Category Archive: 5.) Charles Hugh Smith

The Banality of (Financial) Evil

The financialized American economy and State are now totally dependent on a steady flow of lies and propaganda for their very survival. Were the truth told, the status quo would collapse in a putrid heap.

Read More »

Read More »

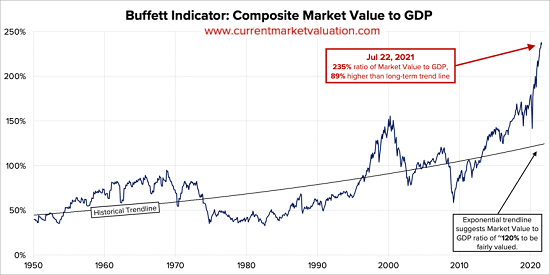

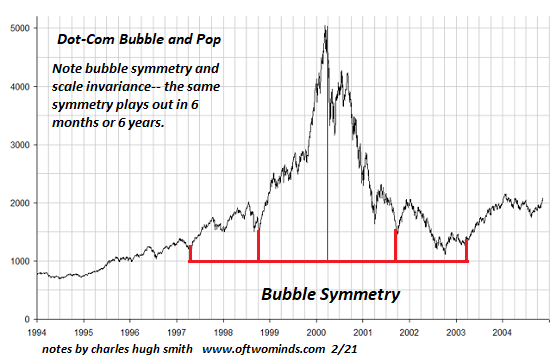

Please Don’t Pop Our Precious Bubble!

It's a peculiarity of the human psyche that it's remarkably easy to be swept up in bubble mania and remarkably difficult to be swept up in the same way by the bubble's inevitable collapse.

Read More »

Read More »

The Upside of a Stock Market Crash

A drought-stricken forest choked with dry brush and deadfall is an apt analogy. While a stock market crash that stairsteps lower for months or years is generally about as welcome as a trip to the guillotine in Revolutionary France, there is some major upside to a crash.

Read More »

Read More »

The Smart Money Has Already Sold

Generations of punters have learned the hard way that their unwary greed is the tool the 'Smart Money' uses to separate them from their cash and capital.

Read More »

Read More »

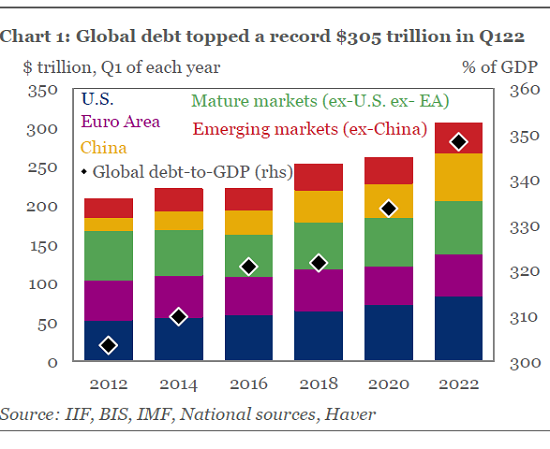

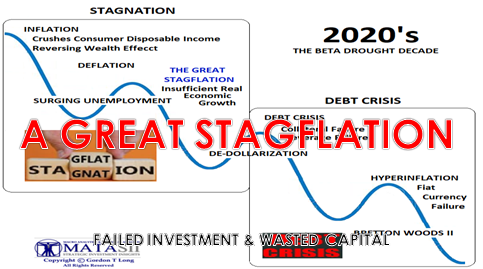

Why the Global Economy Is Unraveling

Global supply chain logjams and global credit/financial crises aren't bugs, they're intrinsic features of Neoliberalism's fully financialized global economy. To understand why the global economy is unraveling, we have to look past the headlines to

the primary dynamic of globalization: Neoliberalism, the ideological orthodoxy which holds that introducing market dynamics to sectors that were closed to global markets generates prosperity for all.

Read More »

Read More »

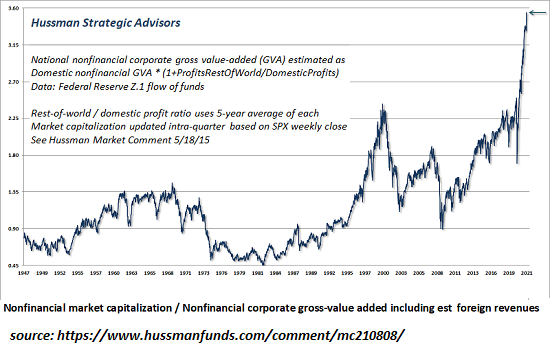

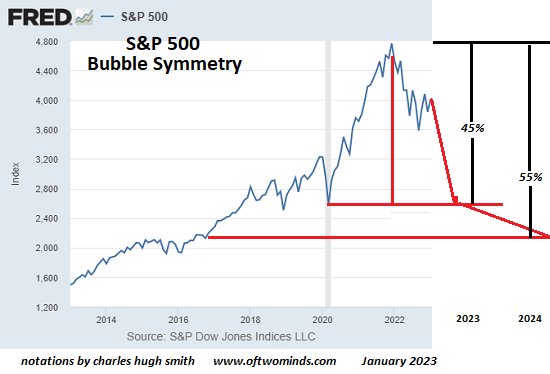

Dear Fed: Are You Insane?

So sorry, America, but your central bank is certifiably insane, and it's not going to magically work out. History definitively shows that speculative bubbles always pop--always. Every speculative

bubble mania, regardless of its supposed uniqueness--"it's different this time"--pops.

Read More »

Read More »

The End of Global Tourism?

Viewed as a complex non-linear system, the pandemic varinants can only be controlled by drastically pruning the physical connections between disparate global groups, which means effectively ending the unrestricted flow of individuals around the planet.

Read More »

Read More »

While the Herd Slumbers, Risk Is Rocketing Higher

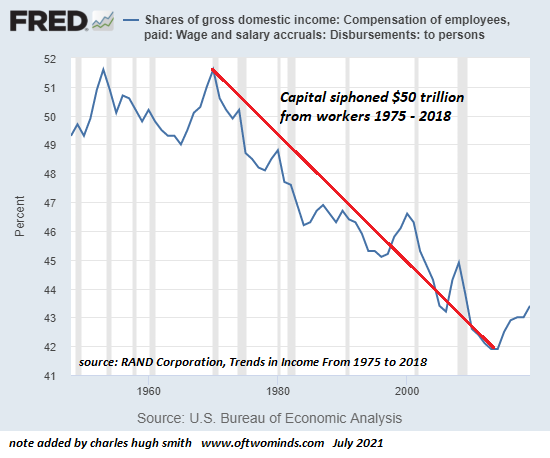

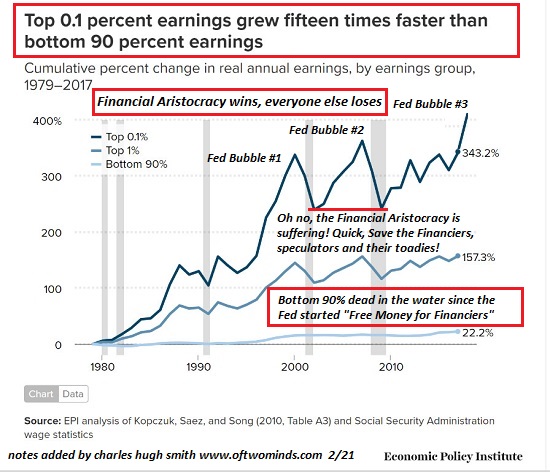

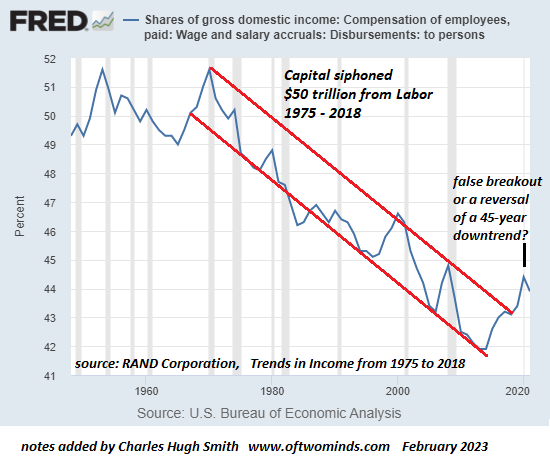

This wholesale transfer of risk from elites to the workers is finally becoming consequential as wealth / income / security inequality is reaching extremes that are destabilizing society and the economy.

Read More »

Read More »

The Moment Wall Street Has Been Waiting For: Retail Is All In

The ideal bagholder is one who

adds more on every downturn (buy the dip) and who refuses to sell (diamond hands), holding

on for the inevitable Fed-fueled rally to new highs.

Old hands on Wall Street have been wary of being bearish for one reason, and no, it's not

the Federal Reserve: the old hands have been waiting for retail--the individual investor--

to go all-in stocks. After 13 long years, this moment has finally arrived:

retail is...

Read More »

Read More »

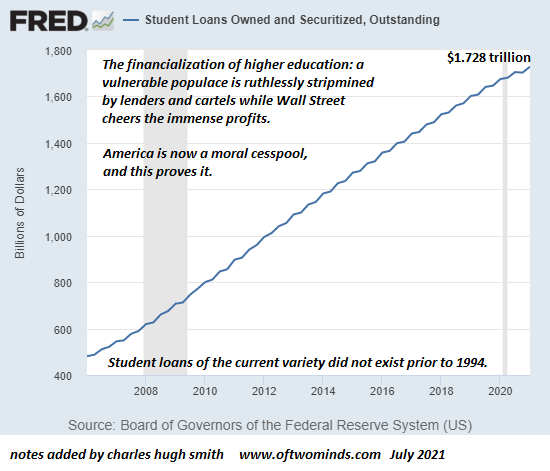

America Is a Moral Cesspool, and Student Loans Prove It

If America somehow managed to educate millions of college students without burdening them with $2 trillion in debt in 1993, why is it now "impossible" to do so, even as America's wealth and gross national product (GDP) have both rocketed higher over the past 27 years?

Read More »

Read More »

Have We Reached “Peak Self-Glorifying Billionaire”?

Perhaps we should update Marie Antoinette's famous quip of cluelessness to: "Let them eat space tourism." As billionaires squander immense resources on self-glorifying space flights, the corporate media is nothing short of worshipful. Millions of average citizens, on the other hand, wish the self-glorifying billionaires had taken themselves and all the other parasitic, tax-avoiding, predatory billionaires with them on a one-way trip into space.

Read More »

Read More »

Big Tech: “Our Terms Have Changed”

So go ahead and say whatever you want around all your networked devices, but don't be surprised if bad things start happening. I received another "Our Terms Have Changed" email from a Big Tech quasi-monopoly, and for a change I actually read this one. It was a revelation on multiple fronts. I'm reprinting it here for your reading pleasure: We wanted to let you know that we recently updated our Conditions of Use.

Read More »

Read More »

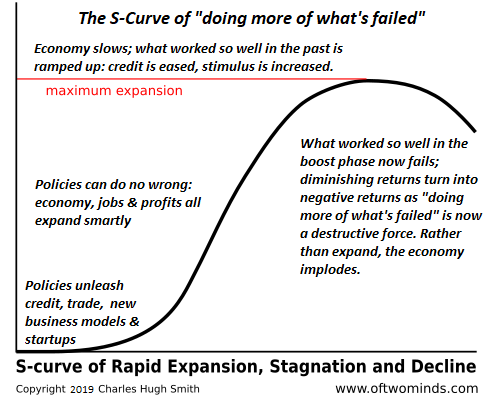

How Breakdown Cascades Into Collapse

Maintaining the illusion of confidence, permanence and stability serves the interests of those benefiting from the bubbles and those who prefer the safety of the herd, even as the herd thunders toward the precipice.

Read More »

Read More »

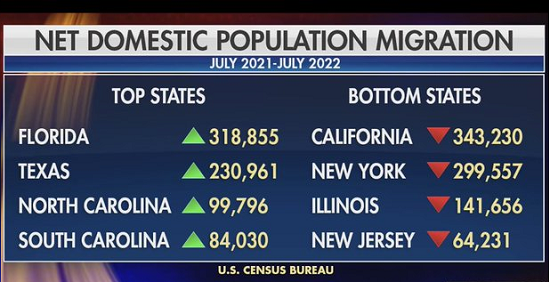

Here’s Why America’s Labor-Shortage Will Drive Inflation Higher

America's labor shortage is complex and doesn't lend itself to the simplistic expectations favored by media talking heads. The Wall Street cheerleaders extol the virtues of "getting America back to work" which is Wall-Street-speak for getting back to exploiting workers to maximize corporate profits.

Read More »

Read More »

The $50 Trillion Plundered from Workers by America’s Aristocracy Is Trickling Back

The depth of America's indoctrination can be measured by the unquestioned assumption that Capital should earn 15% every year, rain or shine, while workers are fated to lose ground every year, rain or shine. And if wages should ever start ticking upward even slightly, then the Billionaires' Apologists are unleashed to shout that higher wages means higher inflation, which will kill the economic "recovery."

Read More »

Read More »

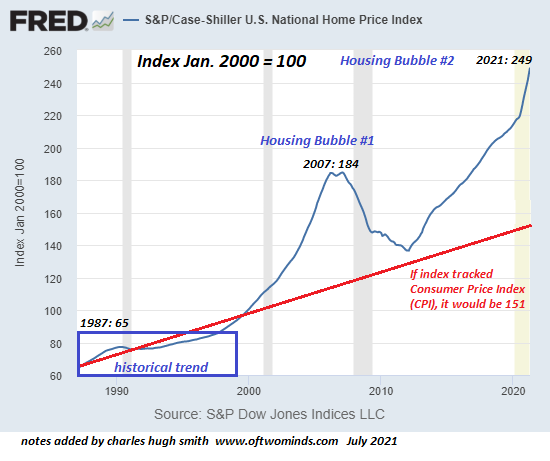

Housing Bubble #2: Ready to Pop?

The expansion of Housing Bubble #2 is clearly visible in these two charts of house valuations, courtesy of the St. Louis Federal Reserve database (FRED). The first is the Case-Shiller Index, which as you recall tracks the price of homes on an "apples to apples" basis, i.e. it tracks price movements for the same house over time. Note that this is an index chart where the index is set at 100 as of January 2000. It is not a chart of median housing...

Read More »

Read More »

A Few Things About Reinforced Concrete High-Rise Condos

The second most remarkable thing about the sudden collapse of the Florida condo building was the rush to assure everyone that this was a one-off catastrophe: all the factors fingered as causes were unique to this building, the implication being all other high-rise reinforced concrete condos without the exact same mix of causal factors were not in danger.

Read More »

Read More »

Virus Z: A Thought Experiment

Let's run a thought experiment on a hypothetical virus we'll call Virus Z, a run-of-the-mill respiratory variety not much different from other viruses which are 1) very small; 2) mutate rapidly and 3) infect human cells and modify the cellular machinery to produce more viral particles.

Read More »

Read More »

The Systemic Risk No One Sees

My recent posts have focused on the systemic financial risks created by Federal Reserve policies that have elevated moral hazard (risks can be taken without consequence) and speculation to levels so extreme that they threaten the stability of the entire financial system.

Read More »

Read More »

When Expedient “Saves” Become Permanent, Ruin Is Assured

The belief that the Federal Reserve possesses god-like powers and wisdom would be comical if it wasn't so deeply tragic, for the Fed doesn't even have a plan, much less wisdom. All the Fed has is an incoherent jumble of expedient, panic-driven "saves" it cobbled together in the 2008-2009 Global Financial Meltdown that it had made inevitable.

Read More »

Read More »