Category Archive: 4) FX Trends

Cool Video: CNBC’s Power Lunch-China and Mexico

Two central banks were particularly active today. Chinese officials appear to be engineering short squeeze that has lifted the yuan 1.2% over the past two sessions. While this does not sound like much, it is a record two-day move, for the still closely managed currency.

Read More »

Read More »

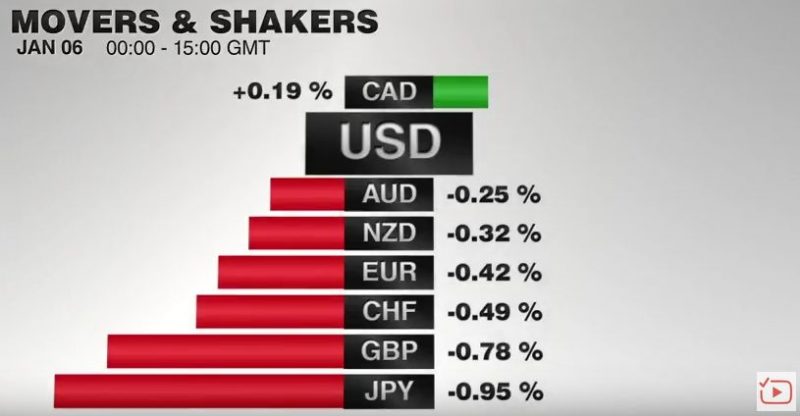

FX Daily, January 06: Dollar Consolidates Losses, Peso Firms while Yuan Reverses

I am reading a lot about the pound in 2017 which is likely to be as volatile as in 2016. But the Franc is a harder beast to predict. Loosely tracking the euro but subject to its own rules and trends GBPCHF could be an interesting pair to watch in 2017. There are numerous global events which can shape the direction on the Franc and clients looking to exchange pounds into Francs or move Francs back to the UK should be considering the path ahead.

Read More »

Read More »

A Few Thoughts Ahead of the US Jobs Report

ADP and Non-Manufacturing ISM lend credence to our fear of a disappointing national jobs report. Economists estimate only a small part of the manufacturing jobs loss can be traced to trade policy. 19 states increased min wage at the start of the year, but the impact on the nation's average weekly earnings will likely be too small to detect.

Read More »

Read More »

When your forex trading risk is really low, reward does not really matter

Risk a little to make more than a little… There are times when a forex technical level is important enough to just focus on the risk, and forget about the reward. In other words, if you trade at a key level where risk is only 5 pips, you only have to see the market move … Continue reading...

Read More »

Read More »

VIDEO: USDJPY bangs against lower support as market prepares for US employment

January 5, 2017. US employment report up tomorrow The USDJPY has moved lower in trading today and tests a support area defined by some key swing levels going back two years ago. That area comes in between 115.96 and 116.09. Below that is the 61.8% of the move down from the 2015 high at the …

Read More »

Read More »

FX Daily, January 05: Dollar Slide but Resilience Demonstrated while Yuan Squeezed Higher

There are two main developments. First, the high degree of uncertainty expressed in the FOMC minutes and the repeated references to the strong dollar spurred a wave of dollar selling. The dollar retreated in Asia, but European participants saw the pullback as a new buying opportunity.

Read More »

Read More »

Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

FX Daily, January 04: Consolidation in Capital Markets

GBP/CHF rates have jumped during the first official day of trading in 2017, with the pair hitting 1.2657 at today’s high. The Pound gained support this morning following positive UK Manufacturing data, which came in well above market expectation. This increased market confidence in the UK economy and the Pound has ultimately benefited as a result, gaining a cent on the CHF.

Read More »

Read More »

Forex technical analysis: EURUSD higher but stalling at resistance

100 and 200 hour MAs, 38.2% and 2015 low keeping a lid on the pair The EURUSD is trading higher on the day but is running into resistance against MA, retracement and an old low from 2015. What needs to happen to turn the bias more bullish? Greg Michalowski of ForexLive takes a technical look … Continue...

Read More »

Read More »

A Few Takeaways from the Latest IMF Reserve Figures

Overall reserve holdings hardly changed in Q3. China continues to bleed its reserves from unallocated to allocated. Sterling's share of new reserves warns it may be losing some allure.

Read More »

Read More »

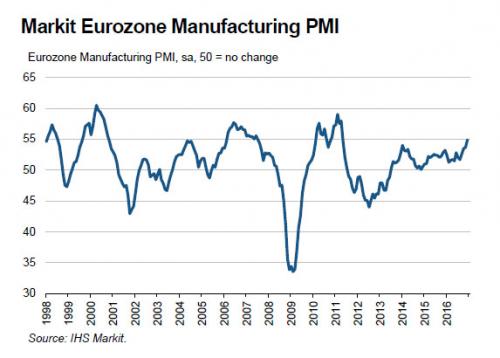

European Stocks Greet The New Year By Rising To One Year Highs; Euro Slides

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia's major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April 2011.

Read More »

Read More »

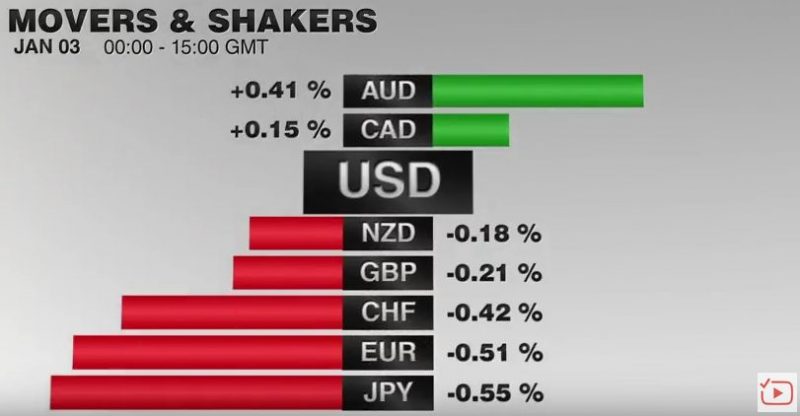

FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling's earlier losses were recouped following news that the manufacturing PMI jumped to 56.1, its highest since June 2014.

Read More »

Read More »

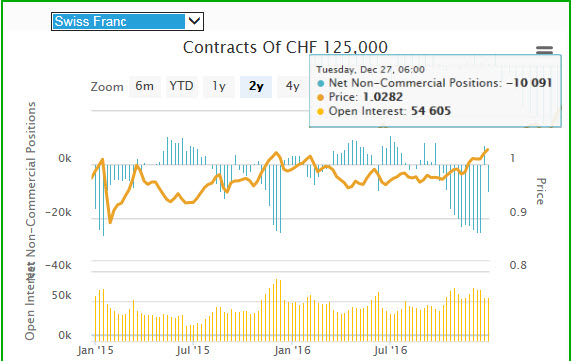

Weekly Speculative Positions: Speculators go short CHF again after a brief period of Long CHF

The sudden adjustment of CHF speculative positions ended (see last week's post) . Speculators went net short CHF USD with 10K contracts, this is still far from the 26.K contracts record. We should wait for another Fed rate hike, to reach these levels again.

Read More »

Read More »

FX Weekly Preview: What You Should Know to Start the First Week of 2017

Data has already been reported. Trends reversed in the last two weeks. US jobs data may disappoint. It will take a few more weeks to lift some of the uncertainty hanging over the markets.

Read More »

Read More »

FX Weekly Review, December 26 – 30: Dollar Correction Poised to Continue

The technical condition of the US dollar, which has been advancing through most of the Q4 16, has been deteriorating This led us to anticipate a consolidative or corrective phase.

Read More »

Read More »

FX Daily, December 30: Dollar Slips into Year End

In exceptionally thin conditions that characterize the year-end markets, a reportedly computer-generated order lifted the euro from about $1.05 to a little more than $1.0650 in a few minutes early in the Asian sessions.

Read More »

Read More »

FX Daily, December 29: Dollar, Equities and Yields Fall

In thin holiday markets, a correction to the trends seen in Q4 has materialized. The US dollar is heavy. Japanese and European equities are lower. Bonds are firmer.

Read More »

Read More »

Cool Video: Double Feature on Bloomberg

I am finishing the year like I began it, on Bloomberg Television, talking about the dollar and Fed policy. Bloomberg has made two clips of my interview available.

Read More »

Read More »

FX Daily, December 28: Short Note for Holiday Markets

Economic data: Japan stands out with industrial production in Nov rising 1.5%, the most in five months. It was a little less than expected, but the expectations for Dec (2%) and Jan (2.2%) are constructive.

Read More »

Read More »