Category Archive: 5) Global Macro

Could blockchain save the Amazon rainforest? | The Economist

Blockchain technology can do more than underpin crypto-currencies—it could help save the Amazon rainforest by stopping so called “biopirates” from plundering its biological riches. If it works, more money could be made by preserving the rainforest than cutting it down Click here to subscribe to The Economist on YouTube: http://econ.st/2v5mUik Daily Watch: mind-stretching short films …

Read More »

Read More »

Why Systems Fail

Since failing systems are incapable of structural reform, collapse is the only way forward. Systems fail for a wide range of reasons, but I'd like to focus on two that are easy to understand but hard to pin down. Systems are accretions of structures and modifications laid down over time.Each layer adds complexity which is viewed at the time as a solution. This benefits insiders, as their job security arises from the need to manage the added...

Read More »

Read More »

Emerging Markets: What Changed

Reserve Bank of India cut its inflation forecast for the first half of FY2018/19 to 4.7-5.1%. Former South Korean President Park was sentenced to 24 years in prison. Malaysia Prime Minister Razak has called for early elections. Bahrain discovered its biggest oil field since it started producing crude in 1932. Local press reports Turkey’s Deputy Prime Minister Simsek tendered his resignation.

Read More »

Read More »

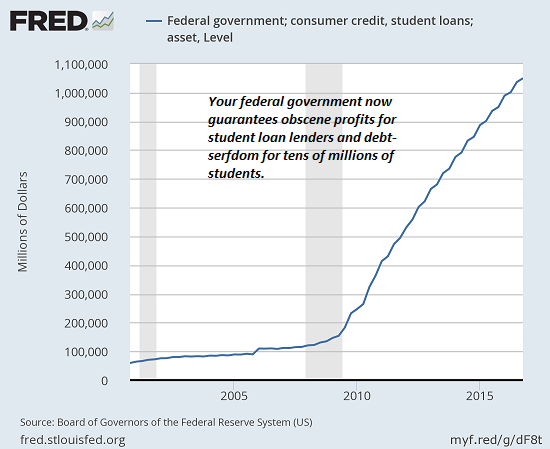

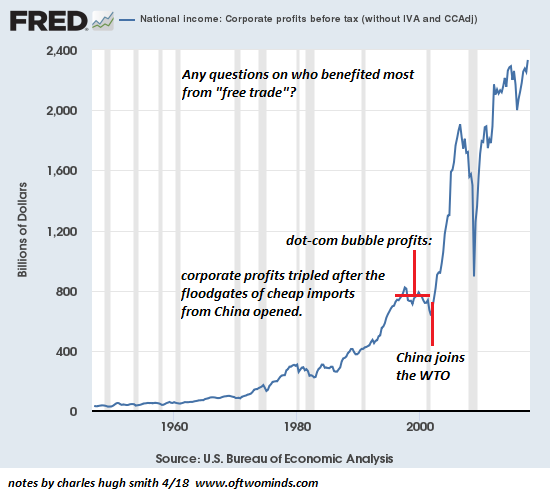

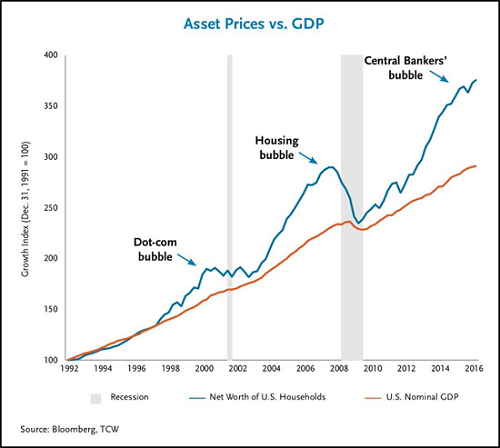

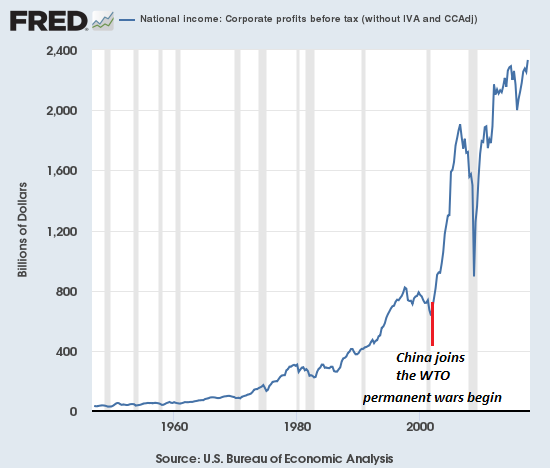

Were Trade Wars Inevitable?

Were trade wars inevitable? The answer is yes, due to the imbalances and distortions generated by financialization and central bank stimulus. Gordon Long and I peel the trade-war onion in a new video program, Were Trade Wars Inevitable?

Read More »

Read More »

Jeff Snider: U.S. Treasury Yield Curve Deep Dive

Erik Townsend and Patrick Ceresna welcome Jeffrey Snider to MacroVoices. Erik and Jeff discuss what the current yield curve is telling us? They touch on the changes from an era of fed funds rate targeting and reflect on the 2006-2009 period for interest rates and the reflation trends in the post “Great Financial Crisis”. Jeff …

Read More »

Read More »

Playing for All the Marbles

Global Plunge Protection Teams must be ordering take-out food; every night is a long one now. The current stocks/bonds game is for all the marbles, by which I mean the status quo now depends on valuations and interest rates remaining near their current levels for the system to function.

Read More »

Read More »

CHARLES HUGH SMITH – At the Beginning of 2020, Major Structural Reset Begins

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

MACRO ANALYTICS – 04-05-18 – Were Trade Wars Inevitable? Part I w/Charles Hugh Smith

VIDEO NOTIFICATION SIGN-UP: http://bit.ly/2y63PvX-Sign-Up Covering Article: http://bit.ly/2J5IxRV Thank you to all Macro Analytics/Gordon T Long YouTube followers. I will continue to add the following message to each video, which many have already seen to help all of those that haven’t learned of the new update. Thank you again for your support! To all Macro Analytics/Gordon …

Read More »

Read More »

China Vows Retaliation With “Same Scale, Intensity” To Any New US Tariffs

Trump’s aggressive trade war overtures and China's initial retaliatory moves have spooked Wall Street over the past week and again on Monday, which helped drive down the Dow Jones by 459 points, with the Nasdaq Composite quickly approaching correction territory. And as the mass exodus continues out of Wall Street’s highest-flying stocks, trade war concerns are sparking political, regulatory and market challenges that could soon derail the global...

Read More »

Read More »

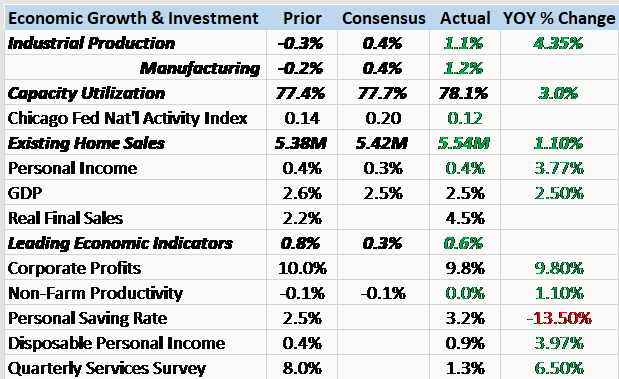

Bi-Weekly Economic Review

Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for April 01, 2018.

Read More »

Read More »

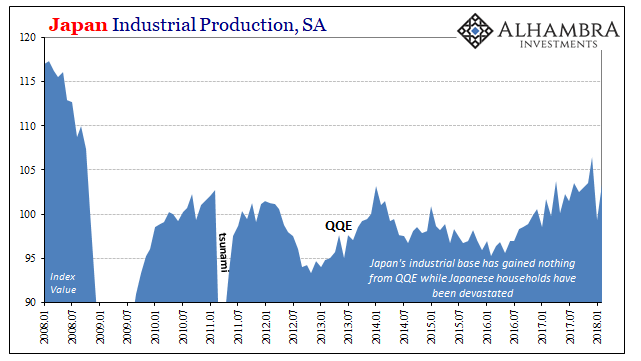

The Best ‘Reflation’ Indicator May Be Japanese

Japanese industrial production dropped sharply in January 2018, Japan’s Ministry of Economy, Trade, and Industry reported last month. Seasonally-adjusted, the IP index fell 6.8% month-over-month from December 2017. Since the country has very little mining sector to speak of, and Japan’s IP doesn’t include utility output, this was entirely manufacturing in nature (99.79% of the IP index is derived from the manufacturing sector).

Read More »

Read More »

The rise of the refugee startup | The Economist

Refugee camps are unlikely hotbeds of untapped entrepreneurial talent. The UN estimates that there are 3,000 businesses inside the Zaatari camp in Jordan, generating $13m per month, even though refugees there are not in theory allowed to start their own businesses. Click here to subscribe to The Economist on YouTube: http://econ.st/2H6fSfw Daily Watch: mind-stretching short …

Read More »

Read More »

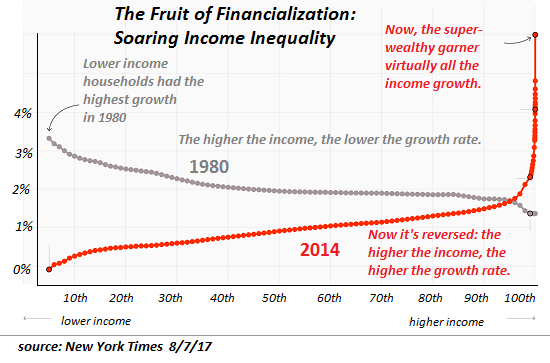

The Problem with a State-Cartel Economy: Prices Rise, Wages Don’t

The vise will tighten until something breaks. It could be the currency, it could be the political status quo, it could be the credit/debt system--or all three. The problem with an economy dominated by state-enforced cartels and quasi-monopolies is that prices rise (since cartels can push higher costs onto the consumer) but wages don't (since cartels can either dominate local labor markets or engage in global wage arbitrage: offshore jobs, move to...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mostly stronger last week, despite the dollar’s firm tone against the majors. Best EM performers on the week were MXN, KRW, and COP while the worst were ZAR, INR, and PEN. US jobs data poses the biggest risk to EM this week, as US yields have been falling ahead of the data. Indeed, the current US 10-year yield of 2.74% is the lowest since February 6.

Read More »

Read More »

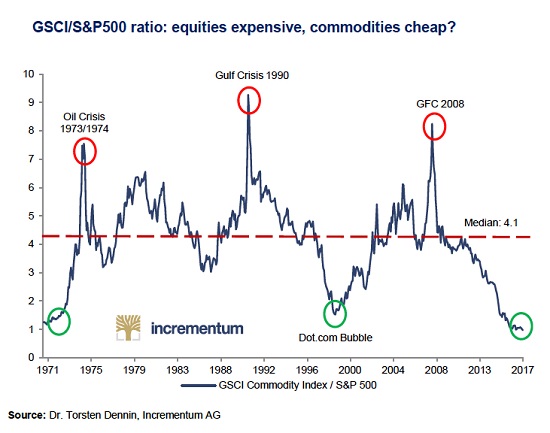

What If All the Cheap Stuff Goes Away?

Nothing stays the same in dynamic systems, and it's inevitable that the current glut of low costs / cheap stuff will give way to scarcities that cannot be filled at current low prices. One of the books I just finished reading is The Fate of Rome: Climate, Disease, and the End of an Empire.

Read More »

Read More »

15 Years of War: To Whose Benefit?

As for Iraq, the implicit gain was supposed to be access to Iraqi oil. Setting aside the 12 years of "no fly zone" air combat operations above Iraq from 1991 to 2003, the U.S. has been at war for almost 17 years in Afghanistan and 15 years in Iraq. (If the word "war" is too upsetting, then substitute "continuing combat operations".)

Read More »

Read More »

How does science fiction influence the real world? | The Economist

Steven Spielberg’s new film “Ready Player One” imagines a future where people live much of their lives in virtual reality. Do science fiction’s predictions of the future ever come true? Yes. And it’s no surprise, given that the tech industry is led by sci-fi fans turning their visions into reality. If you’re watching this on …

Read More »

Read More »

Charles Hugh Smith on Automation, Robotics and Universal Basic Income

Click here for the full transcript: http://financialrepressionauthority.com/2018/03/28/the-roundtable-insight-charles-hugh-smith-on-automation-robotics-and-universal-basic-income/

Read More »

Read More »

Charles Hugh Smith-No “Free Trade”-Only Darwinian Game of Trade

Charles Hugh Smith, author of OfTwoMinds.com, explains what he means by stating, No “Free Trade”- Only Darwinian Game of Trade.

Read More »

Read More »

Bi-Weekly Economic Review: Embrace The Uncertainty

There’s something happening here What it is ain’t exactly clear There’s a man with a gun over there Telling me I got to beware I think it’s time we stop, children, what’s that sound Everybody look what’s going down There’s battle lines being drawn Nobody’s right if everybody’s wrong Young people speaking their minds Getting so much resistance from behind It’s time we stop, hey, what’s that sound Everybody look what’s going...

Read More »

Read More »