Category Archive: 5) Global Macro

The true cost of fast fashion | The Economist

Millions of tonnes of clothes end up in landfill every year—it’s one of the fastest-growing categories of waste in the world. How can the fashion industry continue to grow while addressing the environmental need for people to buy fewer clothes? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films …

Read More »

Read More »

The Direction Is (Globally) Clear

It is definitely one period that they got wrong. Still, IHS Markit’s Composite PMI for the US economy has been one of the better forward-looking indicators around. Tying to real GDP, this blend of manufacturing and services sentiment has predicted the general economic trend in the United States pretty closely. The latter half of 2015 was the big exception.

Read More »

Read More »

Charles Hugh Smith On How & Why Financial Repression Continues

Click here for the full transcript: http://financialrepressionauthority.com/2018/11/28/the-roundtable-insight-charles-hugh-smith-on-how-why-financial-repression-continues/

Read More »

Read More »

For The First Time In 25 Years, China Has To Make A Choice Between External Stability And Growth

Back in August 2 we reported of a historic event for China's economy: for the first time in its modern history, China's current account balance for the first half of the year had turned into a deficit. And while the full year amount was likely set to revert back to a modest surplus, it was only a matter of time before one of the most unique features of China's economy - its chronic current account surplus - was gone for good.

Read More »

Read More »

How could veganism change the world? | The Economist

Interest in vegan food and its associated health benefits has been booming across the rich world. A global retreat from meat could have a far-reaching environmental impact. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy By 2050 the world’s population could approach 10 billion – and around 60% more food could be needed …

Read More »

Read More »

How will people travel in the future? | The Economist

From flying cars to pods that travel at over 1,000kph, revolutionary new ways to travel are being dreamed up by ambitious companies. But which pioneering visions are most likely to take off? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Hollywood movies have envisaged a future of hoverboards and flying cars – these …

Read More »

Read More »

Hyderabad in 360 VR | The Economist

Hyderabad, India’s fourth biggest city, is fast becoming one of the most exciting visitor destinations in the country. Its booming tech scene is attracting global attention and transforming this ancient city into a cosmopolitan hotspot. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Discover Colombo: https://youtu.be/4COeTrjB6hA Discover Buenos Aires: https://youtu.be/q0pMg6rvc0s Discover Miami:...

Read More »

Read More »

Charles Hugh Smith-Why Are so Few Americans Able to Get Ahead?

Charles Hugh Smith, author/ proprietor of the popular blog OfTwoMinds.com, talks about the current economic climate and way so few Americans are unable to get ahead.

Read More »

Read More »

#Metoo: how it’s changing the world | The Economist

#MeToo sparked a defining chapter in gender relations and its seismic reverberations have been felt across the world. From protests about rape and murder in South Africa, to the Times Up Legal Defense Fund in America, discover the latest efforts to tackle sexual harassment and push for gender equality. Click here to subscribe to The …

Read More »

Read More »

Does the Market Need a Heimlich Maneuver?

For all we know, the panic selling is Wall Street's way of forcing the Fed's hand: stop with the rates increases already or Mr. Market expires. Markets everywhere are gagging on something: they're sagging, crashing, imploding, blowing up, dropping and generally exhibiting signs of distress.

Read More »

Read More »

Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword.

Read More »

Read More »

CHARLES HUGH SMITH – Self-Reinforcing Recession

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

Theresa May’s Brexit Monsters, cartooned | The Economist

As the British Prime Minister finally puts forward her contentious draft Brexit plan this week, Kal, our cartoonist, illustrates the potentially monstrous consequences. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Ever since I was a little boy I enjoy drawing monsters. I would spend ages assembling fangs, eyes, scales and horns into …

Read More »

Read More »

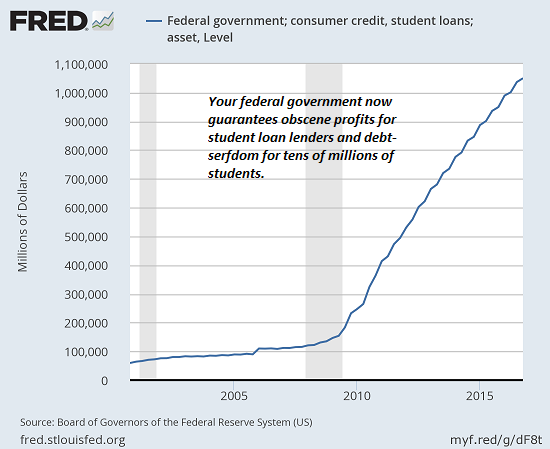

Does Any of This Make Sense?

Does any of this make sense? No. But it's so darn profitable to the oligarchy, it's difficult to escape debt-serfdom and tax-donkey servitude. We rarely ask "does this make any sense?" of things that are widely accepted as beneficial-- or if not beneficial, "the way it is," i.e. it can't be changed by non-elite (i.e. the bottom 99.5%) efforts.

Read More »

Read More »

MACRO ANALYTICS – 11-15-18 – Election Takeaways w/ Charles Hugh Smith

VIDEO NOTIFICATION SIGN-UP: http://bit.ly/2y63PvX-Sign-Up MATASII ABSTRACTION LINK: http://bit.ly/2Bbw128 Charles Hugh Smith Expands on Video in: “The Political Rebellion Gathers Momentum” — https://www.oftwominds.com/blognov18/political-rebellion11-18.html Thank you to all Macro Analytics/Gordon T Long YouTube followers. I will continue to add the following message to each video, which many have already seen to help all of those...

Read More »

Read More »

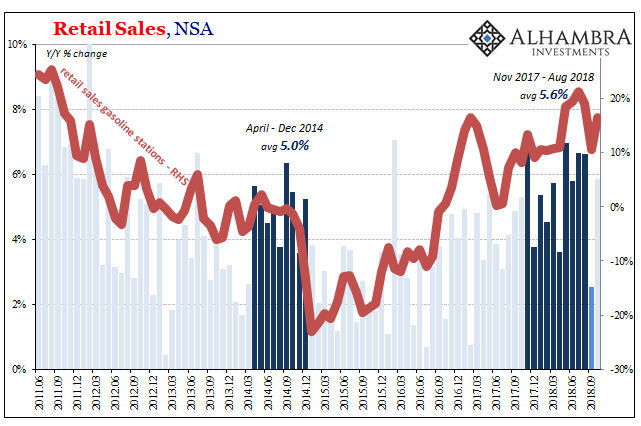

Retail Sales Marked By Revisions

Retail sales rebounded 0.8% in October 2018 from September 2018, but it’s the downward revisions to the prior months that are cause for attention. The estimates for particularly September were moved sharply lower. Total retail sales two months ago had been figured last month at $485.8 billion (unadjusted) originally, but are now believed to have been just $483.0 billion.

Read More »

Read More »

The future of fashion | The Economist

The fashion industry is on the verge of a tech revolution. Clothes of tomorrow could be designed, fitted and sold to us by technology alone. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy From Gucci to Chanel, Topshop to Primark – Clothes industry heavyweights rely on fashion forecasters for next season’s new look. …

Read More »

Read More »

The Implicit Desperation of China’s “Social Credit” System

Other governments are keenly interested in following China's lead. I've been pondering the excellent 1964 history of the Southern Song Dynasty's capital of Hangzhou, Daily Life in China on the Eve of the Mongol Invasion, 1250-1276 by Jacques Gernet, in light of the Chinese government's unprecedented "Social Credit Score" system, which I addressed in Kafka's Nightmare Emerges: China's "Social Credit Score".

Read More »

Read More »

China’s Pooh Lesson

It’s one of those “nothing to see here” moments for Economists trying not to appreciate what’s really going on in China therefore the global economy. The slump in China’s automotive sector dragged on through October, with year-over-year sales down for the fourth straight month.

Read More »

Read More »

Emmanuel Jal: Child soldier to hip-hop star | The Economist

As a child soldier in Sudan, Emmanuel Jal was firing a gun when he was just nine. In an extraordinary turn of events Mr Jal swapped his AK47 for a microphone and is now an international hip-hop star. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Emmanuel Jal was a child soldier during …

Read More »

Read More »