Category Archive: 5) Global Macro

Sterling Pounded by Brexit Developments

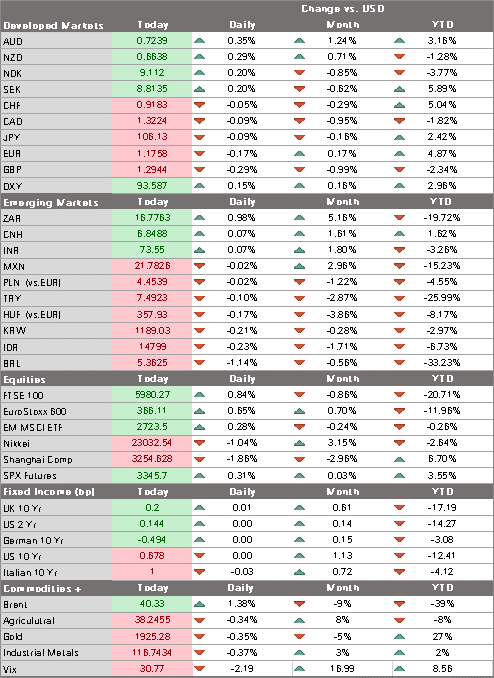

The dollar rebound continues; odds of a near-term stimulus bill in the US are falling; ahead of inflation readings later this week, the US holds a 10-year auction today. Bank of Canada is expected to keep policy steady; Mexico reports August CPI; Brazil reports August IPCA inflation.

Read More »

Read More »

ECB Preview

The ECB meets tomorrow and is widely expected to stand pat. Macro forecasts may be tweaked modestly and there are some risks of jawboning against the stronger euro, but it should otherwise be an uneventful meeting. Looking ahead, a lot of room remains for further ECB actions.

Read More »

Read More »

Bottleneck In Japanese

Japan’s yen is backward, at least so far as its trading direction may be concerned. This is all the more confusing especially over the past few months when this rising yen has actually been aiding the dollar crash narrative while in reality moving the opposite way from how the dollar system would be behaving if it was really happening.

Read More »

Read More »

The Economist Essentials: Public Debt | The Economist

The covid-19 pandemic is set to increase public debt to levels last seen after the second world war. But is rising public debt a cause for concern? New economic thinking suggests perhaps not, at least for now.

Further reading:

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/31E02VY

Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19 coverage: https://econ.st/3ghRh7W

Why economics...

Read More »

Read More »

Charles Hugh Smith on Intensifying Financial Repression Risks

Charles Hugh Smith on Intensifying Financial Repression Risks

http://financialrepressionauthority.com/2020/09/07/the-roundtable-insight-charles-hugh-smith-on-intensifying-financial-repression-risks/

Receive trading ideas weekly from Yra: https://cedarportfolio.com/yra-signup-form

Read More »

Read More »

Monthly Market Monitor – August 2020

Many of the weak dollar trends I noted in June’s update have moderated – even as the dollar has weakened further. US stocks surged over the last month, with growth indices leaving their value counterparts in the dust…again.

Read More »

Read More »

EM Preview for the Week Ahead

EM performance this week will hinge crucially on whether US equity markets can find some traction. If sustained, last week’s equity rout could lead to a deeper generalized risk-off trading environment this week that would weigh on EM FX and equities.

Read More »

Read More »

Jeff Snider talks INFLATION, DEFLATION

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

?? Support! ;) http://www.ko-fi.com/aminray

#fed #reserve #trade #economy #dollar #bloomberg #neworldorder #finance #bitcoin

Jeff Snider talks INFLATION, DEFLATION

Read More »

Read More »

Eurodollar University’s Making Sense; Episode 24, Part 2: Peering Behind The (Unemployment Rate) Curtain

———WHERE———

AlhambraTube: https://bit.ly/2Xp3roy

Apple: https://apple.co/3czMcWN

iHeart: https://ihr.fm/31jq7cI

Castro: https://bit.ly/30DMYza

TuneIn: http://tun.in/pjT2Z

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Castbox: https://bit.ly/3fJR5xQ

Breaker: https://bit.ly/2CpHAFO

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

Overcast: https://bit.ly/2YyDsLa

SoundCloud: https://bit.ly/3l0yFfK...

Read More »

Read More »

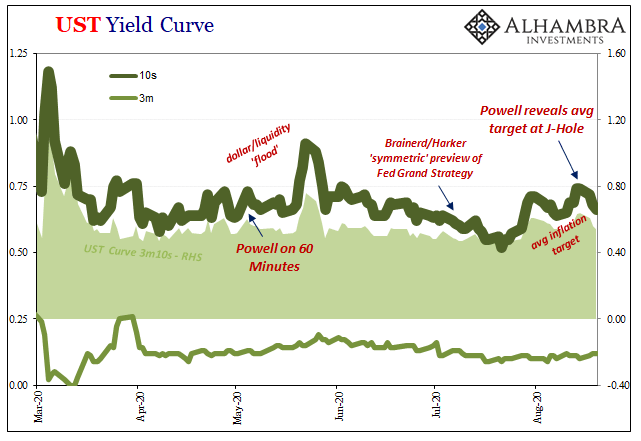

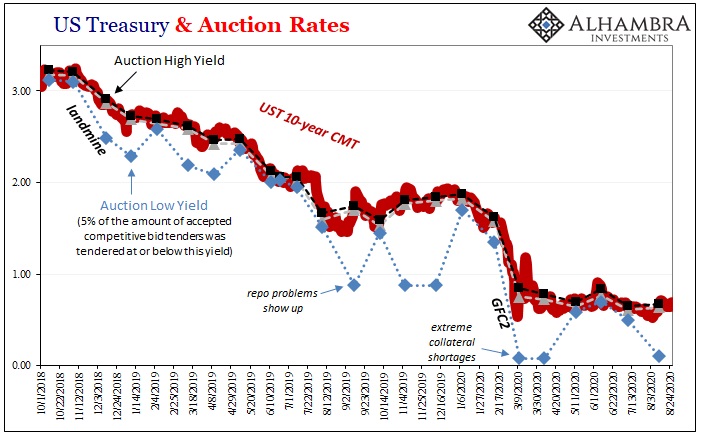

Powell Would Ask For His Money Back, If The Fed Did Money

Since the unnecessary destruction brought about by GFC2 in March 2020, there have been two detectable, short run trendline upward moves in nominal Treasury yields. Both were predictably classified across the entire financial media as the guaranteed first steps toward the “inevitable” BOND ROUT!!!!

Read More »

Read More »

Eurodollars & Global Deflation Risk W/ Jeff Snider | Expert View | Real Vision™

Is the global economy poised to enter another deflationary cycle? Jeff Snider, head of global research and chief investment strategist at Alhambra Partners, believes that we have never enjoyed a true recovery from the global financial crisis - but instead, have merely bounced between cycles of deflation and reflation. In this piece, Snider unpacks the importance of Eurodollars as a key to understanding where the global economy is headed next....

Read More »

Read More »

China v America: why universities are on the front line | The Economist

The covid-19 pandemic could cause a massive drop in the number of Chinese students travelling abroad. That would be disastrous for many Western universities—but for the Chinese government, it is a geopolitical opportunity. Read more here: https://econ.st/3557Pxz

Further reading:

Find The Economist’s most recent coverage of covid-19: https://econ.st/2CQRUr2

Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19...

Read More »

Read More »

Writing Rebound in Italian

As the calendar turned to September, the US Centers for Disease Control and Prevention (CDC) issued new guidelines expanding and extending existing moratoriums previously put in place to stop evictions during the pandemic.

Read More »

Read More »

Jeff Snider talks INFLATION, DEFLATION (RCS Ep75)

Interview original date: July 22nd, 2020

Topics: Jeff’s definition of Deflation, Inflation. Monetary Deflation. Consumer behavior and its effect on prices. Production, wages/income, labor market, labor market destruction. UBI, demand, unemployment, supply, spending, savings, credit. 1930s and destruction of deflation, 1800s and deflation then. Did the Long Depression really exist? Gold Standard after the Civil War, fixed money supply, silver...

Read More »

Read More »

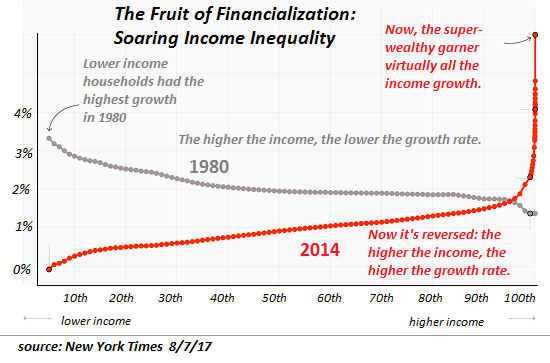

Deflation of the Citizenry’s Hard Assets Will Be a Huge Buying Opportunity for Insider Power Elites

The gravy train will have to stop at some point, but right now the global elites have pushed their chips on to the U.S. dollar and stocks. Editor's note: This is a guest post by my friend and colleague Zeus Yiamouyiannis, Ph.D., who has contributed essays to Of Two Minds since 2009.

Read More »

Read More »

Drivers for the Week Ahead

The dollar is likely to remain under pressure after Powell’s dovish message at Jackson Hole. August jobs data Friday will be the data highlight of the week. The Fed releases its Beige Book report Wednesday; Powell will face many questions about the Framework Review that he unveiled at Jackson Hole.

Read More »

Read More »

Nihilism Embodied: Our Lawless Financial System

Not only have the billionaire class made money, they have tightened their monopolistic grip on the levers of money supply and distribution, turning a global rigged casino into a global company town.

Read More »

Read More »

America’s Metastasizing Class Wars

Class wars are the inevitable result of an economic system in which 'anything goes if you're rich enough and winners take most'. The traditional class war has been waged between wage-earners (who sell their labor) and their employers (owners of capital and the means of production).

Read More »

Read More »

This Has To Be A Joke, Because If It’s Not…

After thinking about it all day, I’m still not quite sure this isn’t a joke; a high-brow commitment of utterly brilliant performance art, the kind of Four-D masterpiece of hilarious deception that Andy Kaufman would’ve gone nuts over. I mean, it has to be, right?I’m talking, of course, about Jackson Hole and Jay Powell’s reportedly genius masterstroke.

Read More »

Read More »

America’s stimulus package: is it working? | The Economist

America has spent trillions of dollars on stimulus packages to prop up its economy in the face of the covid-19 pandemic. But is it working—and what will the long-term effects be? Our experts answer your questions.

Question timecodes:

00:00 Introduction to US economic stimulus

00:44 Where does the stimulus money come from?

01:43 Will the funds actually reach the people who need it most?

03:00 How does the American economic stimulus compare to other...

Read More »

Read More »