Category Archive: 5) Global Macro

Not This Again: Too Many Treasuries?

Tomorrow, the Treasury Department is going to announce the results of its latest bond auction. A truly massive one, $47 billion are being offered of CAH4’s notes dated August 31, 2020, maturing out in August 31, 2027. In other words, the belly of the belly, the 7s.We’ve already seen them drop for two note auctions this week, both equally sizable.

Read More »

Read More »

Fed Watch – “Banking in The Shadows with Jeff Snider” – FED 20

Today, we have the privilege to sit down with Head of Global Research at Alhambra Investments Jeff Snider. We run through the basics of the eurodollar system, why people get it wrong when talking about the Fed, and where we are going from here. Of course, we finish up getting Jeff to talk about bitcoin, and what he says might surprise you!

Alhambra Investments: https://alhambrapartners.com/commentaryanalysis/

Alhambra Youtube:...

Read More »

Read More »

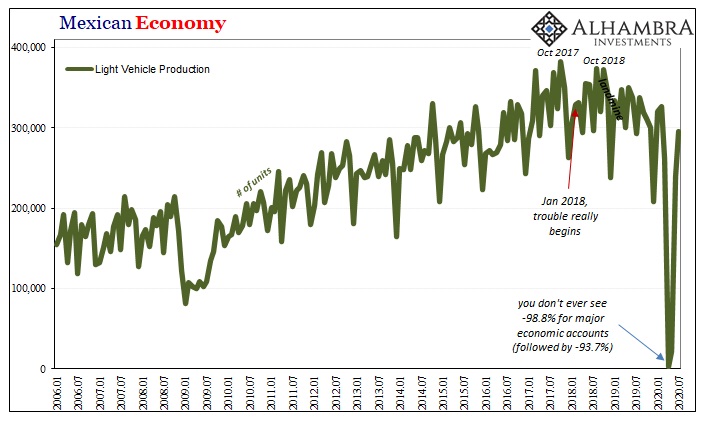

Meaning Mexico

It took some doing, and some time, but Mexico has managed to bring its car production back up to more normal levels. For two months, there had been practically zero automaking in one of the biggest auto-producing nations. Getting back near where things left off, however, isn’t exactly a “V” shaped recovery; it’s only halfway.

Read More »

Read More »

Dollar University with Jeff snider, is the Dollar really going down? #finance

Subscribe here for more : http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

Support! ;) http://www.ko-fi.com/aminray

#fed #reserve #trade #economy #dollar #bloomberg #neworldorder #finance #bitcoin

Dollar University with Jeff snider, is the Dollar really going down? #finance

Read More »

Read More »

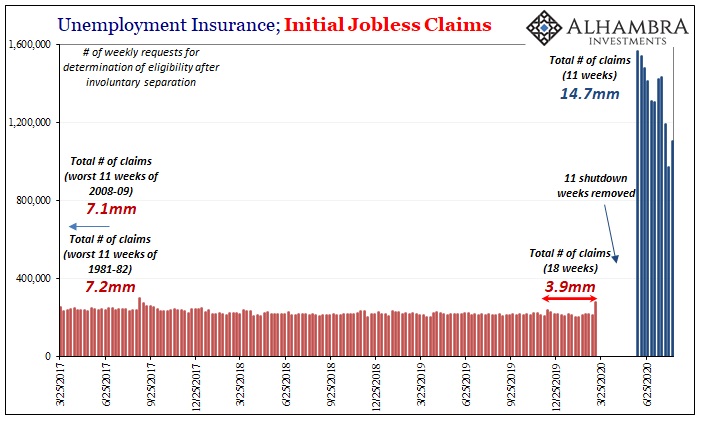

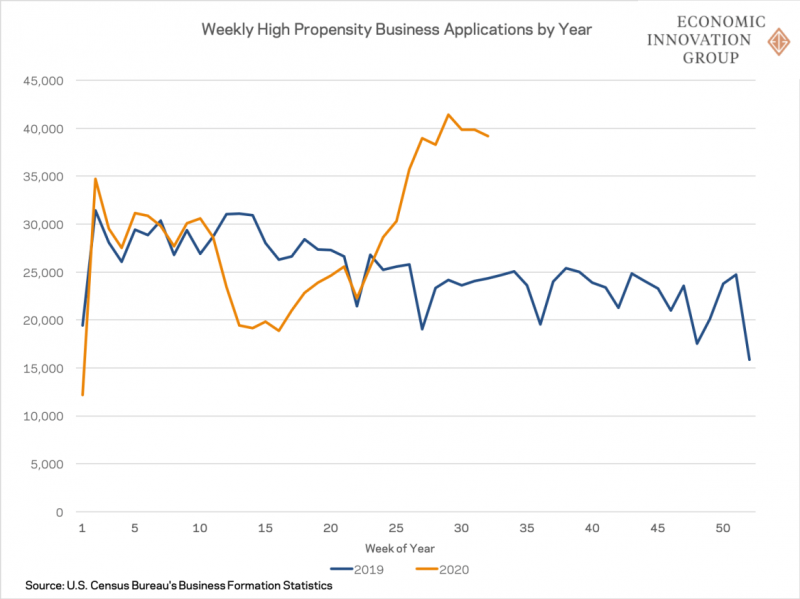

*These* Are The Real Huge Jobs Numbers, And They Will Make Your Blood Run Cold

There is simply no way to spin these figures as anything good. Not just the usual ones were talking about here, but more so some new data that you probably haven’t seen before. Beginning with the regular, it doesn’t matter that the level of initial jobless claims has declined substantially over the past few weeks

Read More »

Read More »

Will Skilled Hands-On Labor Finally Become More Valuable?

The sands beneath what's scarce and what's over-abundant are shifting. On a recent visit to the welding shop where my niece's husband works, I asked him if they had enough welders for their workload.

Read More »

Read More »

* WTF: What The Fed?! – Mike Maloney, Chris Martenson, Grant Williams, Charles Hugh Smith, A. Tagga

Watch the full event free at https://goldsilver.com/wtf

“The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs…

Something is not adding up.

And Mike Maloney agrees…

He recently recorded a free event dedicated exclusively to the topic of the Fed’s recent actions... to help you understand what it’s doing and what it means...

Read More »

Read More »

Monthly Macro Monitor – August 2020

One of the advantages we enjoy here at Alhambra is the opportunity to interact with a lot of investors. We talk to hundreds of individual investors on a monthly basis, giving us a front-row seat to everyone’s fear and greed. Economic data tells us about the past, which isn’t particularly useful for investors focused on the future.

Read More »

Read More »

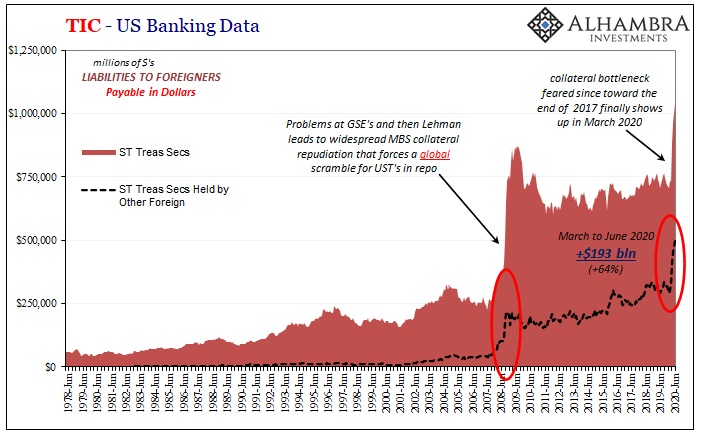

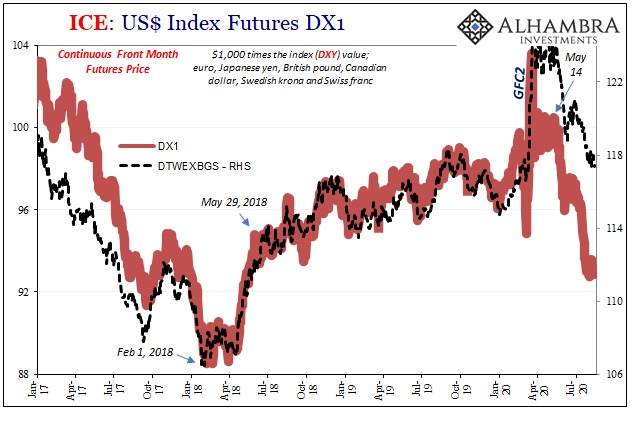

Part 2 of June TIC: The Dollar Why

Before getting into the why of the dollar’s stubbornly high exchange value in the face of so much “money printing”, we need to first go back and undertake a decent enough review of the guts maybe even the central focus of the global (euro)dollar system.

Read More »

Read More »

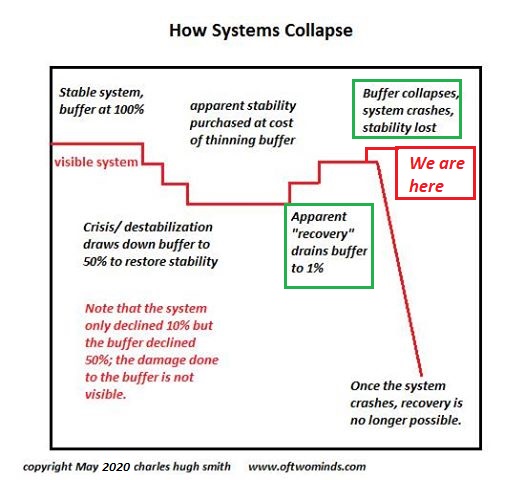

Our Systemic Drift to Collapse

Thus do the lazy complacent passengers drift inexorably toward the cataracts of collapse just ahead. The boat ride down to the waterfall of systemic collapse is not dramatic, it's lazy drifting: a lazy complacency that doing more of what worked in the past will work again, and an equally lazy disregard for how far the system has drifted from the point when things actually worked.

Read More »

Read More »

Where Has All the Carry Gone?

Despite broad-based dollar weakness, EM currencies have not fully participated in the risk on environment that’s now in place. The good news is that fundamentals matter again. The bad news is that there are a lot of EM countries with bad fundamentals, and the secular decline in carry no longer gives these weaklings any cover.

Read More »

Read More »

Part 1 of June TIC: The Dollar What

While the world is taking the smallest of baby steps in the right direction, mostly it’s been related to the part of the eurodollar system that everyone can see. Not bank reserves and the Fed’s “money printing”, though you can see them and we’re told to obsess about them those things don’t matter.

Read More »

Read More »

Covid-19: Bill Gates predicts the end of the pandemic | The Economist

Bill Gates had long warned of the risk that a new virus would go global. Now he explains to Zanny Minton Beddoes, our editor-in-chief, how—and when—the covid-19 pandemic is likely to end.

To find out more read here: https://econ.st/3aCqVvI

00:00 Introduction

00:50 Are we spending enough?

01:51 Why aren't we spending the billions to save the trillions?

03:35 What is realistic for the global coverage of a vaccine?

04:55 Will anti-vaxxers be a...

Read More »

Read More »

Case Study: Advances in Modular WWTP Design by Jeffrey Snider-Nevan, Newterra Decentralized Water

Webinar – Tuesday, August 18, 2020

With our many brands and vast water treatment technologies, we invite you to experience this online library of unique and informative presentations packed with valuable insight, new products & technologies, and product demonstrations relevant to today's water industry. Enjoy!

Newterra’s Reclaiming The World’s Water (A Virtual Expo by Newterra)

August 18 & 19, 2020

Read More »

Read More »

The Empire Will Strike Back: Dollar Supremacy Is the Fed’s Imperial Mandate

Triffin's Paradox demands painful trade-offs to issue a reserve currency, and it demands the issuing central bank serve two competing audiences and markets. Judging by the headlines and pundit chatter, the U.S. dollar is about to slide directly to zero. This sense of certitude is interesting, given that no empire prospered by devaluing its currency.

Read More »

Read More »

Here’s Why the “Impossible” Economic Collapse Is Unavoidable

This is why denormalization is an extinction event for much of our high-cost, high-complexity, heavily regulated economy. A collapse of major chunks of the economy is widely viewed as "impossible" because the federal government can borrow and spend unlimited amounts of money because the Federal Reserve can create unlimited amounts of money: the government borrows $1 trillion by selling $1 trillion in Treasury bonds, the Fed prints $1 trillion...

Read More »

Read More »

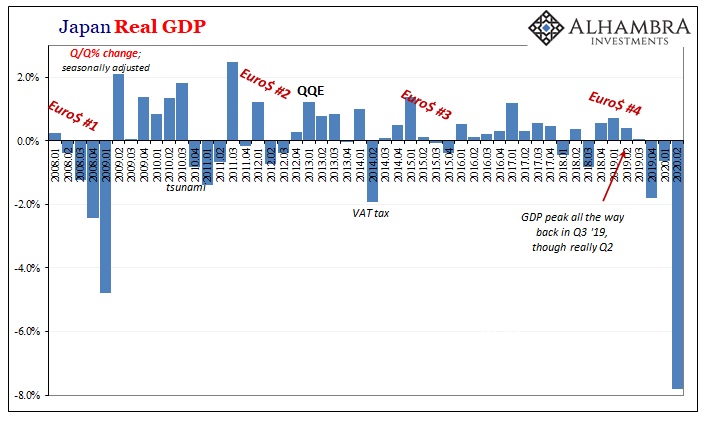

It Was Bad In The Other Sense, So Now What?

According to the latest figures, Japan has tallied 56,074 total coronavirus cases since the outbreak began, leading to the death of an estimated 1,103 Japanese citizens. Out of a total population north of 125 million, it’s hugely incongruous.

Read More »

Read More »

It’s Do-or-Die, Deep State: Either Strangle the Stock Market Rally Now or Cede the Election to Trump

With only 56 trading days and fewer than 80 calendar days to the election, the Deep State camps seeking to torpedo Trump's re-election have reached the do-or-die point. Back in June I speculated that the only way the Deep State could deep-six Trump's re-election was to sink the stock market rally, which the president has long touted as evidence of his economic leadership.

Read More »

Read More »

Covid-19: When will a vaccine be ready? | The Economist

Around $10bn is being spent on finding a vaccine for coronavirus—it’s not nearly enough. And even when a covid-19 vaccine is found how should it be distributed fairly? Our experts answer your questions.

00:50 - Will there ever be a “silver-bullet” vaccine?

01:41 - How long would it take for the whole world to be vaccinated?

02:25 - Who benefits financially from the vaccine?

03:54 - How much will each vaccine cost?

05:10 - What percentage of...

Read More »

Read More »