Category Archive: 5) Global Macro

Technology Is Not Just Disruptive, It’s Disastrously Deflationary

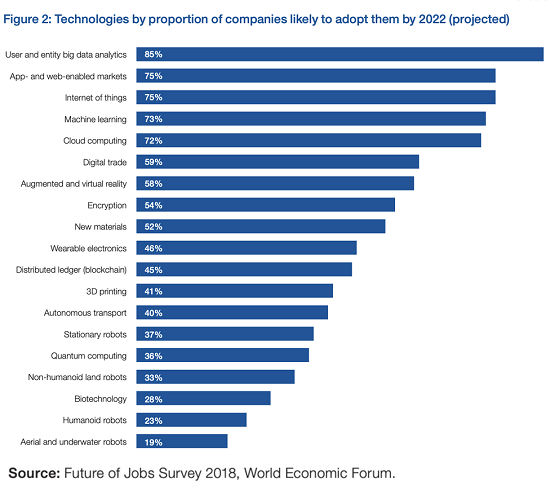

Deflation eats credit-dependent, mass-consumption economies alive from the inside. While AI (artificial intelligence) garners the headlines, the next wave of disruptive technologies extend far beyond AI: as the chart of technologies rapidly being adopted shows, this wave includes new materials and processes as well as the "usual suspects" of machine learning, natural language processing, data mining and so on.

Read More »

Read More »

The Transitory Story, I Repeat, The Transitory Story

Understand what the word “transitory” truly means in this context. It is no different than Ben Bernanke saying, essentially, subprime is contained. To the Fed Chairman in early 2007, this one little corner of the mortgage market in an otherwise booming economy was a transitory blip that booming economy would easily withstand.

Just eight days before Bernanke would testify confidently before Congress, the FOMC had met to discuss their lying eyes....

Read More »

Read More »

Charles Hugh Smith on the U.S.-China Trade War

Click here for the full transcript: http://financialrepressionauthority.com/2019/05/23/the-roundtable-insight-charles-hugh-smith-on-the-u-s-china-trade-war/

Read More »

Read More »

Proposed Negative Rates Really Expose The Bond Market’s Appreciation For What Is Nothing More Than Magic Number Theory

By far, the biggest problem in Economics is that it has no sense of itself. There are no self-correction mechanisms embedded within the discipline to make it disciplined. Without having any objective goals from which to measure, the goal is itself. Nobel Prize winning economist Ronald Coase talked about this deficiency in his Nobel Lecture:

Read More »

Read More »

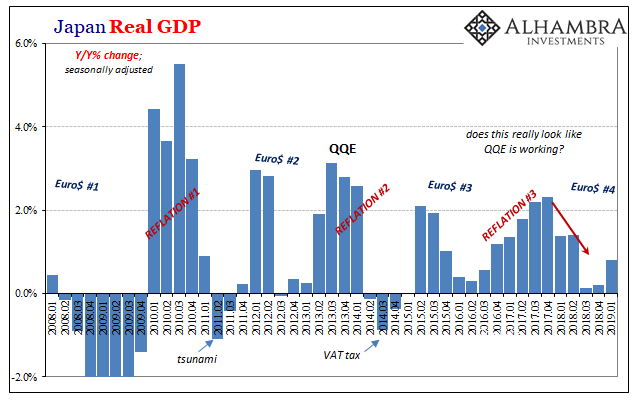

Weakening Japanese momentum behind strong GDP figures

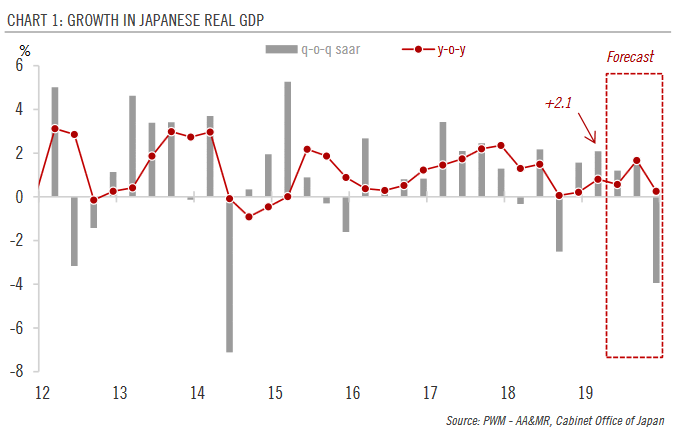

Japan’s latest GDP report reveals some notable weakness in the economy despite the strong headline figures.The preliminary reading of Japanese GDP for Q1 shows that the economy grew by 2.1% q-o-q annualised, beating the consensus forecast of -0.2%.However, behind the strong headline figures, details of the GDP report reveal some broad-based weakening in momentum.Declining corporate capex and sluggish household consumption both drag on domestic...

Read More »

Read More »

Why India’s election has stoked conflict | The Economist

India’s prime minister, Narendra Modi, has galvanised voters with an appeal to Hindu nationalism. But rising Hindu-Muslim violence is putting India’s historic secularism at risk. Read more here: https://econ.st/2M3ApHC Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy India, the world’s biggest democracy. 29 states, seven territories, 900m voters and one age-old fault line …

Read More »

Read More »

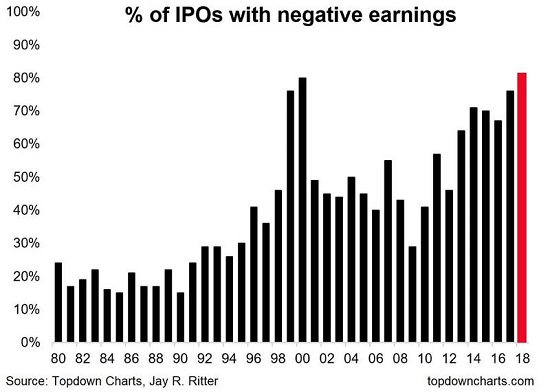

Two Intertwined Dynamics Are Transforming the Economy: Technology and Financialization

If you want to understand how the economy is being transformed, look at the intersection of Big Tech, financialization and the central state. The two dynamics transforming the economy--technology and financialization--are intertwined yet widely viewed as unrelated. Critics and proponents of each largely ignore the other dynamic: critics of institutionalized fraud and other manifestations of financialization implicitly assume the economy will return...

Read More »

Read More »

Why Europe’s nationalist parties all sound alike

Nationalist parties in the European Union are gaining momentum. At a time when the EU is increasingly fractured, they are united on many issues. What are they? Read more here: https://econ.st/2M0LERr Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Three European politicians. They speak different languages but they’re all singing the same tune. …

Read More »

Read More »

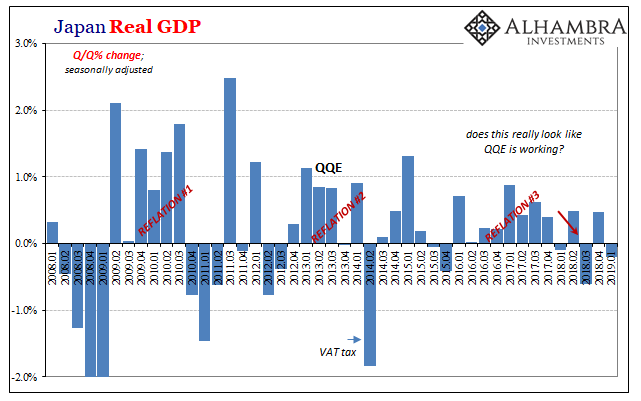

Japan’s Surprise Positive Is A Huge Minus

Preliminary estimates show that Japanese GDP surprised to the upside by a significant amount. According to Japan’s Cabinet Office, Real GDP expanded by 0.5% (seasonally-adjusted) in the first quarter of 2019 from the last quarter of 2018. That’s an annual rate of +2.1%. Most analysts had been expecting around a 0.2% contraction, which would’ve been the third quarterly minus out of the last five.

Read More »

Read More »

The Normalization and Institutionalization of Fraud

Normalizing and institutionalizing fraud undermines the foundations of the economy and the financial system. I am indebted to Manoj Samanta (twitter: @flation_debate) for the insightful concept the commoditization of fraud. The first step in the commoditization of fraud is to normalize fraud as Business as Usual (BAU) to the point that it's no longer viewed as "wrong," destructive or an aberration of evil-doers but as an accepted way to maximize...

Read More »

Read More »

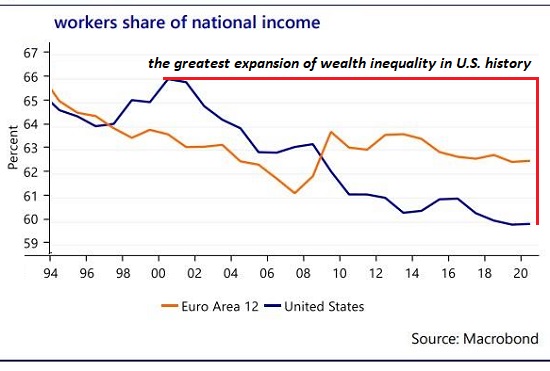

Downward Mobility Matters More Than Liberal-Conservative Labels

The real heresy here is the American economy is now rigged for downward mobility. In the conventional narrative, one's economic class is overshadowed by one's political belief structure: liberal, conservative, libertarian, etc. In terms of economic class, the conventional narrative divides people into their ideological beliefs about economic ideologies: free market capitalism, socialism, etc.

Read More »

Read More »

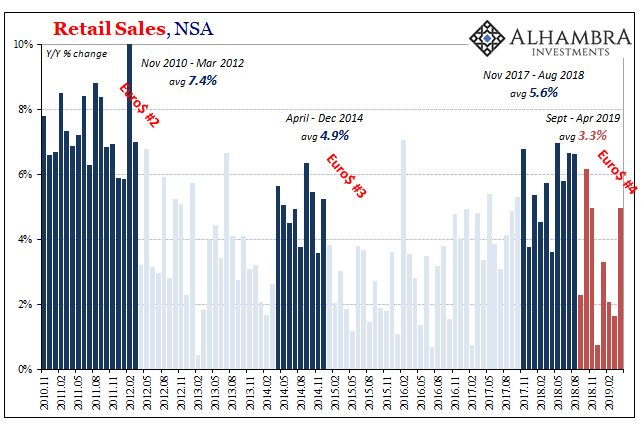

Global Doves Expire: Fed Pause Fizzles (US Retail Sales)

Before the stock market’s slide beginning in early October, for most people they heard the economy was booming, the labor market was unbelievably good, an inflationary breakout just over the horizon. Jay Powell did as much as anyone to foster this belief, chief caretaker to the narrative. He and his fellow central bankers couldn’t use the word “strong” enough.

Read More »

Read More »

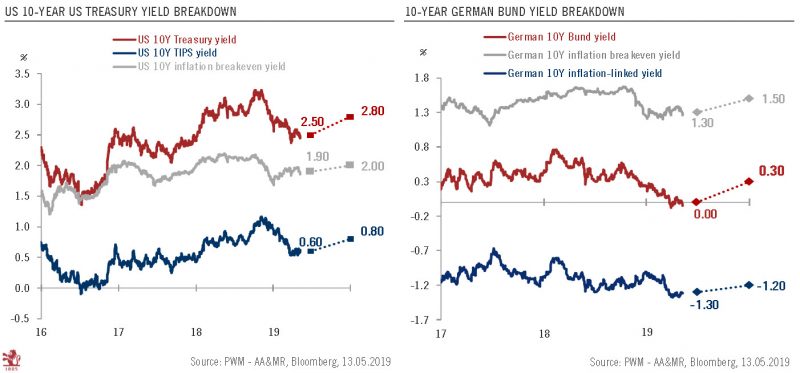

Core sovereign bond yields – update

We are adjusting downward our year-end targets for the 10-year US Treasury and Bund yields.Taking hold of two important changes to our central macroeconomic scenarios, we are adjusting downward our year-end target for the 10-year US Treasury yield from 3.0% to 2.8% and the Bund yield from 0.5% to 0.3%.

Read More »

Read More »

Effective Recession First In Japan?

For a lot of people, a recession is two consecutive quarters of negative GDP. This is called the technical definition in the mainstream and financial media. While this specific pattern can indicate a change in the business cycle, it’s really only one narrow case. Recessions are not just tied to GDP. In the US, the Economists who make the determination (the NBER) will tell you recessions aren’t always so straightforward.

Read More »

Read More »

Why is vanilla so expensive? | The Economist

In recent years, natural vanilla has sometimes been more expensive than silver by weight. Vanilla farmers in Madagascar are cashing in—but violence, theft and volatile markets are threatening their prospects. Read more here: https://econ.st/2W5qwNB Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy From ice cream to cakes and even perfume, vanilla is the …

Read More »

Read More »

The Economy Has Fundamentally Changed in the 21st Century–and Not for the Better

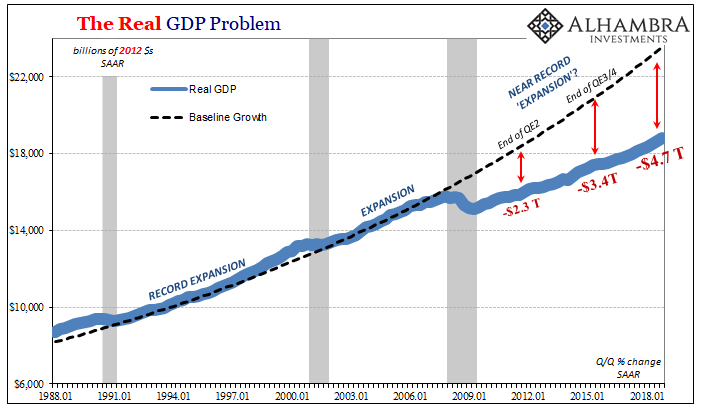

The net result is we have an economy that's supposedly expanding smartly while our well-being and financial security are collapsing. Gross Domestic Product (GDP) and other metrics of economic activity don't measure either broad-based prosperity or well-being. Elites skimming financialization profits by expanding corporate debt and issuing more loans to commoners while spending more on their lifestyles boosts GDP quite nicely while the security and...

Read More »

Read More »

Jeffrey P. Snider of Alhambra Investments speaks on impact of tariff trade | EXCLUSIVE

Alhambra Investments’ Head of Global Research, Jeffrey Snider speaks to ET NOW. He talks about the US-China trade war and its impact on emerging markets, exchanges stock portfolios in India, bond market pricing. He said that he sees significant market risk in equities and that the economic uncertainties will continue. He also said that US …

Read More »

Read More »

Burnout Nation

A number of recent surveys reflect a widespread sense of financial stress and symptoms of poor health in America's workers, particularly the younger generations. There's no real mystery as to the cause of this economic anxiety:

Read More »

Read More »

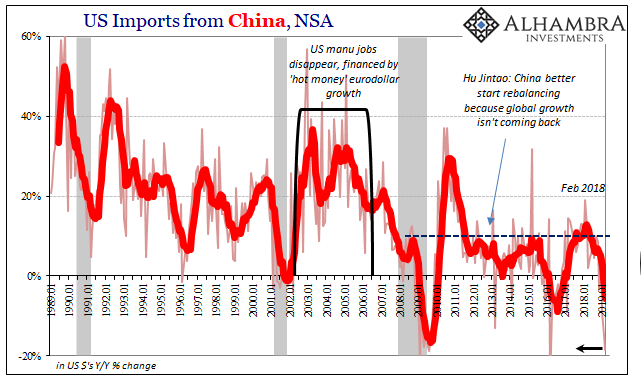

Trade Wars Have Arrived, But It’s Trade Winter That Hurts

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year.

Read More »

Read More »

Unrealistically Great Expectations

Let's see if we can tie together four social dynamics: the elite college admissions scandal, the decline in social mobility, the rising sense of entitlement and the unrealistically 'great expectations' of many Americans. As many have noted, the nation's financial and status rewards are increasingly flowing to the top 5%, what many call a winner-take-all or winner-take-most economy.

Read More »

Read More »