Category Archive: 5.) Charles Hugh Smith

The Systemic Risk No One Sees

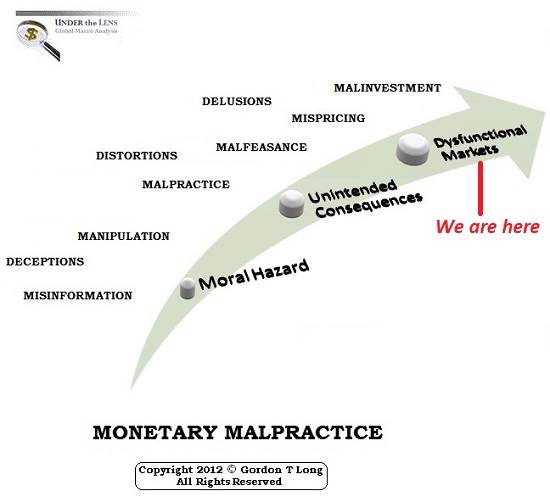

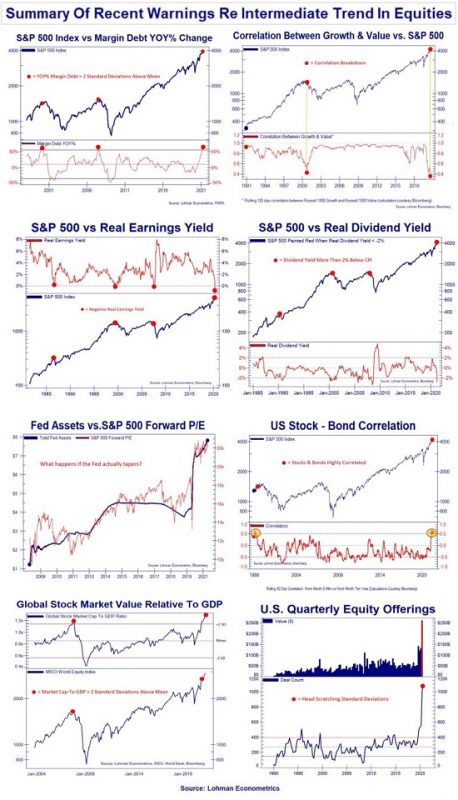

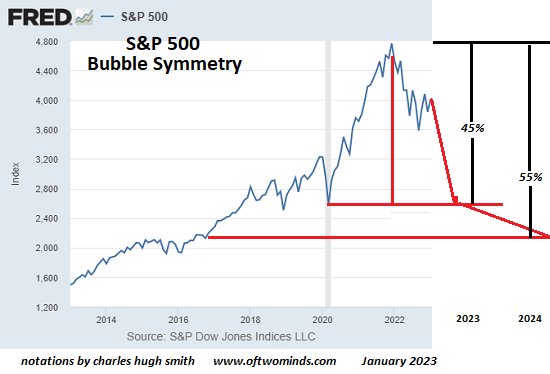

My recent posts have focused on the systemic financial risks created by Federal Reserve policies that have elevated moral hazard (risks can be taken without consequence) and speculation to levels so extreme that they threaten the stability of the entire financial system.

Read More »

Read More »

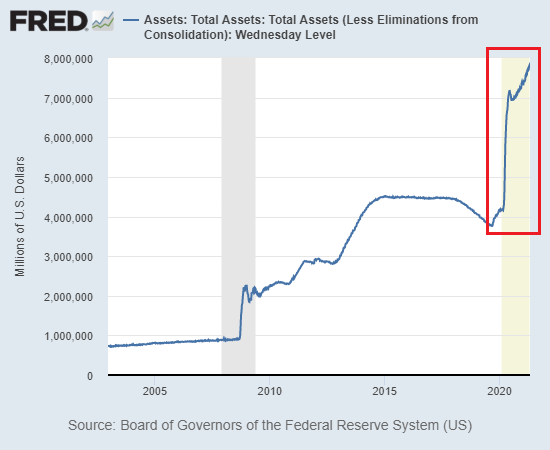

When Expedient “Saves” Become Permanent, Ruin Is Assured

The belief that the Federal Reserve possesses god-like powers and wisdom would be comical if it wasn't so deeply tragic, for the Fed doesn't even have a plan, much less wisdom. All the Fed has is an incoherent jumble of expedient, panic-driven "saves" it cobbled together in the 2008-2009 Global Financial Meltdown that it had made inevitable.

Read More »

Read More »

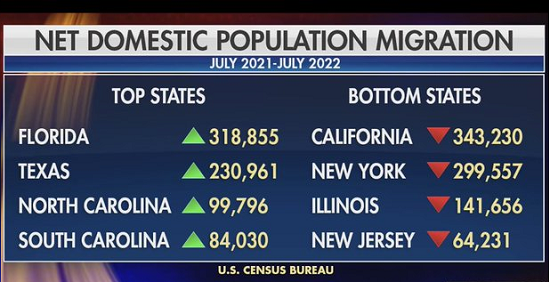

America’s Social Order is Unraveling

What kind of nation boasts a record-high stock market and an unraveling social order? Answer: a failed nation, a nation that has substituted artifice for realism for far too long, a nation that now depends on illusory phantoms of capital, prosperity and democracy to prop up a crumbling facade of "wealth" that the populace now understands is largely in the hands of a few families and corporations, most of which pay little to support the citizenry...

Read More »

Read More »

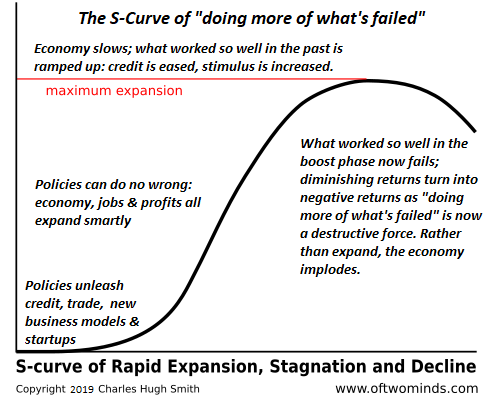

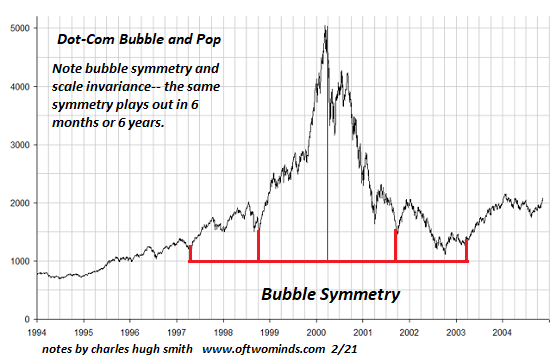

It Always Ends The Same Way: Crisis, Crash, Collapse

One of the most under-appreciated investment insights is courtesy of Mike Tyson: "Everybody has a plan until they get punched in the mouth." At this moment in history, the plan of most market participants is to place their full faith and trust in the status quo's ability to keep asset prices lofting ever higher, essentially forever.

Read More »

Read More »

Front-Running the Crash

We have a fine-sounding word for running with the herd: momentum. When the herd is running, those who buy what the herd is buying and sell what the herd is selling are trading momentum, which sounds so much more professional and high-brow than the noisy, dusty image of large mammals (and their trading machines) mindlessly running with the herd.

Read More »

Read More »

Seven Things Nobody Talks About that Will Eventually Matter–A Lot

Perhaps it shouldn't surprise us that everything that will eventually matter is ignored until it does matter--but by then it's too late. Here's a short list to start the discussion: 1. The Federal Reserve has transformed the American populace into a nation of dismayingly over-confident gamblers.

Read More »

Read More »

The Sources of Rip-Your-Face-Off Inflation Few Dare Discuss

Inflation will be transitory, blah-blah-blah--I beg to differ, for these reasons. There are numerous structural sources of inflation, which I define as prices rise while the quality and quantity of goods and services remain the same or diminish.

Read More »

Read More »

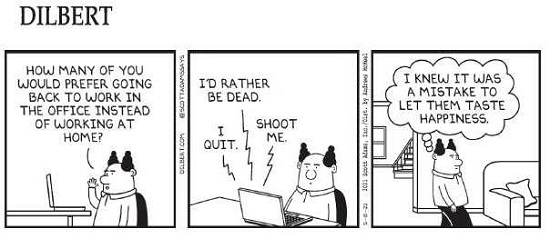

Post-Pandemic Metamorphosis: Never Going Back

People caught on that the returns on the frenzied hamster wheel of "normal" have been diminishing for decades, but everyone was too busy to notice. The superficial "return to normal" narrative focuses solely on first order effects: now that people can dispense with masks and social distancing, they are resuming their pre-pandemic spending orgy with a vengeance, which augurs great profits for Corporate America and higher tax revenues.

Read More »

Read More »

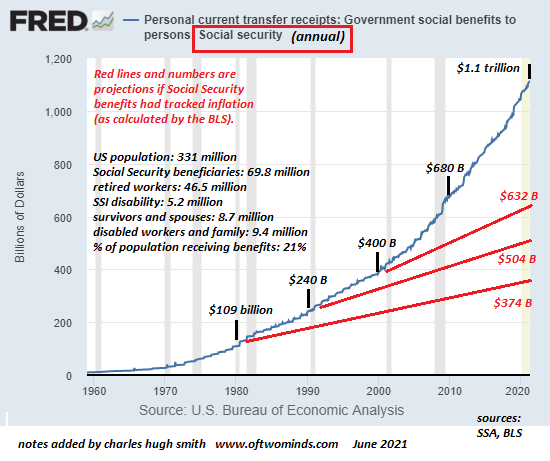

(Not) Living Large on Social Security

How many retired workers are getting less than $1,000 per month in Social Security benefits? The question came up and I was curious enough to find the answer, and download the data into an Excel spreadsheet which I saved as a

Read More »

Read More »

Increasingly Chaotic Volatility Ahead–The New Normal Few Think Possible

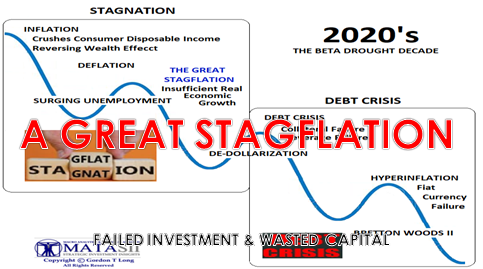

The standard debate about the future of the economy is: which will we get, high inflation or a deflationary collapse of defaults and asset bubbles popping? The debate goes round and round in widening circles of complexity as analysts delve into every nuance of the debate.

Read More »

Read More »

Systemic Risks Abound

For the past 22 years, every time the stock market whimpered, wheezed or whined, the Federal Reserve rushed to soothe the spoiled crybaby. There are two consequential results of the Fed as savior: The Fed has perfected moral hazard. Organic (i.e. non-manipulated) market forces have been extinguished.

Read More »

Read More »

FOMO Is Loco

We can also posit a general rule that those who inherit wealth and succumb to FOMO are eventually less wealthy while those who are wealthy and take a pass on FOMO / hoarding at the top of the manic frenzy increase their wealth.

Read More »

Read More »

Fed to Treasury Dealers and Congress: We Can’t Count On You, We’re Taking Charge

The Fed sees itself as trapped by the incompetence and greed of the other players and by its own policy extremes that were little more than expedient "saves" of a system that is unraveling due to its fragility and brittleness.

Read More »

Read More »

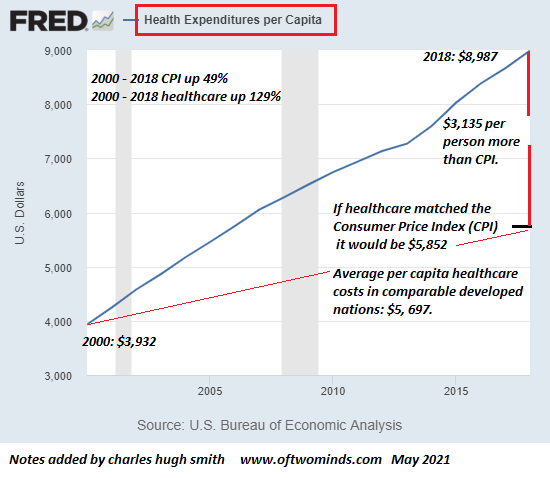

Sickcare is the Knife in the Heart of Employment–and the Economy

We need to change the incentives of the

entire system, not just healthcare, but if we don't start with healthcare, that financial

cancer will drag us into national insolvency all by itself.

American Healthcare is a growth industry in the same way cancer is a growth industry:

both keep growing until they kill the host, which in the case of healthcare is the U.S. economy.

While a great many individuals in the system care about improving the...

Read More »

Read More »

Why Wage Inflation Will Accelerate

The Fed has created trillions out of thin air to boost the speculative wealth of Wall Street, but it can't print experienced workers willing to work for low wages. The Federal Reserve is reassuring us daily that inflation is temporary, but allow me to assure you that wage inflation is just getting started and will accelerate rapidly.

Read More »

Read More »

The ‘Take This Job and Shove It’ Recession

So hey there Corporate America, the Fed and your neofeudal cronies: take this job and shove it. This time it really is different, but not in the way the Wall Street shucksters are claiming.

Read More »

Read More »

Here’s How ‘Everything Bubbles’ Pop

At long last, the moment you've been hoping for has arrived: you're pitching your screenplay to a producer. Your agent is cautious but you're confident nobody else has concocted a story as outlandish as yours. Your agent gives you the nod and you're off and running:

Read More »

Read More »

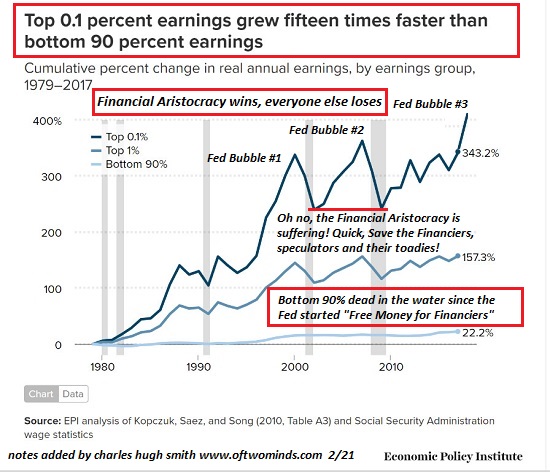

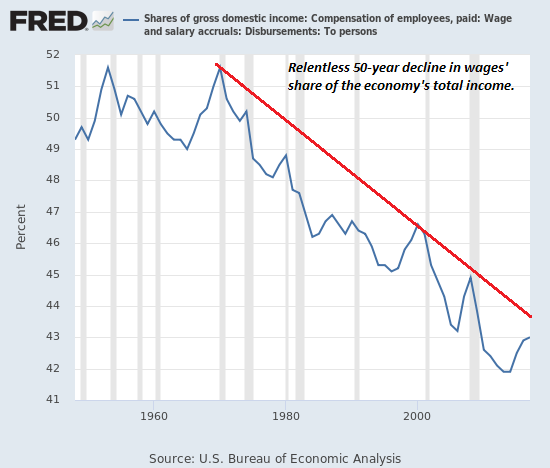

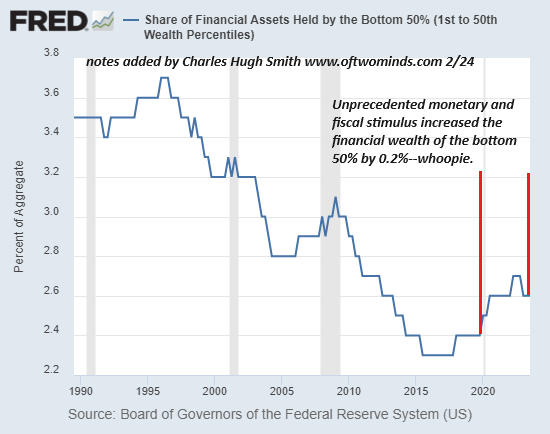

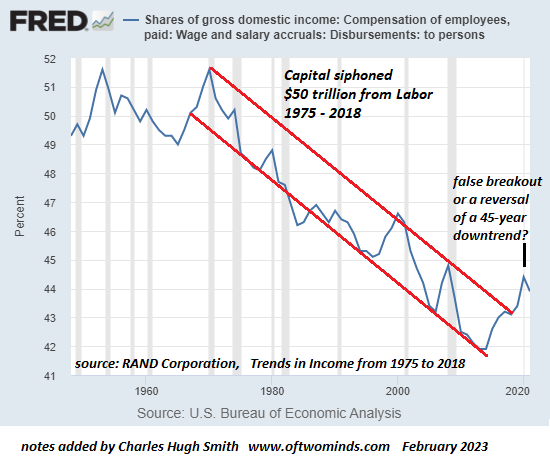

Hey Fed, Explain Again How Making Billionaires Richer Creates Jobs

Despite their hollow bleatings about 'doing all we can to achieve full employment',

the Fed's policies has been Kryptonite to employment, labor and the bottom 90%--and most especially

to the bottom 50%, the working poor that one might imagine most deserve a leg up.

As wealth and income inequality soar to new heights thanks to the Federal Reserve's policies

of zero interest rates, money-printing and financial stimulus, the Fed says its goal...

Read More »

Read More »

What’s Yours Is Now Mine: America’s Era of Accelerating Expropriation

The takeaway here is obvious: earn as little money as possible and invest your surplus labor in assets that can't be expropriated. Expropriation: dispossessing the populace of property and property rights, via the legal and financial over-reach of monetary and political authorities.

Read More »

Read More »

The Only Way to Get Ahead Now Is Crazy-Risky Speculation

It's all so pathetic, isn't it? The only way left to get ahead in America is to leverage up the riskiest gambles. It's painfully obvious that the only way left to get ahead in America is crazy-risky speculation, but nobody seems to even notice this stark and stunning reality. Why are people piling into crazy-risky bets on speculative vehicles like Gamestop and Dogecoin?

Read More »

Read More »