Category Archive: 5) Global Macro

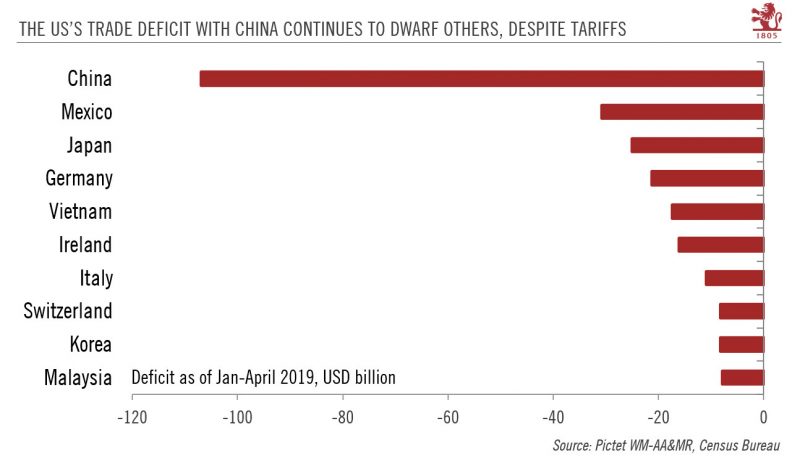

Fragile truce in Osaka

The US and China reached a ‘trade truce’ on the margins of the G20 summit this weekend, but existing tariffs remain in place. And we are only a tweet away from more Trumpian upheaval.The US and China leaders agreed on a truce during their much-anticipated meeting at the G20 summit in Osaka this weekend. Bilateral trade talks will restart.

Read More »

Read More »

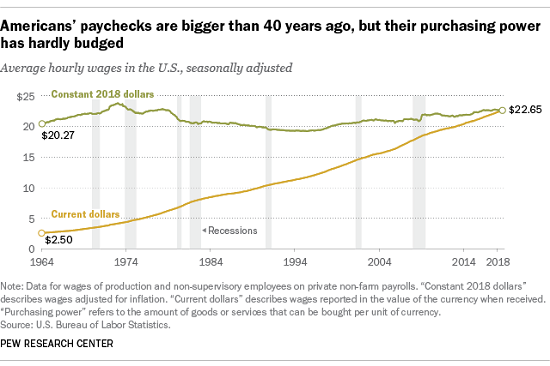

America’s Concealed Crisis: Fifty Years of Economic Decline, 1969 to 2019

If we consider the long term, it's clear America's economy and society have been declining for the average household for 50 years. What if the "prosperity" of the past 50 years is mostly a statistical mirage for the bottom 80% of households?

Read More »

Read More »

Following in Rome’s Footsteps: Moral Decay, Rising Inequality

Here is the moral decay of America's ruling elites boiled down to a single word. There are many reasons why Imperial Rome declined, but two primary causes that get relatively little attention are moral decay and soaring wealth inequality. The two are of course intimately connected: once the morals of the ruling Elites degrade, what's mine is mine and what's yours is mine, too.

Read More »

Read More »

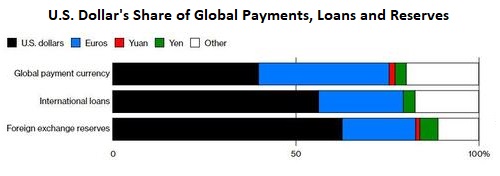

Could a Cryptocurrency Become a Global Reserve Currency?

Could a non-state cryptocurrency like bitcoin become a global reserve currency? I first proposed the idea back in November 2013, long before bitcoin's rise to $19,000, decline to $3,200, recent ascent to $13,000 and current retrace.

Read More »

Read More »

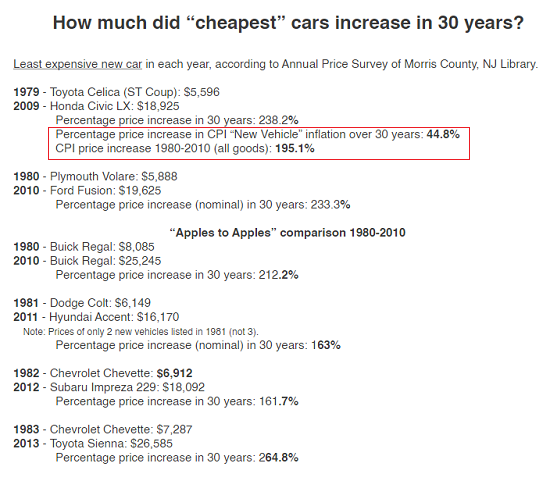

No, Autos Are Not “Cheaper Now”

According to the BLS, inflation in the category of "New Vehicles" has been practically non-existent the past 21 years. Longtime readers know I've long turned a skeptical gaze at official calculations of inflation, offering real-world analyses such as The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016) and Burrito Index Update: Burrito Cost Triples, Official Inflation Up 43% from 2001 (May 31, 2018).

Read More »

Read More »

Local Government Is an Engine of Inflation

Insolvency isn't restricted to private enterprise; governments go broke, too. One reason the economy is so much more precarious than advertised is inflation has pushed households and small businesses to the edge--and one engine of that inflation is local government. This is not to dump on local government, which is facing essentially unlimited demands from the public for more services while mandated cost increases in government union employee wages...

Read More »

Read More »

Who will challenge Donald Trump in 2020? | The Economist

The 2020 Democratic primary election is already one of the most hotly contested in history, with over 20 candidates vying to lead the party. John Prideaux, our US editor, takes a look at the front-runners. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Read more here: https://econ.st/2X2ZdzG For more from Economist Films visit: …

Read More »

Read More »

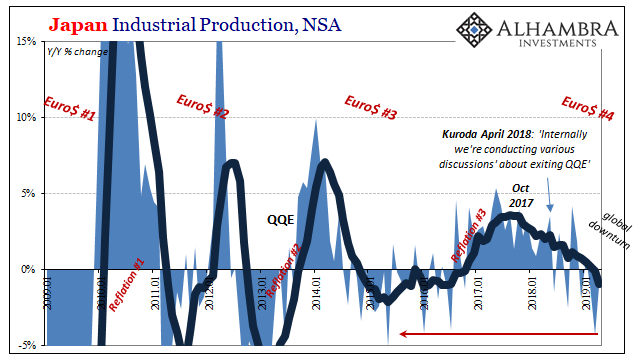

Japan’s Bellwether On Nasty #4

One reason why Japanese bond yields are approaching records like their German counterparts is the global economy indicated in Japan’s economic accounts. As in Germany, Japan is an outward facing system. It relies on the concept of global growth for marginal changes. Therefore, if the global economy is coming up short, we’d see it in Japan first and maybe best.

Read More »

Read More »

The Human Cost of “Recovery”: We’re Burning Out

The asymmetries are piling up and we're cracking under the weight. Judging by the record-high stock market and the record-low unemployment rate, the "recovery" has reached new heights of prosperity. Academics and think-tankers viewing the global economy from 40,000 feet are brimming with policies to bring the remaining laggards into the booming economy.

Read More »

Read More »

The Lessons of Rome: Our Neofeudal Oligarchy

Our society has a legal structure of self-rule and ownership of capital, but in reality it is a Neofeudal Oligarchy. The Inheritance of Rome: Illuminating the Dark Ages 400-1000 is not an easy, breezy read; its length and detail are daunting. The effort is well worth it, as the book helps us understand how the power structures of societies change over time in ways that may be largely invisible to those living through the changes.

Read More »

Read More »

Secrets of the deep ocean | The Economist

Parts of the ocean floor are being explored for the first time. Scientists are using technology to map the damage caused by humanity—and reveal clues about how the ocean can be better protected. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Deep beneath the ocean’s surface lie vast areas of seabed that have …

Read More »

Read More »

The Fed’s Casino Is Giving Away Free Gambling Chips (But Only to the Super-Rich)

The rest of us eat our losses, either all at once or in bitter bites as we trudge through the financial wasteland left after bubbles burst. The news that the Federal Reserve Casino is giving away free gambling chips triggered a frenzied rush that trampled the bears, including poor Yogi:

Read More »

Read More »

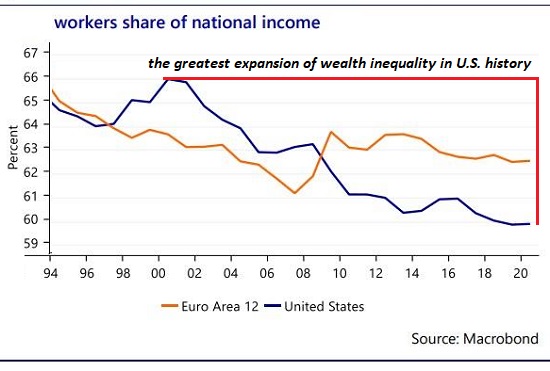

Dear Central Bankers: Prepare to be Swept Away in the Next Wave of Populism

The political moment when the "losers" connect their discontent and decline with central bankers is approaching. The Ruling Elites' Chattering Classes still haven't absorbed the key lesson of the 2016 U.S. presidential election.

Read More »

Read More »

How to spot a child genius | Economist

Gifted children around the world are going under the radar—their talents not recognised or nurtured. More should be done to spot these “lost Einsteins” Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy How do you spot a child genius? Gifted children tend to share three defining characteristics. First, they develop skills at a …

Read More »

Read More »

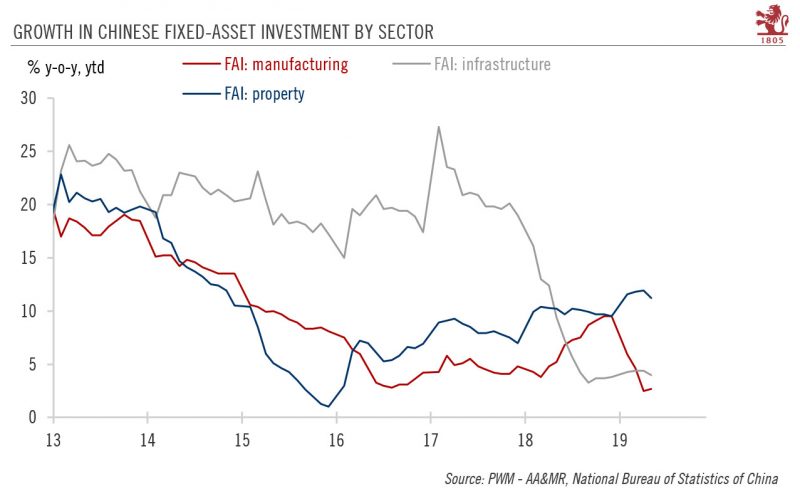

China looks to new policies to boost infrastructure spending

To stabilise growth, the Chinese government will likely put more focus on infrastructure investment. A new policy announced recently could give a further boost to this sector.Activity data in May point to continued weakness in Chinese economic momentum, with growth in both fixed-asset investment and industrial production slowing last month.

Read More »

Read More »

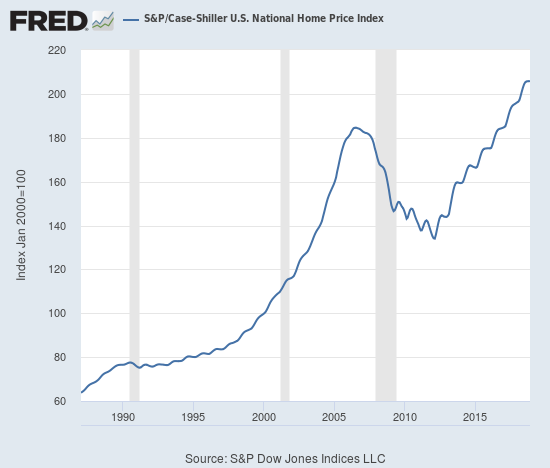

How Much of Your “Wealth” Is Hostage to Bubbles and Impossible Promises?

All asset "wealth" in credit-asset bubble dependent economies is contingent and ephemeral. A funny thing happens to "wealth" in a bubble economy: it only remains "wealth" if the owner sells at the top of the bubble and invests the proceeds in an asset which isn't losing purchasing power.

Read More »

Read More »

Misplaced Pride: Most of the “Middle Class” Is Actually Working Class

If we look at these charts, it looks like only the top 10%, or perhaps the top 20% at best, might qualify as "middle class" by the metrics described below. The conventional definition of working class is based on income and education:the working class household earns between $30,000 and $69,000 annually, and the highest education credential in the household is a two-year community college degree or trade certification.

Read More »

Read More »

Charles Hugh Smith CONFIRMED?THE CRASH IS COMING! 100% Global RESET in Jun 2019

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected] Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/ Contact advertising :[email protected]

Read More »

Read More »

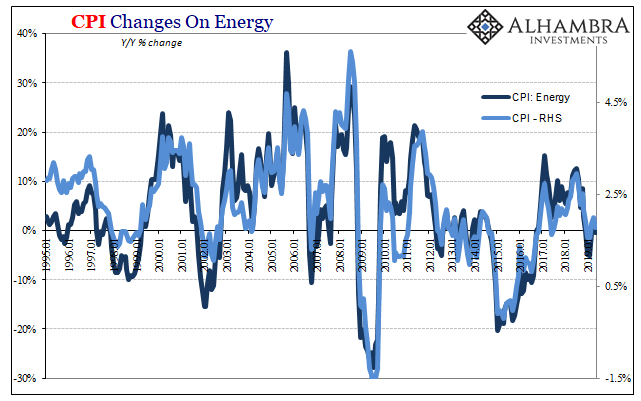

When Verizons Multiply, Macro In Inflation

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were).

Read More »

Read More »

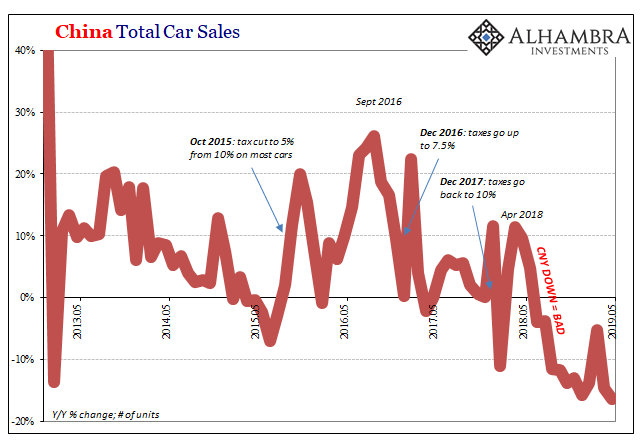

Dimmed Hopes In China Cars, Too

As noted earlier this week, the world’s two big hopes for the global economy in the second half are pinned on the US labor market continuing to exert its purported strength and Chinese authorities stimulating out of every possible (monetary) opening. Incoming data, however, continues to point to the fallacies embedded within each.

Read More »

Read More »