Category Archive: 5) Global Macro

China Going Back To 2011

The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of one US investment “bank”) the...

Read More »

Read More »

‘Paris’ Technocrats Face Another Drop

How quickly things change. Only a few days ago, a fuel tax in France was blamed for widespread rioting. Today, Emmanuel Macron’s government under siege threatens to break its fiscal budget. Having given up on gasoline and diesel, the French government now promises wage increases and tax cuts.

Read More »

Read More »

Are We in a Recession Already?

The value of declaring the entire nation in or out of recession is limited. Recessions are typically only visible to statisticians long after the fact, but they are often visible in real time on the ground: business volume drops, people stop buying houses and vehicles, restaurants that were jammed are suddenly sepulchral and so on. There are well-known canaries in the coal mine in terms of indicators.

Read More »

Read More »

Chip wars: the other fight between China and America | The Economist

The trade war between China and America is not just about traditional products like steel and cars. A battle for dominance is under way in semiconductor chips, as the two superpowers fight to control this vital industry. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working …

Read More »

Read More »

Economics Is Easy When You Don’t Have To Try

The real question is why no one says anything. They can continue to make these grossly untrue, often contradictory statements without fear of having to explain themselves. Don’t even think about repercussions. Even in front of politicians ostensibly being there on behalf of the public, pedigree still matters more than results.

Read More »

Read More »

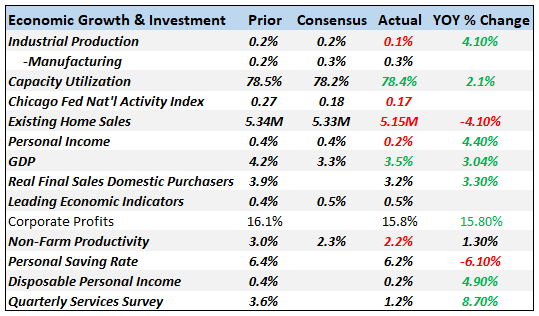

Converging Views Only Starts With Fed ‘Pause’

There’s no sign of inflation, markets are unsettled, and now new economic data keeps confirming that dark side. Forget each month, every day there is something else suggesting a slowdown. That much had been evident across much of the global economy, but this is now different. The US has apparently been infected, too, not that that is any surprise.

Read More »

Read More »

Unexpected?

Now that the slowdown is being absorbed and even talked about openly, it will require a period of heavy CYA. This part is, or at least it has been at each of the past downturns, quite easy for its practitioners. It was all so “unexpected”, you see. Nobody could have seen it coming, therefore it just showed up out of nowhere unpredictably spoiling the heretofore unbreakable, incorruptible boom everyone was talking about just last week.

Read More »

Read More »

Can Macron save his presidency? | The Economist

What began as a protest against higher taxes on diesel has turned into a revolt against France’s president, Emmanuel Macron. How he handles it will decide the rest of his presidency. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films …

Read More »

Read More »

House View, December 2018

We remain neutral on global equities overall, seeing relatively limited potential for developed market stocks in particular as earnings growth declines. We favour companies with pricing power as well as measurable growth drivers and low leverage.

Read More »

Read More »

The View from the Trenches of the Alternative Media

What's scarce in a world awash in free content and nearly infinite entertainment content? After 3,701 posts (from May 2005 to the present), here are my observations of the Alternative Media from the muddy trenches. It's increasingly difficult to make a living creating content outside the corporate matrix.

Read More »

Read More »

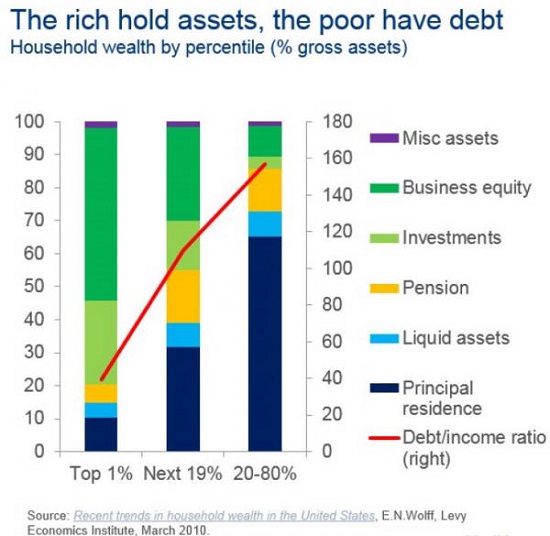

Charles Hugh Smith: Preventing The Final Fall Of Our Democratic Republic

Full description and comments at: https://www.peakprosperity.com/podcast/114587/charles-hugh-smith-preventing-final-fall-our-democratic-republic There’s mounting evidence that the Age of American Exceptionalism is grinding to an end. Demographically, in the U.S. (as well as many other developed nations), the prospects of the younger generations are substantially less than those of the Baby Boomers. The same is true socioeconomically as well;...

Read More »

Read More »

How data transformed the NBA | The Economist

NBA teams are changing the way they play basketball. The Houston Rockets, who boast stars like James Harden, have used data analytics to help them become championship contenders in recent seasons. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Sponsored by DXC Technology. An invisible powerful force is lifting professional basketball to new …

Read More »

Read More »

China’s Global Slump Draws Closer

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and a lower RRR banks were hoarding RMB liquidity.

Read More »

Read More »

Truth Is What We Hide, Self-Serving Cover Stories Are What We Sell

The fact that lies and cover stories are now the official norm only makes us love our servitude with greater devotion. We can summarize the current era in one sentence: truth is what we hide, self-serving cover stories are what we sell. Jean-Claude Juncker's famous quote captures the essence of the era: "When it becomes serious, you have to lie."

Read More »

Read More »

Bearish on Fake Fixes

The conventional definition of a Bear is someone who expects stocks to decline. For those of us who are bearish on fake fixes, that definition doesn't apply: we aren't making guesses about future market gyrations (rip-your-face-off rallies, dizziness-inducing drops, boring melt-ups, etc.), we're focused on the impossibility of reforming or fixing a broken economic system.

Read More »

Read More »

CHARLES HUGH SMITH – Why We Are Going Toward Venezuela’s Path

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

America Needs a New National Strategy

A productive national Strategy would systemically decentralize power and capital rather than concentrate both in the hands of a self-serving elite. If you ask America's well-paid punditry to define America's National Strategy, you'll most likely get the UNESCO version: America's national strategy is to support a Liberal Global Order (LGO) of global cooperation on the environment, trade, etc. and the encouragement of democracy, a liberal order that...

Read More »

Read More »

Monthly Macro Monitor – November 2018

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral.

Read More »

Read More »