Category Archive: 5) Global Macro

Mispriced Delusion

Recency bias is one thing. Back in late 2006/early 2007 when the eurodollar futures curve inverted, for example, it was a textbook case of mass delusion. All the schoolbooks and Economics classes had said that it couldn’t happen; not that it wasn’t likely, it wasn’t even a possibility. A full-scale financial meltdown was at the time literally inconceivable in orthodox thinking.

Read More »

Read More »

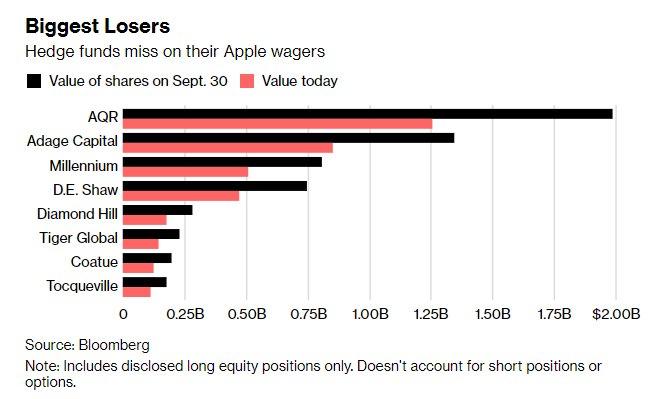

Hedge Funds, ETFs, Central Banks Suffer Billions In Losses On Apple

It wasn't that long ago that Apple was the most beloved stock by the hedge fund community, and although in recent months the company's popularity faded somewhat among the 2 and 20 crowd it is still one of the most popular names among the professional investing community. Which on a day that saw AAPL stock tumble as much as 10% is clearly bad news.

Read More »

Read More »

Nothing To See Here, It’s Just Everything

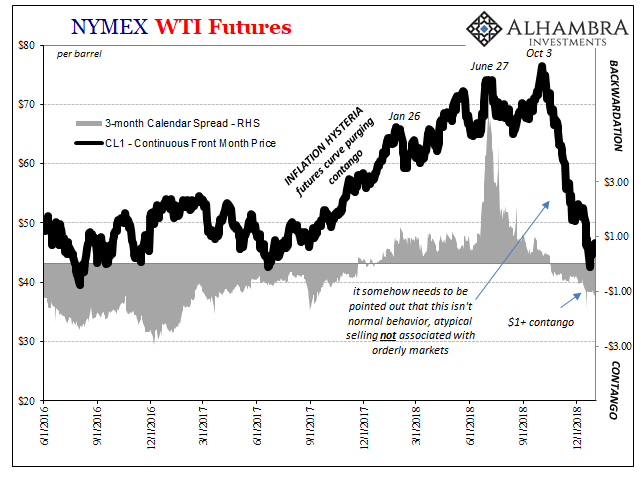

The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal.

Read More »

Read More »

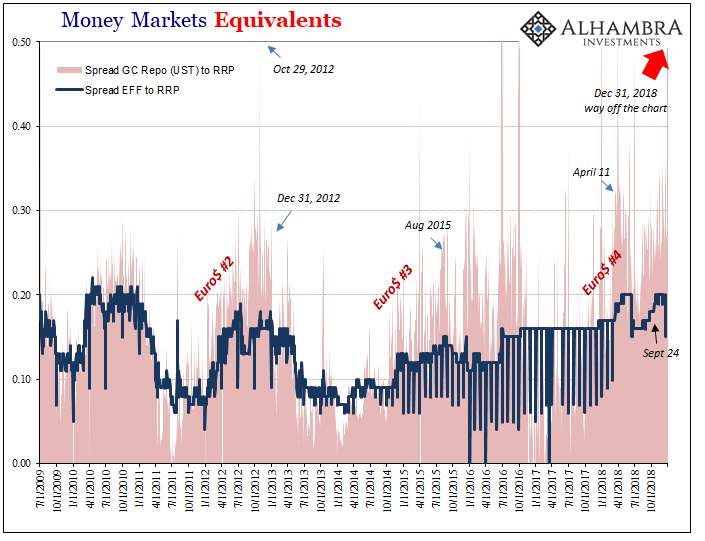

Insane Repo Reminds Us

It was only near the quarter end, that’s what made it so unnerving. We may have become used to these calendar bottlenecks over the years, but they still remind us what they are. Late October 2012 was a little different, though. On October 29, the GC repo rate for UST collateral (DTCC) surged to 52.6 bps. The money market floor, so to speak, was zero at the time and IOER (the joke) 25 bps. We also have to keep in mind the circumstances of that...

Read More »

Read More »

Where to invest in 2019? | The Economist

Where should you look to invest in 2019? Our capital-markets editor John O’Sullivan suggests the best strategy for the year ahead. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on Facebook: https://www.facebook.com/TheEconomist/ Follow The Economist …...

Read More »

Read More »

The Crisis of 2025

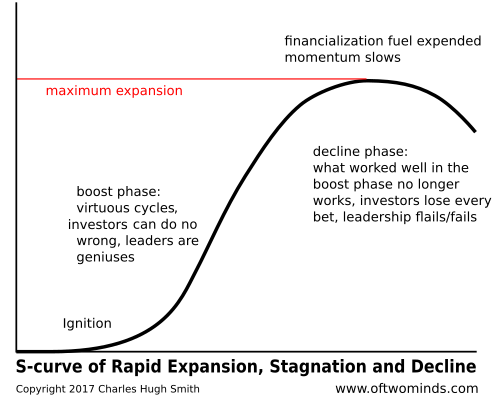

This is the predictable path because it's the only one that's politically expedient and doesn't cause much financial pain until it's too late to stave off collapse. While many fear a war between the nuclear powers or the breakdown of civil order, I tend to think the Crisis of 2023-26 is more likely to be financial in nature.

Read More »

Read More »

What will be the biggest stories of 2019? | Part Two | The Economist

Augmented-reality surgery, moon landings and a battle for the soul of Europe will be major talking points in the year ahead. But what else will make our countdown for the top ten stories for 2019? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy What will be the biggest stories of the year ahead? …

Read More »

Read More »

A Couple of Thoughts on 2019

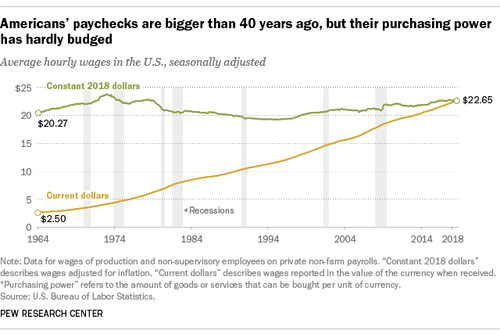

The story of the 21st century is debt is soaring while earned income is stagnating for the bottom 95%. Best wishes to all my readers and correspondents for a safe, healthy and productive 2019. Thank you, longstanding supporters, for renewing your financial support at the new year without any pathetic begging on my part. (The pathetic begging will commence shortly.)

Read More »

Read More »

Chart of the Week: The Dreaded Full Frown

I’m going to break my personal convention and use the bulk of the colors in the eurodollar futures spectrum, not just the single EDM’s (June) contained within each. The current front month is January 2019, and its quoted price as I write this is 97.2475. The EDH (March) 2019 contract trades at 97.29 currently and it will drop off the board on March 18.

Read More »

Read More »

The Crisis of Capital

The undeniable reality of the 21st century economy is that capital has gained while labor has stagnated. While various critics quibbled about his methodology, Thomas Piketty's core finding--that capital expanded faster than GDP and wages/salaries (i.e. earned income from labor)--is visible in these charts.

Read More »

Read More »

Wasting the Middle: Obsessing Over Exits

What was the difference between Bear Stearns and Lehman Brothers? Well, for one thing Lehman’s failure wasn’t a singular event. In the heady days of September 2008, authorities working for any number of initialism agencies were busy trying to put out fires seemingly everywhere. Lehman had to compete with an AIG as well as a Wachovia, already preceded by a Fannie and a Freddie.

Read More »

Read More »

What will be the biggest stories of 2019? | Part One | The Economist

Power suits, robotaxis, Leonardo da Vinci mania—just a few of the things to look out for in 2019. But what else will make our top ten stories for the year ahead? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy What will be the biggest stories of the year ahead? 00:35 – 10 – …

Read More »

Read More »

The net result is capital is impaired in eras of uncertainty.

The net result is capital is impaired in eras of uncertainty. As we look ahead to 2019, what can we be certain of? Maybe your list is long, but mine has only one item: certainty is fraying. Confidence in financial policies intended to eliminate recessions is fraying, confidence in political processes that are supposed to actually solve problems rather than make them worse is fraying, confidence in the objectivity of the corporate media is fraying,...

Read More »

Read More »

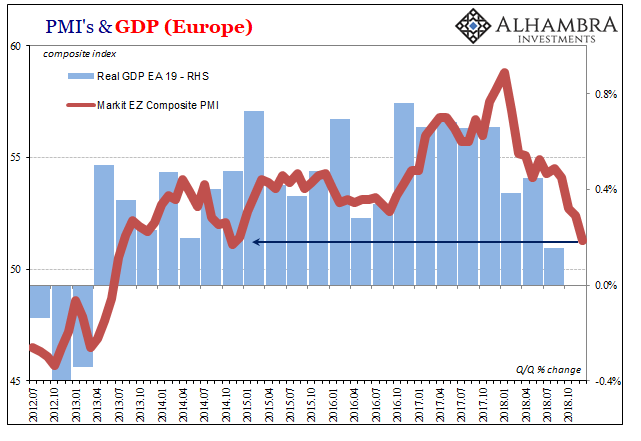

Just In Time For The Circus

Just in time to follow closely upon yesterday’s European circus, IHS Markit piles on with more of the same forward-looking indications looking forward the wrong way. Mario Draghi says the ECB is ending QE, good for him. The central bank will do this despite balanced risks rebalancing in a different place. The more bad news and numbers stack up the more “they” say it’s nothing just transitory roughness.

Read More »

Read More »

Das: “The Bubble Is Losing Air. Get Ready For A Crisis”

The shift to tighter monetary policies in the West is weakening credit markets. Over-indebted emerging markets face headwinds from rising borrowing costs and dollar shortages... Investors need to focus on their response to financial stresses in an era in which policymakers will be constrained.

Read More »

Read More »

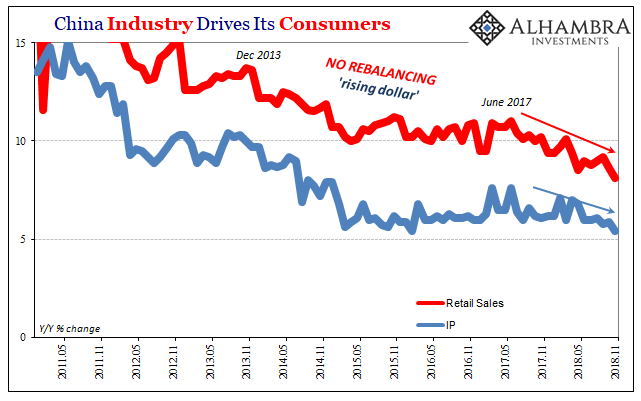

Xi Jinping’s Pretty Consistent Message

It seems many were disappointed by the speech delivered by Xi Jinping. China’s supreme leader spoke at the Great Hall of the People in Beijing today on the 40th anniversary of his country’s first embrace of economic reform. Commentators had been expecting Xi to use the occasion to recommit to liberalization, further opening China to free market forces.

Read More »

Read More »

Powell: Still Strong; Markets: AYFKM

The official statement that accompanies each every FOMC policy action is by nature bland and sterile. Still, despite the sparseness of printed words those that are included can say a lot. Here’s its essence for what just wrapped up in December 2018: The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions,...

Read More »

Read More »

2019: the year of moon missions, marijuana and mega-hub airports | The Economist

From groundbreaking moon missions to growth in the legal-cannabis market, 2019 will be year of new highs. Here’s what to watch out for in the year ahead. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist …

Read More »

Read More »

Why Everything That Needs to Be Fixed Remains Permanently Broken

Just in case you missed what's going on in France: the status quo in Europe is doomed. The status quo has a simple fix for every crisis and systemic problem: 1. create currency out of thin air. 2. give it to super-wealthy banks, financiers and corporations to boost their wealth and income.

Read More »

Read More »

The best place to be a woman? | The Economist

In the battle for gender equality Iceland is leading the world. The tiny island is pioneering news ways to close the gender pay gap, root out stereotypes and get more mothers back to work. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Supported by Mishcon de Reya Today women around the globe have …

Read More »

Read More »