Category Archive: 4) FX Trends

FX Daily, September 01: A Couple of Surprises to Start the New Month

The new month has begun with a couple of surprises. The biggest surprise has been the record jump in the UK manufacturing PMI to 53.3 from 48.3. A much smaller rebound was expected in August after the Brexit shock drop in July.

Read More »

Read More »

FX Daily, August 31: Dollar Bides Times, Month-End at Hand, Jobs Data Ahead

The US dollar is a little softer against most of the major and emerging market currencies. The exception is the Japanese yen, where the greenback has moved above JPY103 for the first time in a month. The tone is consolidative as the market awaits assurances that the jobs growth this month has been sufficiently strong as to keep the prospects of a September meeting still alive.

Read More »

Read More »

Great Graphic: Oil is Looking Crude

Oil is breaking down. Doubts are growing over output freezes while US inventories rise. The technicals are poor.

Read More »

Read More »

Spain’s Political Deadlock Likely Leads to Third Election

Rajoy is hoping to form a minority government this week. It seems unlikely to succeed, which could lead to an election on Christmas. Regional elections and corruption trials may change Spain's political dynamics.

Read More »

Read More »

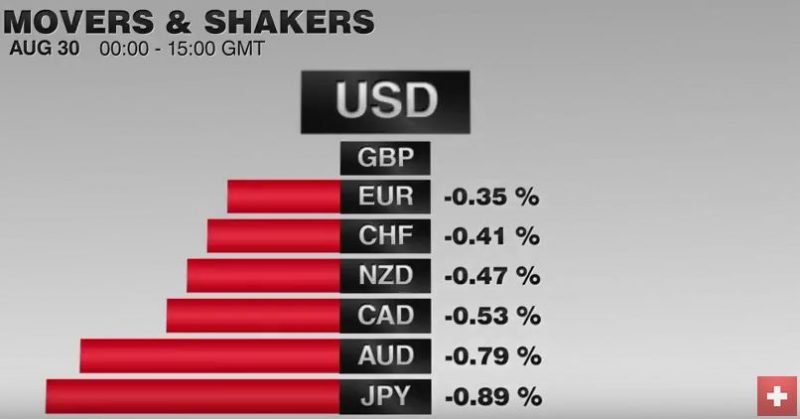

FX Daily, August 30: Greenback Remains Firm, Awaiting Fresh Cues

The US dollar is trading firmly, largely within yesterday's ranges. The odds implied by the September Fed fund futures eased to 36% from 42% before the weekend, but ahead of Fischer's Bloomberg TV appearance, and tomorrow's ADP employment estimate, the market seems cautious about fading the dollar's strength.

Read More »

Read More »

Natural Rates and Terminal Fed Funds

The neutral or natural interest rate is linked to potential growth. Potential growth has fallen so has the neutral rate. The implication is that the FOMC has made the bulk of the adjustment on its long-term Fed funds forecast.

Read More »

Read More »

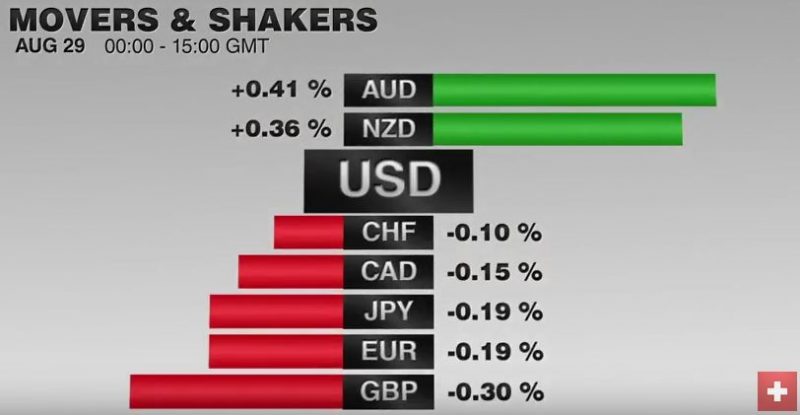

FX Daily, August 29: Dollar Gains Extended, but Momentum Fades

The US dollar staged a strong pre-weekend rally on hints that the Fed will raise rates before the end of the year. There was initially follow through dollar buying in Asia before a more stable tone emerged in Europe, where London markets are closed for a bank holiday. The easing of the dollar’s upside momentum may set the stage for a bout of profit-taking later today and tomorrow.

Read More »

Read More »

Great Graphic: Low Wages in US Rising

The bottom of the US wage scale is rising. The added wage costs are being blunted by less staff turnover, hiring and training costs. It is consistent with our expectation of higher price pressures.

Read More »

Read More »

FX Weekly Preview: Yellen Pushes Divergence Front and Center

The summer dynamics of the capital markets has changed by the enhanced prospects of a Fed hike. Equity markets and other risk assets look particularly vulnerable. Sterling may do better against the euro than the dollar.

Read More »

Read More »

FX Weekly Review, August 22 – August 26: Swiss Franc Loses Most Gains Again

After winning 5% against the dollar index last week, the Swiss Franc index lost 3% again. CHF lost against both USD and EUR. Reason: An increased probability of a rate hike in the U.S.

Read More »

Read More »

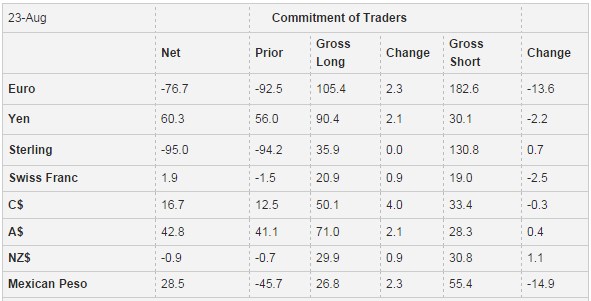

Weeky Speculative Positions: Euro Shorts Trimmed, More Sterling Shorts, Long CHF again

Three weeks ago speculators went net short in CHF, when the U.S. jobs report was published. Now the net position shifted to long again. Last week GBP shorts increased but Euro Shorts were reduced.

Read More »

Read More »

Video of the purported Yemen attack on a Saudi oil facility

This video was originally posted to Facebook with the caption: By the grace of Allah, Just about an hour ago, a video from inside Najran city for #Aramco oil company burning by a Yemeni ballistic missile “Zelzal-3″, Friday 26-8-2016. The video shows a huge fire on the oil tanks .. Note the oil tanks at …

Read More »

Read More »

FX Daily, August 26: And now for Yellen…

Yellen's presentation at Jackson Hole today is the highlight of the week. It also marks the end of the summer for many North American and European investors. It may be a bit of a rolling start for US participants, until after Labor Day. However, with US employment data next Friday, many will return in spirit if not in body.

Read More »

Read More »

FX Daily, August 25: Narrow Ranges Prevail as Breakouts Fail

The US dollar remains mostly within the ranges seen yesterday against the major currencies.The market awaits fresh trading incentives and the end of the summer lull, which is expected next week. The Jackson Hole Fed gathering at which Yellen speaks tomorrow is seen as the highlight of this quiet week.

Read More »

Read More »

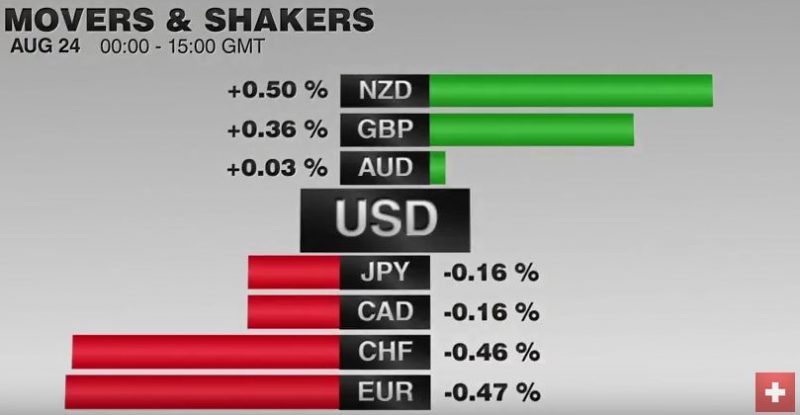

FX Daily, August 24: Narrowly Mixed Greenback in Summer Churn

The US dollar is going nowhere fast. It is narrowly mixed against the major currencies. The market awaits for fresh trading incentives, with much hope placed on Yellen's presentation at Jackson Hole at the end of the week. Is it too early to suggest that the build-up ahead of it is too much?

Read More »

Read More »

Great Graphic: GDP Per Capita Selected Comparison

US population growth has been greater than other major centers that helps explain why GDP has risen faster. GDP per capita has also growth faster than other high income regions. The US recovery is weak relative to post-War recoveries but it has been faster than anticipated after a financial crisis and shows little evidence of secular stagnation.

Read More »

Read More »

The five smartest words retail forex traders say

Greg Michalowski, Author Attacking Currency Trends. Director of Client Education and Technical Analysis at ForexLive.com. I am more of technical forex trader, but that bias comes with some important reasons, especially for retail traders. Fundamental analysis is important, but it does not do a good job with defining and limiting risk…especially when traders are wrong. …

Read More »

Read More »

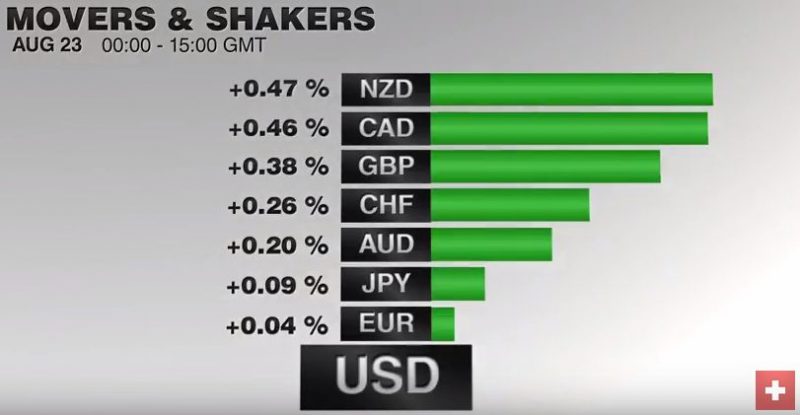

FX Daily, August 23: Broadly Mixed Dollar in a Mostly Quiet Market

The US dollar is mostly little changed against the major, as befits a summer session.There are two exceptions.The first is the New Zealand dollar. Comments by the central bank's governor played down the need for urgent monetary action and suggested that the bottom of cycle may be near 1.75% for the cash rate, which currently sits at 2.0%.This means that a cut next month is unlikely. November appears to be a more likely timeframe.

Read More »

Read More »

FX Daily, August 22: Fischer Joins Dudley; Waiting for Yellen

Last week, some market participants were giving more credence to what seemed like dovish FOMC minutes than to NY Fed President Dudley's remarks that accused investors of complacency over the outlook for rates. Yesterday, Vice-Chairman of the Federal Reserve Fischer seemed to echo Dudley's sentiment, and this has underpinned the dollar and is the major spur of today's price action.

Read More »

Read More »