Category Archive: 5) Global Macro

Can sea creatures adapt to climate change? | The Economist

Horseshoe crabs predate the dinosaurs and have survived mass extinctions and major climatic shifts. Meet the biologist who is researching these living fossils to see if they could hold evolutionary secrets for marine species in the face of climate change.

Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy

For more from Economist Films visit: http://films.economist.com/

Check out The Economist’s full video catalogue:...

Read More »

Read More »

Can sea creatures adapt to climate change? | The Economist

Horseshoe crabs predate the dinosaurs and have survived mass extinctions and major climatic shifts. Meet the biologist who is researching these living fossils to see if they could hold evolutionary secrets for marine species in the face of climate change. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films …

Read More »

Read More »

The global economy doesn’t care about the ECB (nor any central bank)

The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.”They did it – and it didn’t take.Lagarde’s outreach was simply an act of admitting reality.

Read More »

Read More »

Dollar Mixed as Markets Await Fresh Drivers

The virus news stream is mixed; the dollar continues to consolidate; US-China tensions continue to rise. US Treasury wraps up its quarterly refunding; April budget statement is a harbinger of things to come; the next round of stimulus will be contentious. We got some dovish BOE comments yesterday; UK continues to play Brexit hardball; UK data was slightly better than expected but awful nonetheless.

Read More »

Read More »

Different Type of Crisis, Some Old Concerns

Over the past two months we have witnessed historic turmoil followed by unprecedented intervention by policy makers and central banks in supporting the capital markets (and more). In many ways the 2020 COVID-19 pandemic is very different from the 2008 global financial crisis, but for some, certain old concerns still linger. In the face of short selling bans and worries about market liquidity, we discuss below how best to navigate some of the common...

Read More »

Read More »

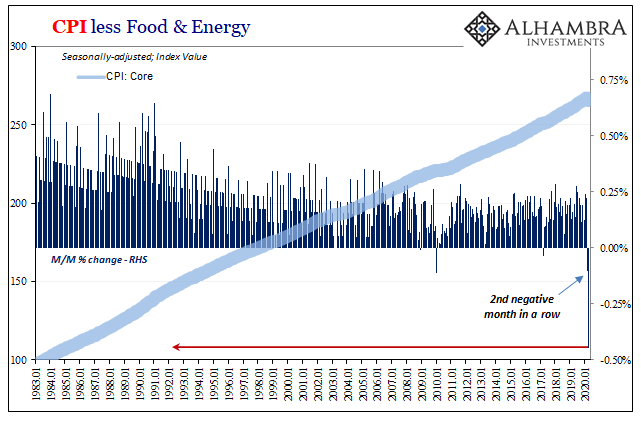

A Big One For The Big “D”

From a monetary policy perspective, smooth is what you are aiming for. What central bankers want in this age of expectations management is for a little bit of steady inflation. Why not zero? Because, they decided, policymakers need some margin of error. Since there is no money in monetary policy, it takes time for oblique “stimulus” signals to feed into the psychology of markets and the economy.

Read More »

Read More »

How covid-19 could change the financial world order | The Economist

America has dominated global finance for decades. But could covid-19 tip the balance of financial power in China's favour?

Further reading:

Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19 coverage: https://econ.trib.al/YD53WI6

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ

Read Matthieu Favas’ special report here: https://econ.st/3fAPKu1

How the pandemic is driving...

Read More »

Read More »

How covid-19 could change the financial world order | The Economist

America has dominated global finance for decades. But could covid-19 tip the balance of financial power in China’s favour? Further reading: Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19 coverage: https://econ.trib.al/YD53WI6 Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ Read Matthieu Favas’ special report here: …

Read More »

Read More »

The Way of the Tao Is Reversal

As Jackson Browne put it: Don't think it won't happen just because it hasn't happened yet. We can summarize all that will unfold in the next few years in one line: The way of the Tao is reversal. This is the opening line of Chapter 40 of Lao Tzu's 5,000-character commentary on the Tao, The Tao Te Ching. There are many translations of this slim volume, and for a variety of reasons I favor the 1975 translation by my old professor at the University of...

Read More »

Read More »

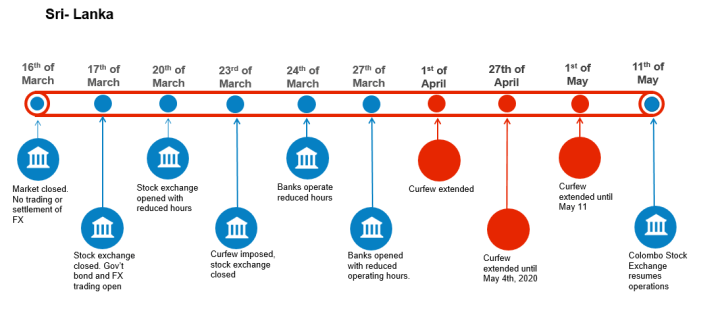

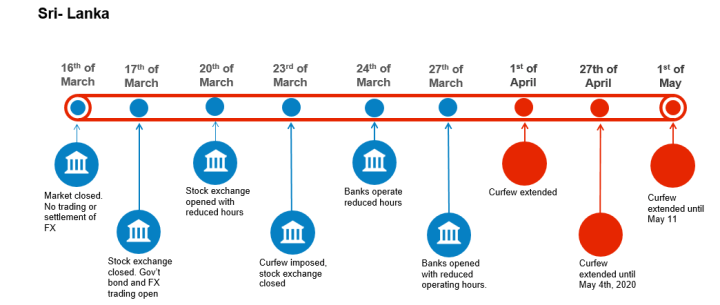

Restricted Market Trading Comments

Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below.

Read More »

Read More »

Surviving 2020 #3: Plans A, B and C

Readers ask for specific recommendations for successfully navigating the post-credit/speculative-bubble era and I try to do so while explaining the impossibility of the task. As the bogus prosperity economy built on exponential growth of debt implodes, we all seek ways to protect ourselves, our families and our worldly assets.

Read More »

Read More »

Everyone Knows The Gov’t Wants A ‘Controlled’ Weimar

There are two parts behind the inflation mongering. The first, noted yesterday, is the Fed’s balance sheet, particularly its supposedly monetary remainder called bank reserves. The central bank is busy doing something, a whole bunch of something, therefore how can it possibly turn out to be anything other than inflationary?The answer: the Federal Reserve is not a central bank, not really.

Read More »

Read More »

Covid-19: how it will change the world | The Economist

Even when covid-19 is under control, the long-term effects of the virus will be far-reaching. How will the coronavirus pandemic—and the way it has been handled—change the world? Read more here: https://econ.st/2yEhCg9

Further reading:

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ

Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19 coverage: https://econ.trib.al/YD53WI6...

Read More »

Read More »

Covid-19: how it will change the world | The Economist

Even when covid-19 is under control, the long-term effects of the virus will be far-reaching. How will the coronavirus pandemic—and the way it has been handled—change the world? Read more here: https://econ.st/2yEhCg9 Further reading: Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ Sign up to The Economist’s daily newsletter to keep up to …

Read More »

Read More »

Dollar Mixed as Doves Fly

Measures of cross-market implied volatility have been stable for a few weeks now. Weekly jobless claims are expected at 3 mln; reports suggest House Democrats are pushing ahead with a possible vote next week on another relief package. Canada reports April Ivey PMI; Peru is expected to keep rates steady; Brazil COPOM delivered a dovish surprise last night.

Read More »

Read More »

We All Know Who’s On First, But What’s On Second?

It wasn’t entirely unexpected, though when it was announced it was still quite a lot to take in. On September 1, 2005, the Bureau of Economic Analysis (BEA) reported that the nation’s personal savings rate had turned negative during the month of July. The press release announcing the number, in trying to explain the result was reduced instead to a tautology, “The negative personal saving reflects personal outlays that exceed disposable personal...

Read More »

Read More »

Negative News from Europe Helps Dollar Build on Gains

UK has been confirmed to have the highest death toll in Europe the dollar is getting more traction. Reports suggest Congress is resisting President Trump’s call for a payroll tax cut; ADP private sector jobs data is expected to come in at -21 mln. Brazil is expected to cut rates 50 bp; Fitch cut its outlook on Brazil to negative; Chile is expected to keep rates steady.

Read More »

Read More »

Where the Rubber Meets the Road

Longtime correspondent Paul B. suggested I re-publish three essays that have renewed relevance. This is the second essay, from July 2008. Thank you, Paul, for the suggestion. I received this timely inquiry from astute reader Paul B.: I'm interested in # 1, while you seem to take into account 300 million people in your writings--would you comment on rubber-meets-the-road impacts and proactive actions we can take to help shield ourselves (and our...

Read More »

Read More »

Wrenching And Immediate Jobs Problem, Just As Consumer Prices Must Rise

Charles Hugh Smith joins us to discuss the economic reality on Main Street, totally disconnected from Wall Street. From the abrupt loss of jobs, to a consumer that’s nowhere to be found and inflation ready to run rampant, here’s robust discussion about these unprecedented, dark times… Some of the questions that developed during today’s discussion: …

Read More »

Read More »

Restricted Market Trading Comments

Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity.

Read More »

Read More »