst, or a Minsky moment in China, to name a few.

Read More »

Read More »

MUST : The ‘Wealth Effect’ Is Widening Wealth Inequality Charles Hugh Smith

Please click above to subscribe to my channel Thanks for ing! Financial News Silver News Gold Bix Weir RoadToRoota Road To Roota Kyle Bass Realist News Greg Mannarino Rob Kirby Reluctant. What does politics in the United States have in common with that of declining empires of ages past? Too much, argues Glenn Hubbard. The …

Read More »

Read More »

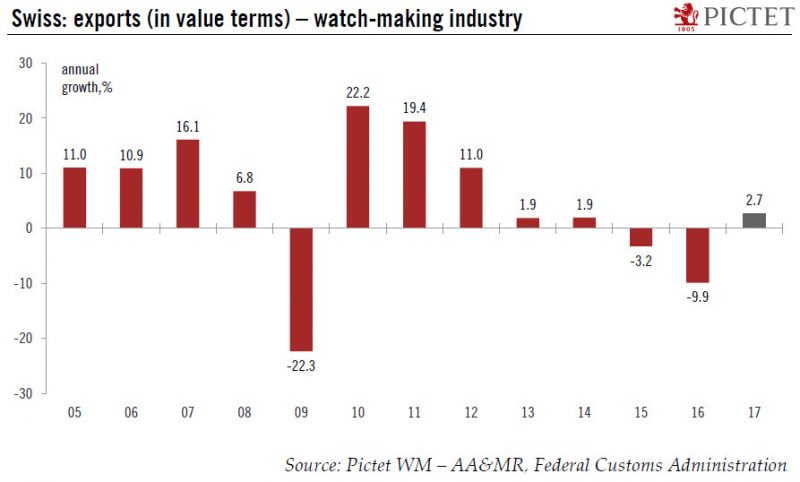

Chinese demand leads the Swiss watch industry’s recovery

The most important driver of the Swiss watch industry’s recovery has been the revival of the mainland China market. After years of impressive growth, the Swiss watch industry faced difficult conditions in 2015 and 2016, when exports declined by 3.2% and 9.9% respectively in value terms.

Read More »

Read More »

Christmas 2017: Why I’m Hopeful

A more human world lies just beyond the edge of the Status Quo. Readers often ask me to post something hopeful, and I understand why: doom-and-gloom gets tiresome. Human beings need hope just as they need oxygen, and the destruction of the Status Quo via over-reach and internal contradictions doesn't leave much to be happy about.

Read More »

Read More »

Santa’s Stock Market Rally: Tears of Joy, Or Just Tears?

Judging by this year's version of Santa Claus's reliable year-end stock market rally, risk has vanished, not just in stocks but in bonds, junk bonds, housing, commercial real estate, collectible art--just about the entire spectrum of tradable assets (with precious metals and agricultural commodities among the few receiving coals rather than rallies).

Read More »

Read More »