Category Archive: 5) Global Macro

The Big Risks Left (and Right) In Europe

Another local election in Germany, another stunning defeat for the ruling center. How many more of these does anyone need before they realize the electorate is going to keep migrating toward the poles? And it all stems from the one reason; there is no and has been no economic growth. But because the so-called establishment has insisted the economy is booming, or it was, people are doing what people always do.

Read More »

Read More »

Monthly Macro Monitor: Market Indicators Review

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations.

Read More »

Read More »

Dollar Firm as Two-Day FOMC Meeting Begins

The dollar continues to gain traction as the two-day FOMC begins; US political uncertainty has entered a new phase. Yesterday marked the third time that UK Prime Minister Johnson lost a vote for elections; he will try again today. Weak South Africa data support our call for imminent easing; the threat of sanctions against Turkey are back on the table.

Read More »

Read More »

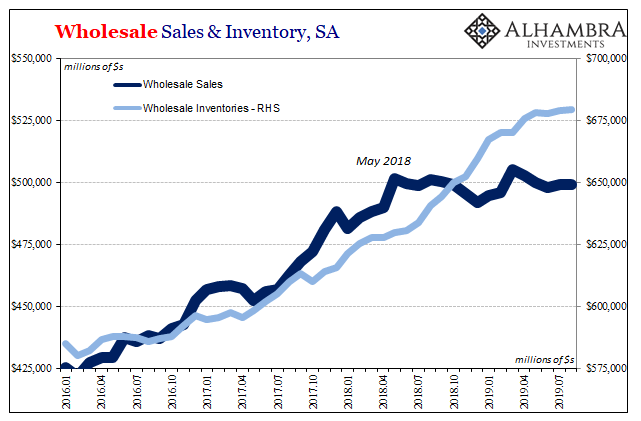

More Points For, And Pointing To, The Midpoint

It’s not surprising that the Census Bureau would report another weird sideways trend in wholesale sales. After all, the agency has already produced that kind of pattern in the related data for durable goods. For reasons that aren’t going to be explained, economic activity across the supply chain from producers to consumers has been curtailed. That hasn’t mean outright shrinking in seasonally adjusted forms, but it also doesn’t mean growth,...

Read More »

Read More »

EM Preview for the Week Ahead

EM has been on a good run but this week will be a big test. Brexit uncertainty may finally end. Or it may not. A delay would be positive for EM, whilst a potential hard Brexit would be negative. The Fed meets Wednesday and key US data will be reported during the week, culminating with the jobs report Friday.

Read More »

Read More »

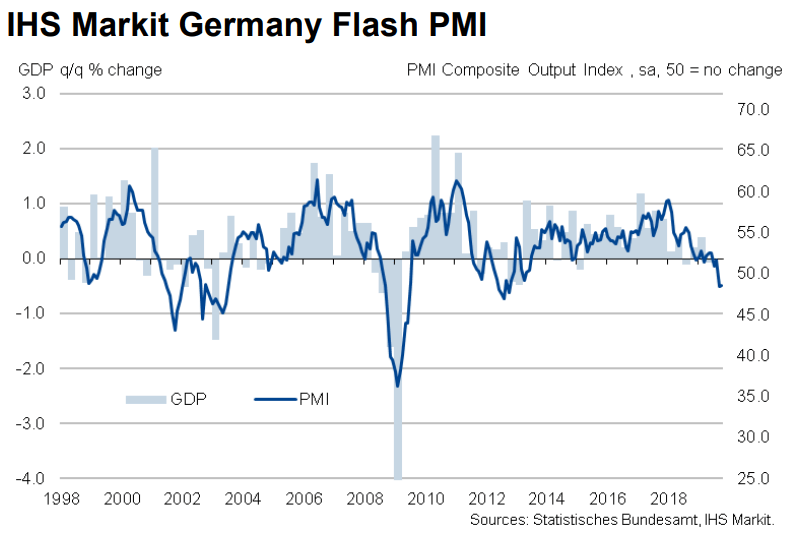

Somehow Still Decent European Descent

How times have changed. In the middle of 2018, we were told the risks to the global economy were all tilted to the upside. If central bankers weren’t careful, they chanced an uncontrollable inflationary breakout, the kind that would make the last few years of the 2010’s look too much like the 1970’s. Always eager to bottle up the inflation genie, Germany out of everyone actually welcomed negative factors as they built up during the year.

Read More »

Read More »

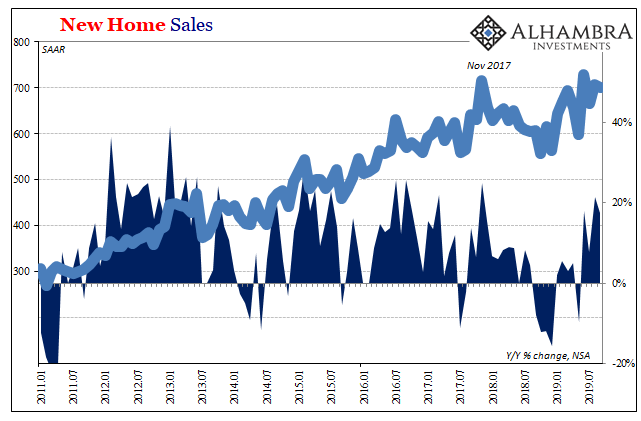

Downward Home Prices In The Downturn, Too

The Census Bureau reported today New Home Sales remained at a better than 700k SAAR in September following the big jump over the previous few months. Though the number was slightly lower last month than the month before, it wasn’t meaningfully less. As discussed yesterday, while that might seem the Fed’s rate cut psychology combined with the bond market’s pessimism (reducing the mortgage rate) is having a positive effect, I don’t see it that...

Read More »

Read More »

Doping in sport: why it can’t be stopped | The Economist

Many sports’ reputations are being tarnished by doping scandals. The International Olympic Committee and The World Anti-Doping Agency (WADA) should be responsible for tackling drug cheats—but are they at the heart of the problem? Read more here: https://econ.st/2Weuels Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy It was one of sport’s darkest episodes. …

Read More »

Read More »

Charles Hugh Smith new book – Will You Be Richer Or Poorer?

Charles Hugh Smith new book – Will You Be Richer Or Poorer? Click here for the full transcript: http://financialrepressionauthority.com/2019/10/25/the-roundtable-insight-charles-hugh-smith-new-book-will-you-be-richer-or-poorer/

Read More »

Read More »

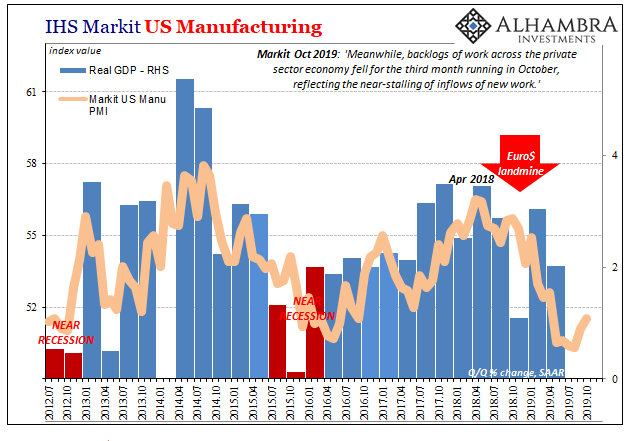

More Down In The Downturn

Flash PMI’s from IHS Markit for the US economy were split in October. According to the various sentiment indicators, there’s a little bit of a rebound on the manufacturing side as contrary to the ISM’s estimates for the same sector. Markit reports a sharp uptick in current manufacturing business volumes during this month.

Read More »

Read More »

CHARLES HUGH SMITH – Whole Political Severe Is Highly Polarized Now

SUBSCRIBE For The Latest Issues About ; #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ

Read More »

Read More »

Macro Housing: Bargains and Discounts Appear

While things go wrong for Jay Powell in repo, they are going right in housing. Sort of. It’s more than cliché that the real estate sector is interest rate sensitive. It surely is, and much of the Fed’s monetary policy figuratively banks on it. When policymakers talk about interest rate stimulus, they largely mean the mortgage space.

Read More »

Read More »

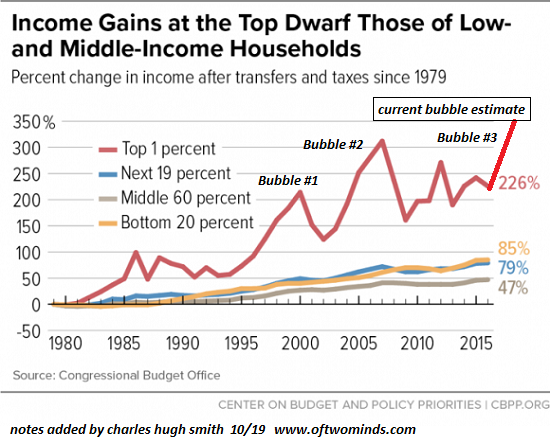

The Unraveling Quickens

Even if we don't measure the erosion of intangible capital, the social and political consequences of this impoverishment are manifesting in all sorts of ways. The central thesis of my new book Will You Be Richer or Poorer? is the financial "wealth" we've supposedly gained (or at least a few of us have gained) in the past 20 years has masked the unraveling of our intangible capital: the resilience of our economy, our social capital, i.e. our ability...

Read More »

Read More »

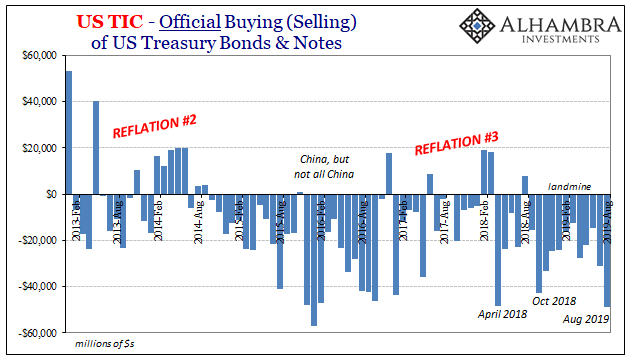

August TIC: Trying To Get Collateral Out of the Shadows

The second most frustrating aspect of trying to analyze global shadow money is how the term “shadow” really applies in this case. It’s not really because banks are being sneaky, desperately maintaining their cover for any number of illicit activities they are regularly accused of undertaking. The money stays in the shadows for the simple reason central bankers don’t know their jobs; even after a somehow Global Financial Crisis in 2008, they don’t...

Read More »

Read More »

A New Stage of the US-China Conflict

The US-China diplomatic relationship may be entering a new stage. The balance of power between the key players – Trump, China, the US Congress, and the Democrats – is changing and their roles are being reshuffled. This might be enough to break the endless cycle of agreements and re-escalations. In short, we think both Trump and Chinese officials have a greater incentive to reach a deal (or at least not to escalate) this time around.

Read More »

Read More »

Could deepfakes weaken democracy? | The Economist

Videos can be faked to make people say things they never actually said. This poses dangers for democracy. Can you spot ALL the deep fake interviews in this film? Read more here: https://www.economist.com/leaders/2019/11/09/women-in-public-life-are-increasingly-subject-to-sexual-slander-dont-believe-it Artwork by: Bill Posters and Daniel Howe Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy These videos are all deepfakes....

Read More »

Read More »

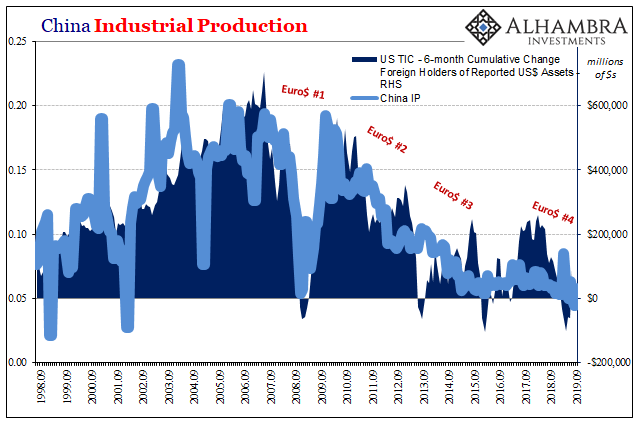

The Dollar-driven Cage Match: Xi vs Li in China With Nowhere Else To Go

China’s growing troubles go way back long before trade wars ever showed up. It was Euro$ #2 that set this course in motion, and then Euro$ #3 which proved the country’s helplessness. It proved it not just to anyone willing to honestly evaluate the situation, it also established the danger to one key faction of Chinese officials.

Read More »

Read More »

Prying Open the Overton Window

If you're truly interested in finding solutions to humanity's pressing problems, then start helping us pry open the Overton Window. The Overton Window describes the spectrum of concepts, policies and approaches that can be publicly discussed without being ridiculed or marginalized as "too radical," "unworkable," "crazy," etc.

Read More »

Read More »

Charles Hugh Smith – The Financial System is Headed for Collapse

SUBSCRIBE For The Latest Issues About ; #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ

Read More »

Read More »

All-Stars #72 Jeff Snider: The Supply-side of the Eurodollar equation

Please visit our website www.macrovoices.com to register your free account to gain access to supporting materials.

Read More »

Read More »