Category Archive: 5) Global Macro

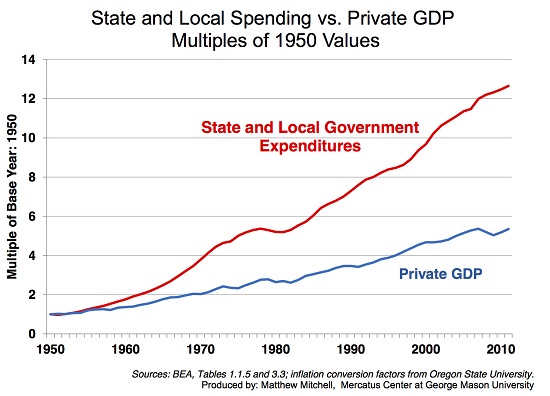

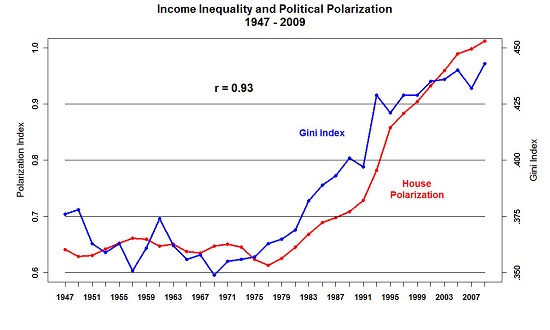

Push Them Hard Enough and the Productive Class Will Opt Out of Servitude

People love their big paychecks, but they also value their sanity. One of the most astonishing manifestations of disconnected-from-reality hubris is public authorities' sublime confidence that employers and entrepreneurs will continue starting and operating enterprises no matter how difficult and costly it becomes to keep the doors open, much less net a profit.

Read More »

Read More »

This is the most over-fished sea in the world | The Economist

The Mediterranean supports countries in Europe, the Middle East and North Africa—but its fish stocks are almost completely collapsed. Meet the man who is leading attempts to revive its marine habitats. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy This is the extraordinary story of one man’s dream to save the most over-fished …

Read More »

Read More »

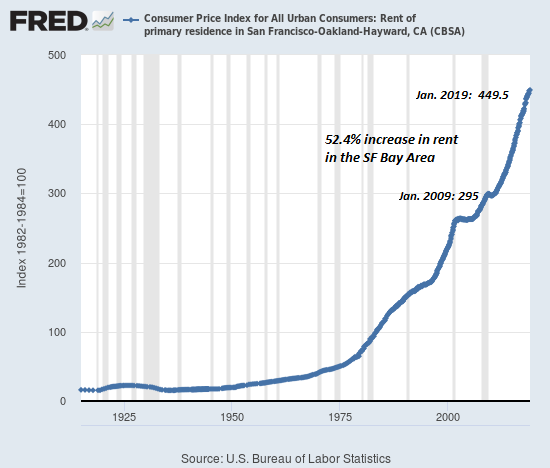

The Feedback Loop of Doom: When Mobile Creatives and Capital Abandon Unaffordable, Dysfunctional Cities

When the 4% who generate the jobs and tax revenues have had enough and leave, the effects quickly impact the 64%. At the end of any trend, everyone's a true believer: this trend is so enduring, so broad-based, so based on unchanging fundamentals that it will never ever reverse.

Read More »

Read More »

How to defeat malaria | The Economist

Malaria still kills around 400,000 people a year. Efforts to eradicate the disease have stalled because of drug resistance—but pioneering gene-editing technology might offer a new solution Read more here: https://econ.st/2XHVIiY Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: …

Read More »

Read More »

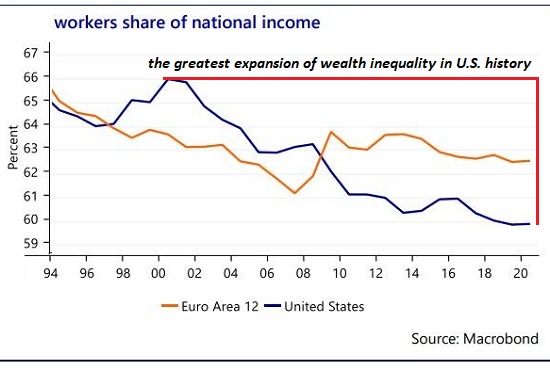

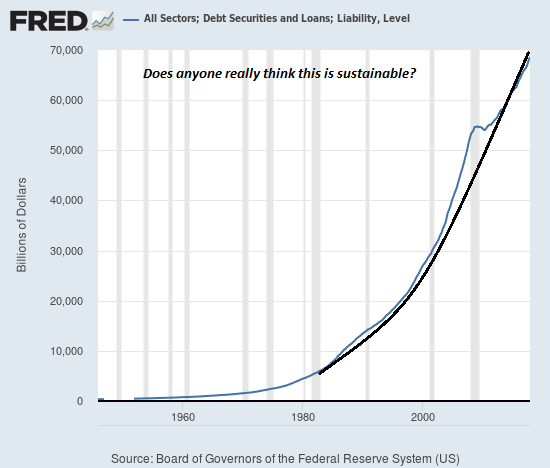

If “Getting Ahead” Depends on Asset Bubbles, It’s Not “Getting Ahead,” It’s Gambling

Given that the economy is now totally and completely dependent on inflating asset bubbles, it makes no sense to invest for the long-term. Beneath the endlessly hyped expansion in gross domestic product (GDP) of the past two decades, the economy has changed dramatically. The American Dream boils down to social and economic mobility, a.k.a. getting ahead through hard work, merit and wise investments in oneself and one's family.

Read More »

Read More »

Charles Hugh Smith – Debt Rising Faster Than Income

Can team Trump keep the economy going until after the 2020 election? Journalist and book author Charles Hugh Smith says, “I think you are pushing a little bit on a string to get a 10 year long expansion to stretch out to 12 years. It’s like you are pushing sand uphill at some point. . … Continue reading »

Read More »

Read More »

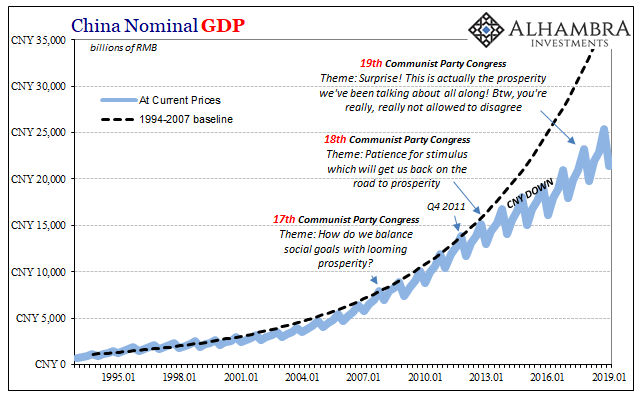

The Eurodollar, Unfortunately, Is What Is Rebalancing China’s Services Economy

If the “equation” CNY DOWN = BAD is valid, and it is, then what drives CNY downward in the first place? In conventional Economics, authorities command the currency to affect the level of exports. In reality, that’s not at all how it works. The eurodollar system of shadow money is almost purely calculated risk versus return.

Read More »

Read More »

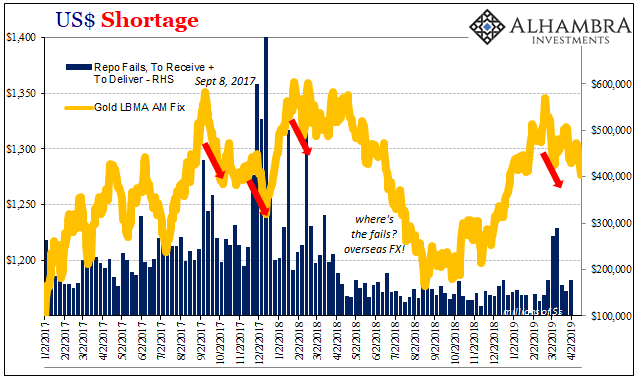

COT Blue: Distinct Lack of Green But A Lot That’s Gold

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge.

Read More »

Read More »

How Empires Fall: Moral Decay

There is a name for this institutionalized, commoditized fraud: moral decay. Moral decay is an interesting phenomenon: we spot it easily in our partisan-politics opponents and BAU (business as usual) government/private-sector dealings (are those $3,000 Pentagon hammers now $5,000 each or $10,000 each? It's hard to keep current...), and we're suitably indignant when non-partisan corruption is discovered in supposed meritocracies such as the college...

Read More »

Read More »

America’s Forced Financial Flight: Fleeing Unaffordable and Dysfunctional Cities

The forced flight from unaffordable and dysfunctional urban regions is as yet a trickle, but watch what happens when a recession causes widespread layoffs in high-wage sectors. For hundreds of years, rural poverty has driven people to urban areas: cities offer paying work and abundant opportunities to get ahead, and these financial incentives have transformed the human populace from largely rural to largely urban in the developed world.

Read More »

Read More »

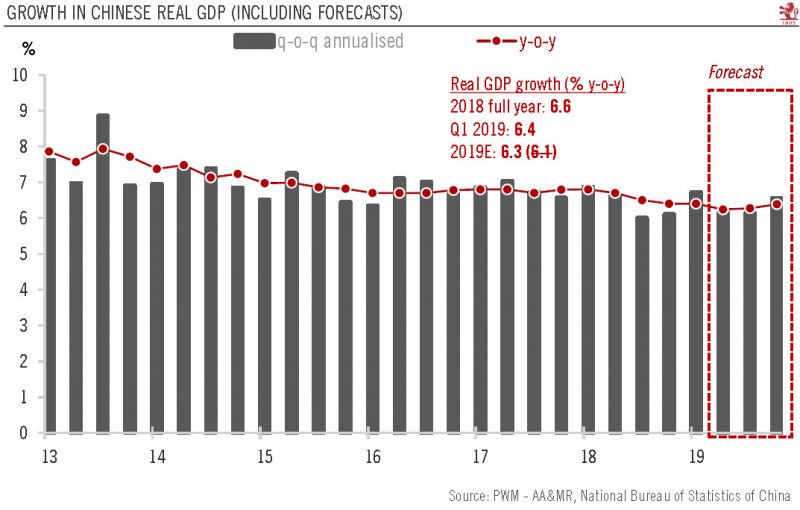

China: Q1 growth beats expectations

The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in.The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest data releases still surprised to...

Read More »

Read More »

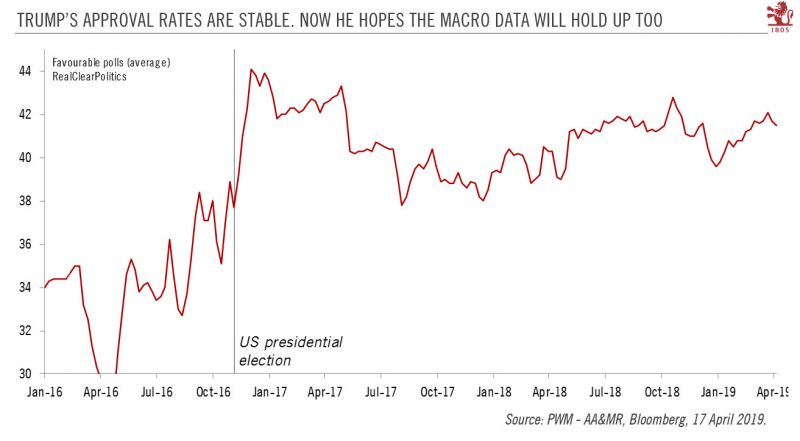

Business cycle could define Trump’s re-election chances

President Trump’s focus on getting re-elected in November 2020 may have implications for his economic policy choices.As we move closer to the 2020 presidential election, Trump has been blatantly leaning on the Federal Reserve to be more accommodative and has been trying to appoint nominees who share his preference for loose monetary policy to the Fed board.

Read More »

Read More »

Jeff Snider: Eurodollar System Overview

Erik Townsend and Patrick Ceresna welcome Jeff Snider to MacroVoices. Erik and Jeff discuss the history of Eurodollar, Eurodollar as global reserve currency, and how the global economy and the global financial system depend on the Eurodollar system. They also discuss the breakdown of Eurodollar system, the Great Global Monetary Crisis and the effect the Eurodollar squeeze has on …

Read More »

Read More »

MACRO ANALYTICS – 04 18 19 – Forced Migration in America w/Charles Hugh Smith

VIDEO NOTIFICATION SIGN-UP: http://bit.ly/2y63PvX-Sign-Up VIDEO ABSTRACT: America’s Forced Financial Flight: Fleeing Unaffordable and Dysfunctional Cities April 22, 2019 — https://www.oftwominds.com/blogapr19/forced-flight4-19.html Thank you to all Macro Analytics/Gordon T Long YouTube followers. I will continue to add the following message to each video, which many have already seen to help all of those that haven’t learned of …...

Read More »

Read More »

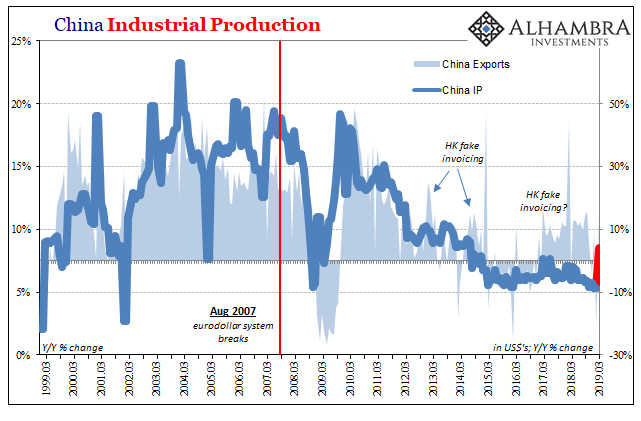

China’s Blowout IP, Frugal Stimulus, and Sinking Capex

It had been 55 months, nearly five years since China’s vast and troubled industrial sector had seen growth better than 8%. Not since the first sparks of the rising dollar, Euro$ #3’s worst, had Industrial Production been better than that mark. What used to be a floor had seemingly become an unbreakable ceiling over this past half a decade. According to Chinese estimates, IP in March 2019 was 8.5% more than it was in March 2018. That was far more...

Read More »

Read More »

CHARLES HUGH SMITH – We Are Gonna Destroy The Economy If We Keep Going Like This

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

The Next Financial Crisis Won’t Be Caused by Fraud: This Time Will Be Different

Financial crises come in two flavors: fraud and credit-valuation over-reach.Fraud-based financial crises may differ in particulars, but they share many traits: perverse incentives are institutionalized; the perverse incentives reward figuring out how to evade oversight via fraud, embezzlement, masking risk, etc. which are soon commoditized; regulations are gutted by insider-funded lobbying; regulators fail to do their job in hopes of getting...

Read More »

Read More »

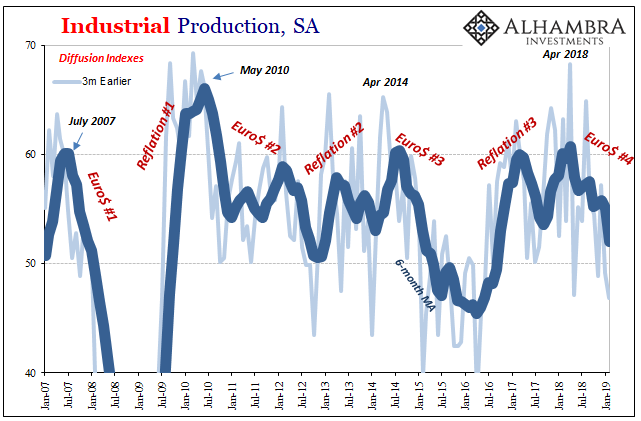

Green Shoot or Domestic Stall?

According to revised figures, things were really looking up for US industry. For the month of April 2018, the Federal Reserve’s Diffusion Index (3-month) for Industrial Production hit 68.2. Like a lot of other sentiment indicators, this was the highest in so long it had to be something. For this particular index, it hadn’t seen better than 68 since way back in March 2010, back when the economy looked briefly like it might actually recover.

Read More »

Read More »

Round Table with Gordon T. Long & Charles Hugh Smith #4299

Financial experts Gordon T. Long and Charles Hugh Smith join FSN for a discussion on what went/is going wrong with the American Experiment. Obviously among the culprits, corrupt government, corporatization, financialization and inflation to name just a few. The solution is very straight forward and simple. Go back to localization, bring back the institutions that …

Read More »

Read More »

Who will be Britain’s next prime minister? | The Economist

The race is already on to replace Theresa May as Britain’s prime minister. Adrian Wooldridge, our political editor, assesses the chances of five leading Conservative politicians hoping to take the top job. To read more, click this link: https://econ.st/2GjzNYA Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: …

Read More »

Read More »