Category Archive: 5) Global Macro

Writing Rebound in Italian

As the calendar turned to September, the US Centers for Disease Control and Prevention (CDC) issued new guidelines expanding and extending existing moratoriums previously put in place to stop evictions during the pandemic.

Read More »

Read More »

Jeff Snider talks INFLATION, DEFLATION (RCS Ep75)

Interview original date: July 22nd, 2020

Topics: Jeff’s definition of Deflation, Inflation. Monetary Deflation. Consumer behavior and its effect on prices. Production, wages/income, labor market, labor market destruction. UBI, demand, unemployment, supply, spending, savings, credit. 1930s and destruction of deflation, 1800s and deflation then. Did the Long Depression really exist? Gold Standard after the Civil War, fixed money supply, silver...

Read More »

Read More »

Deflation of the Citizenry’s Hard Assets Will Be a Huge Buying Opportunity for Insider Power Elites

The gravy train will have to stop at some point, but right now the global elites have pushed their chips on to the U.S. dollar and stocks. Editor's note: This is a guest post by my friend and colleague Zeus Yiamouyiannis, Ph.D., who has contributed essays to Of Two Minds since 2009.

Read More »

Read More »

Drivers for the Week Ahead

The dollar is likely to remain under pressure after Powell’s dovish message at Jackson Hole. August jobs data Friday will be the data highlight of the week. The Fed releases its Beige Book report Wednesday; Powell will face many questions about the Framework Review that he unveiled at Jackson Hole.

Read More »

Read More »

Nihilism Embodied: Our Lawless Financial System

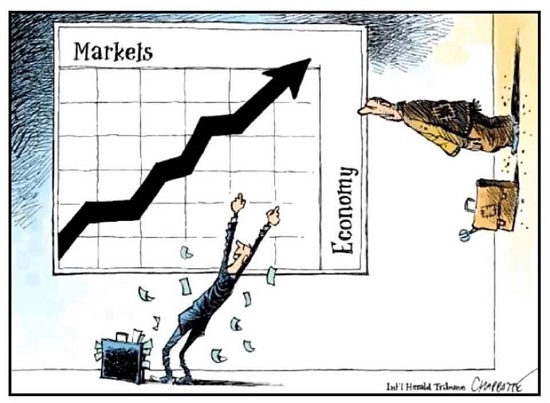

Not only have the billionaire class made money, they have tightened their monopolistic grip on the levers of money supply and distribution, turning a global rigged casino into a global company town.

Read More »

Read More »

America’s Metastasizing Class Wars

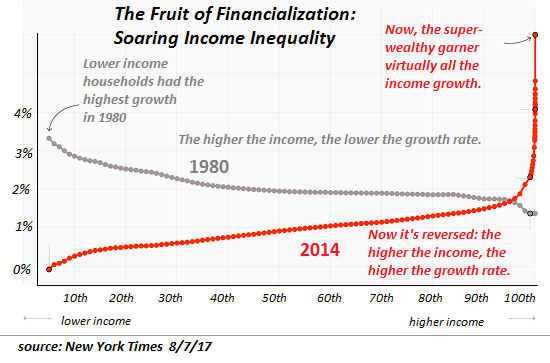

Class wars are the inevitable result of an economic system in which 'anything goes if you're rich enough and winners take most'. The traditional class war has been waged between wage-earners (who sell their labor) and their employers (owners of capital and the means of production).

Read More »

Read More »

This Has To Be A Joke, Because If It’s Not…

After thinking about it all day, I’m still not quite sure this isn’t a joke; a high-brow commitment of utterly brilliant performance art, the kind of Four-D masterpiece of hilarious deception that Andy Kaufman would’ve gone nuts over. I mean, it has to be, right?I’m talking, of course, about Jackson Hole and Jay Powell’s reportedly genius masterstroke.

Read More »

Read More »

America’s stimulus package: is it working? | The Economist

America has spent trillions of dollars on stimulus packages to prop up its economy in the face of the covid-19 pandemic. But is it working—and what will the long-term effects be? Our experts answer your questions.

Question timecodes:

00:00 Introduction to US economic stimulus

00:44 Where does the stimulus money come from?

01:43 Will the funds actually reach the people who need it most?

03:00 How does the American economic stimulus compare to other...

Read More »

Read More »

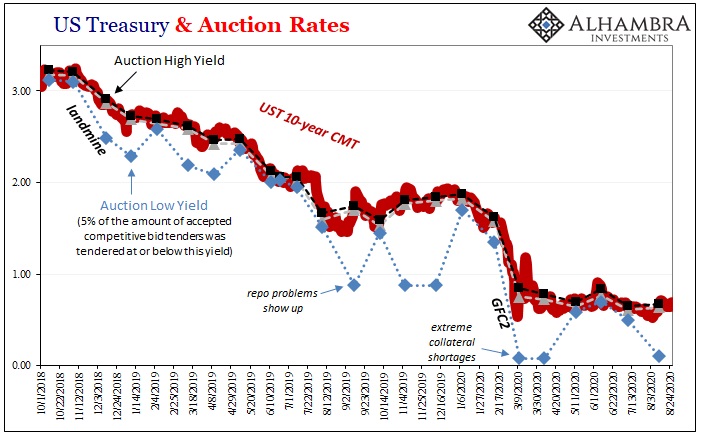

Not This Again: Too Many Treasuries?

Tomorrow, the Treasury Department is going to announce the results of its latest bond auction. A truly massive one, $47 billion are being offered of CAH4’s notes dated August 31, 2020, maturing out in August 31, 2027. In other words, the belly of the belly, the 7s.We’ve already seen them drop for two note auctions this week, both equally sizable.

Read More »

Read More »

Fed Watch – “Banking in The Shadows with Jeff Snider” – FED 20

Today, we have the privilege to sit down with Head of Global Research at Alhambra Investments Jeff Snider. We run through the basics of the eurodollar system, why people get it wrong when talking about the Fed, and where we are going from here. Of course, we finish up getting Jeff to talk about bitcoin, and what he says might surprise you!

Alhambra Investments: https://alhambrapartners.com/commentaryanalysis/

Alhambra Youtube:...

Read More »

Read More »

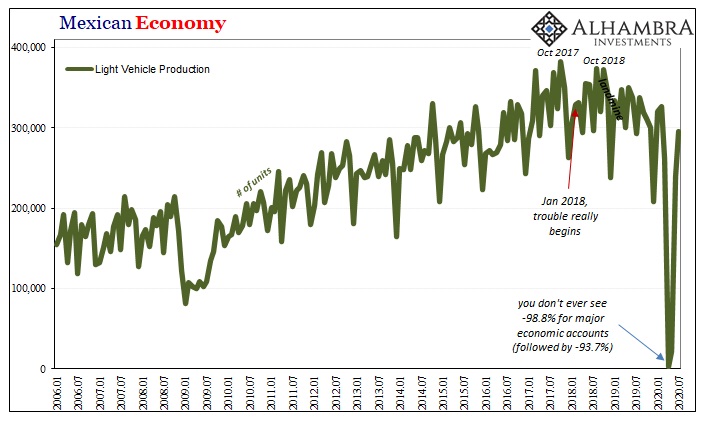

Meaning Mexico

It took some doing, and some time, but Mexico has managed to bring its car production back up to more normal levels. For two months, there had been practically zero automaking in one of the biggest auto-producing nations. Getting back near where things left off, however, isn’t exactly a “V” shaped recovery; it’s only halfway.

Read More »

Read More »

Dollar University with Jeff snider, is the Dollar really going down? #finance

Subscribe here for more : http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

Support! ;) http://www.ko-fi.com/aminray

#fed #reserve #trade #economy #dollar #bloomberg #neworldorder #finance #bitcoin

Dollar University with Jeff snider, is the Dollar really going down? #finance

Read More »

Read More »

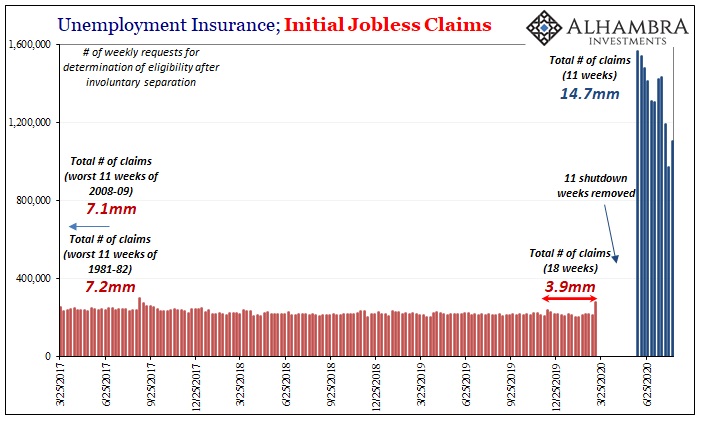

*These* Are The Real Huge Jobs Numbers, And They Will Make Your Blood Run Cold

There is simply no way to spin these figures as anything good. Not just the usual ones were talking about here, but more so some new data that you probably haven’t seen before. Beginning with the regular, it doesn’t matter that the level of initial jobless claims has declined substantially over the past few weeks

Read More »

Read More »

Will Skilled Hands-On Labor Finally Become More Valuable?

The sands beneath what's scarce and what's over-abundant are shifting. On a recent visit to the welding shop where my niece's husband works, I asked him if they had enough welders for their workload.

Read More »

Read More »

* WTF: What The Fed?! – Mike Maloney, Chris Martenson, Grant Williams, Charles Hugh Smith, A. Tagga

Watch the full event free at https://goldsilver.com/wtf

“The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs…

Something is not adding up.

And Mike Maloney agrees…

He recently recorded a free event dedicated exclusively to the topic of the Fed’s recent actions... to help you understand what it’s doing and what it means...

Read More »

Read More »

Monthly Macro Monitor – August 2020

One of the advantages we enjoy here at Alhambra is the opportunity to interact with a lot of investors. We talk to hundreds of individual investors on a monthly basis, giving us a front-row seat to everyone’s fear and greed. Economic data tells us about the past, which isn’t particularly useful for investors focused on the future.

Read More »

Read More »

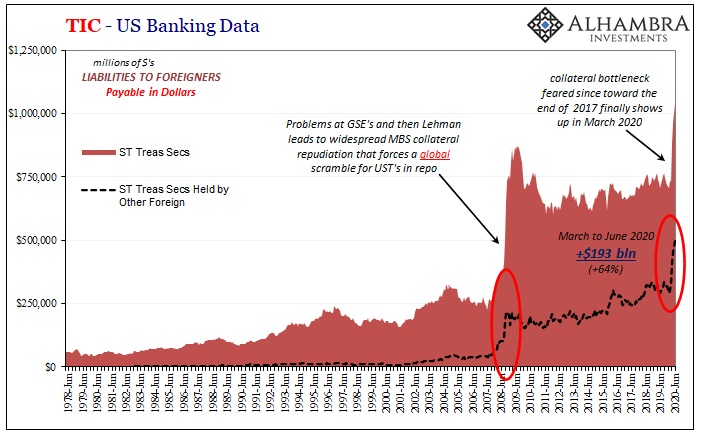

Part 2 of June TIC: The Dollar Why

Before getting into the why of the dollar’s stubbornly high exchange value in the face of so much “money printing”, we need to first go back and undertake a decent enough review of the guts maybe even the central focus of the global (euro)dollar system.

Read More »

Read More »

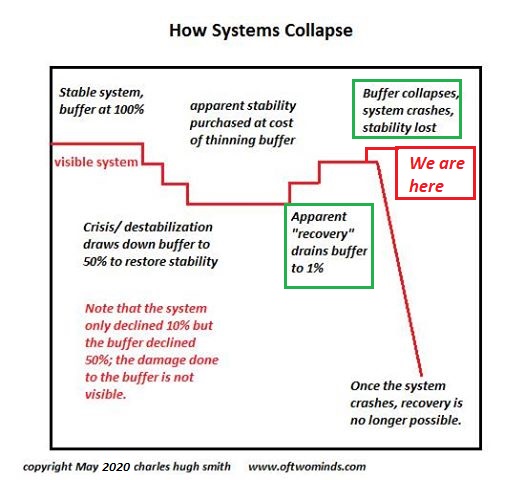

Our Systemic Drift to Collapse

Thus do the lazy complacent passengers drift inexorably toward the cataracts of collapse just ahead. The boat ride down to the waterfall of systemic collapse is not dramatic, it's lazy drifting: a lazy complacency that doing more of what worked in the past will work again, and an equally lazy disregard for how far the system has drifted from the point when things actually worked.

Read More »

Read More »

Where Has All the Carry Gone?

Despite broad-based dollar weakness, EM currencies have not fully participated in the risk on environment that’s now in place. The good news is that fundamentals matter again. The bad news is that there are a lot of EM countries with bad fundamentals, and the secular decline in carry no longer gives these weaklings any cover.

Read More »

Read More »