Category Archive: 5.) Charles Hugh Smith

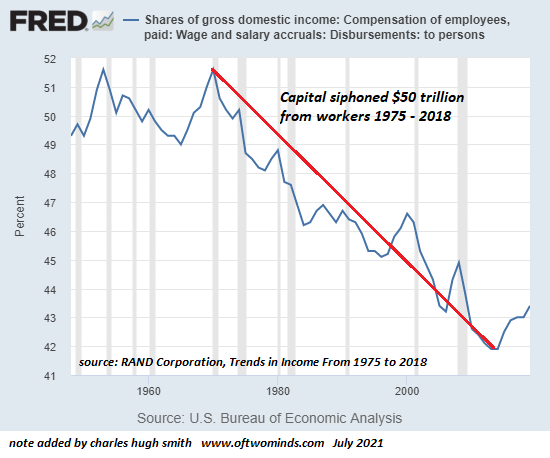

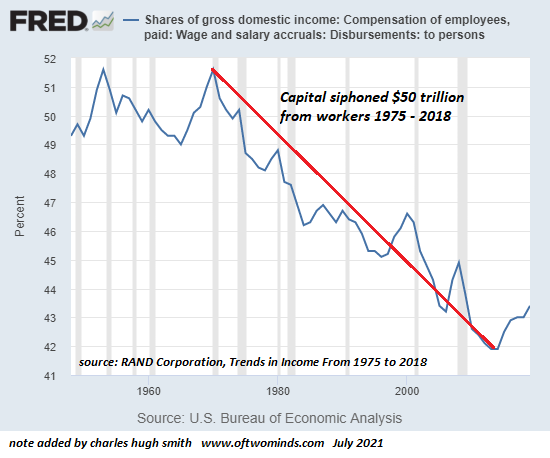

Our Financial System Is Optimized for Sociopaths and Exploitation

Let's call this financial system what it really is: the MetaPerverse, a conjured world of self-serving cons. We live in a peculiar juncture of history in which truth has been banished as a threat to the maximization of private gain, i.e. the hyper-pursuit of self-interest. Evidence that supports a causal chain has been replaced by cherry-picked data that supports a self-serving narrative: both the evidence and narrative are manufactured to serve...

Read More »

Read More »

Our Leaders Made a Pact with the Devil, and Now the Devil Wants His Due

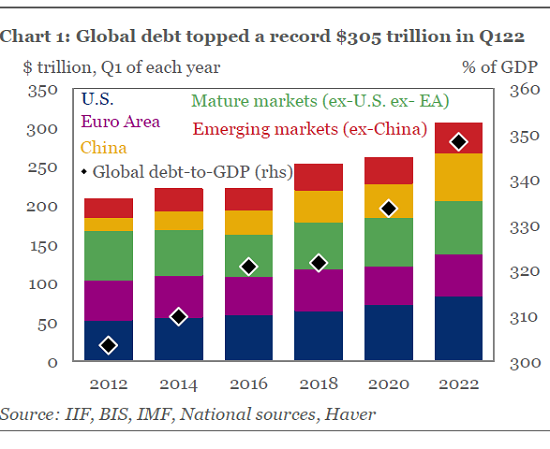

The unprecedented credit-fueled bubbles in stocks, bonds and

real estate are popping, and America's corrupt leaders can only stammer and spew excuses and empty promises.

Unbeknownst to most people, America's leadership made a pact with the Devil: rather than face the constraints

and injustices of our economic-financial system directly, a reckoning that would require difficult choices and

some sacrifice by the ruling financial-political elites,...

Read More »

Read More »

How Empires Die

When the state / empire loses the ability to recognize and solve core problems of security and fairness, it will be replaced by another arrangement that is more adaptable and adept at solving problems. From a systems perspective, nation-states and empires arise when they are superior solutions to security compared to whatever arrangement they replace: feudalism, warlords, tribal confederations, etc.

Read More »

Read More »

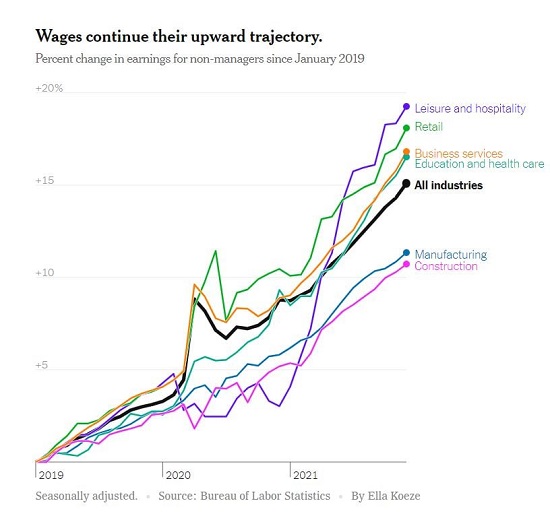

Inflation Winners and Losers

The clear winners in inflation are those who require little from global supply chains, the frugal, and those who own their own labor, skills and enterprises. As the case for systemic inflation builds, the question arises: who wins and who loses in an up-cycle of inflation? The general view is that inflation is bad for almost everyone, but this ignores the big winners in an inflationary cycle.

Read More »

Read More »

The Cult of Speculation Is a Cult of Doom

Surely the Fed gods will affirm the cult's most revered articles of faith. But false gods eventually fail, even the Fed. Every once in awhile the zeitgeist sets up an either / or: either the zeitgeist is crazy or I'm crazy. (OK, let's agree I'm crazy; see, it's not that hard to find something to agree on, is it?)

Read More »

Read More »

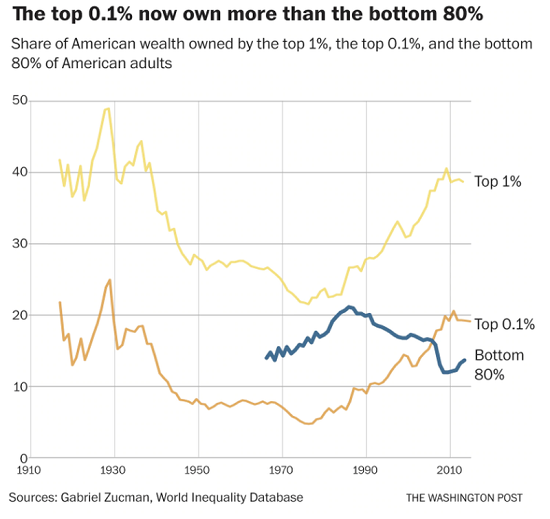

Politics Is Dead, Here’s What Killed It

Here's "politics" in America now: come with mega-millions or don't even bother to show up. Representational democracy--a.k.a. politics as a solution to social and economic problems--has passed away. It did not die a natural death. Politics developed a cancer very early in life (circa the early 1800s), caused by wealth outweighing public opinion.

Read More »

Read More »

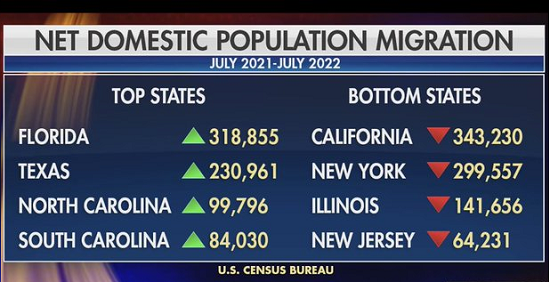

The Real Revolution Is Underway But Nobody Recognizes It

Revolutions have a funny characteristic: they're unpredictable. The general assumption is that revolutions are political. The revolution some foresee in the U.S. is the classic armed insurrection, or a coup or the fragmentation of the nation as states or regions declare their independence from the federal government.

Read More »

Read More »

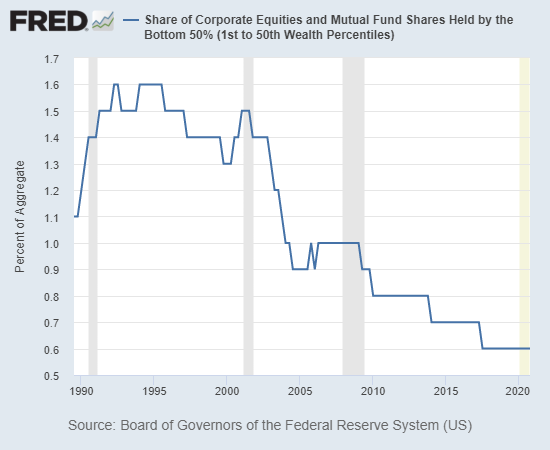

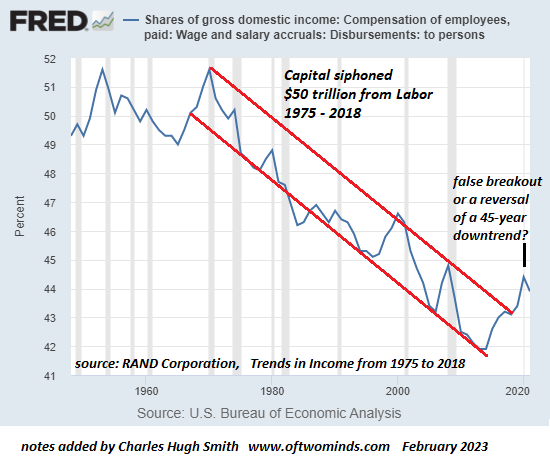

The Real Threat to Democracy is Corrupting Wealth Inequality

Try to find a developing-world kleptocracy in which the top few collect more than 97% of the income from capital. There aren't any that top the USA, the world's most extreme kleptocracy. We're Number 1. Imagine a town of 1,000 adults and their dependents in which one person holds the vast majority of wealth and political influence. Would that qualify as a democracy?

Read More »

Read More »

Why Don’t We Cut Out the Middleman and Just Elect Pfizer and Merck?

If we no longer have the capacity to distinguish between moral legitimacy and self-serving corruption, then we might as well eliminate the Middleman and vote directly for Pfizer or Merck. There's a fancy word for cutting out the Middleman: disintermediation. Removing intermediaries who take a cut but neither produce nor add value makes perfect sense, reducing costs and increasing efficiency.

Read More »

Read More »

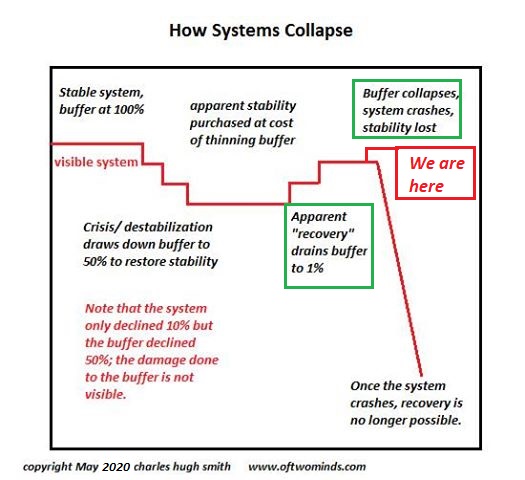

The Economy / Market Look “Healthy” Until They Have a Seizure and Collapse

So one index or asset or another hits a new high, wow, more proof everything is so robust and healthy, we never had it so good--right up to the seizure and collapse.

Read More »

Read More »

What Will Surprise Us in 2022

What seemed so permanent for 13 long years will be revealed as shifting sand and what seemed so real for 13 long years will be revealed as illusion. Magical thinking isn't optimism, it is folly. Predictions are hard, especially about the future, but let's look at what we already know about 2022.

Read More »

Read More »

Watch the Top 5percent – They’re the Key to the Whole Economy

Go ahead and become dependent on asset bubbles and the free spending of the top 5%, and optimize your economy to serve this "growth," but be prepared for the consequences when the costs of this optimization and dependency come due.

Read More »

Read More »

Obsession

Obsession composition and first lead guitar by charles hugh smith, rhythm and second lead guitar by Jimi Juju.

Read More »

Read More »

You Owe Me

You Owe Me composition, vocals and lead guitar by charles hugh smith, rhythm guitar, bass, drums and recording engineering by Jimi Juju.

You tell me that you can't afford the rent

the student loan or your truck

I don't care about your problems pal

just do what it takes to get me the bucks

You owe me

You owe me and I'm gonna tell you how it's gonna be

You say that you did everything you were told

Got your degree and a gig

Now you lost your job...

Read More »

Read More »

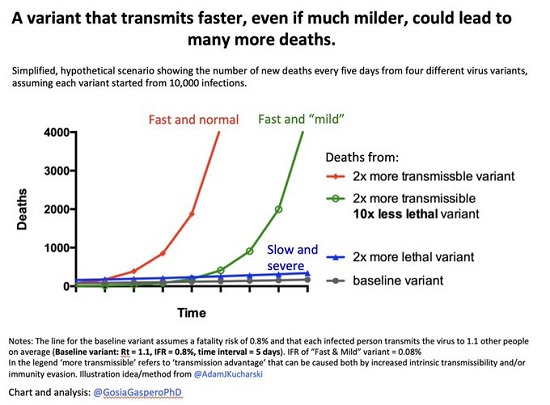

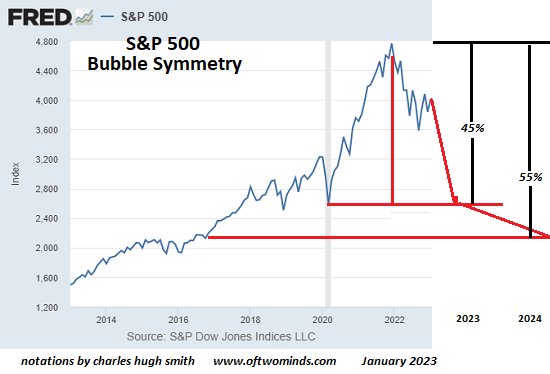

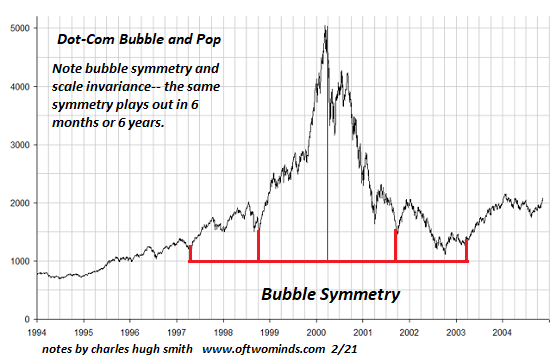

One Chart Traders Might Want to Ponder

But when the Fed's fundamental powerlessness is revealed and the buy-the-dippers have been forced to liquidate, the true meaning of "mild" contagion will become apparent. Since I'd rather not be renditioned to a rat-infested, freezing cell in an unnamed 'stan, I'm circumspect about viruses in general.

Read More »

Read More »

How Vulnerable Is Your Personal Supply Chain?

How vulnerable is your personal supply chain? For the average American, the answer is: very. Americans consider abundance and ready availability as birthrights so basic they're like the air we breathe. The idea that shelves could become bare and stay bare is incomprehensible. yet that is the world we're entering, for a number of complex reasons.

Read More »

Read More »

Smart Enough to Get Rich, Not Smart Enough to Keep It

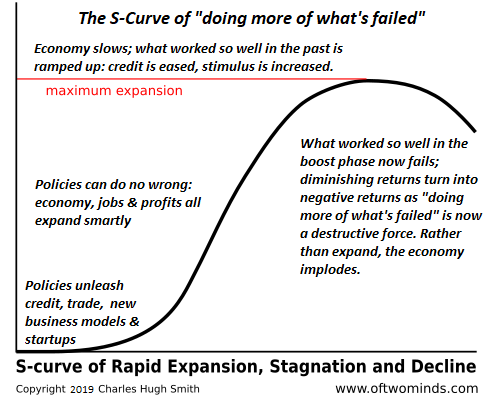

Are we smart enough to keep our oh-so-easily conjured riches? If we continue to believe that doing more of what's failed spectacularly will deliver permanently expanding riches, then the answer is no.

Read More »

Read More »

Get in Crash Positions

When the market goes bidless, it's too late to preserve capital, never mind all those life-changing gains. Everyone with some gray in their ponytails knows the stock market has ticked every box for a bubble top, so everybody get in crash positions: Let's run through the requirements for a bubble top: 1. Retail investors (i.e. dumb money) are all in and buying the dip with absolute confidence.

Read More »

Read More »

Xi’s Gambit: China at the Crossroads

If Xi's gambit succeeds, China could become a magnet for global capital. If success is only partial or temporary, China may well struggle with the structural excesses that are piling up not just in China but in the entire global economy.

Read More »

Read More »

The Long Cycles Have All Turned: Look Out Below

But alas, humans do not possess god-like powers, they only possess hubris, and so all bubbles pop: the more extreme the bubble, the more devastating the pop. Long cycles operate at such a glacial pace they're easily dismissed as either figments of fevered imagination or this time it's different.

Read More »

Read More »