Category Archive: 5.) Charles Hugh Smith

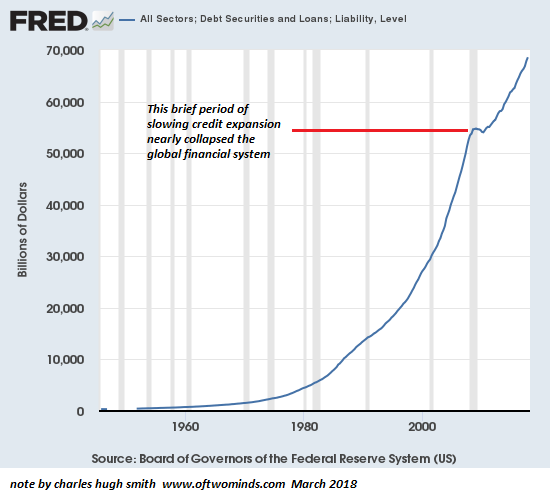

The Next Recession Will Be Devastatingly Non-Linear

The acceleration of non-linear consequences will surprise the brainwashed, loving-their-servitude mainstream media. Linear correlations are intuitive: if GDP declines 2% in the next recession, and employment declines 2%, we get it: the scale and size of the decline aligns. In a linear correlation, we'd expect sales to drop by about 2%, businesses closing their doors to increase by about 2%, profits to notch down by about 2%, lending contracts by...

Read More »

Read More »

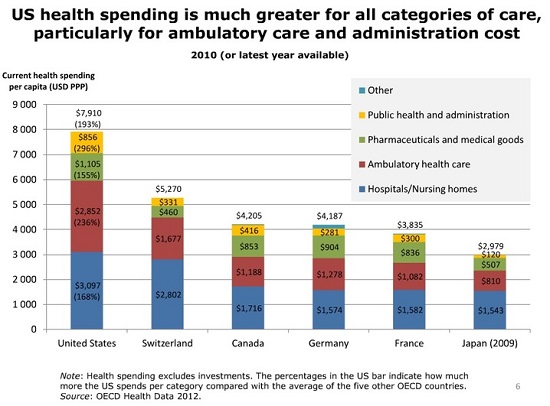

U.S. Healthcare Isn’t Broken–It’s Fixed

If you want to understand why the U.S. healthcare system is bankrupt, financially, morally and politically, then start with this representative anecdote from a U.S. physician. I received this report from correspondent J.F. on the topic of direct advertising of pharmaceutical products to the public (patients).

Read More »

Read More »

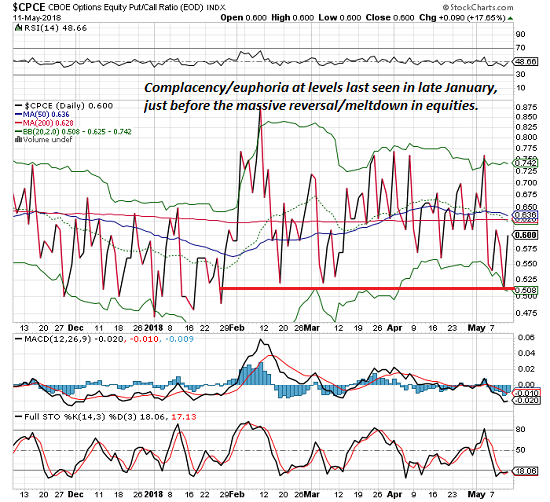

A Funny Thing Happened on the Way to Market Complacency / Euphoria

Fortunately for Bulls, none of this matters. A relatively reliable measure of complacency/euphoria in the stock market just hit levels last seen in late January, just before stocks reversed in a massive meltdown, surprising all the complacent/euphoric Bulls. The measure is the put-call ratio in equities. Since this time is different, and the market is guaranteed to roar to new all-time highs, we can ignore this (of course).

Read More »

Read More »

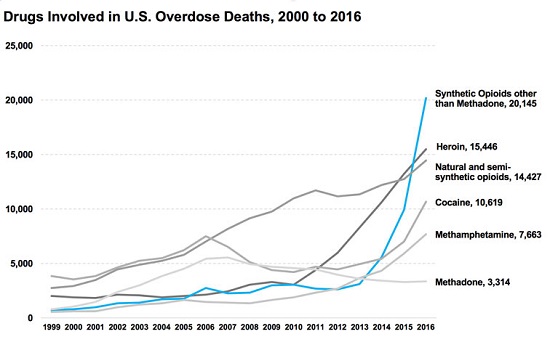

How Safe Are We? Our Blindness to Systemic Dangers

How do we explain our obsession with relatively low risk dangers and our collective blindness to manufactured/marketed scourges that kill tens of thousands of people annually? If you've bought a new vehicle recently, you may have noticed some "safety features" that strike many as Nanny State over-reach. You can't change radio stations, for example, if the vehicle is in reverse.

Read More »

Read More »

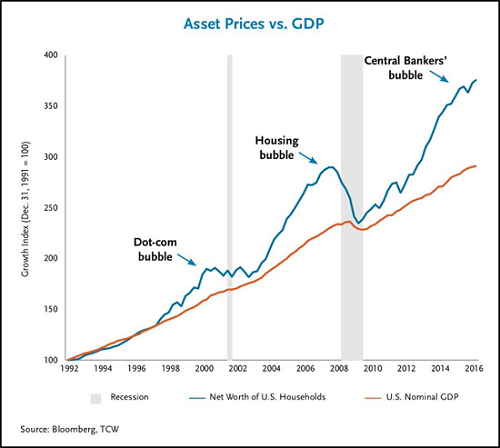

Taking the Pulse of a Weakening Economy

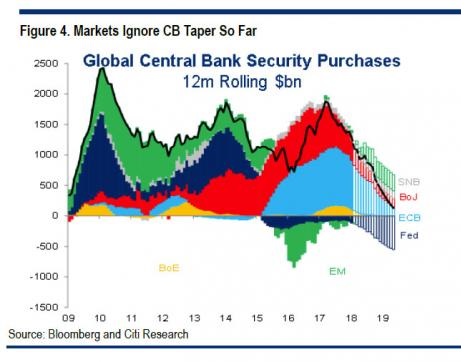

Corporate buybacks provide the key analogy for the economy as a whole. Central banks have been running a grand experiment for 9 years, and now we're about to find out if it succeeds or fails. For 9 unprecedented years, central banks have pushed the pedal of monetary stimulus to the metal: near-zero interest rates, monumental purchases of bonds, mortgage-backed securities, stocks and corporate bonds.

Read More »

Read More »

What Lies Beyond Capitalism and Socialism?

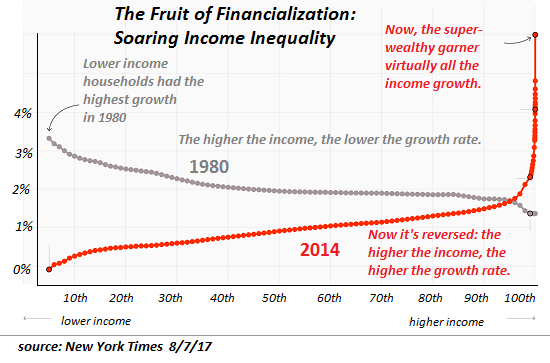

The status quo, in all its various forms, is dominated by incentives that strengthen the centralization of wealth and power. As longtime readers know, my work aims to 1) explain why the status quo -- the socio-economic-political system we inhabit -- is unsustainable, divisive, and doomed to collapse under its own weight and 2) sketch out an alternative Mode of Production/way of living that is sustainable, consumes far less resources while providing...

Read More »

Read More »

Our Strange Attraction to Self-Destructive Behaviors, Choices and Incentives

Self-destruction isn't a bug, it's a feature of our socio-economic system. The gravitational pull of self-destructive behaviors, choices and incentives is scale-invariant, meaning that we can discern the strange attraction to self-destruction in the entire scale of human experience, from individuals to families to groups to entire societies.

Read More »

Read More »

What Do We Know About Syria? Next to Nothing

Anyone accepting "facts" or narratives from any interested party is being played. About the only "fact" the public knows with any verifiable certainty about Syria is that much of that nation is in ruins. Virtually everything else presented as "fact" is propaganda intended to serve one of the competing narratives or discredit one or more competing narratives.

Read More »

Read More »

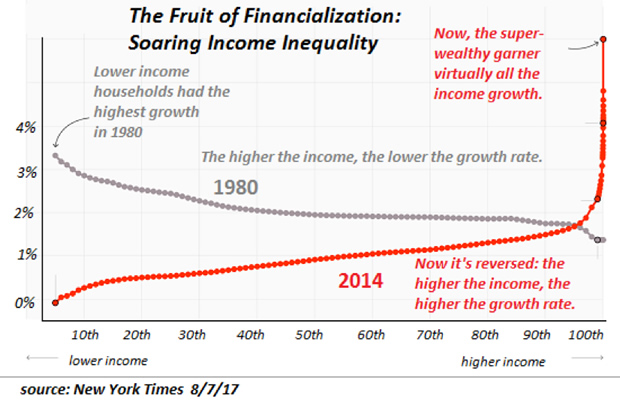

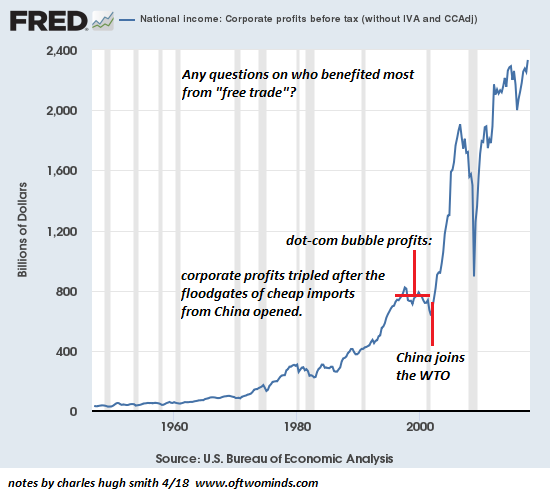

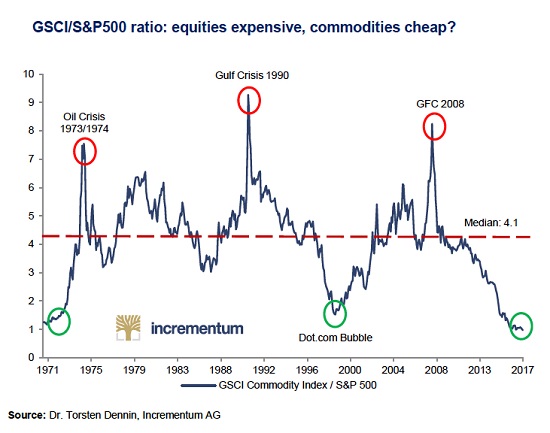

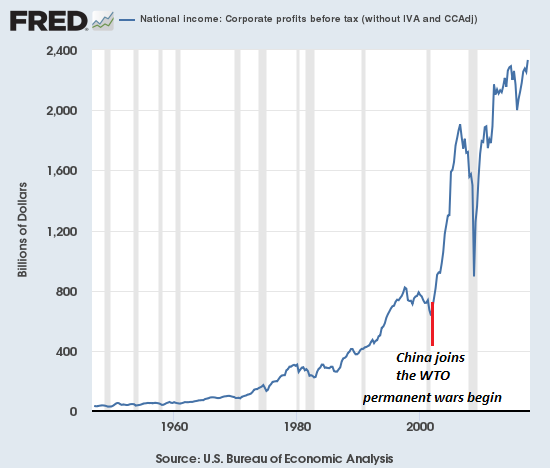

Why Trade Wars Ignite and Why They’re Spreading

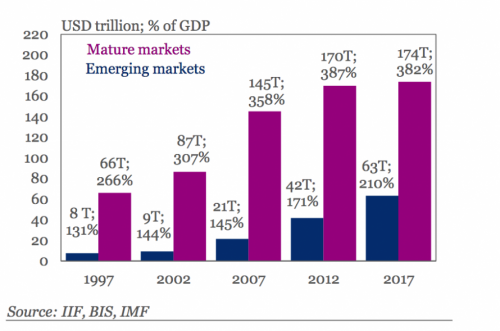

What ignites trade wars? The oft-cited sources include unfair trade practices and big trade deficits. But since these have been in place for decades, they don't explain why trade wars are igniting now. To truly understand why trade wars are igniting and spreading, we need to start with financial repression, a catch-all for all the monetary stimulus programs launched after the Global Financial Meltdown/Crisis of 2008/09.

Read More »

Read More »

The Genie’s Out of the Bottle: Eight Defining Trends Are Reversing

Though the Powers That Be will attempt to placate or suppress the Revolt of the Powerless, the genies of political disunity and social disorder cannot be put back in the bottle. The saying "the worm has turned" refers to the moment when the downtrodden have finally had enough, and turn on their powerful oppressors.

Read More »

Read More »

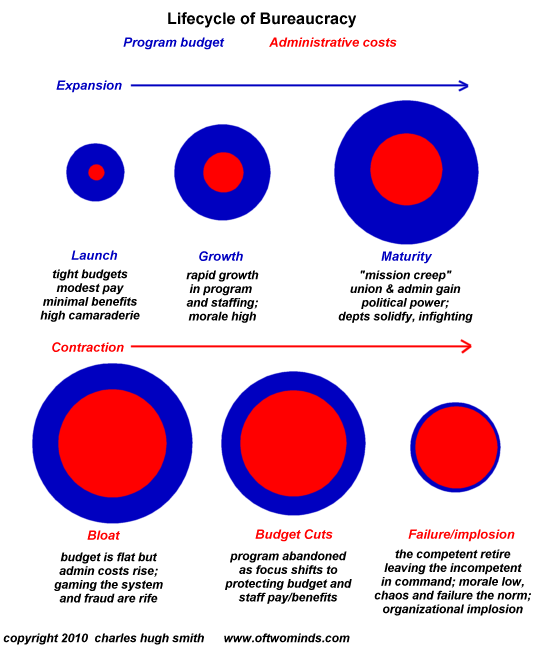

Why Systems Fail

Since failing systems are incapable of structural reform, collapse is the only way forward. Systems fail for a wide range of reasons, but I'd like to focus on two that are easy to understand but hard to pin down. Systems are accretions of structures and modifications laid down over time.Each layer adds complexity which is viewed at the time as a solution. This benefits insiders, as their job security arises from the need to manage the added...

Read More »

Read More »

Were Trade Wars Inevitable?

Were trade wars inevitable? The answer is yes, due to the imbalances and distortions generated by financialization and central bank stimulus. Gordon Long and I peel the trade-war onion in a new video program, Were Trade Wars Inevitable?

Read More »

Read More »

Playing for All the Marbles

Global Plunge Protection Teams must be ordering take-out food; every night is a long one now. The current stocks/bonds game is for all the marbles, by which I mean the status quo now depends on valuations and interest rates remaining near their current levels for the system to function.

Read More »

Read More »

The Problem with a State-Cartel Economy: Prices Rise, Wages Don’t

The vise will tighten until something breaks. It could be the currency, it could be the political status quo, it could be the credit/debt system--or all three. The problem with an economy dominated by state-enforced cartels and quasi-monopolies is that prices rise (since cartels can push higher costs onto the consumer) but wages don't (since cartels can either dominate local labor markets or engage in global wage arbitrage: offshore jobs, move to...

Read More »

Read More »

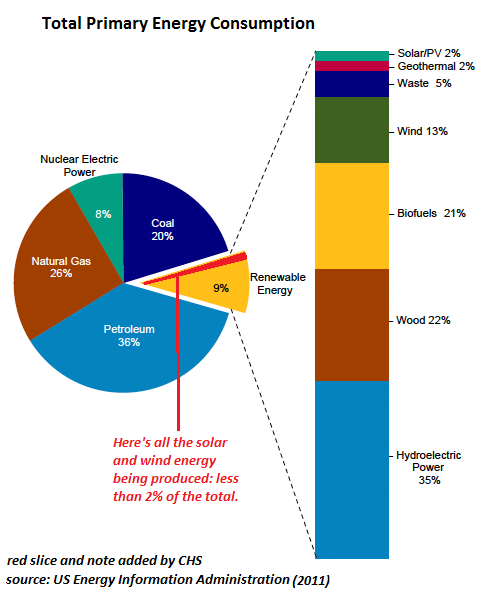

What If All the Cheap Stuff Goes Away?

Nothing stays the same in dynamic systems, and it's inevitable that the current glut of low costs / cheap stuff will give way to scarcities that cannot be filled at current low prices. One of the books I just finished reading is The Fate of Rome: Climate, Disease, and the End of an Empire.

Read More »

Read More »

15 Years of War: To Whose Benefit?

As for Iraq, the implicit gain was supposed to be access to Iraqi oil. Setting aside the 12 years of "no fly zone" air combat operations above Iraq from 1991 to 2003, the U.S. has been at war for almost 17 years in Afghanistan and 15 years in Iraq. (If the word "war" is too upsetting, then substitute "continuing combat operations".)

Read More »

Read More »

Decrypting the Appointment of John Bolton

So perhaps the dominant wing of the Deep State is finally willing to cut a deal with Trump. To many observers, the appointment of John Bolton as national security advisor is the functional equivalent of appointing the Anti-Christ--or maybe worse. Indeed, these observers would, when comparing the two, find grudging favor with the Anti-Christ.

Read More »

Read More »

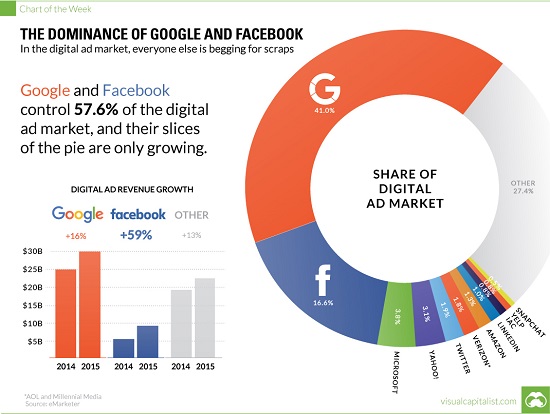

Should Facebook and Google Pay Users When They Sell Data Collected from Users?

Let's imagine a model in which the marketers of data distribute some of their immense profits to the users who created and thus "own" the data being sold for a premium. It's not exactly news that Facebook, Google and other "free" services reap billions of dollars in profits by selling data mined/collected from their millions of users. As we know, If you're not paying for it, you're not the customer; you're the product being sold, also phrased as if...

Read More »

Read More »

Solutions Only Arise Outside the Status Quo

Solutions are only possible outside these ossified, self-serving centralized hierarchies. Correspondent Dan F. asked me to reprint some posts on solutions to the systemic problems I've outlined for years, most recently in How Much Longer Can We Get Away With It? and Checking In on the Four Intersecting Cycles. I appreciate the request, because it's all too easy to dwell on what's broken rather than on the difficult task of fixing what's broken.

Read More »

Read More »

Is Profit-Maximizing Data-Mining Undermining Democracy?

As many of you know, oftwominds.com was falsely labeled propaganda by the propaganda operation known as ProporNot back in 2016. The Washington Post saw fit to promote ProporNot's propaganda operation because it aligned with the newspaper's view that any site that wasn't pro-status quo was propaganda; the possibility of reasoned dissent has vanished into a void of warring accusations of propaganda and "fake news" --which is of course propaganda in...

Read More »

Read More »