Category Archive: 5.) Charles Hugh Smith

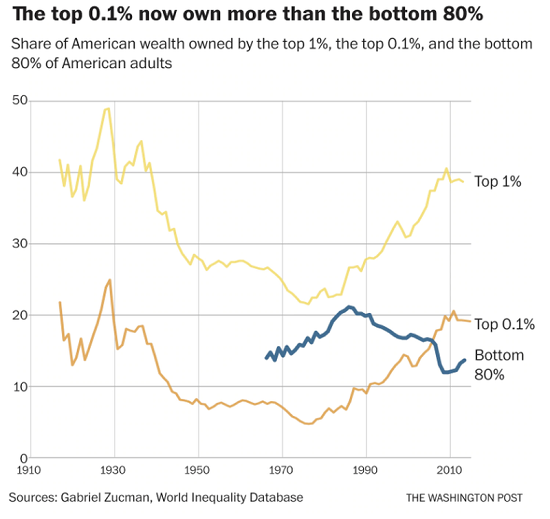

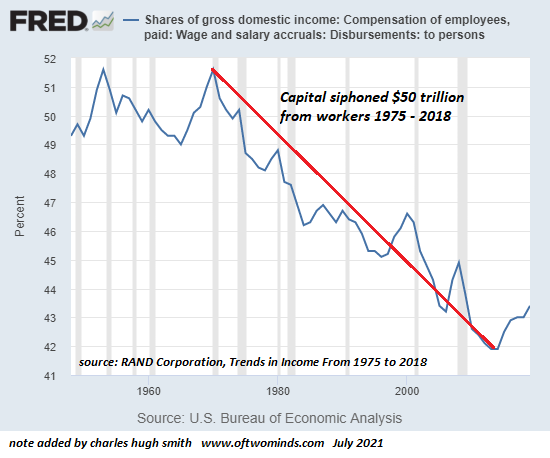

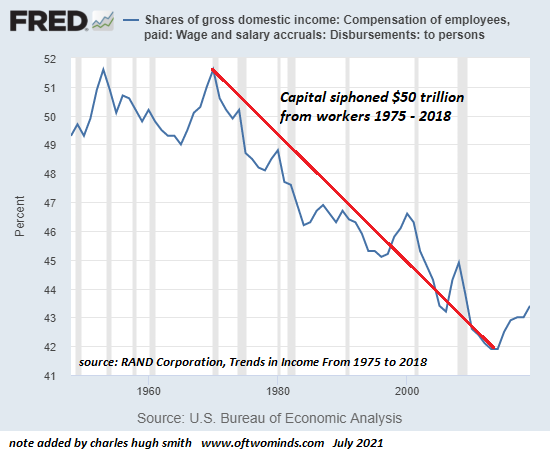

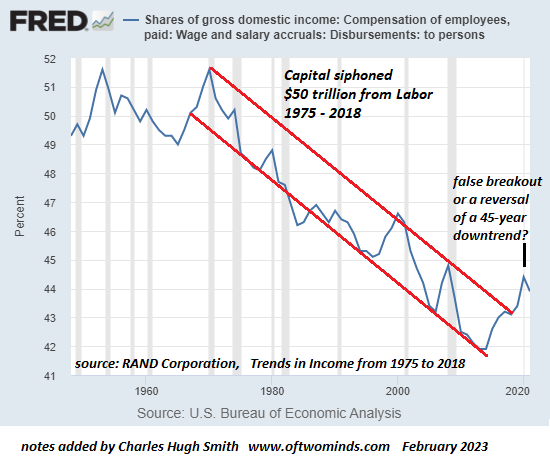

The Real Threat to Democracy is Corrupting Wealth Inequality

Try to find a developing-world kleptocracy in which the top few collect more than 97% of the income from capital. There aren't any that top the USA, the world's most extreme kleptocracy. We're Number 1. Imagine a town of 1,000 adults and their dependents in which one person holds the vast majority of wealth and political influence. Would that qualify as a democracy?

Read More »

Read More »

Why Don’t We Cut Out the Middleman and Just Elect Pfizer and Merck?

If we no longer have the capacity to distinguish between moral legitimacy and self-serving corruption, then we might as well eliminate the Middleman and vote directly for Pfizer or Merck. There's a fancy word for cutting out the Middleman: disintermediation. Removing intermediaries who take a cut but neither produce nor add value makes perfect sense, reducing costs and increasing efficiency.

Read More »

Read More »

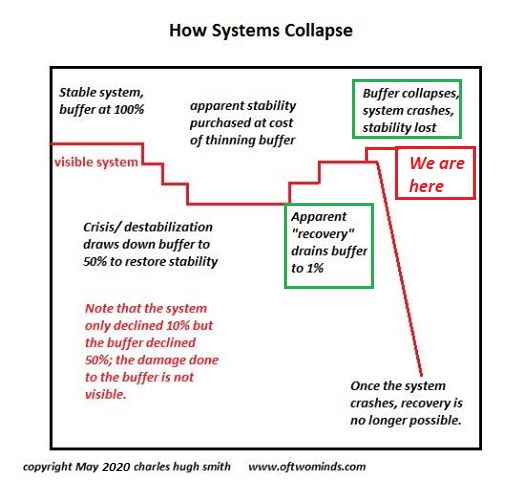

The Economy / Market Look “Healthy” Until They Have a Seizure and Collapse

So one index or asset or another hits a new high, wow, more proof everything is so robust and healthy, we never had it so good--right up to the seizure and collapse.

Read More »

Read More »

What Will Surprise Us in 2022

What seemed so permanent for 13 long years will be revealed as shifting sand and what seemed so real for 13 long years will be revealed as illusion. Magical thinking isn't optimism, it is folly. Predictions are hard, especially about the future, but let's look at what we already know about 2022.

Read More »

Read More »

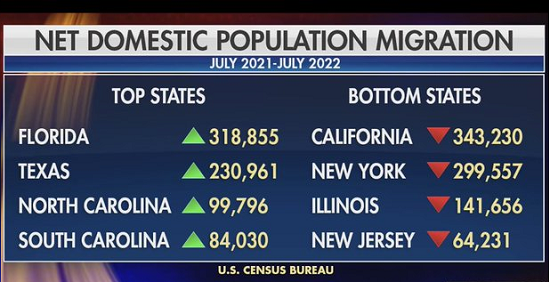

Watch the Top 5percent – They’re the Key to the Whole Economy

Go ahead and become dependent on asset bubbles and the free spending of the top 5%, and optimize your economy to serve this "growth," but be prepared for the consequences when the costs of this optimization and dependency come due.

Read More »

Read More »

One Chart Traders Might Want to Ponder

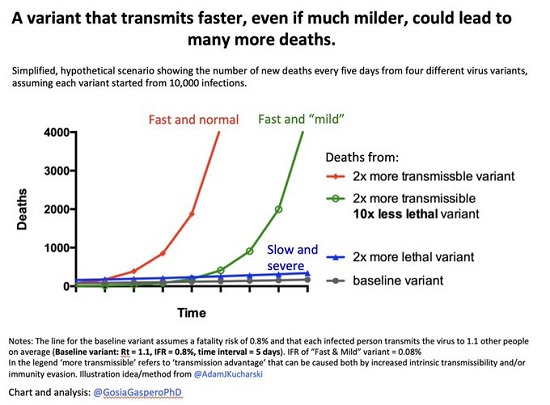

But when the Fed's fundamental powerlessness is revealed and the buy-the-dippers have been forced to liquidate, the true meaning of "mild" contagion will become apparent. Since I'd rather not be renditioned to a rat-infested, freezing cell in an unnamed 'stan, I'm circumspect about viruses in general.

Read More »

Read More »

How Vulnerable Is Your Personal Supply Chain?

How vulnerable is your personal supply chain? For the average American, the answer is: very. Americans consider abundance and ready availability as birthrights so basic they're like the air we breathe. The idea that shelves could become bare and stay bare is incomprehensible. yet that is the world we're entering, for a number of complex reasons.

Read More »

Read More »

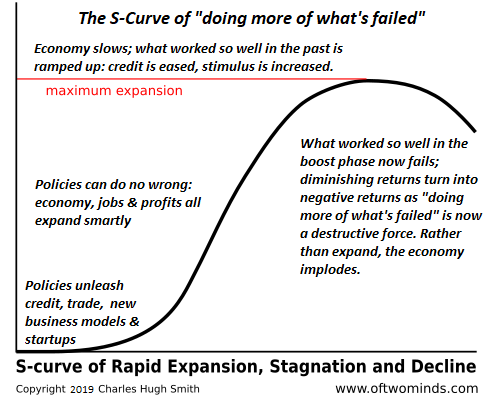

Smart Enough to Get Rich, Not Smart Enough to Keep It

Are we smart enough to keep our oh-so-easily conjured riches? If we continue to believe that doing more of what's failed spectacularly will deliver permanently expanding riches, then the answer is no.

Read More »

Read More »

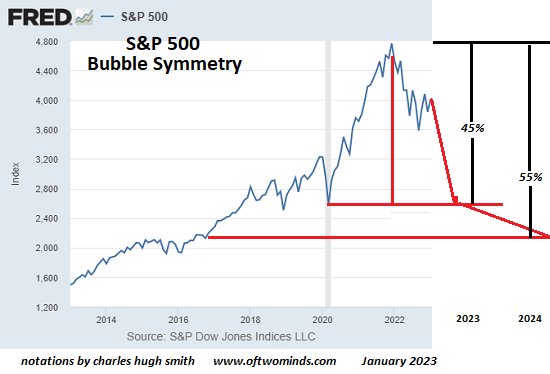

Get in Crash Positions

When the market goes bidless, it's too late to preserve capital, never mind all those life-changing gains. Everyone with some gray in their ponytails knows the stock market has ticked every box for a bubble top, so everybody get in crash positions: Let's run through the requirements for a bubble top: 1. Retail investors (i.e. dumb money) are all in and buying the dip with absolute confidence.

Read More »

Read More »

Xi’s Gambit: China at the Crossroads

If Xi's gambit succeeds, China could become a magnet for global capital. If success is only partial or temporary, China may well struggle with the structural excesses that are piling up not just in China but in the entire global economy.

Read More »

Read More »

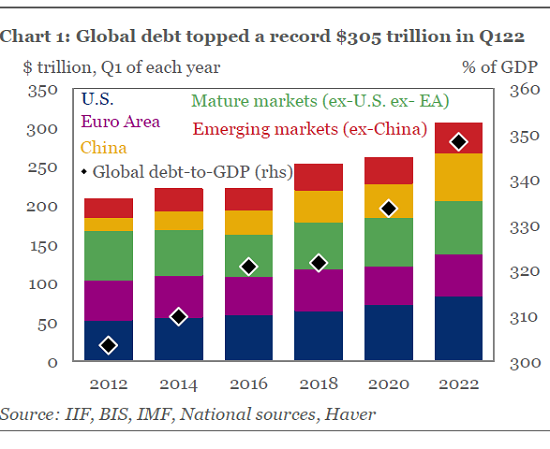

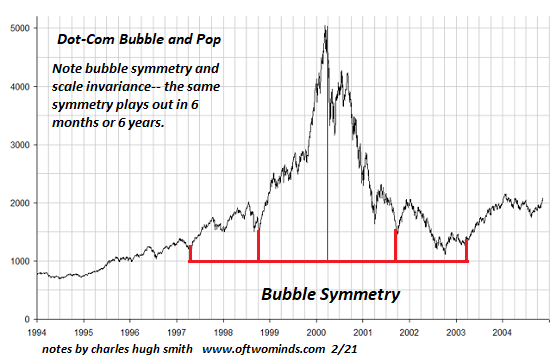

The Long Cycles Have All Turned: Look Out Below

But alas, humans do not possess god-like powers, they only possess hubris, and so all bubbles pop: the more extreme the bubble, the more devastating the pop. Long cycles operate at such a glacial pace they're easily dismissed as either figments of fevered imagination or this time it's different.

Read More »

Read More »

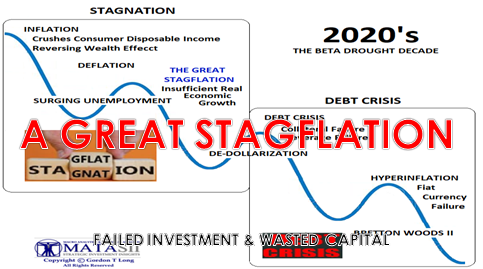

Why Inflation Is a Runaway Freight Train

The value of these super-abundant follies will trend rapidly to zero once margin calls and other bits of reality drastically reduce demand. Inflation, deflation, stagflation--they've all got proponents. But who's going to be right?

Read More »

Read More »

When Risk and Opportunity Become Personal

The opportunity to lower our exposure to risk is always present in some fashion, but embracing this opportunity becomes critical when precarity and change-points rise like restless seas.

Read More »

Read More »

When Everything Is Artifice and PR, Collapse Beckons

The notion that consequence can be as easily managed as PR is the ultimate artifice and the ultimate delusion. The consequences of the drip-drip-drip of moral decay is difficult to discern in day-to-day life. It's easy to dismiss the ubiquity of artifice, PR, spin, corruption, racketeering, fraud, collusion and narrative manipulation (a.k.a. propaganda) as nothing more than human nature, but this dismissal of moral decay is nothing more than...

Read More »

Read More »

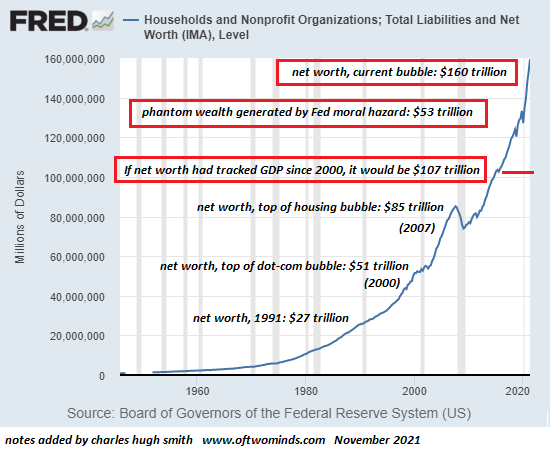

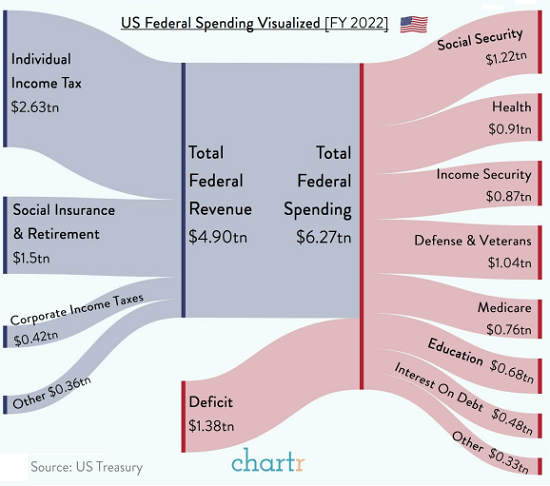

The Fed’s Moral Hazard Monster Is About to Lay Waste to “Wealth”

If the Fed set out to destroy the financial system, they're very close to finishing the job. If you set out to destroy markets and the financial system, your most important weapon is moral hazard, the disconnection of risk and consequence. You disconnect risk from consequence by rewarding those making the riskiest bets and bailing out gamblers whose bets went bad.

Read More »

Read More »

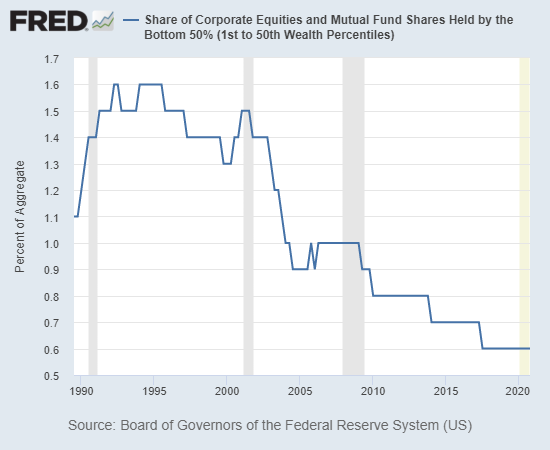

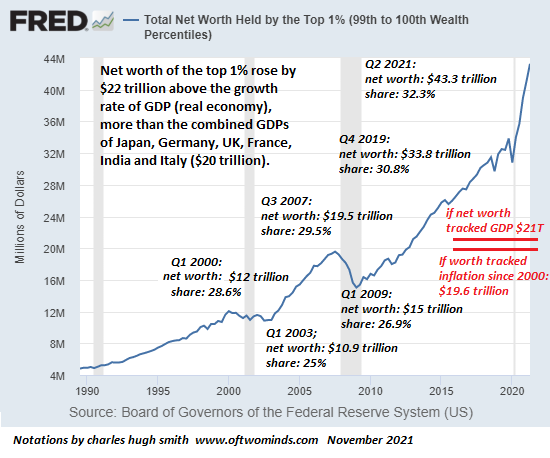

Top 1% Gains More Wealth Than the Combined GDPs of Japan, Germany, UK, France, India and Italy, Bottom 50%–You Get Nothing

Given that political power in America is a pay-to-play auction in which the highest bidder wins, how this incomprehensibly lopsided ownership of wealth plays out is an open question.

Read More »

Read More »

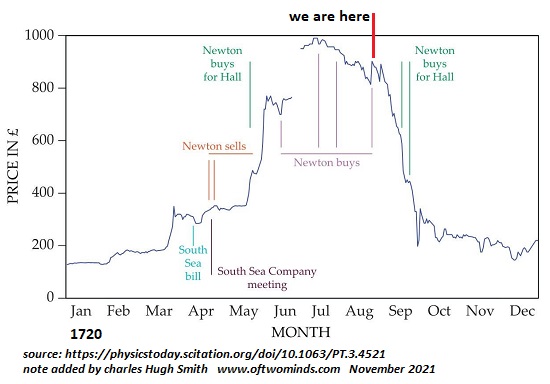

Paging Isaac Newton: Time to Buy the Top of This Bubble

Despite Newton's tremendous intelligence and experience, he fell victim to the bubble along with the vast herd of credulous greedy punters. One of the most famous examples of smart people being sucked into a bubble and losing a packet as a result is Isaac Newton's forays in and out of the 1720 South Seas Bubble that is estimated to have sucked in between 80% and 90% of the entire pool of investors in England.

Read More »

Read More »

Look Out Below: Why a Rug-Pull Flash Crash Makes Perfect Sense

It makes perfect financial sense to crash the market and no sense to reward the retail options marks by pushing it higher. An extraordinary opportunity to scoop up mega-millions in profits has arisen, and grabbing all this free money makes perfect financial sense. Now the question is: will those who have the means to grab the dough have the guts to do so?

Read More »

Read More »

The Contrarian Trade of the Decade: The Dollar Refuses to Die

Which is more valuable: Wall Street's debt/asset bubbles or the global empire? You can't have both, so choose wisely. The consensus makes sense: the U.S. dollar is doomed because the Federal Reserve and the Treasury will conjure trillions of new dollars out of thin air to prop up the status quo entitlements, monopolies, cartels and debt/asset bubbles, and since little of this issuance actually increases productivity, all it will accomplish is the...

Read More »

Read More »

Eight Reasons Scarcities Will Increase Rather Than Evaporate

Who knew it would be so easy? All we have to do is collect urine and we'll be flying our electric air taxi tomorrow! While the private-jet crowd is busy selling a future of 1 billion electric vehicles, 1 billion windmills, 1 billion solar arrays, hundreds of thousands of electric aircraft, thousands of new nuclear power plants and trillions more in "wealth" accumulating in their bloated ledgers, reality is intruding on their technocratic...

Read More »

Read More »