Category Archive: 5.) Alhambra Investments

* Jeff Snider! Huge Money Printing Speaks For Itself

Full Document transcript go to:https://www.financialanalysis.tv

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected]

Skype: akira10k

Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

SPECIAL REPORT: Follow The Money – Volume 5

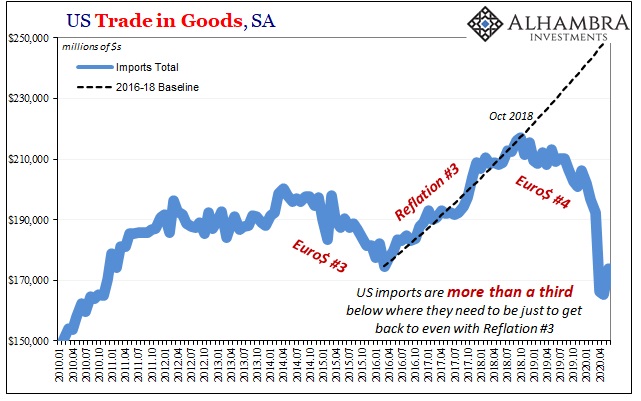

If the recession was the first “shoe to drop”, what’s the second…or third? The shock of the self-inflicted COVID recession is behind us. What we’re all wondering now is what comes next? Will the economy recover to its previous state? Something better? Something worse? That will be determined by the second and third-order effects and they are already starting.

Read More »

Read More »

A Second JOLTS

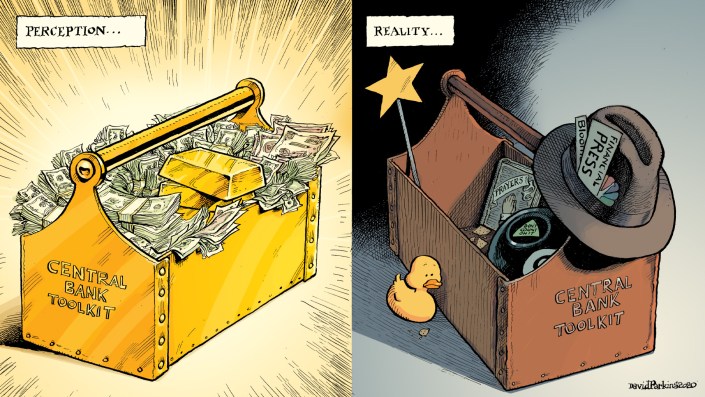

What happens when we are stunned and dazed? We filter out the noise to focus on the bare basics by getting back to our instincts, acting reflexively based upon our deeply held beliefs and especially training. When faced with a crisis and there’s no time to really think, shorthand will have to suffice.

Read More »

Read More »

Shoe V arning

It’s no wonder we’re obsessed with shoes these days. Even the V-people, as I’ll call them, keep one wary eye glued looking behind them. Survivor’s euphoria means a lot of potentially bad things, only beginning with a false sense of survivor-hood.

Read More »

Read More »

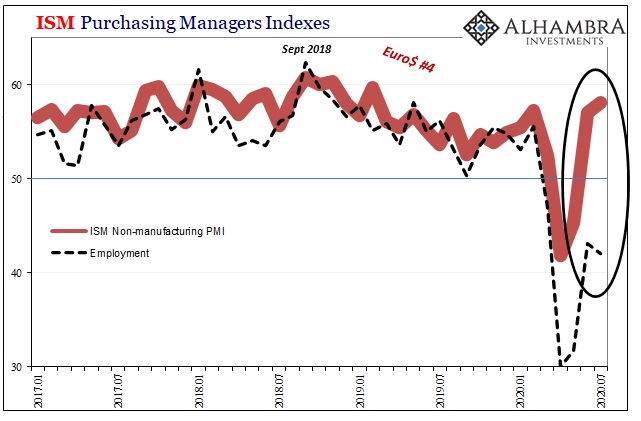

Purchasing Managers Indigestion

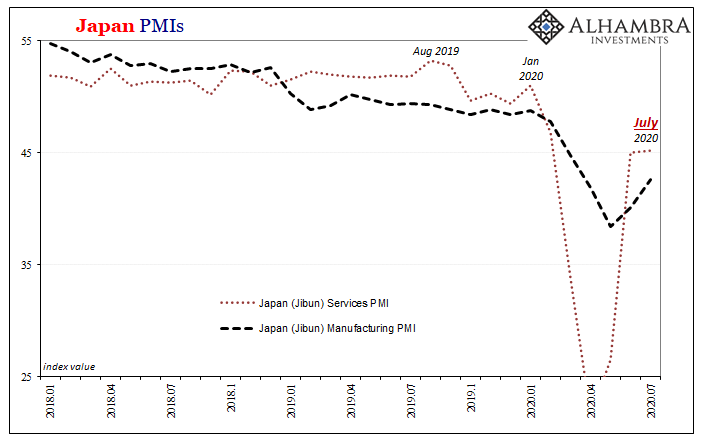

There’s already doubt given how the two major series supposedly measuring the same thing seemingly can’t agree. If the rebound was truly robust, it would show up unambiguously everywhere. But IHS Markit’s purchasing managers indices struggled to get back above 50 in July, barely getting there, suggesting the economy might be slowing or even stalling way too close to the bottom.

Read More »

Read More »

5 Tax Strategies to Help you Hold on to Your Money in Retirement

What is retirement, really? We think we know. So, we do our best to prepare for both current circumstances and as many surprises as we can conjure up. After all, with people living longer than ever before your money has to last longer than ever before.

Read More »

Read More »

Summer Special – Deep Dive into U.S. Dollar with Jeff Snider

MacroVoices Erik Townsend and Patrick Ceresna welcome Jeff Snider to the show to discuss the U.S. Dollar system, structurally how it works and why it’s leading systemically to a dollar shortage.

Read More »

Read More »

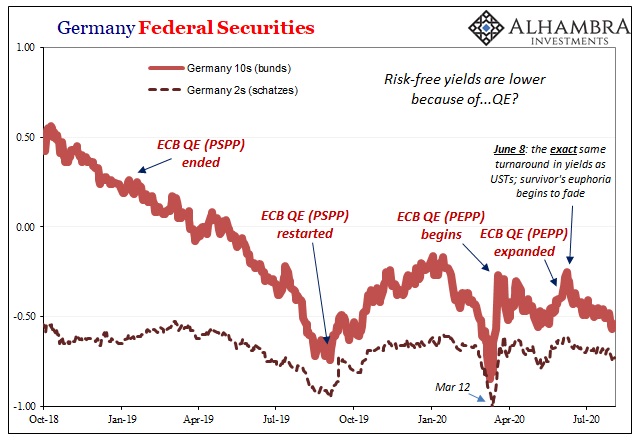

Accusing the Accused of Excusing the Mountain of Evidence

Why not let the accused also sit in the jury box? The answer seems rather obvious. While maybe the truly honest man accused of a crime he did commit would vote for his own conviction, the world seems a bit short on supply of those while long and deep offering up practitioners of pure sophistry in their stead.

Read More »

Read More »

That’s Probably Why Only Half a “V”

Why only half a “V?” If the latest PMI’s are anywhere close to accurate, and they don’t have to be all that close, then the production side of the economy may have stalled out somewhere nearer the trough of this contraction. The promise of May’s big payroll report surprise has dissipated in more than just the bond market.

Read More »

Read More »

A Tactical Update: Whither Goest The Dollar

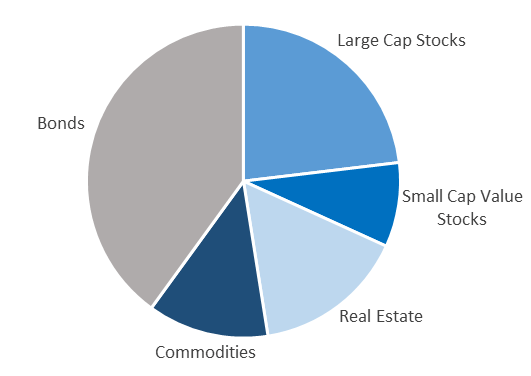

Our Fortress strategic asset allocation includes 5 distinct asset classes: The Fortress allocation has historically produced better risk-adjusted returns than the traditional 60% stocks/40% bonds allocation.

Read More »

Read More »

US Stall? Only Half The Imagined “V” May Indicate One, Too

These are not numbers that are consistent with a robust rebound. In fact, they don’t indicate very much of one at all. IHS Markit’s flash PMI’s for July 2020 instead look way too much like the sentiment indicators in Germany and Japan. Though they are now back near 50, both services and manufacturing, that doesn’t actually indicate what everyone seems to think it does.

Read More »

Read More »

Jeff Snider on Federal Reserve art ofJawboning markets about U.S. dollars Part 2 investing in gold

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

??http://www.ko-fi.com/aminray

#markets #investing #trading #economy #money #currency #stocks #robinhood

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar...

Read More »

Read More »

Jeff Snider on the Federal Reserve Jawboning

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

??https://www.patreon.com/Aminray

#markets #investing #trading #economy #money #currency #stocks #robinhood

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar...

Read More »

Read More »

All About The Eurodollar , Repo Markets, Gold and Volatility with Jeff Snider.

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

??https://www.patreon.com/Aminray

#markets #investing #trading #economy #money #currency #stocks #robinhood

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar...

Read More »

Read More »

19.2 A Foreign Plot to Dump the Dollar?

America's dollar is said to be the global reserve currency. Might there be hostile nations scheming furiously to undermine the US dollar? Is there a USD Pearl Harbor ahead? No. Precisely the opposite. It's the reserve currency - the EURODOLLAR - that holds everyone hostage, including the USA!

Read More »

Read More »

All About The Eurodollar , Repo Markets, Gold and Volatility with Jeff Snider PART 2

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

??https://www.patreon.com/Aminray

#markets #investing #trading #economy #money #currency #stocks #robinhood

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar...

Read More »

Read More »

All About The Eurodollar , Repo Markets, Gold and Volatility with Jeff Snider PART 1

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

??https://www.patreon.com/Aminray

#markets #investing #trading #economy #money #currency #stocks #robinhood

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar...

Read More »

Read More »

The (Other) Shoe Of Unemployment

After raising the specter of a rebound stall, the idea before limited to Japan and Germany was abruptly given further weight today by US jobless claims numbers. For the first time since the peak at the end of March, the weekly tally of initial filings increased from the prior week.

Read More »

Read More »

A Japanese Stall?

In sharp contrast to the sentimental deference towards central bank stimulus exhibited by Germany’s ZEW, for example, similar Japanese surveys are starting to describe potential trouble developing. Like Germany, Japan is a bellwether country and a pretty reliable indicator of global economy performance.

Read More »

Read More »

Deflation/Inflation, Money Printing, Free Market vs. Socialism, Yield Curve Control

?THE REBEL CAPITALIST SHOW WILL HELP YOU ? learn more about Macro, Investing, Entrepreneurship AND Personal Freedom.

Read More »

Read More »