Category Archive: 5) Global Macro

A softer Brexit is a better Brexit | The Economist

Enter the Economist #OpenFuture contest: A minute to change the world. See more here: https://goo.gl/FU4YL4 The Brexit vote took place two years ago. But when Britons voted to leave the EU they had no say in what sort of Brexit they wanted. It has become clear that a softer Brexit is better, and Britain need … Continue...

Read More »

Read More »

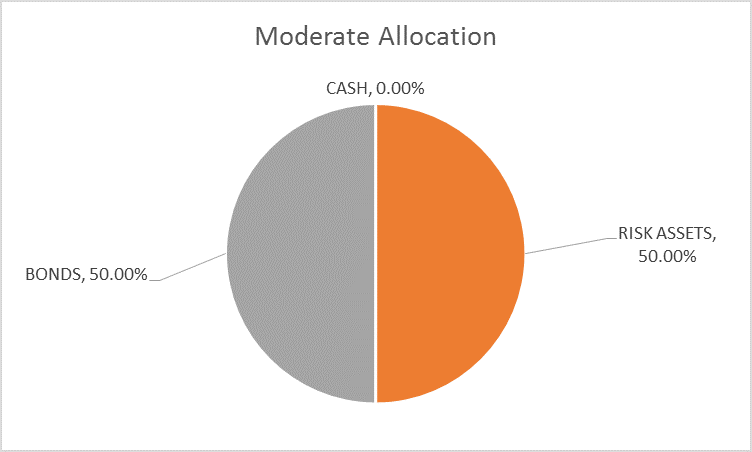

Global Asset Allocation Update

The risk budget is unchanged this month. For the moderate risk investor the allocation to bonds and risk assets is evenly split. There are changes this month within the asset classes. How far are we from the end of this cycle? When will the next recession arrive and more importantly when will stocks and other markets start to anticipate a slowdown?

Read More »

Read More »

CHARLES HUGH SMITH Printing Money Will Not Save Us From Recession This Time

All our reports and Daily Alert News are backed up by source links. We work very hard to bring you the facts and We research everything before presenting the report. Subscribe for Latest on Financial Crisis, Oil Price, Global Economic Collapse, Dollar Collapse, Gold, Silver, Bitcoin, Global Reset, New World Order, Economic Collapse, Economic News, …

Read More »

Read More »

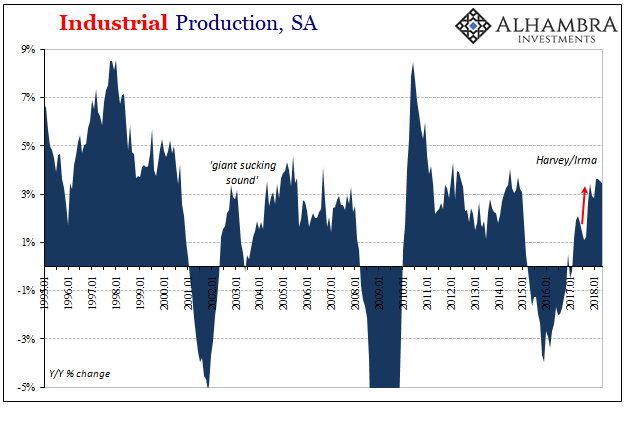

There Isn’t Supposed To Be The Two Directions of IP

US Industrial Production dipped in May 2018. It was the first monthly drop since January. Year-over-year, IP was up just 3.5% from May 2017, down from 3.6% in each of prior three months. The reason for the soft spot was that American industry is being pulled in different directions by the two most important sectors: crude oil and autos.

Read More »

Read More »

CHARLES HUGH SMITH – Printing Money Will Not Save Us From Recession This Time

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

Should we tax the rich more? | The Economist

Taxation is necessary in order to provide public services like roads, education and health care. But as the world’s elderly population grows, and the demand for public services increases, countries will need to reassess how they tax. Where should the money come from? Click here to subscribe to The Economist on YouTube: https://econ.st/2tk2YnG Daily Watch: …

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was mixed on Friday but capped off a largely losing week. MYR, CLP, and CNY were the best performers over the last week, while ARS, TRY, and ZAR were the worst. We expect EM FX to continue weakening, but note that with very few fundamental drivers this week, we may see some consolidation near-term.

Read More »

Read More »

Emerging Markets: What Changed

US-China trade tensions are rising. Pakistan devalued the rupee for a third time since December. Bulgaria will seek to join the eurozone banking union and ERM-2 simultaneously. The National Bank of Hungary appears to have tilted more hawkish. Newly elected Egyptian President El-Sisi shuffled his cabinet. Argentina has a new central bank chief after Federico Sturzenegger resigned.

Read More »

Read More »

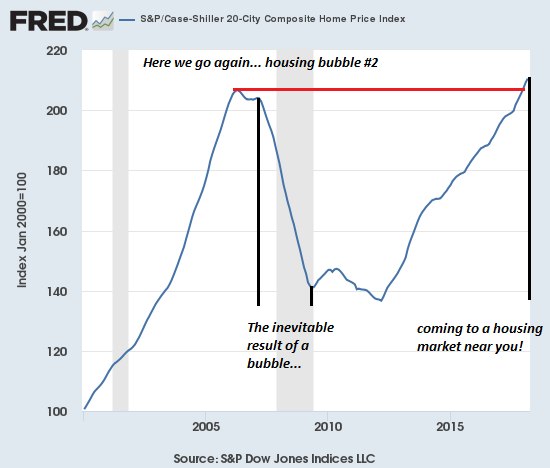

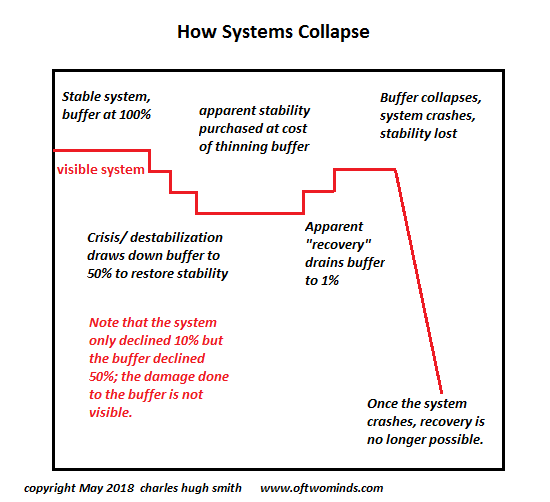

Here We Go Again: Our Double-Bubble Economy

The bubbles in assets are supported by the invisible bubble in greed, euphoria and credulity. Well, folks, here we go again: we have a double-bubble economy in housing and stocks, and a third difficult-to-chart bubble in greed, euphoria and credulity.

Read More »

Read More »

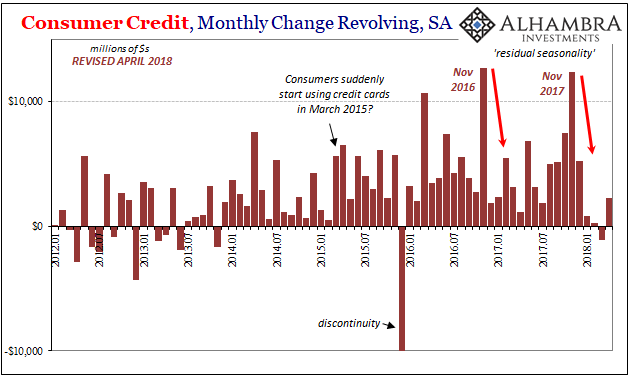

Recent Concerning Consumer Credit Trends Carry On Into April

US consumers continue to recover from their debt splurge at the end of last year. Combined with still weaker income growth, the Federal Reserve estimates that aggregate revolving credit balances grew only marginally for the fourth straight month in April 2018. To put it in perspective, the total for revolving credit (seasonally adjusted) is up a mere $2.2 billion for all four months of this year combined, compared to +$5.2 billion in December 2017...

Read More »

Read More »

Kim Jong won | The Economist

Kim Jong Un and Donald Trump could have pulled off the unthinkable—a denuclearised North Korea. But as our cartoonist Kal imagines, things could spin badly out of control for the American President Click here to subscribe to The Economist on YouTube: https://econ.st/2t0Pmye Daily Watch: mind-stretching short films throughout the working week. For more from Economist …

Read More »

Read More »

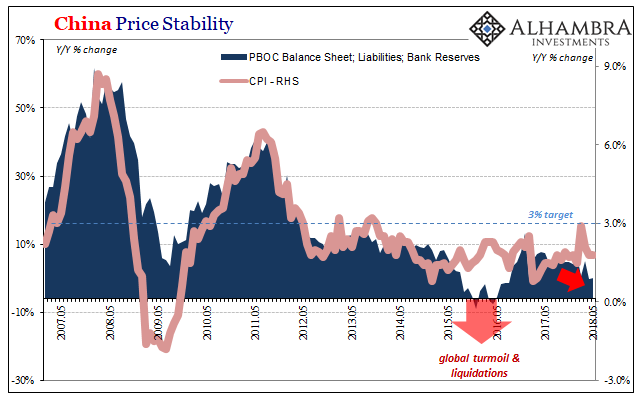

Chinese Inflation And Money Contributions To EM’s

The People’s Bank of China won’t update its balance sheet numbers for May until later this month. Last month, as expected, the Chinese central bank allowed bank reserves to contract for the first time in nearly two years. It is, I believe, all part of the reprioritization of monetary policy goals toward CNY. How well it works in practice remains to be seen.

Authorities are not simply contracting one important form of base money in China (bank...

Read More »

Read More »

Who will win the 2018 FIFA World Cup? | The Economist

The 2018 FIFA World Cup has begun, but who is likely to win? The Economist has scoured historical data and analysed dozens of factors to try to determine which country’s team will lift the iconic trophy.

Read More »

Read More »

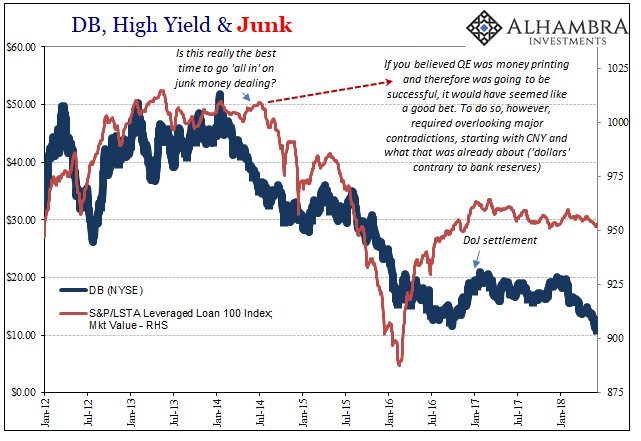

A Slight Hint Of A 2011 Feel

Whenever a big bank is rumored to be in unexpected merger talks, that’s always a good sign, right? The name Deutsche Bank keeps popping up as it has for several years now, this is merely representative of what’s wrong inside of a global system that can’t ever get fixed. In this one case, we have a couple of perpetuated conventional myths colliding into what is still potentially grave misfortune.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended Friday on a mixed note, capping off a roller coaster week for some of the more vulnerable currencies. We expect continued efforts by EM policymakers to inject some stability into the markets. However, we believe the underlying dollar rally remains intact. Central bank meetings in the US, eurozone, and Japan this week are likely to drive home that point.

Read More »

Read More »

Brent’s Back In A Big Way, Still ‘Something’ Missing

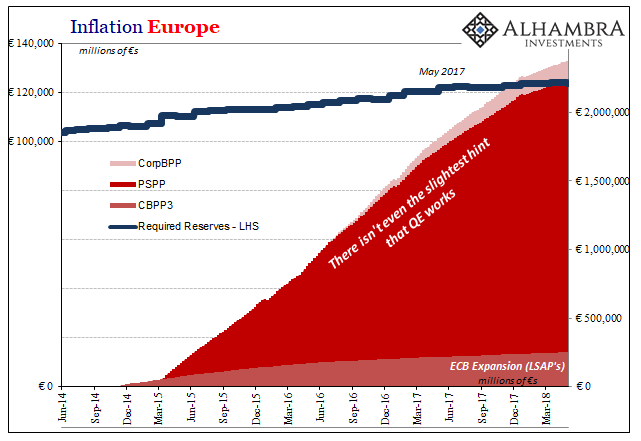

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status.

Read More »

Read More »

Emerging Markets: What Changed

The Reserve Bank of India hiked rates for the first time since 2014. Malaysia’s central bank governor resigned. Czech central bank tilted more hawkish. Russia central bank tilted more dovish. Argentina got a $50 bln standby program from the IMF.

Read More »

Read More »

The Three Crises That Will Synchronize a Global Meltdown by 2025

We're going to get a synchronized global dynamic, but it won't be "growth" and stability, it will be DeGrowth and instability. To understand the synchronized global meltdown that is on tap for the 2021-2025 period, we must first stipulate the relationship of "money" to energy:"money" is nothing more than a claim on future energy. If there's no energy available to fuel the global economy, "money" will have little value.

Read More »

Read More »

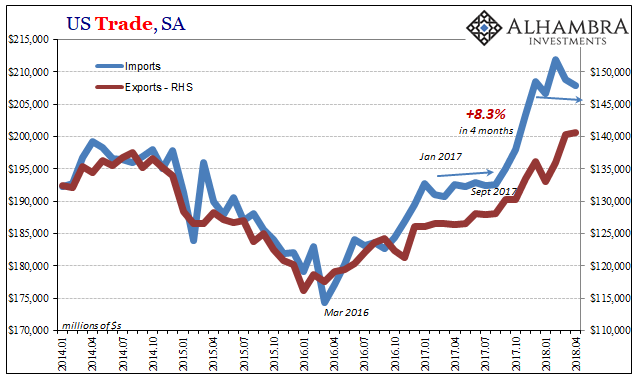

US Trade Settles Down Again

US trade is further leveling off after several months of artificial intrusions. On the import side, in particular, first was a very large and obvious boost following last year’s big hurricanes along the Gulf Coast. Starting in September 2017, for four months the value of imported goods jumped by an enormous 8.3% (revised, seasonally-adjusted). Most of the bump related to consumer and capital goods.

Read More »

Read More »