Category Archive: 5) Global Macro

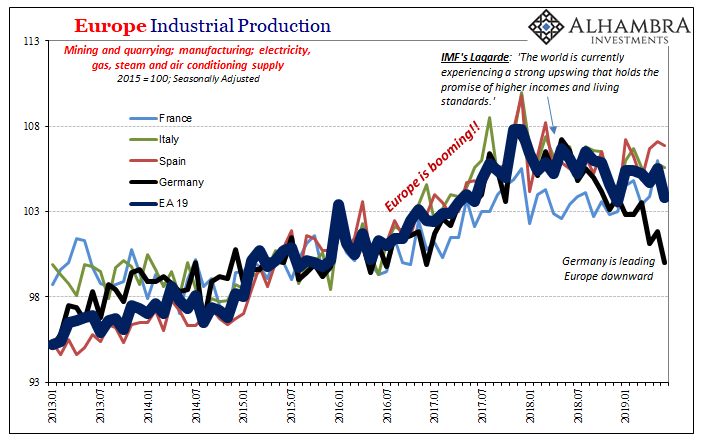

Some Brief European Leftovers

Some further odds and ends of European data. Beginning with Continent-wide Industrial Production. Germany is leading the system lower, but it’s not all just Germany. And though manufacturing and trade are thought of as secondary issues in today’s services economies, the GDP estimates appear to confirm trade in goods as still an important condition and setting for all the rest.

Read More »

Read More »

Market Huddle Episode 41: Harry McLovin (guest: Charles Hugh Smith)

To receive our emails with the charts and links each week, please register at: https://markethuddle.com/ In episode #41, Patrick Ceresna and Kevin Muir welcome Charles Hugh Smith to the show to talk about negative interest rates and Charles explains why the past is not a guide. Then more on the hot topic: GE fraud. Fast …

Read More »

Read More »

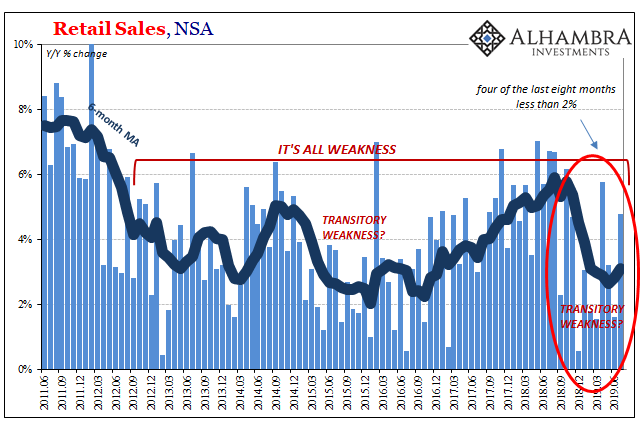

Retail Sales’ Amazon Pick Up

The rules of interpretation that apply to the payroll reports also apply to other data series like retail sales. The monthly changes tend to be noisy. Even during the best of times there might be a month way off trend. On the other end, during the worst of times there will be the stray good month. What matters is the balance continuing in each direction – more of the good vs. more of the bad.

Read More »

Read More »

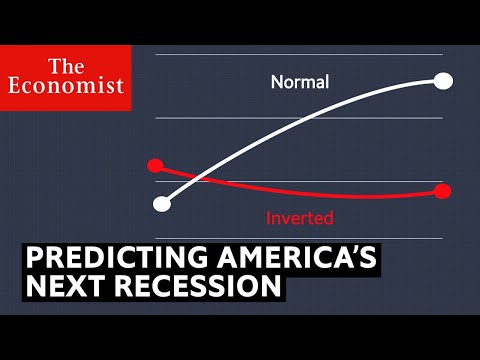

Does this line predict America’s next recession? | The Economist

The yield curve has predicted America’s last eight recessions. In March this year it inverted again. So what does it mean for America? Read more about how the yield curve helps predict economic growth here: https://econ.st/2N3fT98 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy This graph makes a lot of people nervous. Why? …

Read More »

Read More »

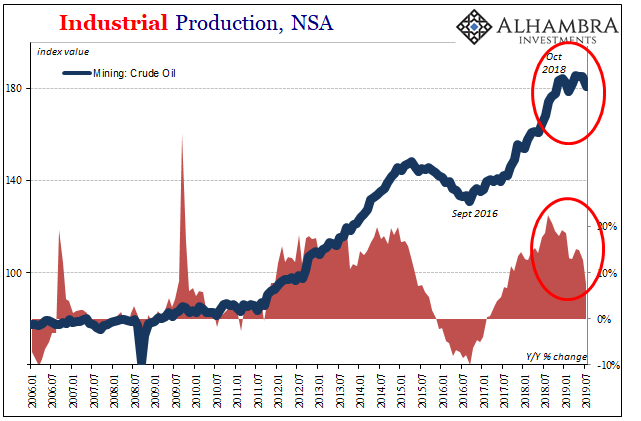

US Industrial Downturn: What If Oil and Inventory Join It?

Revised estimates from the Federal Reserve are beginning to suggest another area for concern in the US economy. There hadn’t really been all that much supply side capex activity taking place to begin with. Despite the idea of an economic boom in 2017, businesses across the whole economy just hadn’t been building like there was one nor in anticipation of one.

Read More »

Read More »

Charles Hugh Smith Parallels Between The Decline of the Roman Empire and America

Here’s an excellent analysis for any history enthusiast on the comparison between the Roman empire in decline and the American empire.

Read More »

Read More »

The Path Clear For More Rate Cuts, If You Like That Sort of Thing

If you like rate cuts and think they are powerful tools to help manage a soft patch, then there was good news in two international oil reports over the last week. The US Energy Information Administration (EIA) cut its forecast for global demand growth for the seventh straight month. On Friday, the International Energy Agency (IEA) downgraded its estimates for the third time in four months.

Read More »

Read More »

Hong Kong protests: what’s at stake for China? | The Economist

The Hong Kong protests are the most serious challenge to China’s authority since the Tiananmen Square massacre. Read more about the Hong Kong protests here: https://econ.st/2YKYdWV Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy This protester calls himself “Bruce”. We’ve hidden his face and obscured his voice to protect his identity. He’s one …

Read More »

Read More »

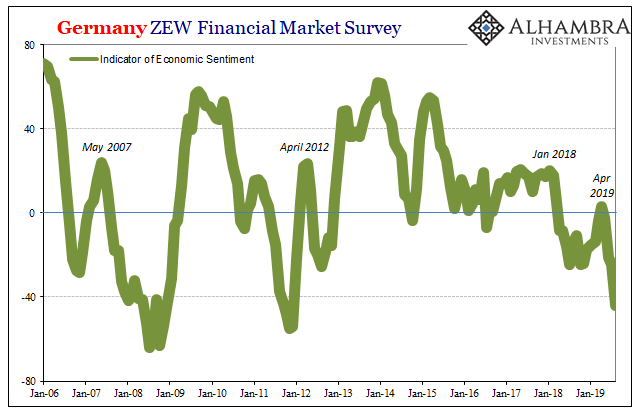

Why You Should Care Germany More and More Looks Like 2009

What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else.

Read More »

Read More »

Developed market equities update: a fairly reassuring reporting season

There is an ongoing tug-of-war between trade tensions and fundamentals Due to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises.

Read More »

Read More »

The Internal War in the Deep State Claims Its High Profile Casualty: Jeffrey Epstein

The "traditionalist" Neocons are going to have to decide to fish or cut bait. I've been writing about the fracturing Deep State for the past five years: The conflict has now reached the hot-war stage where bodies are turning up, explained away by the usual laughable covers: "suicide," "accident" and "heart attack." That Jeffrey Epstein's death in a secure cell is being labeled "suicide" tells us quite a lot about the desperation of the faction...

Read More »

Read More »

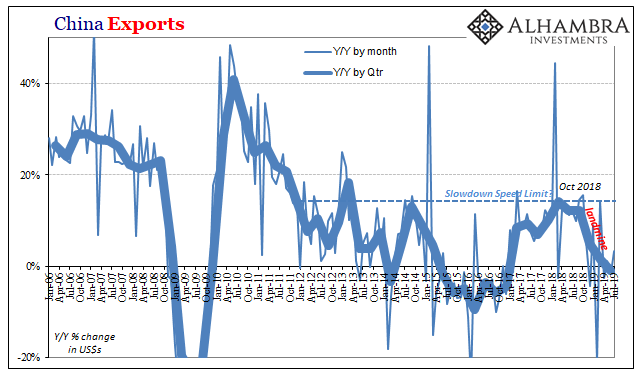

The Myth of CNY DOWN = STIMULUS Won’t Die

On the one hand, it’s a small silver lining in how many even in the mainstream are beginning to realize that there really is something wrong. Then again, they are using “trade wars” to make sense of how that could be. For the one, at least they’ve stopped saying China’s economy is strong and always looks resilient no matter what data comes out.

Read More »

Read More »

The US labels China a currency manipulator

The near-term impact will likely be limited but this is a clear negative for trade negotiations.Shortly after the renminbi’s sharp depreciation on Monday, the US Treasury Department labelled China a currency manipulator. This is the first time in 25 years that the US government has designated a country as a currency manipulator.According to the US Treasury Department, the decision was triggered by the perceived lack of action by the PBoC to resist...

Read More »

Read More »

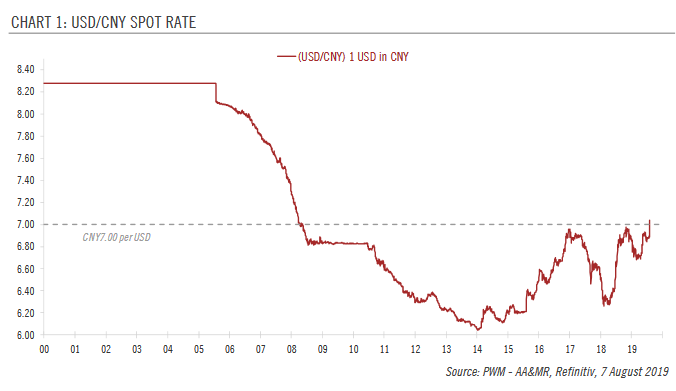

Currency update – the Chinese renminbi

Despite the CNY's recent fall, we believe the People's Bank of China will refrain from competitive devaluationFollowing US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD.

Read More »

Read More »

The Gulag of the Mind

Befuddled and blind, we wander toward the cliff without even seeing it, focusing on our little screens of entertainment and self-absorption. There are no physical barriers in the Gulag of the Mind--we imprison ourselves, and love our servitude. Indeed, we fear the world outside our internalized gulag, because we've absorbed the narrative that the gulag is secure and permanent.

Read More »

Read More »

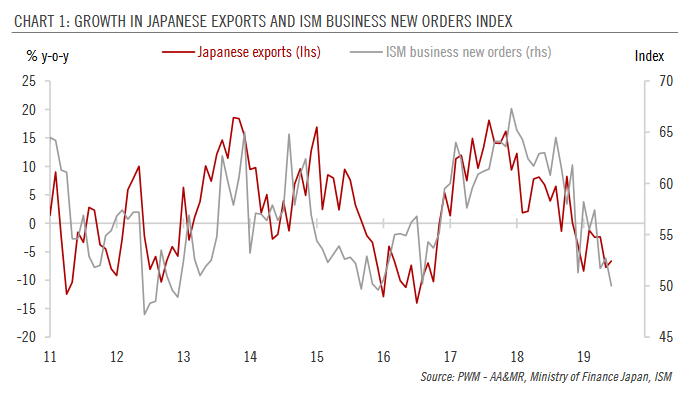

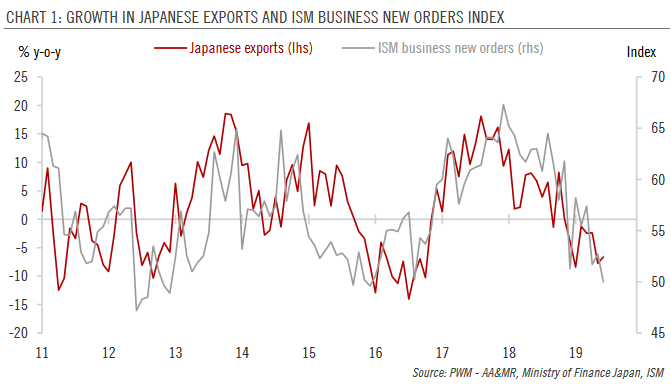

BoJ stays put amid economic headwinds

Japan's central bank has little room for further easing despite a downbeat outlook.At its monetary policy meeting on 30 July, the Bank of Japan (BoJ) decided to keep its monetary policy unchanged, as expected. The decision came as the Japanese economy faces strong external headwinds and a downbeat outlook for domestic demand.

Read More »

Read More »

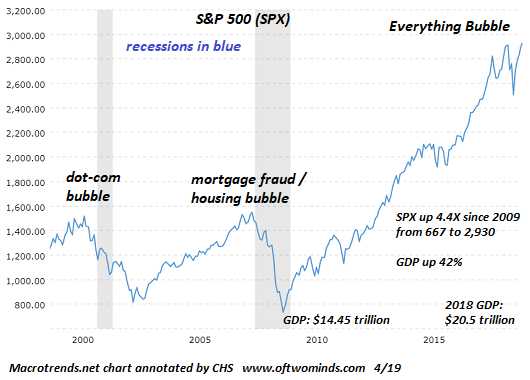

Nothing Is Guaranteed

There are no guarantees, no matter how monumental the hubris and confidence. The American lifestyle and economy depend on a vast number of implicit guarantees-- systemic forms of entitlement that we implicitly feel are our birthright. Chief among these implicit entitlements is the Federal Reserve can always "save the day": the Fed has the tools to escape either an inflationary spiral or a deflationary collapse.

Read More »

Read More »

Charles Hugh Smith ? Economic Collapse Confirmed! – The Collapse of the American Empire?

Charles Hugh Smith ? Economic Collapse Confirmed! – The Collapse of the American Empire? Charles Hugh Smith ? Economic Collapse Confirmed! – The Collapse of the American Empire? ——————————————————————————————————— ? Subscribe To...

Read More »

Read More »

Why are music festivals so expensive? | The Economist

Today there are festivals in more parts of the world than ever before–and ticket prices are higher than ever before. Why are festivals so expensive? Read more about how big stars maximise their take from tours here: https://econ.st/30ktI6U Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ …

Read More »

Read More »