Category Archive: 5) Global Macro

The Blatant Dishonesty of the ‘Boom’

Why do humans tend to behave in herds? It’s a fundamental question that only recently have researchers been able to better understand. On the one hand, it doesn’t take an advanced degree in some neurological science to see the basis behind it; survival for our ancestors often meant getting along with the crowd. There are times when that very trait applies still.

Read More »

Read More »

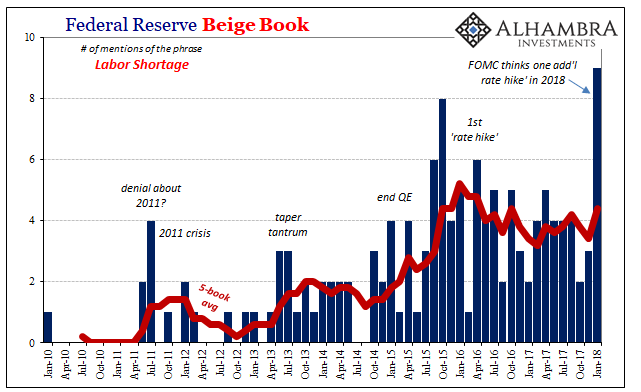

U.S. Unemployment: The Dissonance Book

I’ve found the word “dissonance” has become more common in regular usage beyond just my own. Whether that’s a function of my limited observational capacities or something more meaningful than personal bias isn’t at all clear. Still, the word does seem to fit in economic terms more and more as we carry on uncorrected by meaningful context.

Read More »

Read More »

Good or Bad, But Surely Not Transitory

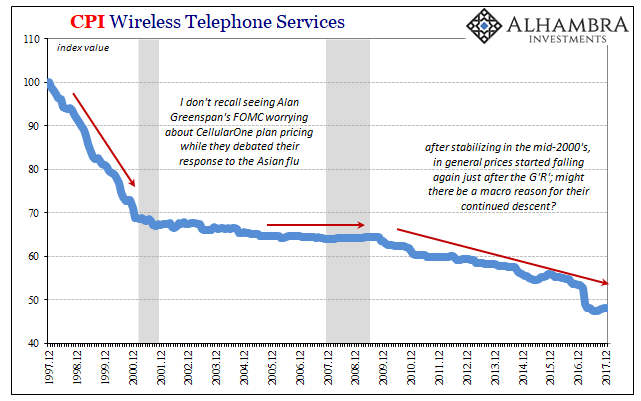

When Federal Reserve officials first started last year to mention wireless network data plans as a possible explanation for a fifth year of “transitory” factors holding back consumer price inflation, it seemed a bit transparent. One of the reasons for immediately doubting their sincerity was the history of that particular piece of the CPI (or PCE Deflator).

Read More »

Read More »

Is Un-Humming A Word? It Might Need To Become One

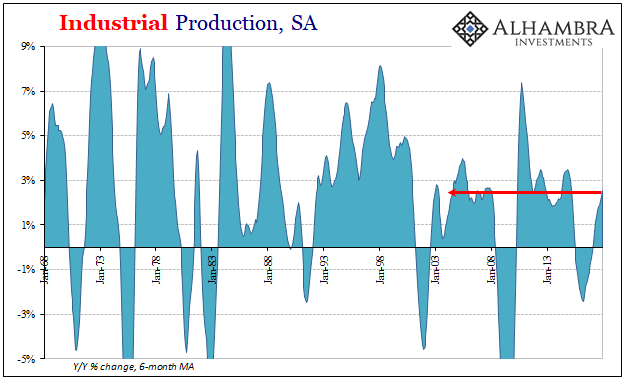

Industrial Production in the US was up 3.6% year-over-year in December 2017. That’s the best for American industry since November 2014 when annual IP growth was 3.7%. That’s ultimately the problem, though, given all that has happened this year. In other words, despite a clear boost the past few months from storm effects, as well as huge contributions from the mining (crude oil) sector, American production at its best can only manage to reflect...

Read More »

Read More »

Charles Hugh Smith–What’s Your Job Worth? #3845

Money & Work Unchainedm started when Charles asked himself: “When we dream of the future of our society, are we hoping for the right things?” The current conventional-wisdom view of our soon-to-be future is rose-tinted: automation will free millions of people from the drudgery of work, then by taxing the robots doing all the work, we can …

Read More »

Read More »

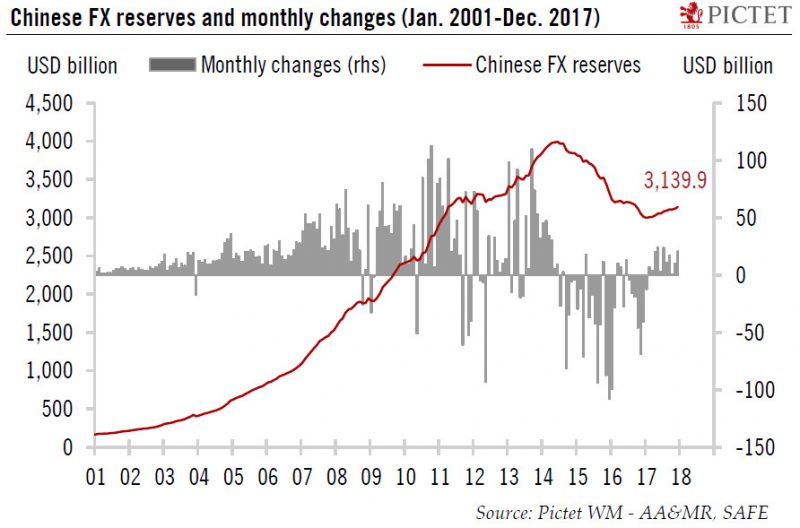

China: FX reserves rise again

According to the Chinese State Administration of Foreign Exchange (SAFE), China’s FX reserves amounted to USD3.14 trillion at end - December 2017, up USD20.7 billion from the previous month. This marks the 11th consecutive monthly increase in Chinese FX reserves since February 2017.

Read More »

Read More »

Nous sommes colonisés par le numérique des multinationales américaines

La révolution numérique est une réalité qui envahit tous les jours plus les sphères publiques et privées…. Qu’en est-il du commerce de détails? Les visuels ci-dessous nous montrent d’abord que certaines habitudes d’achats dans les commerces traditionnels sont maintenues.

Read More »

Read More »

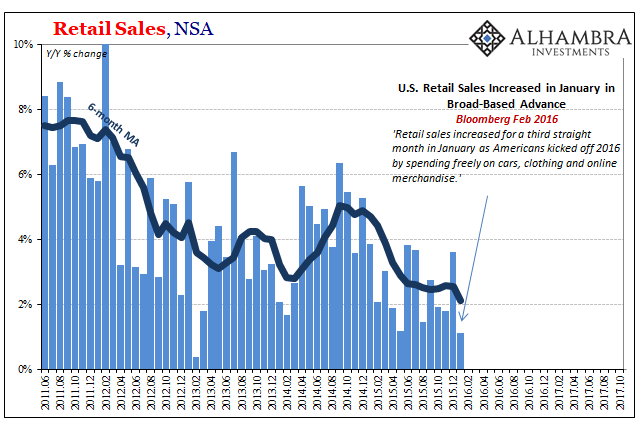

Retail Sales, Consumer Sentiment, And The Aftermath Of Hurricanes

Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past.

Read More »

Read More »

The Dea(r)th of Economic Momentum

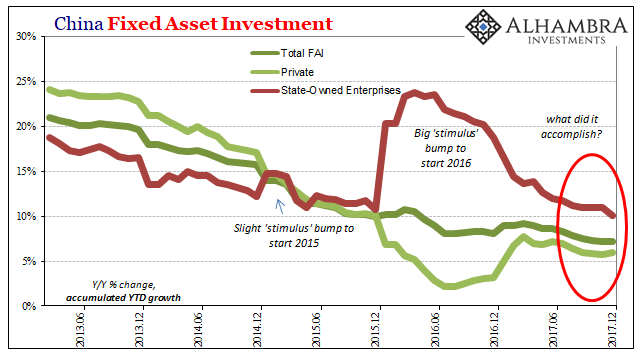

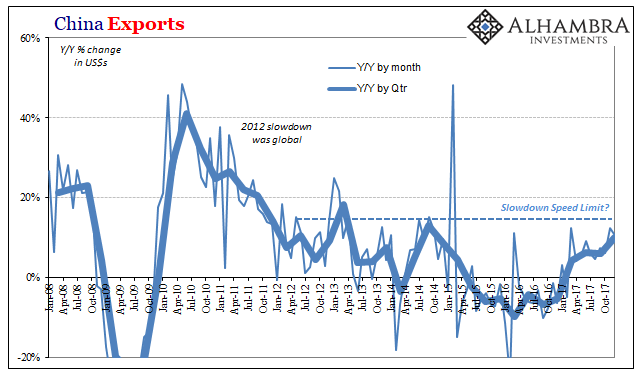

For the fourth quarter as a whole, Chinese exports rose by just less than 10% year-over-year. That’s the highest quarterly rate in more than three years, up from 6.3% and 6.0% in Q2 2017 and Q3, respectively. That acceleration is, predictably, being celebrated as a meaningful leap in global economic fortunes. Instead, it highlights China’s grand predicament, one that country just cannot seem to escape.

Read More »

Read More »

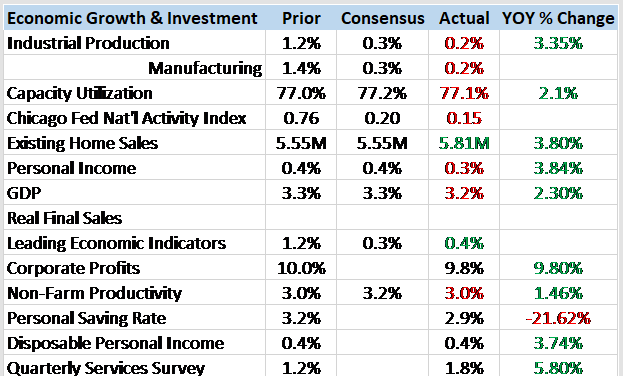

Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits.

Read More »

Read More »

Open borders: the long-term perks and pitfalls | The Economist

Open borders could see global GDP rocket, but free movement around the world could have its downsides. We imagine a borderless world Click here to subscribe to The Economist on YouTube: http://econ.st/2DfRSXX Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://econ.st/2DkJBC6 Check out The Economist’s full video catalogue: …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX continues to rally as the dollar remains on its back foot. With no obvious drivers this week that might help the dollar, we believe EM FX can extend the recent gains. Still, we continue to advise caution when investing in EM, as differentiation should again become evident as idiosyncratic risks remain in play.

Read More »

Read More »

The Fascinating Psychology of Blowoff Tops

The psychology of blowoff tops in asset bubbles is fascinating: let's start with the first requirement of a move qualifying as a blowoff top, which is the vast majority of participants deny the move is a blowoff top.

Read More »

Read More »

Inflation Correlations and China’s Brief, Disappointing Porcine Nightmare

Two years ago, China was gripped by what was described as an epic pig problem. For most Chinese people, pork is a main staple so rapidly rising pig prices could have presented a serious challenge to an economy already at that time besieged by massive negative forces. It was another headache officials in that country really didn’t need.

Read More »

Read More »

Charles Hugh Smith WARNS: Crash Is Coming Control Fraud Is the Core of our Political Syste

My advice is this: Settle! That’s right. Don’t worry about passion or intense connection. Don’t nix a guy based on his annoying habit of yelling Bravo! in theaters. Overlook his halitosis. Spread the word about PropellerAds and earn money! YouTube Tips and Triks to make real dollers: The Best Portable Bluetooth Speaker (.

Read More »

Read More »

Emerging Markets: What Changed

China State Administration of Foreign Exchange (SAFE) disputed press reports that it was slowing or halting purchases of US Treasury bonds. Korean officials warned that it will take stern steps to prevent one-sided currency moves. Bulgaria is talking “intensively” with the ECB and other EU representatives about entering the Exchange Rate Mechanism by mid-year.

Read More »

Read More »

MUST LISTEN Charles Hugh Smith Can Trump pull a Rabbit out of a Hat or is US Economy Doome

MUST LISTEN Charles Hugh Smith Can Trump pull a Rabbit out of a Hat or is US Economy Doomed. Thank you for listening. Follow us on . Thank you for listening. Follow us on . MUST LISTEN Charles Hugh Smith Can Trump pull a Rabbit out of a Hat or is US Economy Doomed. ALERT! …

Read More »

Read More »

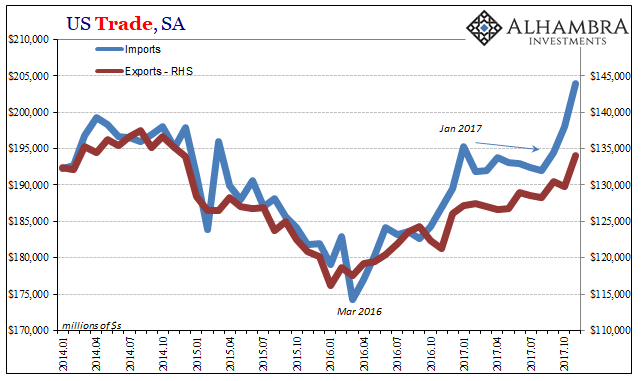

The Conspicuous Rush To Import

According to the Census Bureau, US companies have been importing foreign goods at a relentless pace. In estimates released last week, seasonally-adjusted US imports jumped to $204 billion in November 2017. That’s a record high finally surpassing the $200 billion mark for the first time, as well as the peaks for both 2014 and 2007.

Read More »

Read More »

Trump in two minutes | The Economist

President Donald Trump has spent one year in office. But what exactly has he achieved? Here’s a two-minute snapshot of his presidency so far. Click here to subscribe to The Economist on YouTube: http://econ.st/2D5Gxte Since coming to power Mr Trump has tweeted over two thousand times. Often insulting people and bragging with a liberal use …

Read More »

Read More »

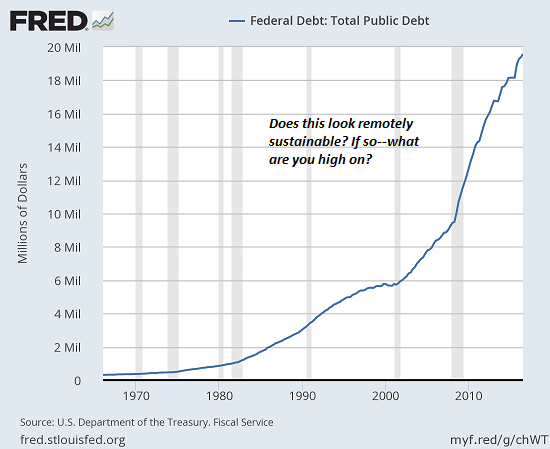

Yes, But at What Cost?

This is how our entire status quo maintains the illusion of normalcy: by avoiding a full accounting of the costs. The economy's going great--but at what cost? "Normalcy" has been restored, but at what cost? Profits are soaring, but at what cost? Our pain is being reduced--but at what cost? The status quo delights in celebrating gains, but the costs required to generate those gains are ignored for one simple reason: the costs exceed the gains by a...

Read More »

Read More »