Category Archive: 5) Global Macro

What’s the point of NATO? | The Economist

NATO was set up in 1949 to counter the Soviet threat. Its North American and European members must continue to change the alliance if it is to remain relevant in the 21st century. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full …

Read More »

Read More »

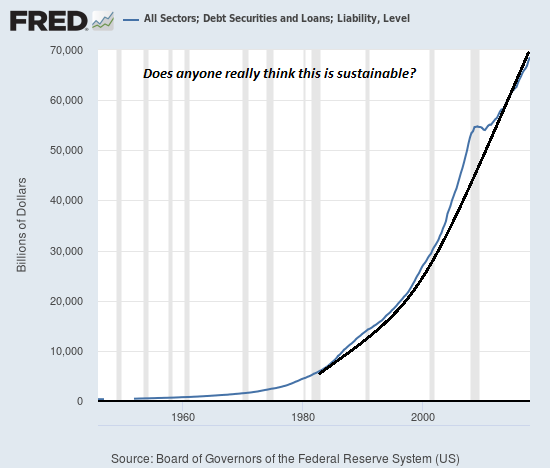

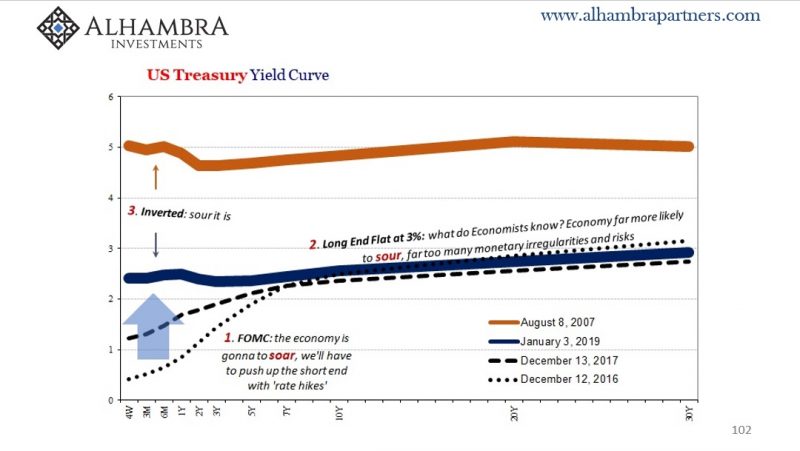

The Coming Crisis the Fed Can’t Fix: Credit Exhaustion

Having fixed the liquidity crisis of 2008-09 and kept a perversely unequal "recovery" staggering forward for a decade, central banks now believe there is no crisis they can't defeat: Liquidity crisis? Flood the global financial system with liquidity. Interest rates above zero? Create trillions out of thin air and use the "free money" to buy bonds. Mortgage and housing markets shaky?

Read More »

Read More »

Why St Patrick’s Day went global | The Economist

St Patrick’s Day is celebrated by 149m people in America alone. How did Ireland’s saint’s day become a global event? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on Facebook: https://www.facebook.com/TheEconomist/ Follow The Economist on …...

Read More »

Read More »

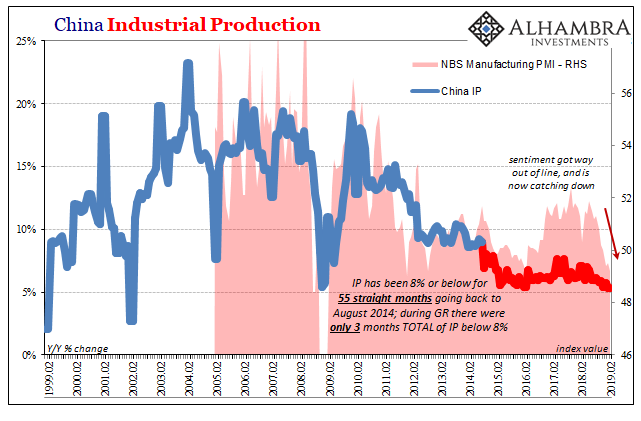

No Sign of Stimulus, Or Global Growth, China’s Economy Sunk By (euro)Dollar

Najib Tun Razak was elected as Malaysia’s Prime Minister in early 2009. Taking office that April amid global turmoil and chaos, Najib’s first official visit was to Beijing in early June. His father, also Malaysia’s Prime Minister, had been the first among Asian nations to open formal diplomatic relations with China thirty-five years before.

Read More »

Read More »

What Sort of “Democracy” Do We Have If Everyone’s Goal Is Maximizing Their Government Swag?

A democratic republic is a government in which power flows from citizens to their elected representatives. The American revolutionaries did not make a big distinction between republic and democracy, for in the context of the late 1700s, the dominant political structure was monarchy, and democracy meant the people have the final say via elections.

Read More »

Read More »

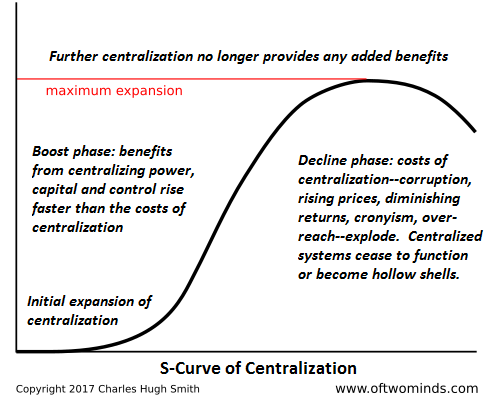

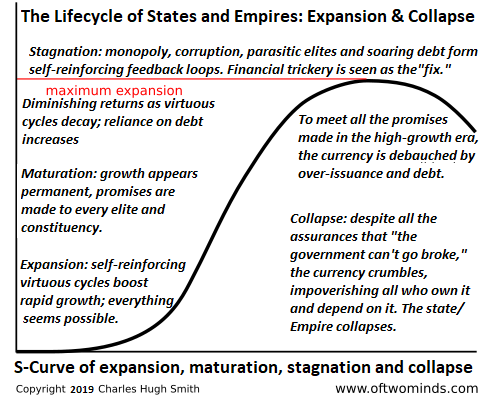

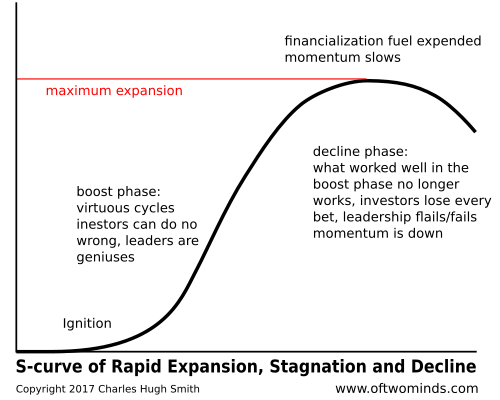

How States/Empires Collapse in Four Easy Steps

There is a grand, majestic tragedy in the inevitable collapse of once-thriving states and empires: it all seemed so permanent at its peak, so godlike in its power, and then slowly but surely, too many grandiose, unrealistic promises were made to too many elites and constituencies, and then as growth decays to stagnation, the only way to maintain the status quo is to appear to meet all the promises by creating money out of thin air, i.e. debauching...

Read More »

Read More »

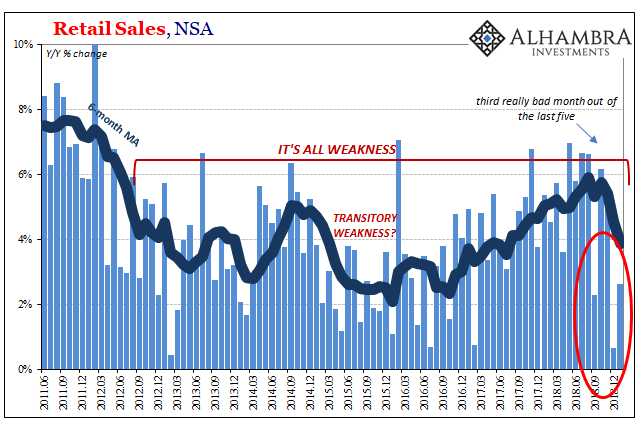

Downturn Rising, No ‘Glitch’ In Retail Sales

You just don’t see $4 billion monthly retail sales revisions, in either direction. Advance estimates are changed all the time, each monthly figure will be recalculated twice after its initial release. Typically, though, the subsequent revisions are minor rarely amounting to a billion. Four times that?

Read More »

Read More »

Charles Hugh Smith The World is Awash in Debt and Can’t Raise Interest Rates & Trump May Not Run

If interest rates rise to normal historical levels then this will collapse the everything bubble. So the central banks will try to lower interest rates into negative territory to try and maintain their ability to maintain debt servicing which are taking more and more of the pie of what’s received in tax revenues. For example …

Read More »

Read More »

Is this the future of health? | The Economist

Artificial intelligence is already shaping the world, from driverless cars to dating. But according to Dr Eric Topol, a pioneer in digital medicine, perhaps its greatest impact will be on people’s health. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video …

Read More »

Read More »

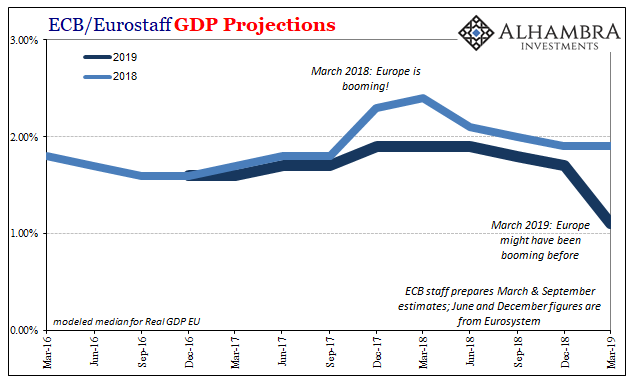

Downturn Rising, German Industry

You know things have really changed when Economists start revising their statements more than the data. What’s going on in the global economy has quickly reached a critical stage. This represents a big shift in expectations, a really big one, especially in the mainstream where the words “strong” and “boom” couldn’t have been used any more than they were.

Read More »

Read More »

Here’s The Problem: The Pie Is Shrinking

Scrape away the churn and distraction and the problem is simple: the pie of prosperity is shrinking, and the "fixes" are failing. The status quo arrangement is based on the endless expansion of "growth" and debt, which is the monetary fuel of more, more, more of everything: money, energy, resources, goods, services, jobs, wealth and income, all of which make up the elixir of prosperity.

Read More »

Read More »

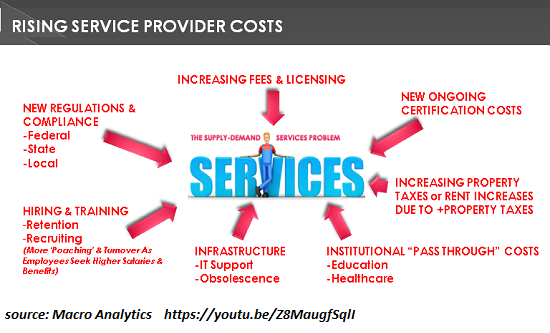

The Source of Killer Inflation: Services

The soaring cost of services is driven by a number of factors. What will the future bring: fire (inflation) or ice (deflation)? The short answer: both, but in very different doses. Goods that are tradeable and exposed to technologically driven commodification will decline in price (deflation) while untradeable services that are difficult to commoditize will increase in price (inflation), generating a self-reinforcing feedback loop of wage-price...

Read More »

Read More »

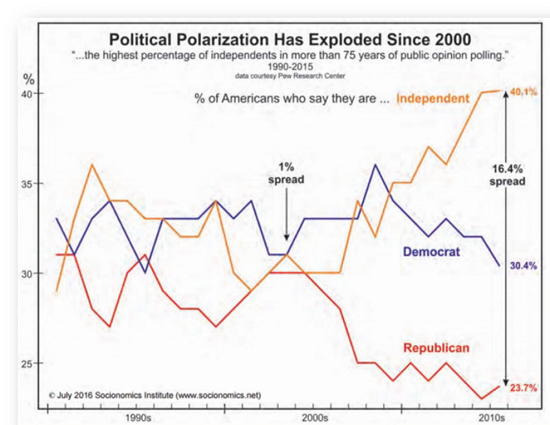

What If Politics Can’t Fix What’s Broken?

This is the politics of decline and collapse. The unspoken assumption of the modern era is that politics can fix whatever is broken: whatever is broken in society or the economy can be fixed by some political policy or political process-- becoming more inclusionary, seeking non-partisan middle ground, etc.

Read More »

Read More »

The new scramble for Africa | The Economist

The past decade has seen a big surge of foreign interest in Africa—involving China, India and Russia. If the continent handles this new “scramble” wisely, the main winners will be Africans themselves. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video …

Read More »

Read More »

CHARLES HUGH SMITH: ELITE DUMBING DOWN MIDDLE-CLASS INTO DUST!

http://www.portfoliowealthglobal.com/Smith MUST-READ FOR INVESTORS: LP(S) – Attack LP(S) – Bear LP(S) – Drama Shelter your Portfolio from the Bonds COLLAPSE: http://www.PortfolioWealthGlobal.com/Bonds Get Immediate Access to our Exclusive Report on the Coming STOCK MARKET CRASH: http://www.portfoliowealthglobal.com/crash/ Download Our Top 5 Cryptocurrencies for 2018 AT: http://www.portfoliowealthglobal.com/top5/ The Gold Bull...

Read More »

Read More »

Not Buying The New Stimulus

What just happened in Europe? The short answer is T-LTRO. The ECB is getting back to being “accommodative” again. This isn’t what was supposed to be happening at this point in time. Quite the contrary, Europe’s central bank had been expecting to end all its programs and begin normalizing interest rates.

Read More »

Read More »

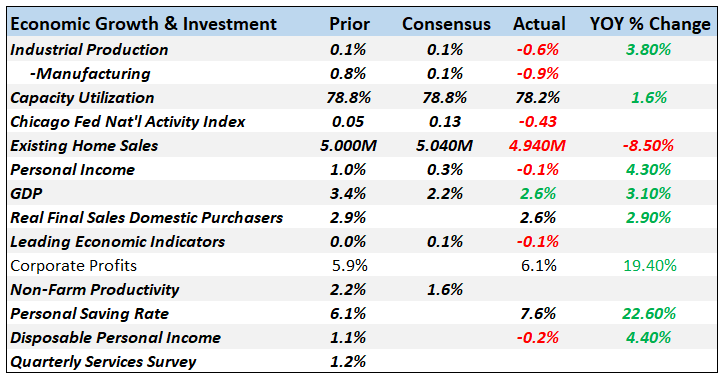

Monthly Macro Chart Review – March

We’re changing the format on our Macro updates, breaking the report into two parts. This is part one, a review of the data released the previous month with charts to highlight the ones we deem important. We’ll post another one next week that will be more commentary and the market based indicators we use to monitor recession risk.

Read More »

Read More »

What if women ruled the world? | The Economist

Only 6.3% of all international leaders are women. Ellen Johnson Sirleaf, former Liberian president and Africa’s first elected female head of state, suggests ways to redress the balance. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The …

Read More »

Read More »