Category Archive: 5.) Charles Hugh Smith

Calm Before the Tempest?

Is it beyond conception that the core actually strengthens for a length of time before the unraveling reaches it?Let's start by stipulating the obvious: no one knows the future, and most of the guesses--oops, I mean forecasts--will be wrong. Arguing about the forecasts now won't make any difference as to which ones are correct and which ones are wrong.

Read More »

Read More »

Why Nations Fail

The irony is that the suppression of dissent is the suppression of competing ideas that generate systemic stability via rapid adaptation. Nations that appear stable may fail once they're under pressure.

Read More »

Read More »

You Know What Would Be Really Irritating? A Crazy Rally to New Highs

It would be very irritating to have a rally suck in all the bears salivating for a crash from a bear-market rally peak and then decimate the shorts with a rally that soars rather than collapses to new lows. As a contrarian, I'm always squinting at the consensus and wondering if it is really that easy to be right.

Read More »

Read More »

The One Solution to All Our Problems

Pick one, America: national security of the essential material foundation of everything, the industrial base, or "global markets," maximizing greed / corporate profits.Sorry about the clickbait title.

Read More »

Read More »

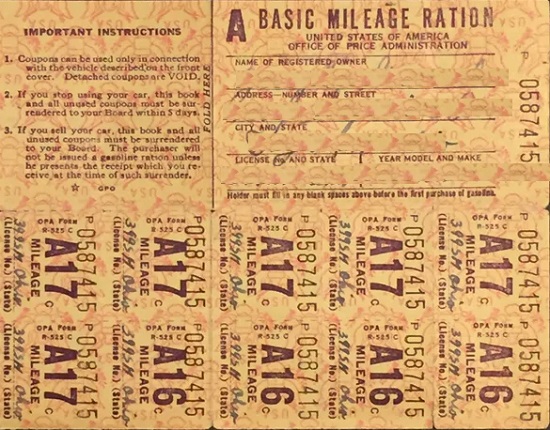

The Most Valuable Form of Money Nobody’s Seen–Yet

What is "money"? "Money" is a claim on the essentials of life. Ration cards are claims on essentials.Many people expect "money" will soon be tied to commodities. Agreed. It's called a ration cardthat grants the holder the right to buy a specific quantity of essential goods at a specified price.

Read More »

Read More »

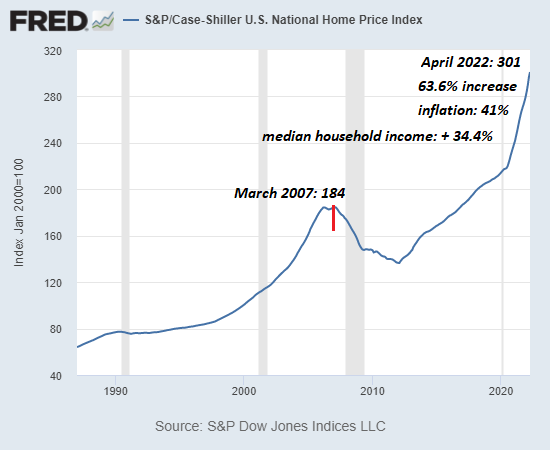

Why the Housing Bubble Bust Is Baked In

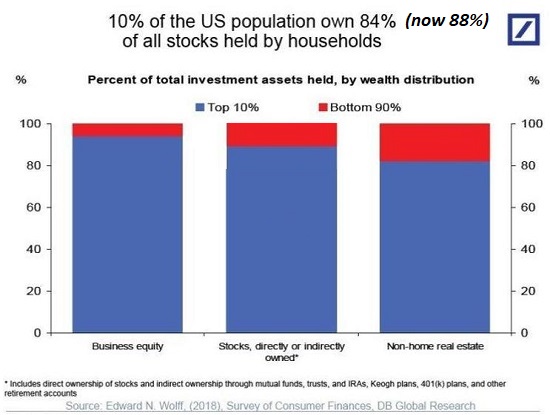

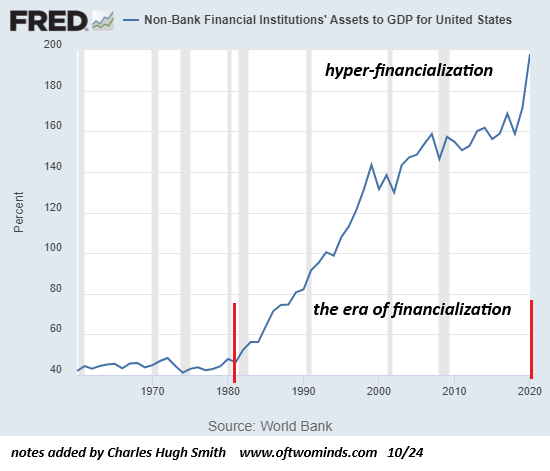

Putting this all together, it's clear that the source of the current housing bubble is the explosion of financial speculation fueled by central bank policies. Those benefiting from speculative bubbles have powerful incentives to deny the bubble can bust.

Read More »

Read More »

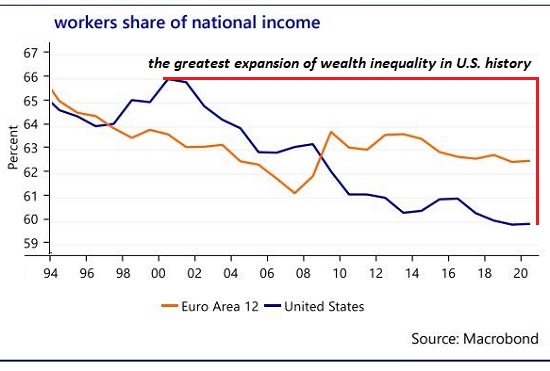

The Age of Discord

It's very difficult to find common ground that supports cooperation in the disintegrative stage of scarcities, rising prices, catastrophically centralized power and social discord. Today's topic echoes Peter Turchin's 2016 book, Ages of Discord, which I have often referenced in blog posts.

Read More »

Read More »

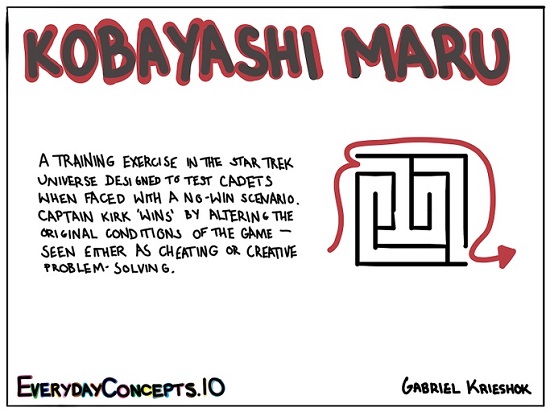

Our No-Win "Kobayashi Maru" Economy

It's time to reprogram the conditions of the economy to serve the many rather than the few.Star Trek's Kobayashi Maru training exercise tests officer candidates' response to a no-win scenario:any attempt to rescue the crippled ship's crew results in the destruction of the candidate's ship, while standing by and taking no action results in the loss of the Kobayashi Maru's crew.

Read More »

Read More »

The Difference Between a Forecast and a Guess

Every forecast or guess has one refreshing quality: one will be right and the rest will be wrong. What's the difference between a forecast and a guess? On one level, the answer is "none": the future is unknown and even the most informed forecast is still a guess.

Read More »

Read More »

Could Retail “Bagholders” Spark a Rally “Smart Money” Will Be Forced to Chase?

There would be some deliciously karmic justice in the "dumb money" driving a rally that forced the "smart money" to cover their shorts and chase the rally that shouldn't even be happening.

Read More »

Read More »

What Happens When the Workforce No Longer Wants to Work?

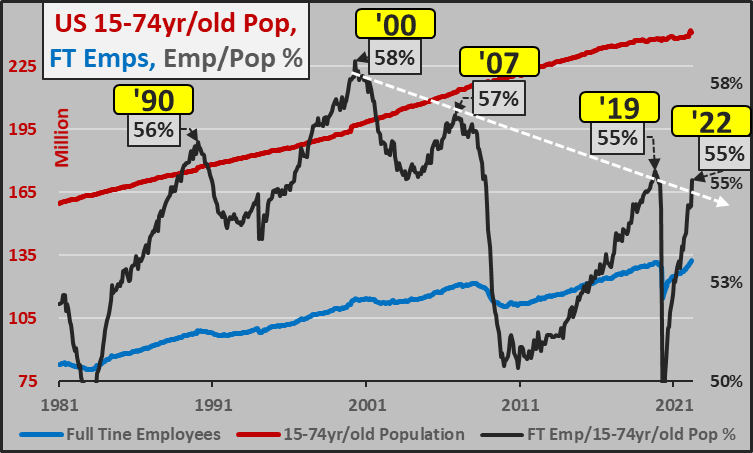

Workers are voting with their feet, and that's difficult to control. When values and expectations change, everything else eventually changes, too. What happens when the workforce no longer wants to work? We're about to find out. As with all cultural sea changes, macro statistics don't tell the full story.

Read More »

Read More »

There’s No Stopping a Recessionary Reckoning

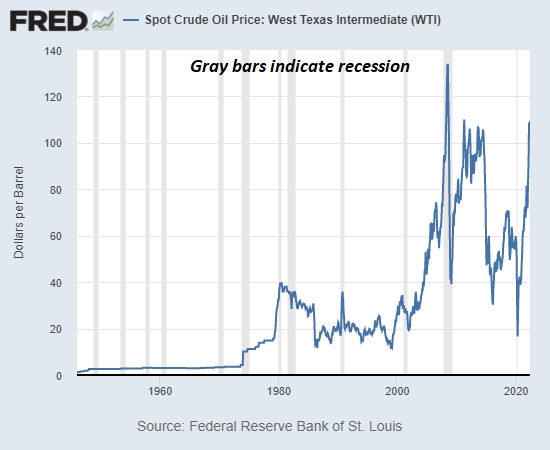

If there was only one causal factor nudging the economy into recession, it might be a mild, brief recession. But with all five conditions in confluence, this recession will be unlike any other. Recessions reliably arise from the confluence of these conditions. Note that any one condition can trigger a recession, but no one condition guarantees a recession.

Read More »

Read More »

"Pay-to-Play" for the Rest of Us

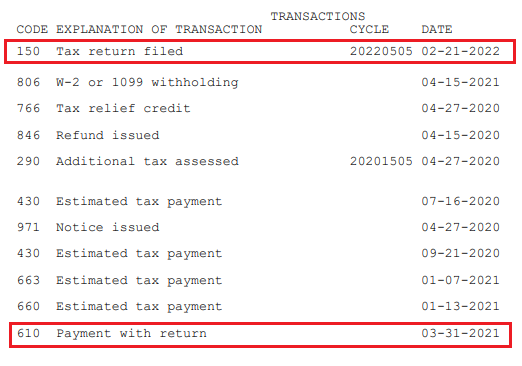

The more kafkaesque quagmires you've slogged through, the more you hope "pay-to-play for the rest of us" beomes ubiquitous. You know how "pay-to-play" works: contribute a couple of million dollars to key political players, and then get your tax break, subsidy, no-bid contract, etc., slipped into some nook or cranny of the legislative process that few (if any) will notice because the legislation is hundreds of pages long or a "gut and replace" magic...

Read More »

Read More »

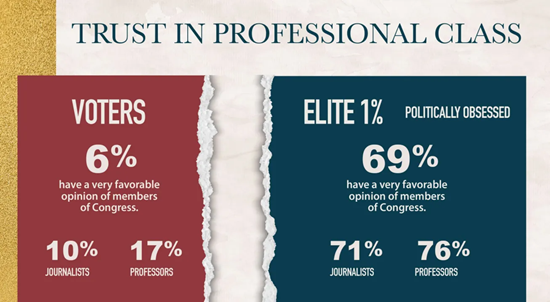

Who’s Going to Fix What’s Broken?

When nobody cares that systems have broken down and there is no will or interest in fixing essential systems, there is no happy ending. Who fixes systems when they break down? The answer appears to be: nobody.

Read More »

Read More »

Why America Decays: The Tyranny of Self-Interest

Only those societies which still have a functional public interest / common good will survive; those ruled by the tyranny of self-interest will fall. I've discussed the moral rot consuming the American Project in blog posts and my books.

Read More »

Read More »

Livelihoods in a Degrowth Economy

The sooner we start preparing for degrowth, the better off we'll be. A Chinese proverb captures this succinctly: By the time you're thirsty, it's too late to dig a well. Let's consider livelihood options in an unsustainable economy of extremes that are unraveling, an economy that is being forced to transition to Degrowth.

Read More »

Read More »

What Could Go Right?

Our economy is not resilient or antifragile, it's a fragile sand castle of debt and denial. What could go off the cliff that hasn't already gone off the cliff? Rip-roaring inflation, check.Hot war in Europe, check. Global food crisis, check. Semi-permanent supply-chain snarls, check. Geopolitical blackmail, check.

Read More »

Read More »

The Solution for Social Media Spam Bots Is Already Here

The right of free speech should not be confused with an obligation for privately owned enterprises to allow spamming and spoofing under the guise of free speech. The problem of bots on Twitter is in the news. This is of course a problem in all social media: fake accounts, spamming accounts, spoofing (expropriating your identity) accounts, and so on, all courtesy of anonymous account creation.

Read More »

Read More »

The Epidemic Nobody Talks About: Burnout

Burnout makes everyone uncomfortable, so it's largely a silent epidemic. Epidemics are not just biological in origin. A strong case can be made that a silent epidemic has been sweeping the nation for years, an epidemic few acknowledge: burnout.

Read More »

Read More »

Checking In On Five Long-Term Cycles

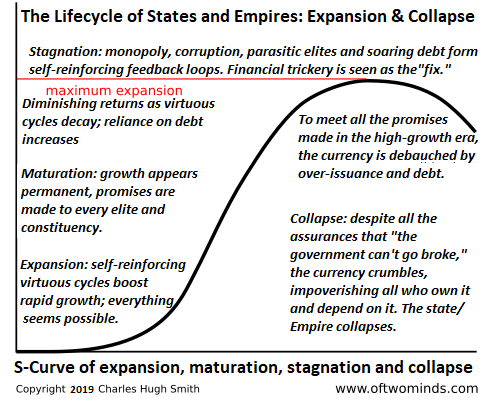

The decline phase of S-Curves can be gradual or a cliff-dive. Way back in 2007 I charted five long-wave cycles that I reckoned consequential: 1. Public debt (accumulating federal deficits)

2. Inflation 3. Oil (energy) 4. Interest rates 5. Speculative fever

Read More »

Read More »