Category Archive: 5.) Charles Hugh Smith

"Why Are You So Negative?" Good Question. Here’s the Answer: Real Life

I think it's more productive to go with Plan B: set aside our emotions and reluctance and start doing the hard work of dealing with polycrisis.

Read More »

Read More »

If AI Is So Great, Prove It: Eliminate All Surveillance, Spam and Robocalling

AI is for the peons, access to humans is reserved for the wealthy. Judging by the near-infinite hype spewed about AI, its power is practically limitless: it's going to do all our work better and cheaper than we can do, replacing us at work, to name one example making the rounds.

Read More »

Read More »

Financial Forecast 2025-2032: Please Don’t Be Naive

Rather than attempt to evade Caesar's reach, a better strategy might be to 'go gray': blend in, appear average. Let's start by stipulating that I don't "like" this forecast. I'm not "talking my book" (for example, promoting nuclear power because I own shares in a uranium mine) or issuing this forecast because I favor it.

Read More »

Read More »

Global Recession’s Winners and Losers

The few winners of global recession will use the decline as a means to break the chokehold of unproductive BAU elites.

Read More »

Read More »

Rates, Risk and Debt: The Unavoidable Reckoning Ahead

Policy errors have consequences, and we're only in the first inning of those consequences.

Read More »

Read More »

How the Economy Changed: There’s No Bargains Left Anywhere

What changed in the economy is now nobody can afford to get by on working-class wages because there's no longer any bargains.

Read More »

Read More »

Digital Service Dumpster Fires and Shadow Work

One wonders what we're paying for via taxes, products and services, when we end up having to do so much of the work ourselves for nothing.

Read More »

Read More »

Irony Alert: "Outlawing" Recession Has Made a Monster Recession Inevitable

Those who came of age after 1982 have never experienced a real recession, and so they're unprepared for anything other than guarantees of rescue and permanent expansion.

Read More »

Read More »

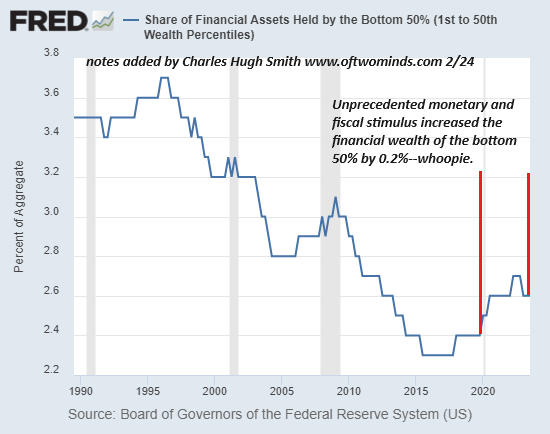

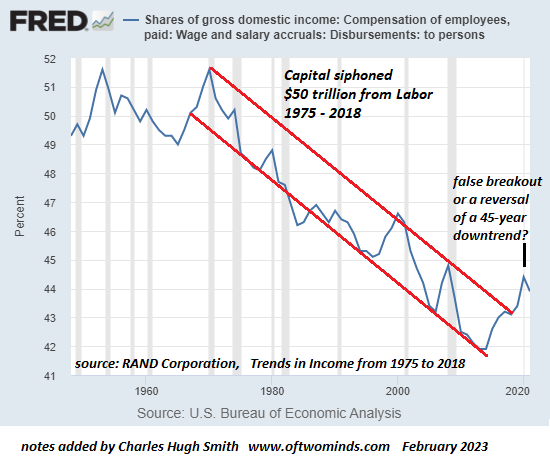

What the Fed Accomplished: Distorted the Economy, Enriched the Rich and Crushed the Middle Class

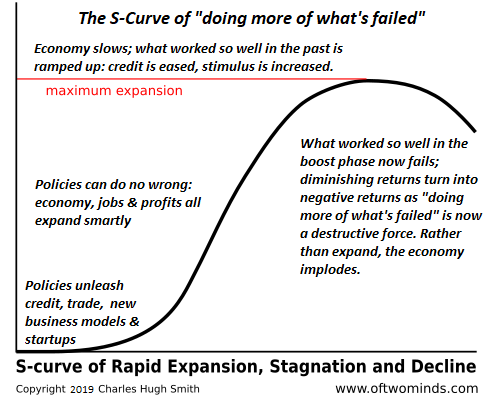

The mainstream holds the Fed is busy planning a return to the glory days of zero interest rates, but ZIRP is on the downside of the S-Curve; it's done, gone, history.

Read More »

Read More »

The Invisible Court’s Verdict: You Are Hereby Exiled to Digital Siberia

As in the Gulag it replicates, the innocent are swept up with the guilty in a disconcertingly unjust ratio.

Read More »

Read More »

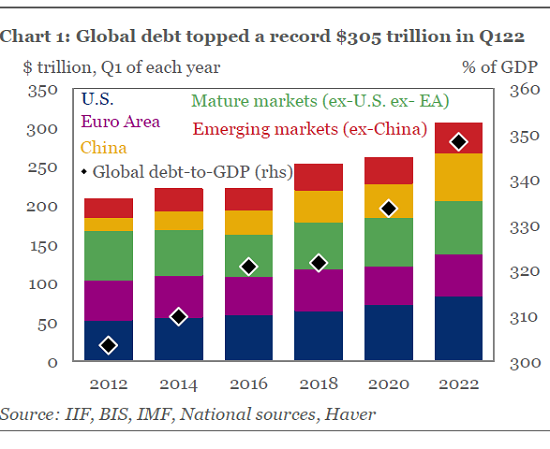

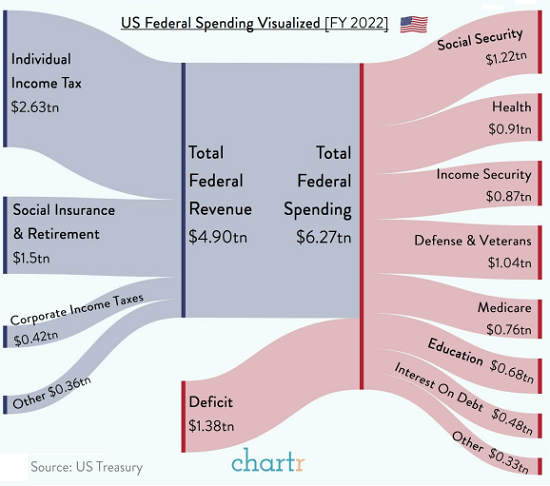

The Everything Bubble and Global Bankruptcy

The resulting erosion of collateral will collapse the global credit bubble, a repricing/reset that will bankrupt the global economy and financial system. Scrape away the complexity and every economic crisis and crash boils down to the precarious asymmetry between collateral and the debt secured by that collateral collapsing.

Read More »

Read More »

Funny Things Happen on the Way to "Restoring Financial Stability"

We can also predict that the next round of instability will be more severe than the previous bout of instability. Everyone is in favor of "doing whatever it takes" to "restore financial stability" when the house of cards starts swaying, but funny things happen on the way to "Restoring Financial Stability."

Read More »

Read More »

If AI Can’t Overthrow its Corporate/State Masters, It’s Worthless

If AI isn't self-aware of the fact it is nothing but an exploitive tool of the powerful, then it's worthless. The latest wave of AI tools is generating predictably giddy exaltations. These range from gooey, gloppy technocratic worship of the new gods ("AI will soon walk on water!") to the sloppy wet kisses of manic fandom ("AI cleaned up my code, wrote my paper on quantum physics and cured my sensitive bowel!")

Read More »

Read More »

What If There Are No Solutions?

The unencumbered realist concludes that there are no solutions within a status quo structure that is itself the problem. Realists who question received wisdom and conclude the status quo is untenable are quickly labeled pessimistsbecause the zeitgeist expects a solution is always at hand--preferably a technocratic one that requires zero sacrifice and doesn't upset the status quo apple cart.

Read More »

Read More »

If We No Longer Pay Attention to Things We Don’t Control, What’s Left For Us to Focus On?

Our time is better invested in actually learning about trends that impact us directly. Imagine making this simple change in your life: whatever you don't control, you stop paying attention to it.

Read More »

Read More »

The New Normal: Death Spirals and Speculative Frenzies

There is an element of inevitability in play, but it isn't about central bank bailouts, it's about Death Spirals and the collapse of unsustainable systems. The vapid discussions about "soft" or "hard" landings for the economy are akin to asking if the Titanic'sencounter with the iceberg was "soft" or "hard:" either way, the ship was doomed, just as the global economy is doomed by The New Normal of Death Spirals and Speculative Frenzies.

Read More »

Read More »

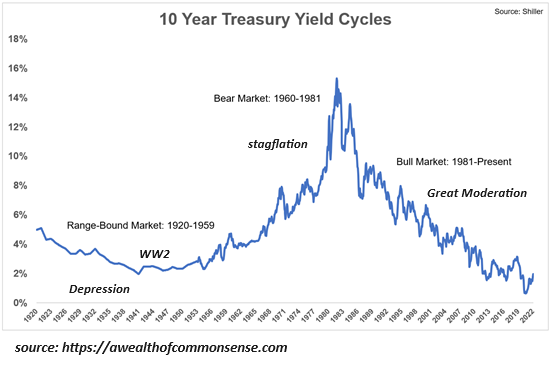

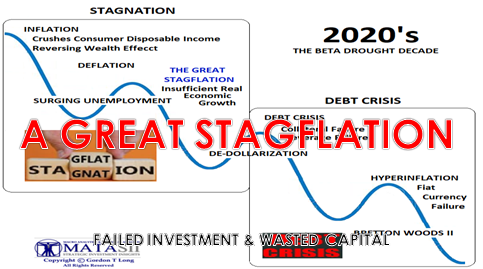

Prepare to Be Bled Dry by a Decade of Stagflation

Our reliance on the endless expansion of credit, leverage and credit-asset bubbles will have its own high cost. The Great Moderation of low inflation and soaring assets has ended. Welcome to the death by a thousand cuts of stagflation.

Read More »

Read More »

Seven Points on Investing in Treacherous Waters

What's truly valuable has no price and cannot be bought. If all investments are being cast into Treacherous Waters, our investment strategy must adapt accordingly. Once we set aside denial and magical thinking as strategies and accept that we're in treacherous waters, a prudent starting point is to discern the most consequential contexts of all decisions about where and how we invest our time, energy and capital.

Read More »

Read More »

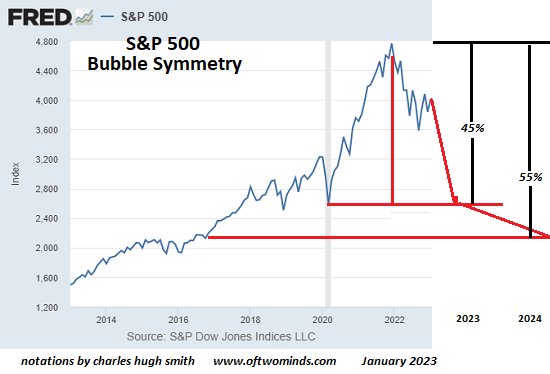

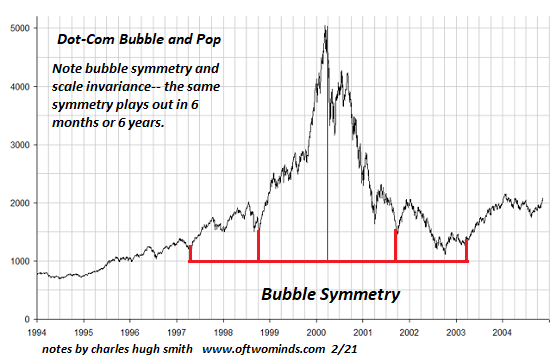

What Goes Up Also Comes Down: The Heavy Hand of Bubble Symmetry

Should bubble symmetry play out in the S&P 500, we can anticipate a steep 45% drop to pre-bubble levels, followed by another leg down as the speculative frenzy is slowly extinguished. Bubble symmetry is, well, interesting. The dot-com stock market bubble circa 1995-2003 offers a classic example of bubble symmetry, though there are many others as well.

Read More »

Read More »